Nebraska Certificate of Limited Partnership of New Private Equity Fund is a legal document that establishes a specific type of partnership within the private equity industry. A private equity fund, often set up as a limited partnership, pools together capital from various investors to invest in privately held companies or acquire other businesses. The Nebraska Certificate of Limited Partnership is required to be filed with the Nebraska Secretary of State and serves as an official registration document for the private equity fund. This certificate outlines the key details and provisions of the partnership, including the fund's name, principal place of business, duration, purpose, and the roles and responsibilities of the general and limited partners involved. This form of partnership offers various benefits for both the private equity fund and its investors. Limited partners typically contribute capital to the fund while having limited liability, meaning they are not personally liable for the fund's debts or liabilities beyond their investment amount. On the other hand, general partners have management control and are responsible for making investment decisions and overseeing the fund's operations. Nebraska also recognizes different types of limited partnerships within the private equity fund space. These include: 1. Traditional Limited Partnership: This is the most common type where there is at least one general partner who assumes unlimited personal liability, and one or more limited partners who have liability limited to their investment. 2. Limited Liability Limited Partnership: In this type, both general and limited partners have limited liability, offering increased protection for the general partners. 3. Family Limited Partnership: Often used for estate planning, this partnership is established among family members to manage assets and facilitate generational wealth transfer. 4. Master Limited Partnership: This structure is utilized when a private equity fund wants to establish multiple investment vehicles, each known as a "series," under one master partnership, allowing for easier management and tax efficiency. It is crucial to consult with legal professionals experienced in private equity law to ensure compliance with Nebraska's regulations and to draft a comprehensive Certificate of Limited Partnership tailored to the specific needs of the fund.

Nebraska Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Nebraska Certificate Of Limited Partnership Of New Private Equity Fund?

Choosing the right authorized document web template could be a struggle. Naturally, there are tons of layouts accessible on the Internet, but how will you get the authorized type you will need? Make use of the US Legal Forms site. The assistance delivers a huge number of layouts, for example the Nebraska Certificate of Limited Partnership of New Private Equity Fund, which can be used for business and personal requirements. Each of the varieties are checked out by experts and fulfill federal and state requirements.

If you are currently registered, log in in your profile and click the Download button to find the Nebraska Certificate of Limited Partnership of New Private Equity Fund. Make use of your profile to search through the authorized varieties you possess purchased earlier. Go to the My Forms tab of your respective profile and have another backup of your document you will need.

If you are a fresh user of US Legal Forms, here are basic guidelines for you to follow:

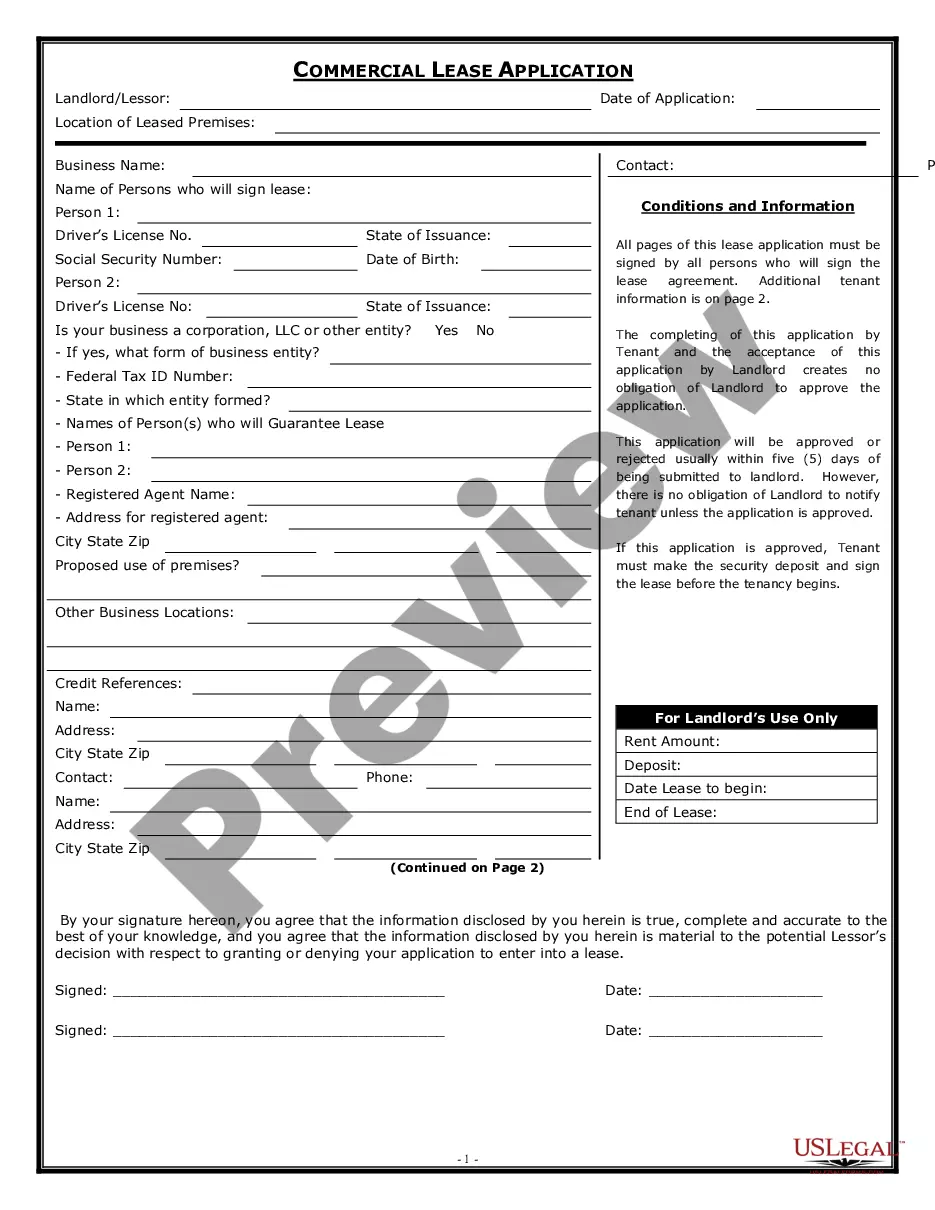

- Initially, make sure you have selected the right type to your area/state. You may look through the shape while using Review button and look at the shape explanation to make sure it will be the right one for you.

- When the type is not going to fulfill your needs, use the Seach industry to get the correct type.

- When you are certain that the shape is proper, click on the Purchase now button to find the type.

- Pick the prices prepare you would like and enter the necessary information and facts. Design your profile and pay for the transaction using your PayPal profile or bank card.

- Select the file format and acquire the authorized document web template in your system.

- Comprehensive, modify and print and sign the acquired Nebraska Certificate of Limited Partnership of New Private Equity Fund.

US Legal Forms will be the largest library of authorized varieties that you will find a variety of document layouts. Make use of the company to acquire appropriately-manufactured paperwork that follow express requirements.