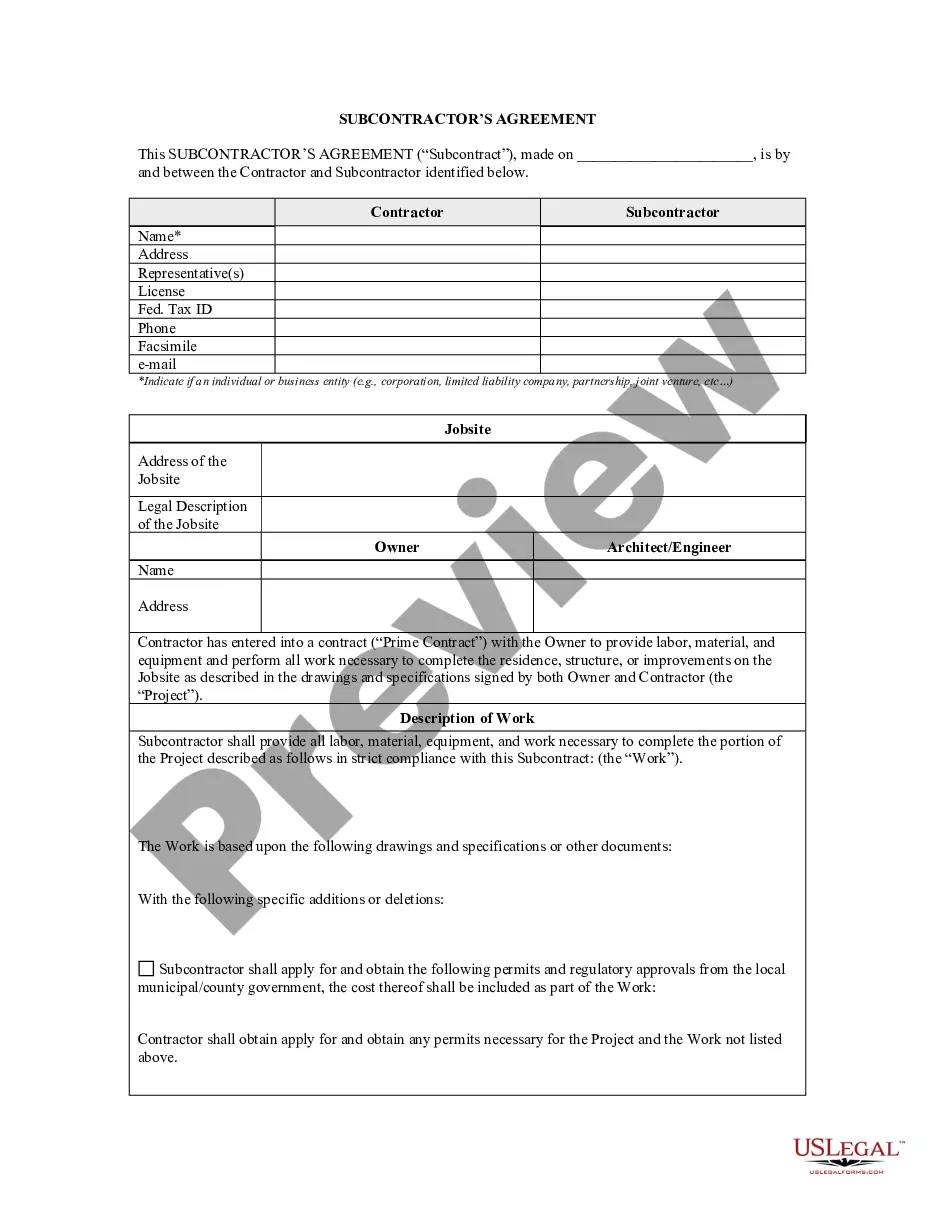

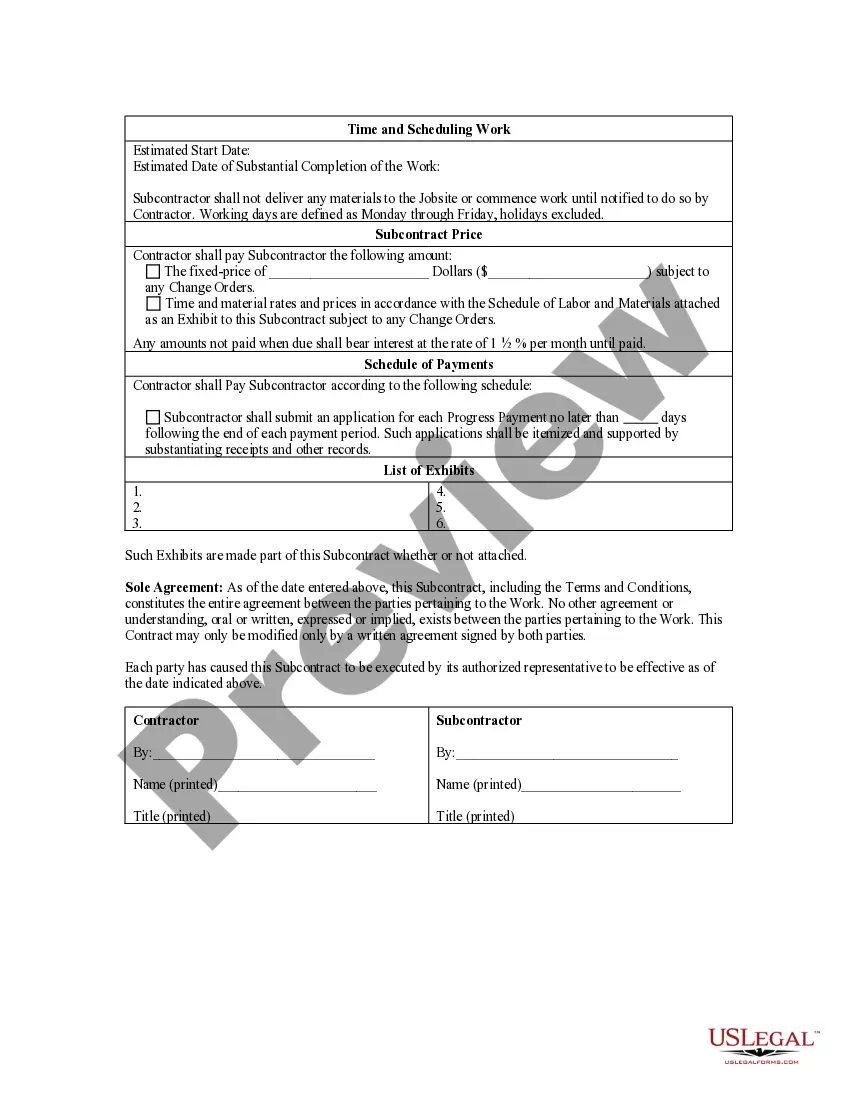

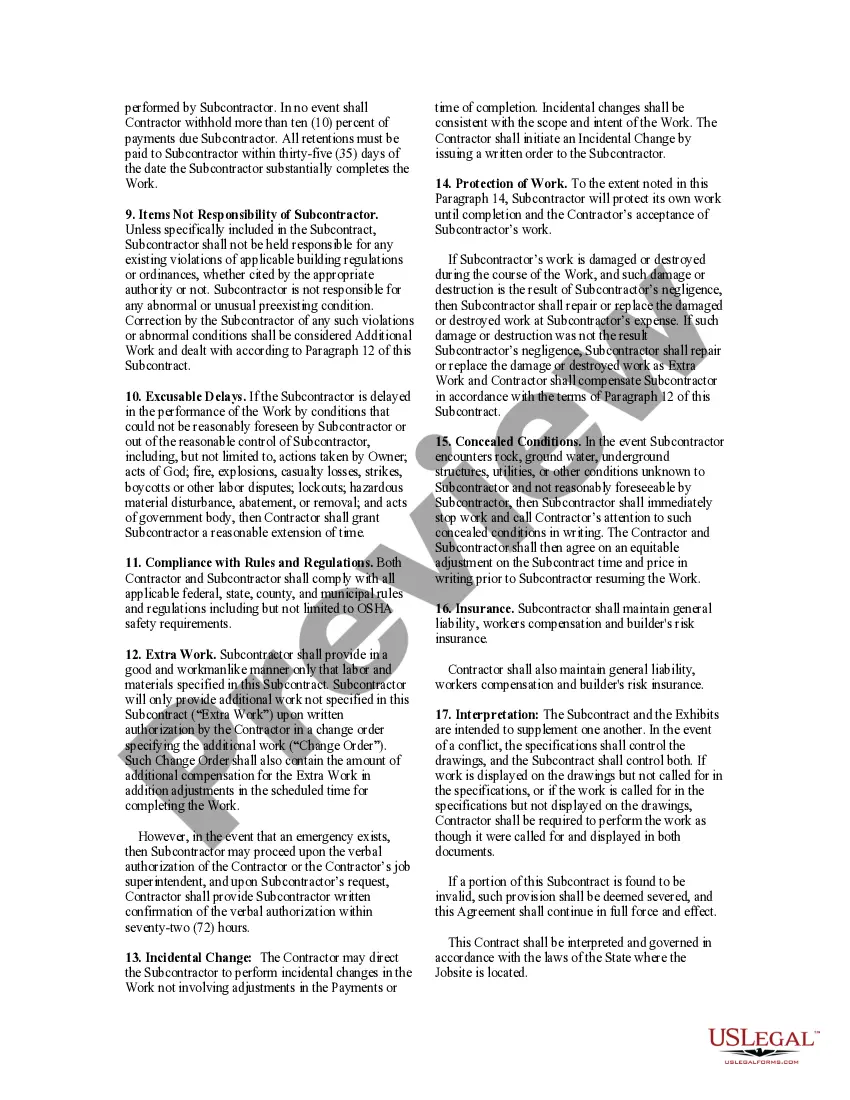

New Hampshire Subcontractor's Agreement

Description

How to fill out New Hampshire Subcontractor's Agreement?

Avoid expensive attorneys and find the New Hampshire Subcontractor's Agreement you want at a reasonable price on the US Legal Forms site. Use our simple groups functionality to search for and download legal and tax documents. Go through their descriptions and preview them well before downloading. Additionally, US Legal Forms provides users with step-by-step tips on how to download and complete every single form.

US Legal Forms customers merely need to log in and obtain the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet must follow the tips below:

- Ensure the New Hampshire Subcontractor's Agreement is eligible for use in your state.

- If available, read the description and make use of the Preview option prior to downloading the templates.

- If you’re sure the template is right for you, click on Buy Now.

- If the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, you can fill out the New Hampshire Subcontractor's Agreement manually or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Scope of Work. A subcontractor agreement should always specify the scope of work. Supply Chain. Defense & Indemnification. Insurance, Bonds, & Liens. Warranty. Arbitration. Conditional Payment.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

A subcontractor has a contract with the contractor for the services provided - an employee of the contractor cannot also be a subcontractor.

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

Define the needs of the project. Finalize the provisions of the agreement, such as the due dates. Clarify the terms for payment. Write a draft of the contract and send it to the subcontractor for her review. Decide on a method to handle disputes, should one arise between you and the subcontractor.