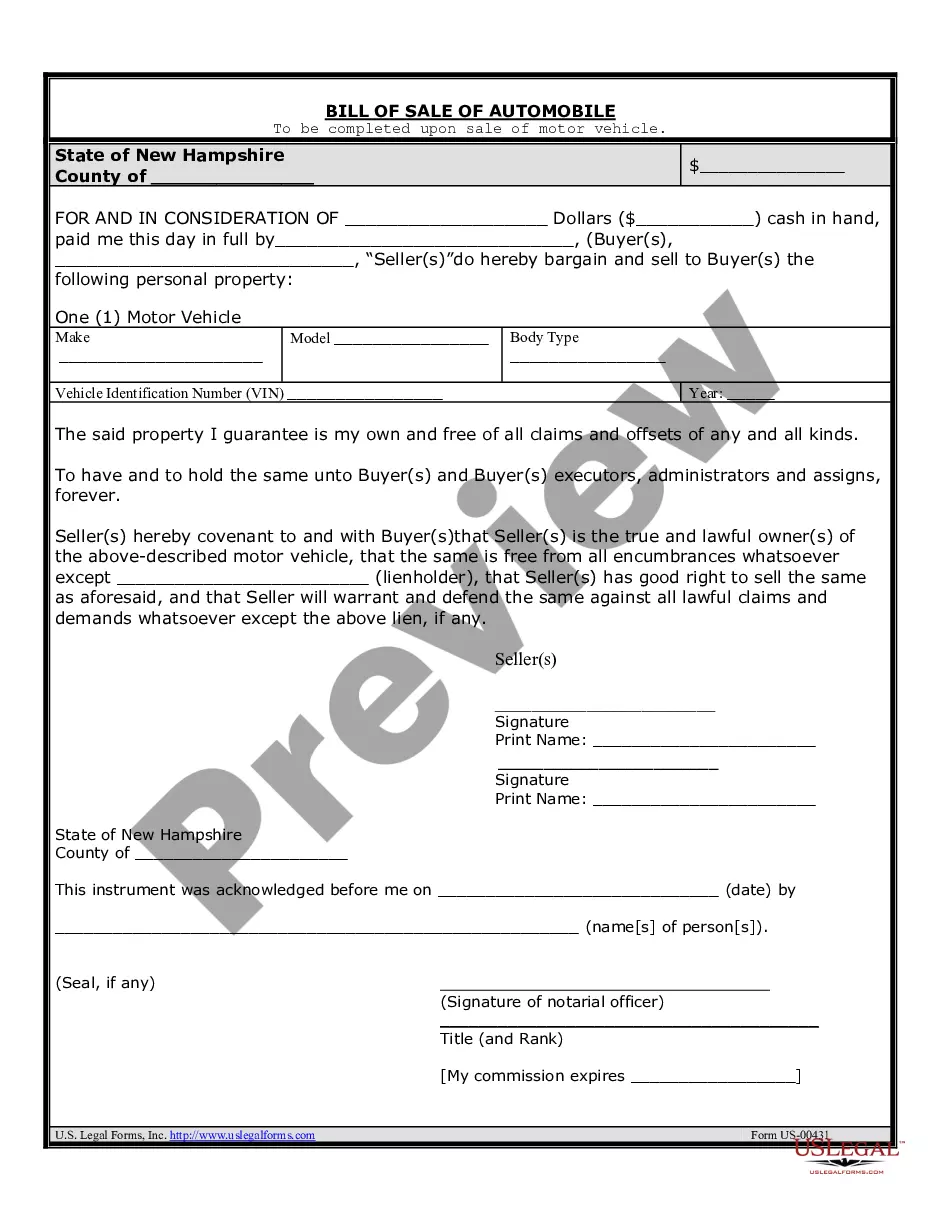

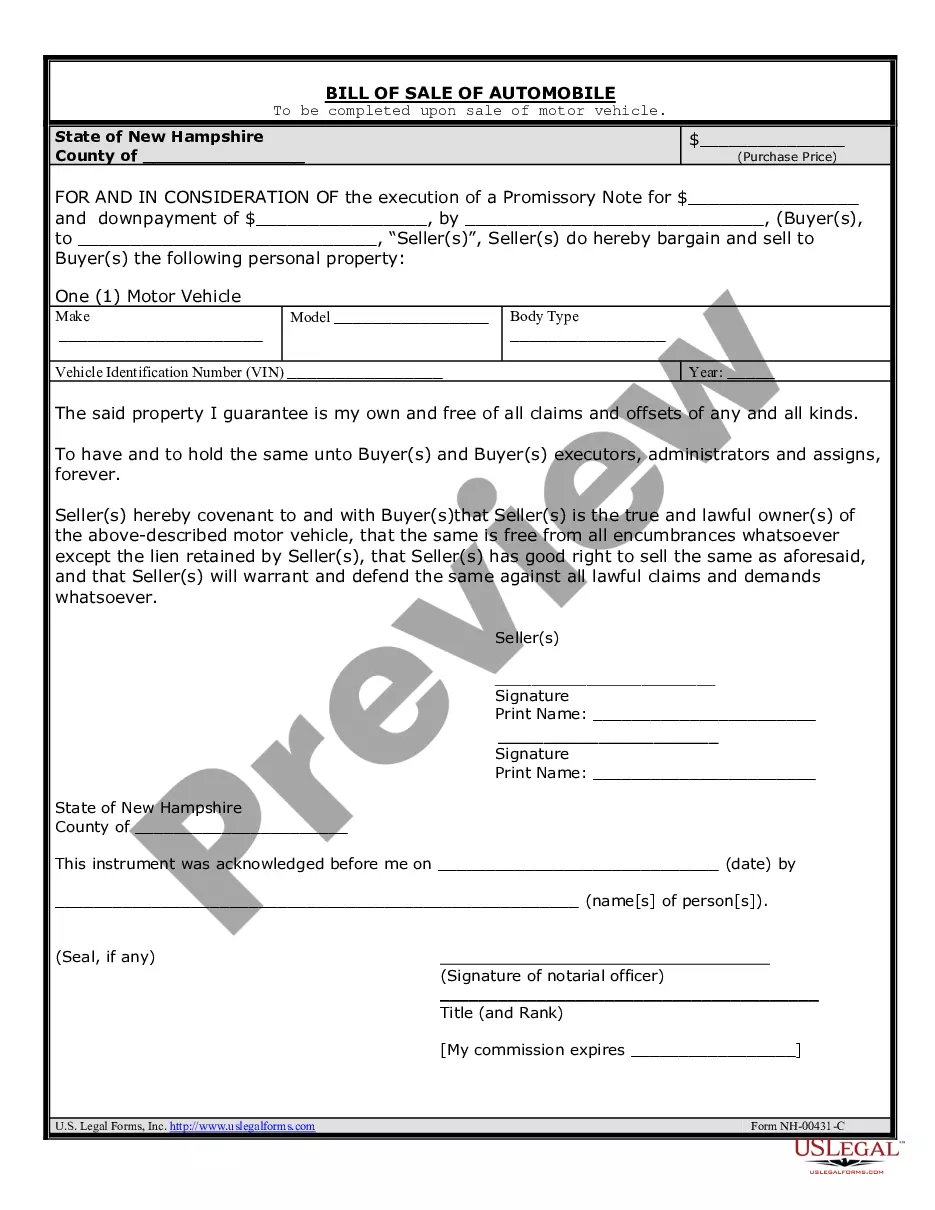

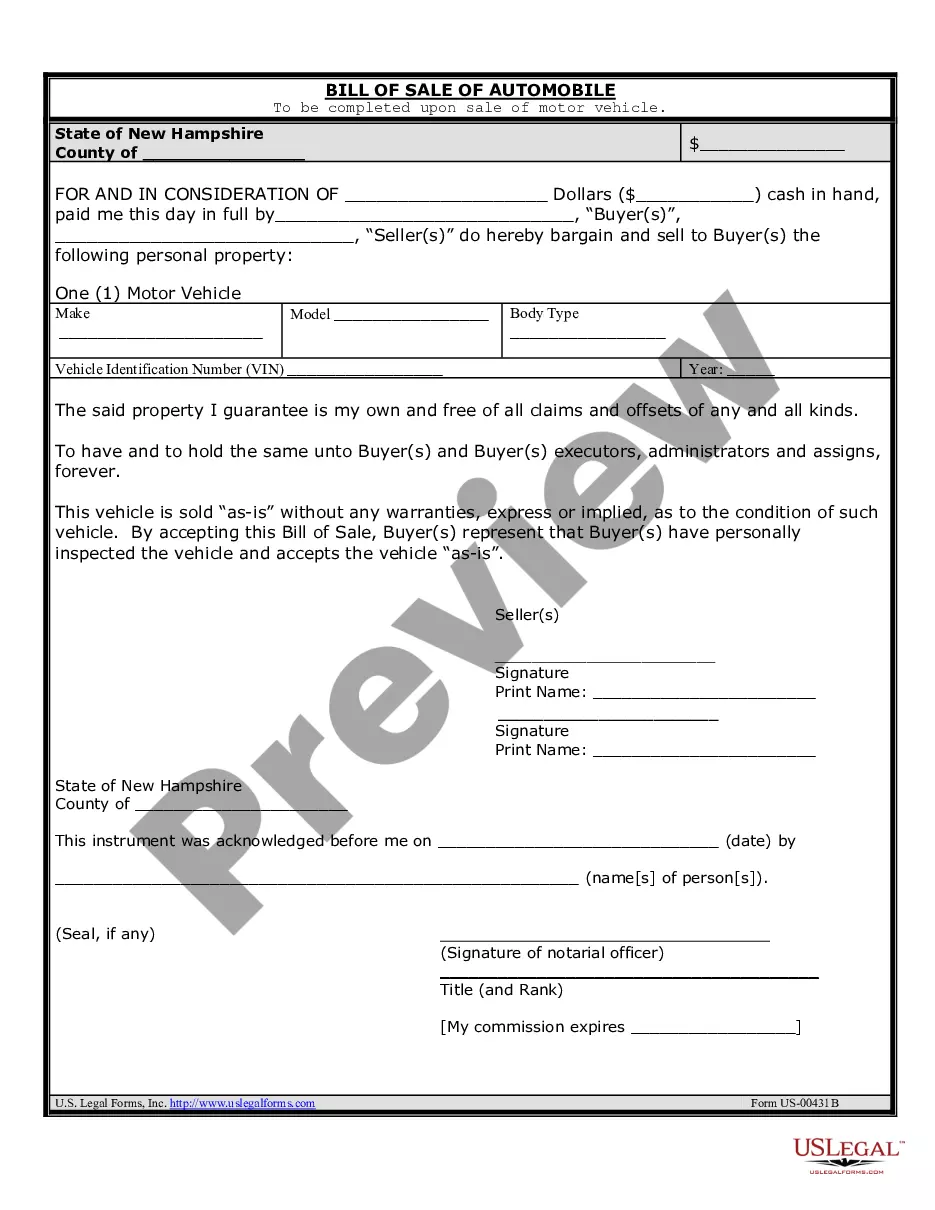

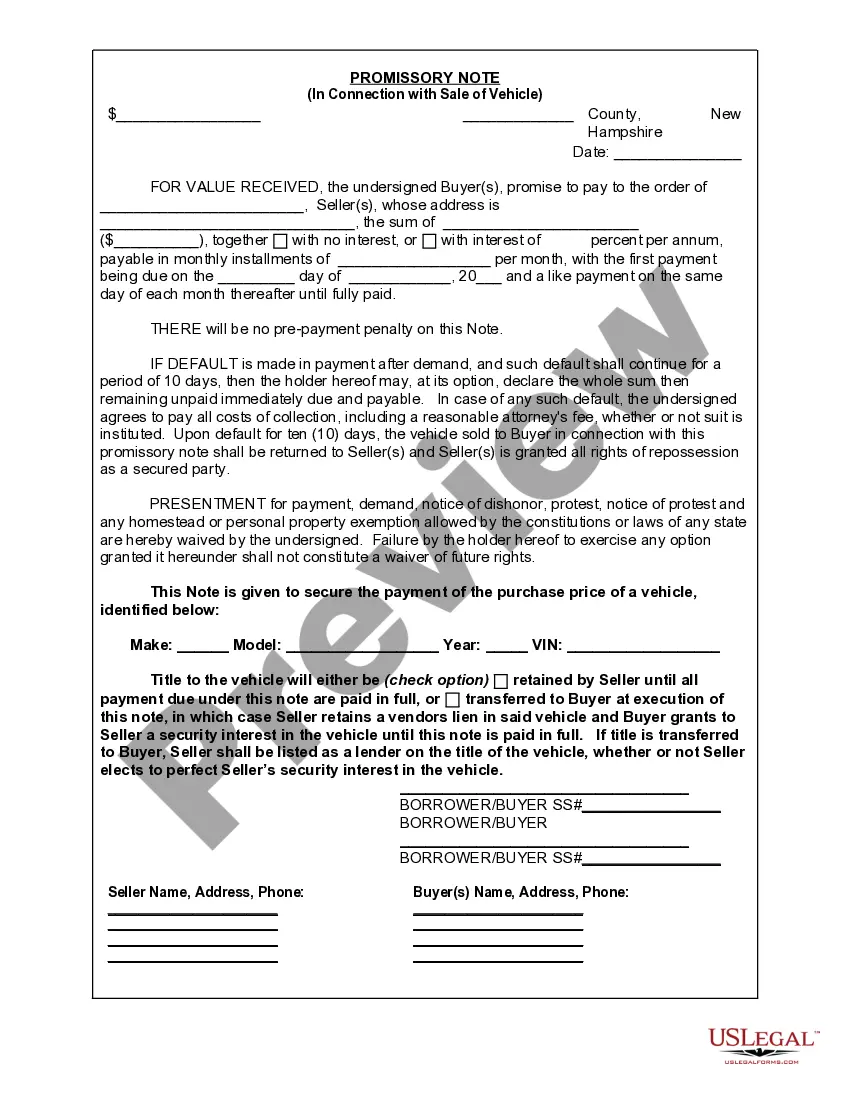

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out New Hampshire Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Avoid expensive attorneys and find the New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile you want at a affordable price on the US Legal Forms website. Use our simple categories functionality to find and download legal and tax documents. Go through their descriptions and preview them prior to downloading. In addition, US Legal Forms provides users with step-by-step tips on how to obtain and fill out every template.

US Legal Forms clients merely have to log in and obtain the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the tips below:

- Ensure the New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile is eligible for use where you live.

- If available, look through the description and make use of the Preview option just before downloading the sample.

- If you’re sure the template meets your needs, click on Buy Now.

- In case the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you can complete the New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile manually or with the help of an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

The date of the sale. A detailed description of the vehicle, including: Make. Model. Color. Vehicle identification number. Model year. Year of manufacture. Type of body. Name, signature and legal address (no PO Box) of purchaser. Name, signature and legal address (no PO Box) of seller.

You only need a New Hampshire bill of sale to register a vehicle if you're registering a title exempt vehicle purchased in a private sale. Otherwise, you need a signed title. You must be prepared to pay the fees associated with registering your vehicle.

A promissory note is often included in a mortgage, student loan, car loan, business loan, or personal loan agreement. If you're loaning someone a large sum of money, you'll likely want a legal record of it. Therefore, promissory notes can be used in personal transactions as well.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Debt Classification A promissory note is a type of written contract a lender uses for secured debts where the lender has collateral to seize in the event of default. It is more likely your car loan is a promissory note if you have a schedule of payments and a fixed interest rate spelled out on your loan document.

200b200bThe promissory note should contain: The car's VIN number, model, make and year of manufacture. The statement that the borrower promises to pay the lender a specific amount, how much each payment will be, the annual interest rate and when the loan will be completely repaid.