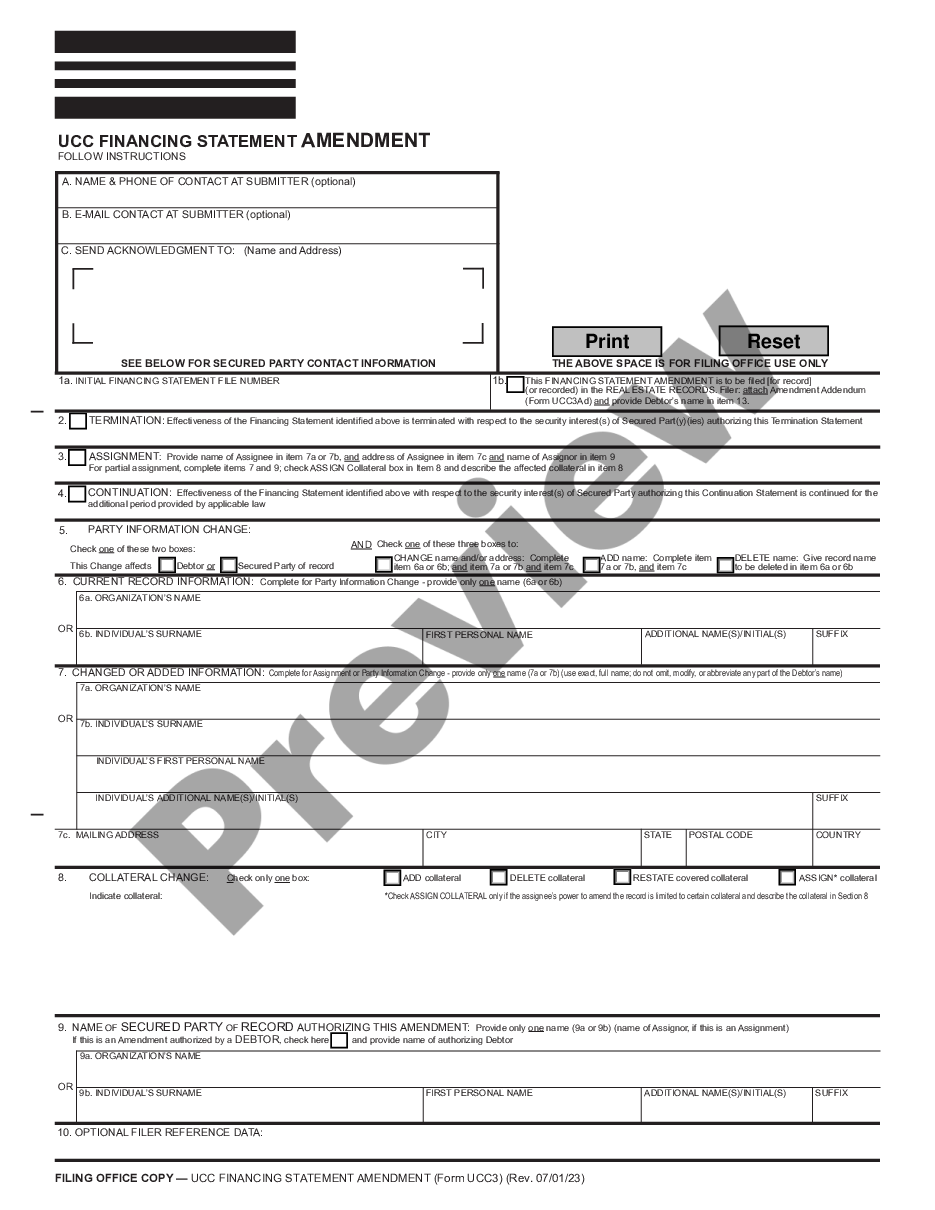

UCC3 - Financing Statement Amendment - Nebraska - For use after July 1, 2001. This amendment is to be filed in the real estate records. This Financing Statement complies with all applicable state statutes.

Nebraska UCC3 Financing Statement Amendment

Description Ucc 3 Filing

How to fill out Nebraska UCC3 Financing Statement Amendment?

Avoid expensive lawyers and find the Nebraska UCC3 Financing Statement Amendment you want at a affordable price on the US Legal Forms website. Use our simple groups functionality to search for and download legal and tax forms. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms enables customers with step-by-step tips on how to download and fill out each form.

US Legal Forms customers just need to log in and download the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should stick to the tips below:

- Make sure the Nebraska UCC3 Financing Statement Amendment is eligible for use in your state.

- If available, read the description and make use of the Preview option before downloading the sample.

- If you’re confident the document fits your needs, click on Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you can complete the Nebraska UCC3 Financing Statement Amendment manually or by using an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

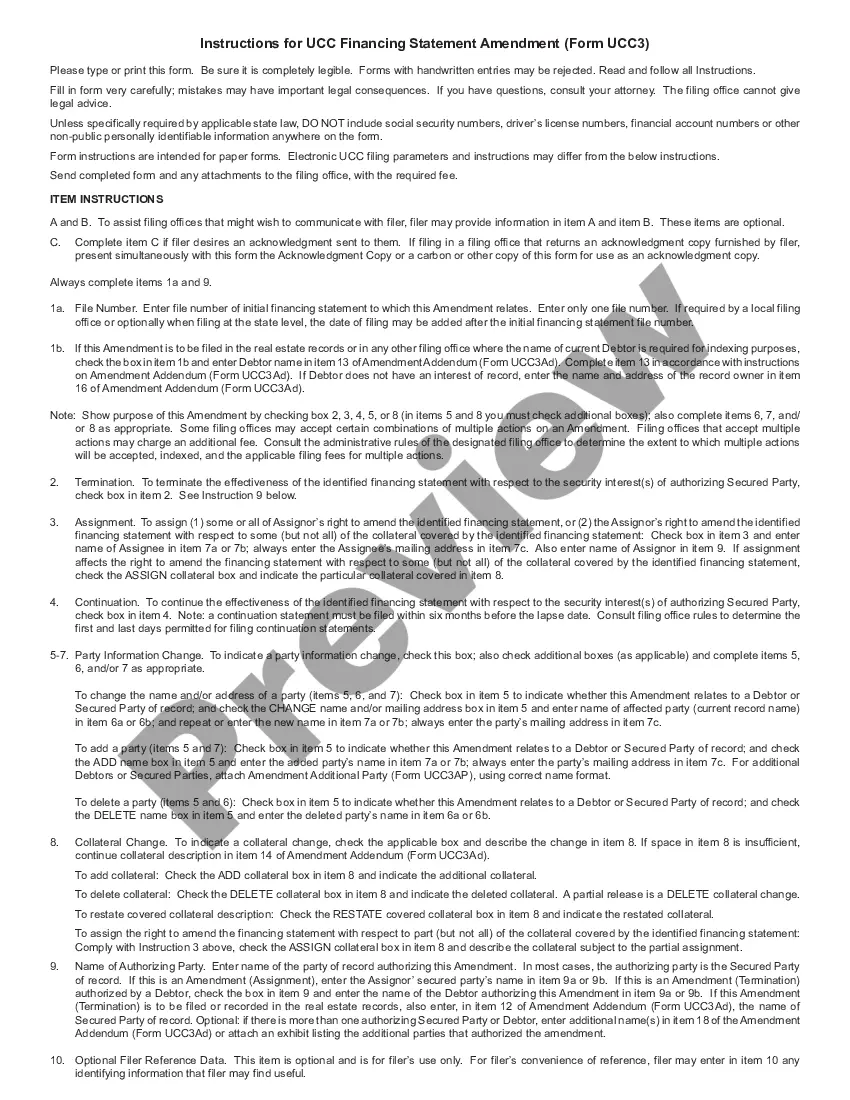

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

After receiving your request, the lender has 20 days to terminate the UCC filing.

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.