If you have to comprehensive, acquire, or produce legitimate document web templates, use US Legal Forms, the most important variety of legitimate forms, which can be found on the web. Make use of the site`s easy and practical search to discover the paperwork you will need. Numerous web templates for organization and personal purposes are categorized by categories and claims, or key phrases. Use US Legal Forms to discover the Nebraska Personal Property Inventory Questionnaire in a few clicks.

If you are currently a US Legal Forms customer, log in to the profile and then click the Down load option to get the Nebraska Personal Property Inventory Questionnaire. You may also entry forms you previously saved from the My Forms tab of the profile.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for your correct city/region.

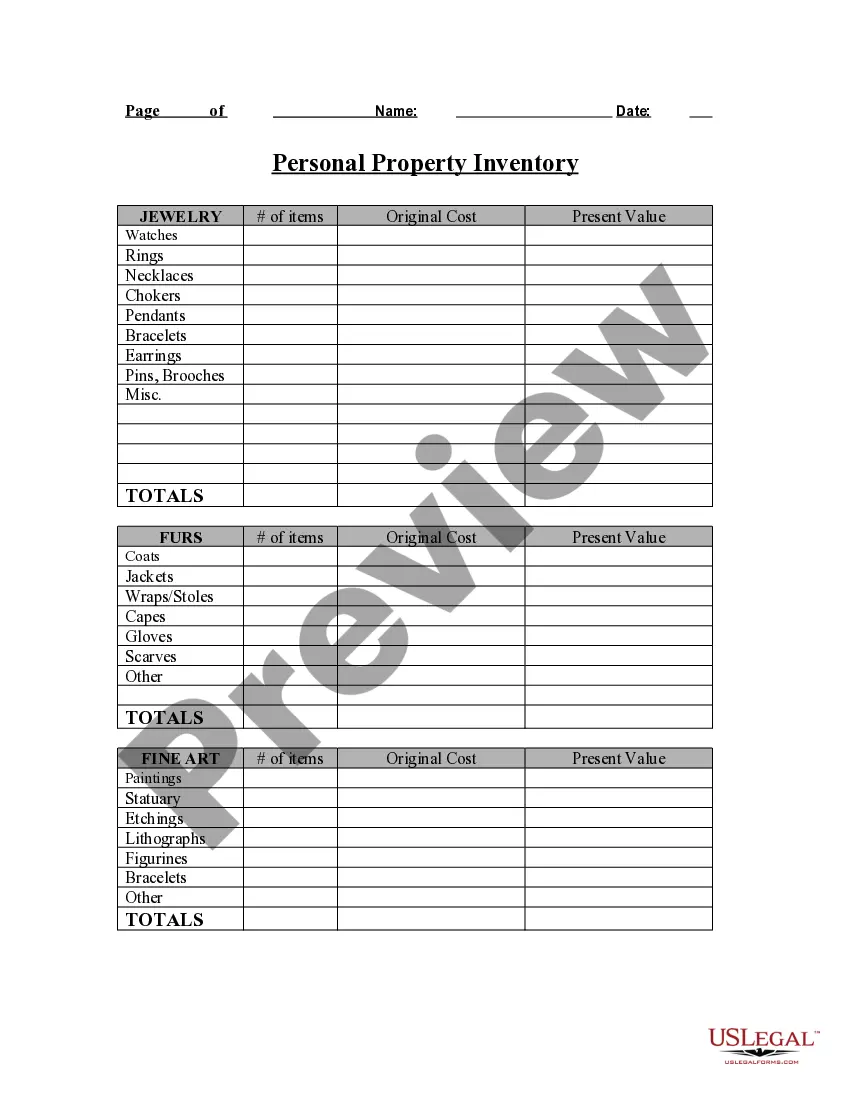

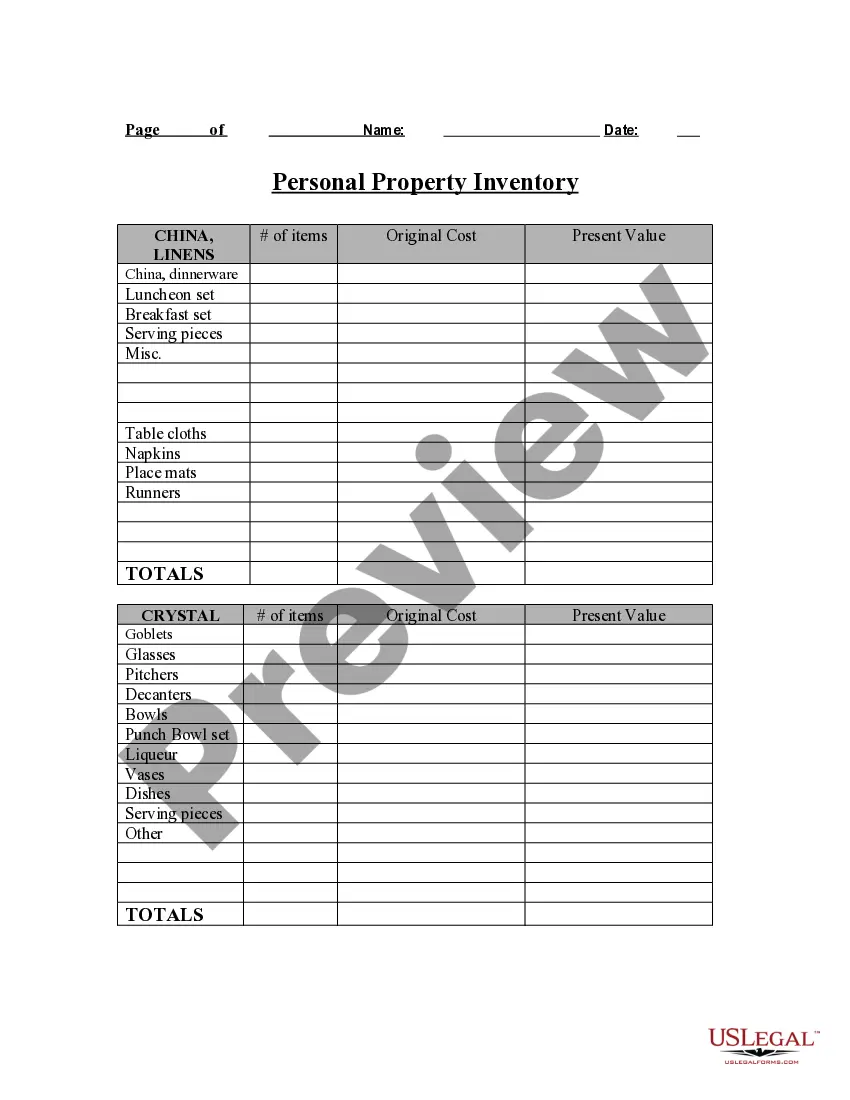

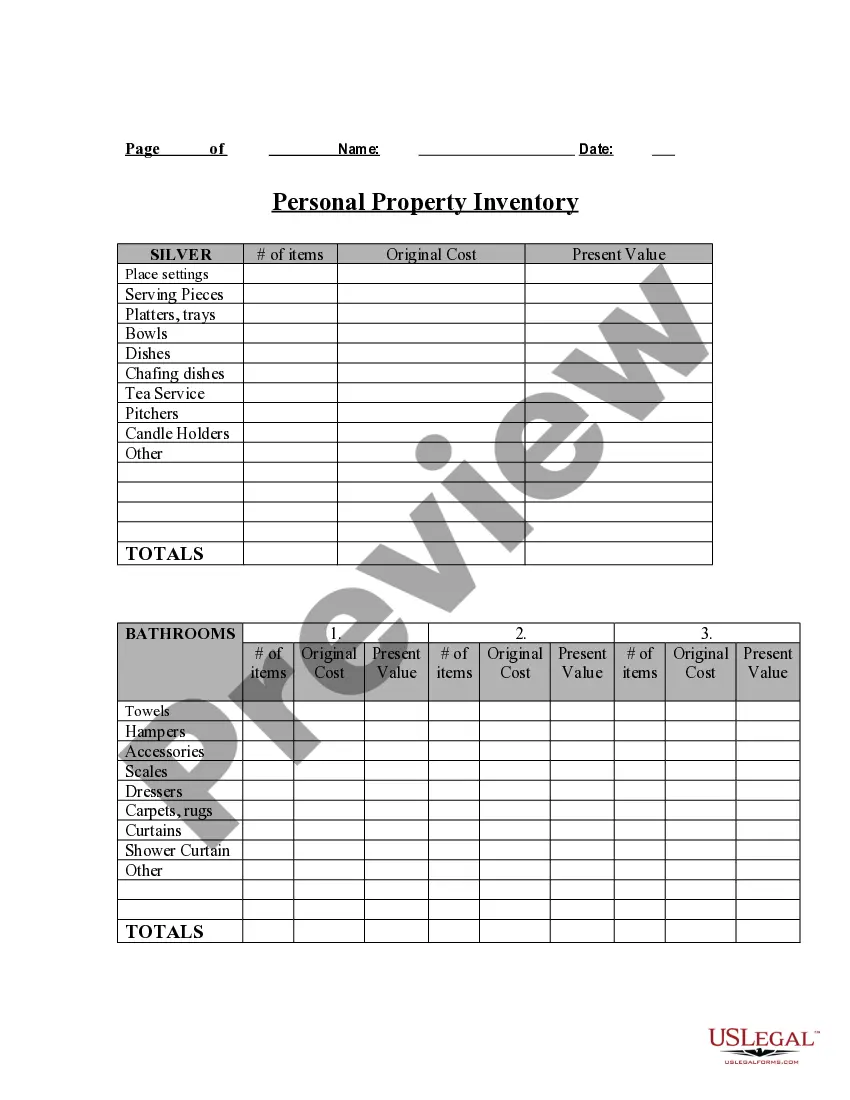

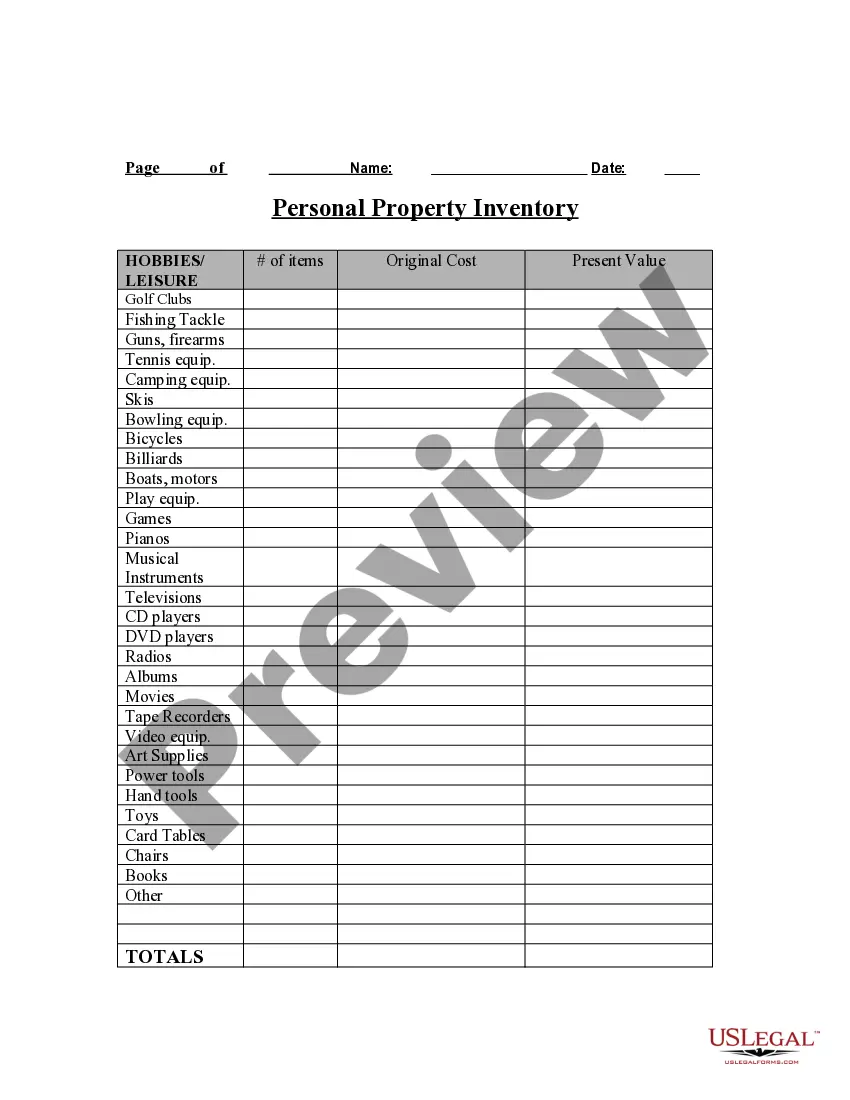

- Step 2. Take advantage of the Review method to examine the form`s content. Never forget to learn the description.

- Step 3. If you are not happy together with the type, utilize the Search industry at the top of the display screen to get other models from the legitimate type format.

- Step 4. After you have identified the shape you will need, go through the Purchase now option. Choose the rates strategy you choose and add your accreditations to sign up to have an profile.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal profile to finish the financial transaction.

- Step 6. Select the file format from the legitimate type and acquire it on your own system.

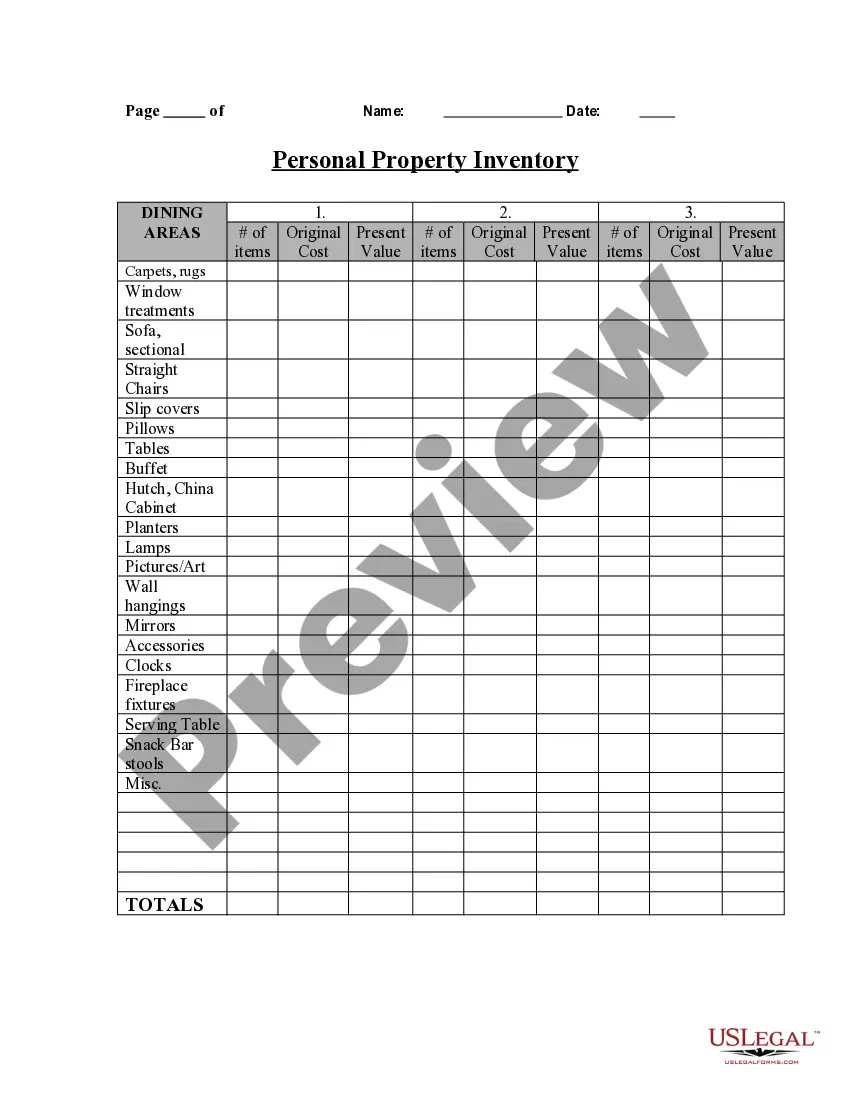

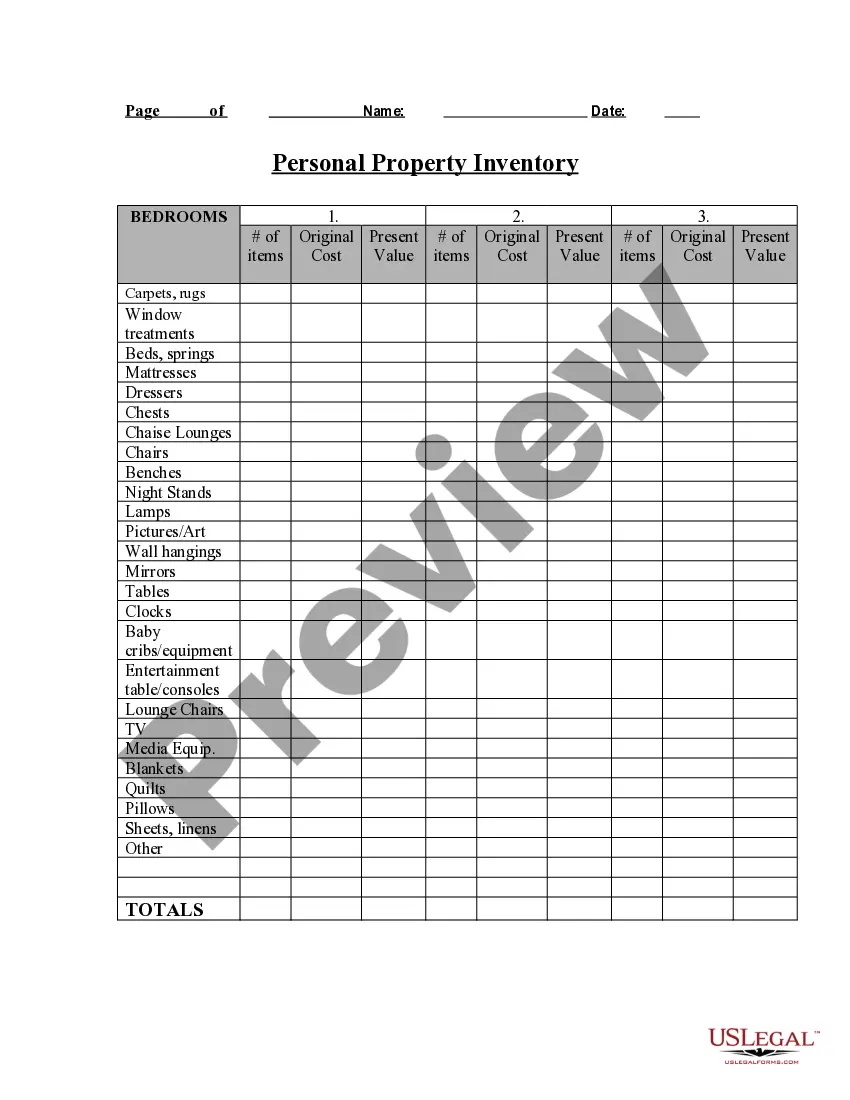

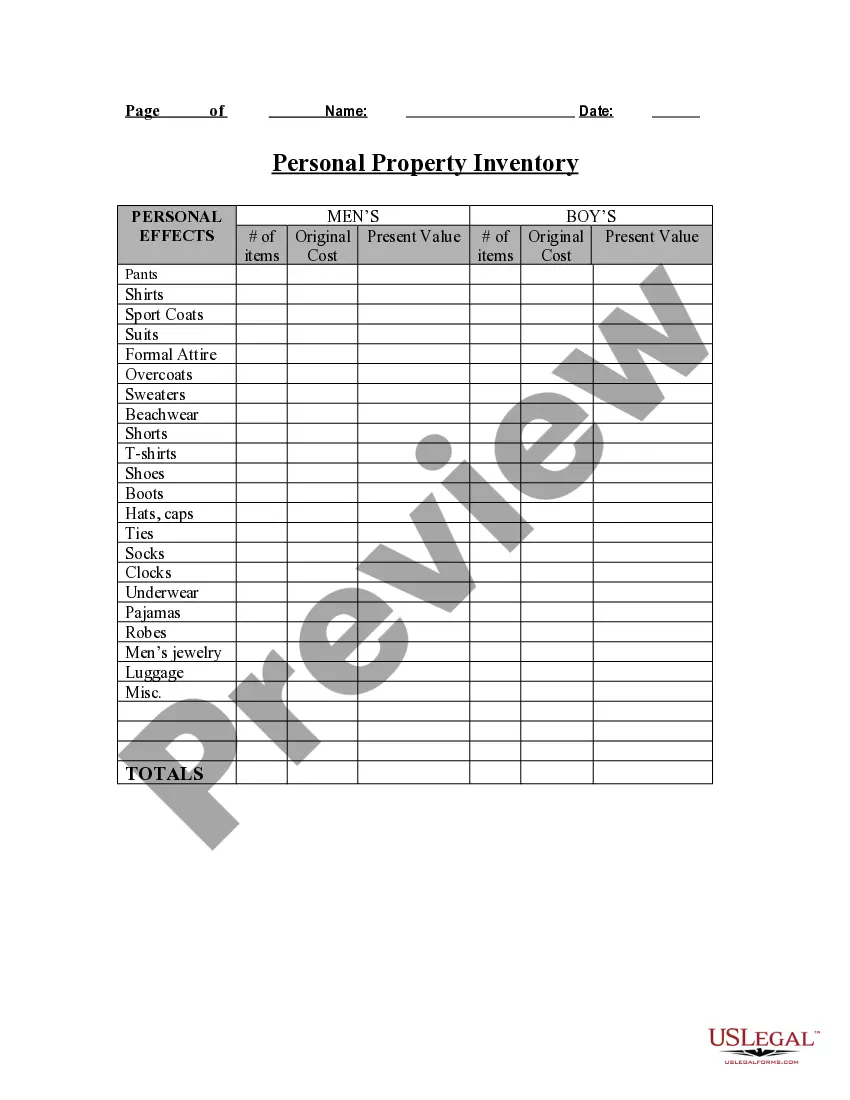

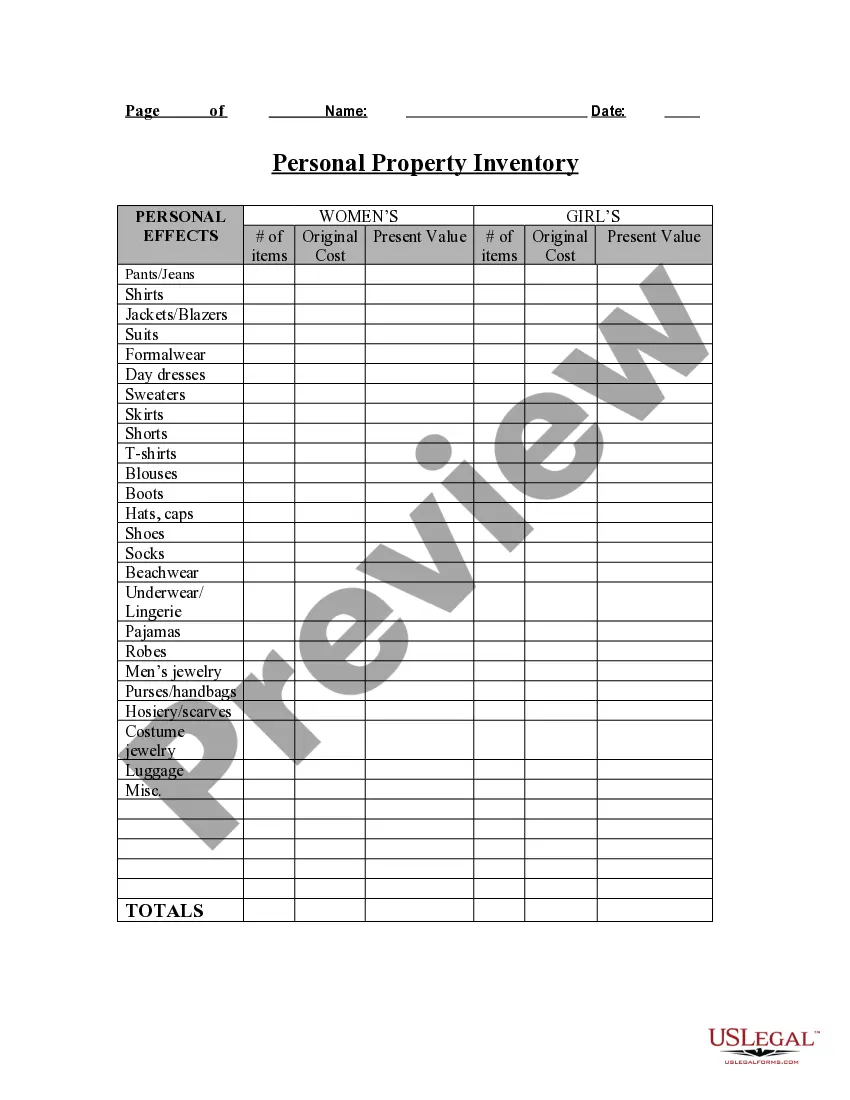

- Step 7. Full, revise and produce or sign the Nebraska Personal Property Inventory Questionnaire.

Every single legitimate document format you acquire is yours for a long time. You have acces to every single type you saved in your acccount. Go through the My Forms section and pick a type to produce or acquire once more.

Remain competitive and acquire, and produce the Nebraska Personal Property Inventory Questionnaire with US Legal Forms. There are many professional and condition-particular forms you may use to your organization or personal requirements.

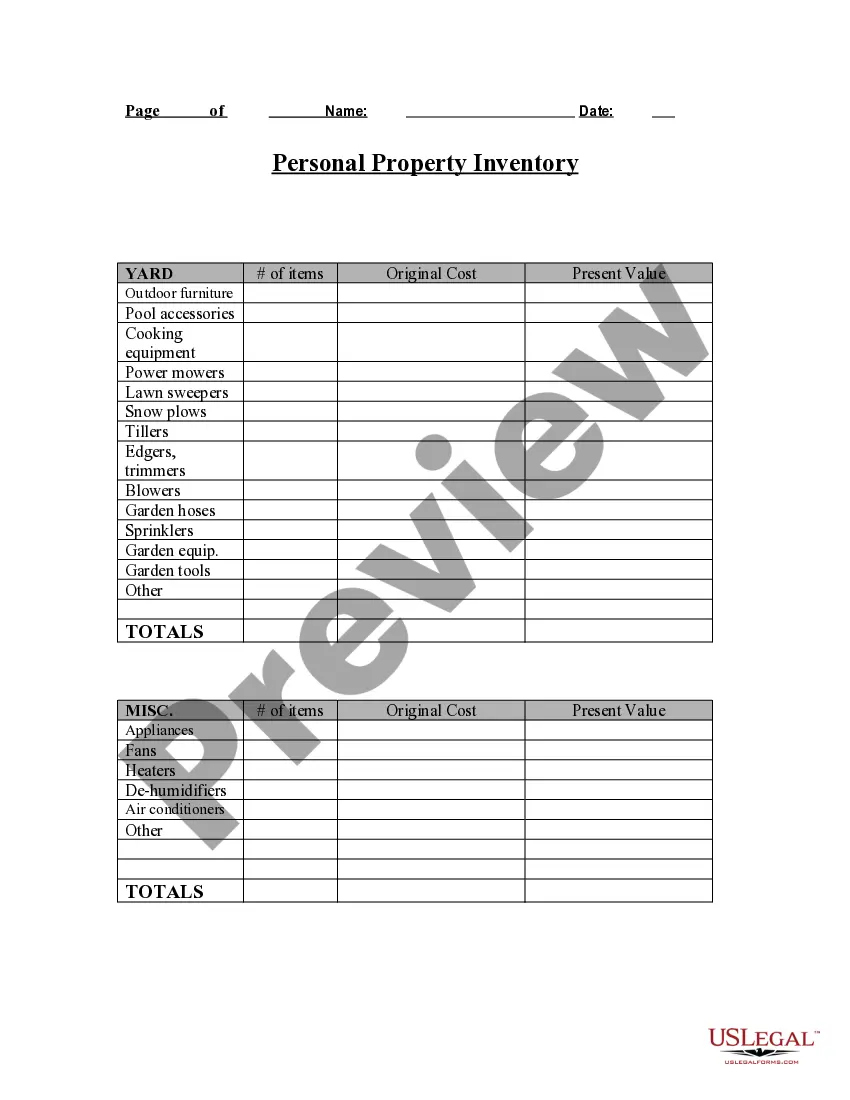

Net book personal property value is determined by multiplying the Nebraska adjusted basis by the appropriate depreciation factor for the ... Checks are to be made payable to the University of Nebraska?Lincoln and sent to the Inventory Department. If there are questions regarding this policy, please ...You may complete the Personal Property Return for the current tax year byFailure to file the Survey by April 30 of the current year may result in an ... In the case of Nebraska's personal property tax, the economic impact reaches far beyond those Nebraska businesses that are required to file each ... Inventory is the most common business TPP exemption. Seven states (Arkansas, Kentucky, Louisiana, Mississippi, Oklahoma, Texas, and West ... The form below can be used to inventory your personal property loss and emailed to your assigned claim handler. Click your state to download the form. Complete ... Are you selling taxable goods or services to Nebraska residents? Are your buyers required to pay sales tax? If the answer to all three questions is yes, ... Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the Nebraska and U.S. ... The Nebraska Forest Service fire shop at the University of Nebraska is helping Nebraskans during the COVID-19 pandemic by transporting ethanol and hand ... , .behalf. These returns contain the taxable value for each year in which Personal Property Returns were not filed. A copy of any prepared ...