New Hampshire Single Member Limited Liability Company LLC Operating Agreement

Description

Key Concepts & Definitions

Single Member Limited Liability Company (LLC): An LLC that has one owner (member), combining the tax advantages and operational flexibility of a partnership with the limited liability of a corporation.

Limited Liability: Protects the personal assets of the LLC's owner from business debts and claims.

Sole Proprietorship: A business owned and operated by one person, where there is no legal distinction between the owner and the business entity.

Operating Agreement: A document outlining the operational and financial decisions of an LLC including rules, regulations, and provisions.

Tax Purposes: The method by which taxes are assessed, collected, and managed according to the business structure.

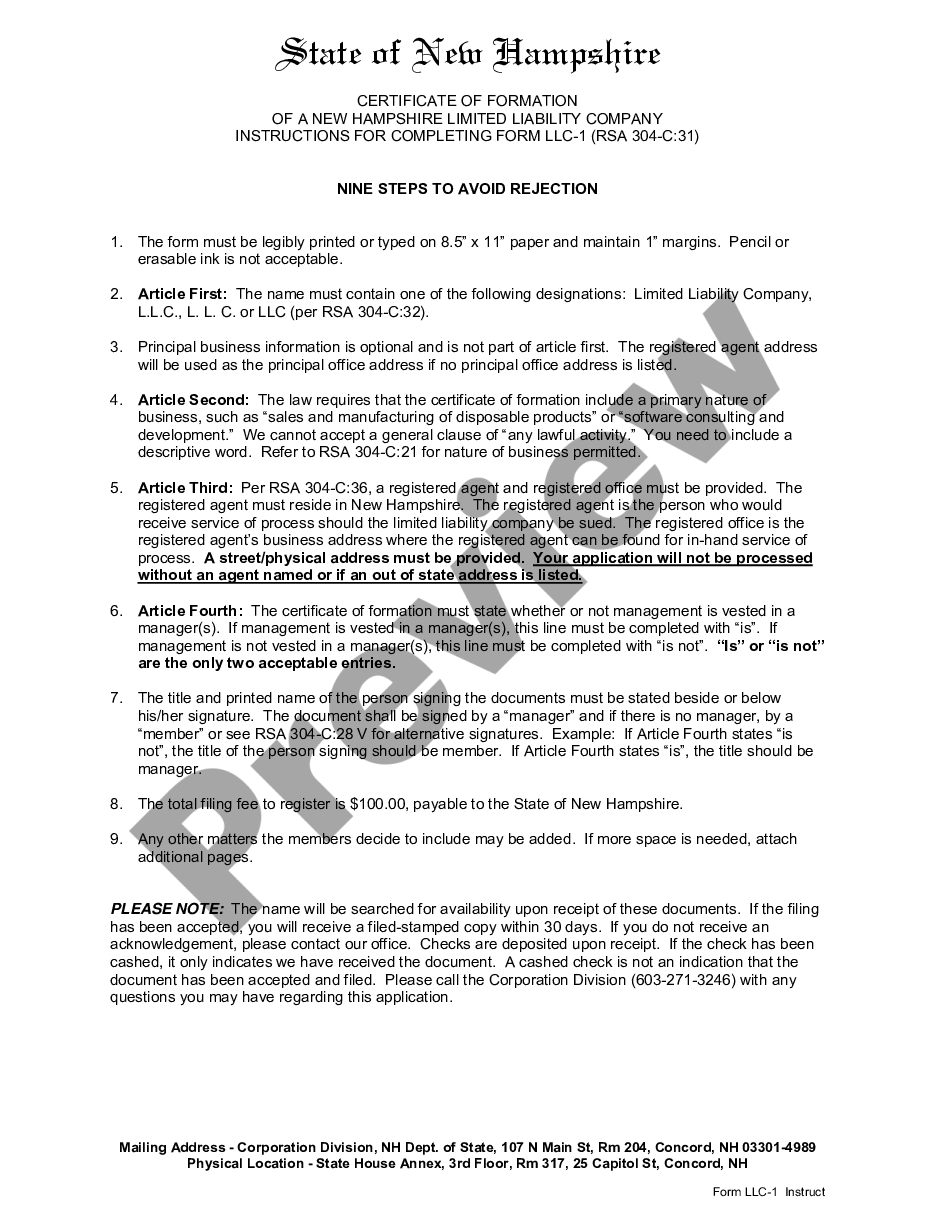

Step-by-Step Guide to Forming a Single Member LLC

- Choose a Unique Business Name: Ensure the name complies with state regulations and is easily searchable for SEO purposes.

- File the Articles of Organization: Submit this vital document to the appropriate state agency to legally establish your single member LLC.

- Create an Operating Agreement: Although not mandatory in every state, it's advisable for clarifying the business structure for tax and legal purposes.

- Obtain EIN and Necessary Permits: Register for an Employer Identification Number (EIN) and any other required permits or licenses, according to your business activity.

- Open a Business Bank Account: Keep your personal and business finances separate to maintain the limited liability protection.

Risk Analysis for Single Member LLCs

Operating as a single member LLC carries specific risks including:

- Personal Asset Vulnerability: Incorrect filing or separation of funds can risk personal liability exposure.

- Pass-Through Taxation Issues: If not properly managed, can lead to unexpected tax liabilities.

- Limited Growth Potential: As a single owner, opportunities for raising capital may be more limited compared to multi-member LLCs.

Pros & Cons of a Single Member LLC

- Pros:

- Limited liability protection

- Simplified tax filing and potentially beneficial tax treatment

- Operational flexibility and minimal compliance requirements

- Cons:

- Potential for personal liability if the corporate veil is pierced

- Limited funding opportunities

- Could be viewed as less credible by some vendors or lenders

Best Practices for Managing a Single Member LLC

- Keep Detailed Records: Maintain up-to-date records and clear separation between personal and business finances to protect the benefits of limited liability.

- Regularly Update Operating Agreement: Reflect any changes in the business to manage risk effectively.

- Consult Tax Professionals: Engage with tax experts to ensure optimal tax planning and compliance, particularly for maximizing the advantages of pass-through taxation.

Common Mistakes & How to Avoid Them

- Commingling of Assets: This major mistake can be avoided by strictly separating personal and business banking.

- Neglecting Proper Documentation: Always update your operating agreement and keep formal minutes of decisions, even as a single member.

- Forgetting Annual Filings: Stay updated with state-required filings to avoid penalties and maintain your LLC's good standing.

How to fill out New Hampshire Single Member Limited Liability Company LLC Operating Agreement?

Avoid pricey lawyers and find the New Hampshire Single Member Limited Liability Company LLC Operating Agreement you want at a reasonable price on the US Legal Forms site. Use our simple groups function to search for and download legal and tax forms. Go through their descriptions and preview them just before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to download and fill out every single template.

US Legal Forms clients simply need to log in and get the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the tips below:

- Make sure the New Hampshire Single Member Limited Liability Company LLC Operating Agreement is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the sample.

- If you are sure the template fits your needs, click Buy Now.

- In case the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you may fill out the New Hampshire Single Member Limited Liability Company LLC Operating Agreement manually or by using an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

A single-member LLC may act as a shield to protect your personal assets from the liabilities associated with the business conducted by the LLC.The same protection applies to protect the owner from any debts of the LLC. Disregarded Entity Tax Status.

LLC operating agreements do not need to be filed with the state. Do not confuse the LLC operating agreement with the articles of organization. Articles of organization are public documents that are filed with the state to actually form the LLC.

The IRS treats one-member LLCs as sole proprietorships for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. As the sole owner of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your 1040 tax return.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

It can secure your liability protection. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.In order to keep this liability protection, you need to keep your business affairs and personal affairs separate.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

There is no requirement that the operating agreement is notarized. Even without being notarized, the document is still considered legally enforceable among the parties. However, some businesses will still have the signatures notarized to make things feel more official.

If you're not sure who is serving as the LLC's registered business agent, the information is available through the Secretary of State's office in the state where your business is registered. The same office may also have a copy of your LLC operating agreement, although filing such agreements is generally not required.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.