Nebraska Clauses Relating to Transfers of Venture Interests — Including Rights of First Refusal In venture capital and private equity transactions, there are specific clauses in agreements that govern the transfer of venture interests. In Nebraska, these clauses play a crucial role in regulating the process and protecting the rights of the parties involved. One such provision is the Right of First Refusal (ROAR). The Right of First Refusal grants existing venture interest holders the opportunity to purchase additional shares or interests in the company before any third party. This clause ensures that current investors have a fair chance to maintain their ownership percentage and protect their initial investment. By exercising their ROAR, existing holders can match any proposed offer from an external party, thus retaining control over the venture. Moreover, Nebraska recognizes two main types of Rights of First Refusal: 1. Standard Right of First Refusal: This type of ROAR provides existing venture interest holders with the first opportunity to purchase additional shares or interests on the same terms as an offer made by a third party. This right is typically extinguished if the existing holder declines to exercise it or fails to communicate their intention within a specified timeframe. 2. Enhanced or Super Right of First Refusal: An enhanced ROAR grants existing venture interest holders additional rights beyond the standard ROAR. These rights may include the ability to match terms more favorable than those proposed by a third party or to purchase interests as a group rather than individually. The enhanced ROAR provides greater flexibility and protects the interests of the venture interest holders more comprehensively. It is important to note that Nebraska law allows parties to negotiate and customize these clauses within the framework of the state's legal principles. The specific terms and conditions of the Right of First Refusal provision can vary depending on the unique circumstances of each venture capital or private equity transaction. Thus, it is crucial to consult with legal professionals experienced in Nebraska venture law to ensure compliance with applicable regulations and to maximize the protection of parties' interests. In conclusion, Nebraska recognizes the significance of ensuring fair and balanced transfers of venture interests through clauses such as the Right of First Refusal. These provisions enable existing venture interest holders to maintain control over their investments and protect their financial stakes. With different types of ROAR available, such as the standard ROAR and the enhanced ROAR, these clauses provide flexibility and customization options for parties involved in venture capital or private equity deals in the state of Nebraska.

Nebraska Clauses Relating to Transfers of Venture interests - including Rights of First Refusal

Description

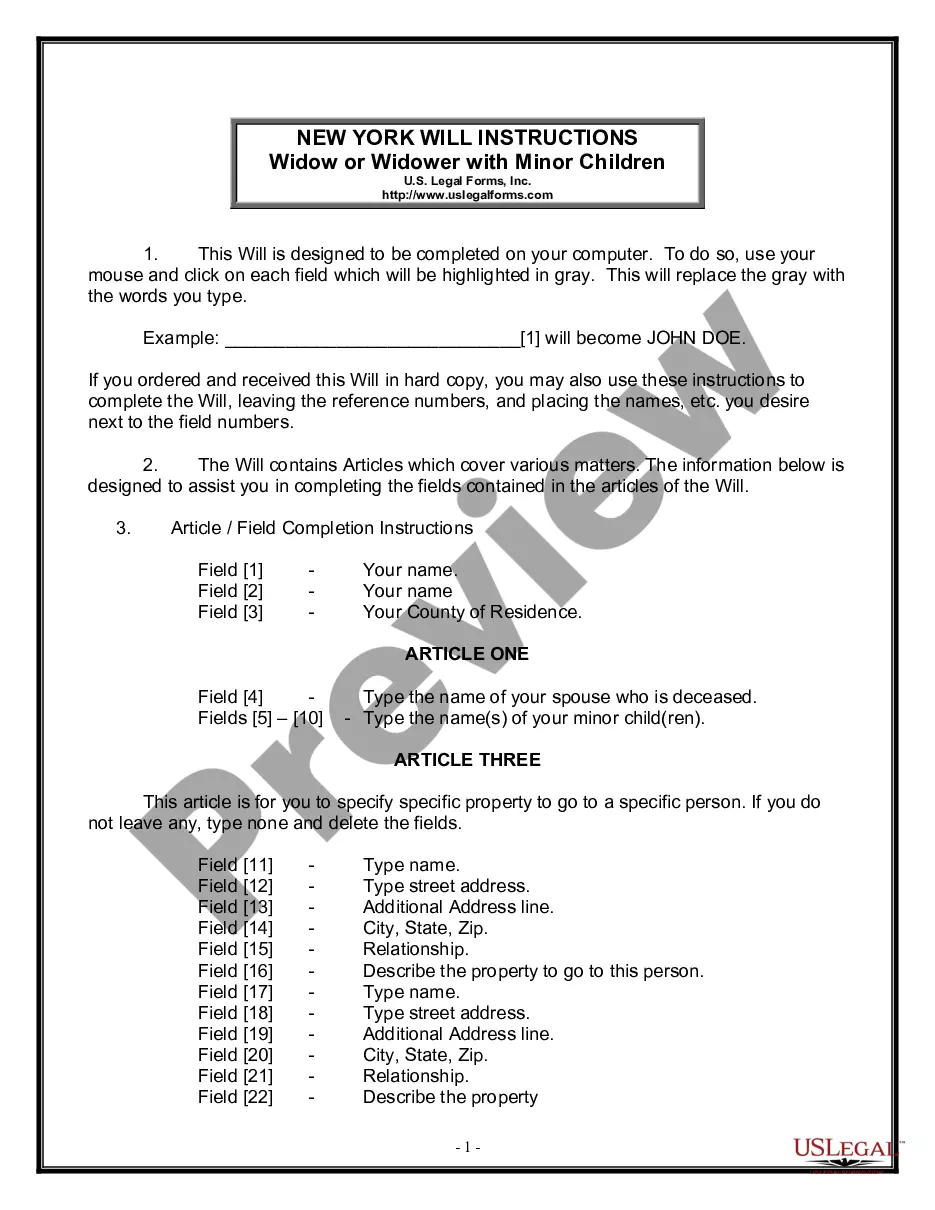

How to fill out Nebraska Clauses Relating To Transfers Of Venture Interests - Including Rights Of First Refusal?

If you have to total, acquire, or printing authorized file web templates, use US Legal Forms, the biggest selection of authorized types, which can be found on-line. Make use of the site`s basic and convenient search to obtain the paperwork you need. A variety of web templates for business and individual purposes are sorted by groups and suggests, or keywords. Use US Legal Forms to obtain the Nebraska Clauses Relating to Transfers of Venture interests - including Rights of First Refusal with a number of click throughs.

Should you be presently a US Legal Forms client, log in to the bank account and then click the Download option to find the Nebraska Clauses Relating to Transfers of Venture interests - including Rights of First Refusal. Also you can gain access to types you earlier downloaded inside the My Forms tab of your bank account.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for the right area/land.

- Step 2. Use the Review choice to check out the form`s content material. Do not neglect to learn the information.

- Step 3. Should you be not happy using the kind, use the Research field near the top of the monitor to locate other versions in the authorized kind web template.

- Step 4. When you have found the shape you need, click the Purchase now option. Pick the rates program you choose and put your accreditations to sign up for the bank account.

- Step 5. Approach the financial transaction. You may use your charge card or PayPal bank account to finish the financial transaction.

- Step 6. Pick the format in the authorized kind and acquire it on your own system.

- Step 7. Total, modify and printing or sign the Nebraska Clauses Relating to Transfers of Venture interests - including Rights of First Refusal.

Every single authorized file web template you get is your own for a long time. You may have acces to every kind you downloaded with your acccount. Select the My Forms segment and pick a kind to printing or acquire again.

Be competitive and acquire, and printing the Nebraska Clauses Relating to Transfers of Venture interests - including Rights of First Refusal with US Legal Forms. There are thousands of professional and status-distinct types you can use for the business or individual requires.

Form popularity

FAQ

Is the right of first refusal a good idea? The right of first refusal can be a good idea in that it allows a potential buyer to have first dibs on a property, providing a sense of security and control. Sellers don't have to worry about listing the property and can save it for preferred buyers.

The ROFR is part of the stock purchase agreement that is signed during a venture capital fund raise. It requires any shareholder who wants to sell stock - common stock, preferred stock, etc. - to give the VCs the right to purchase those shares before allowing any other party to buy them.

What is right of first refusal? Right of pre-emption gives shareholders the right to buy shares from another shareholder on the same terms as agreed with an external party before the external party may buy them. In other words, ROFR is the right to buy existing shares before outsiders can.

This contractual right, also known as ROFR, gives an individual or an entity the option to participate in a business transaction before that opportunity is offered to a third party.

A right of first refusal is a contractual right giving its holder the option to transact with the other contracting party before others can. The ROFR assures the holder that they will not lose their rights to an asset if others express interest.

In real estate, the right of first refusal is a clause in a contract that gives a prioritized, interested party the right to make the first offer on a house before the owner can negotiate with other prospective buyers.

Before the stock is sold to an outside buyer or party, the right of first refusal allows a business to buy it from an employee or owner. As a result, an outside buyer can be prevented from gaining voting rights or an ownership share in the company, allowing the business owners to maintain control over it.