New Hampshire Single Member Limited Liability Company LLC Operating Agreement

Description Llc Nh Operating Agreement

How to fill out Nh Operating Download?

Avoid pricey lawyers and find the New Hampshire Single Member Limited Liability Company LLC Operating Agreement you want at a reasonable price on the US Legal Forms site. Use our simple groups function to search for and download legal and tax forms. Go through their descriptions and preview them just before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to download and fill out every single template.

US Legal Forms clients simply need to log in and get the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the tips below:

- Make sure the New Hampshire Single Member Limited Liability Company LLC Operating Agreement is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the sample.

- If you are sure the template fits your needs, click Buy Now.

- In case the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you may fill out the New Hampshire Single Member Limited Liability Company LLC Operating Agreement manually or by using an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Limited Liability Company Operating Form popularity

New Hampshire Llc Operating Agreement Other Form Names

Member Operating Agreement FAQ

A single-member LLC may act as a shield to protect your personal assets from the liabilities associated with the business conducted by the LLC.The same protection applies to protect the owner from any debts of the LLC. Disregarded Entity Tax Status.

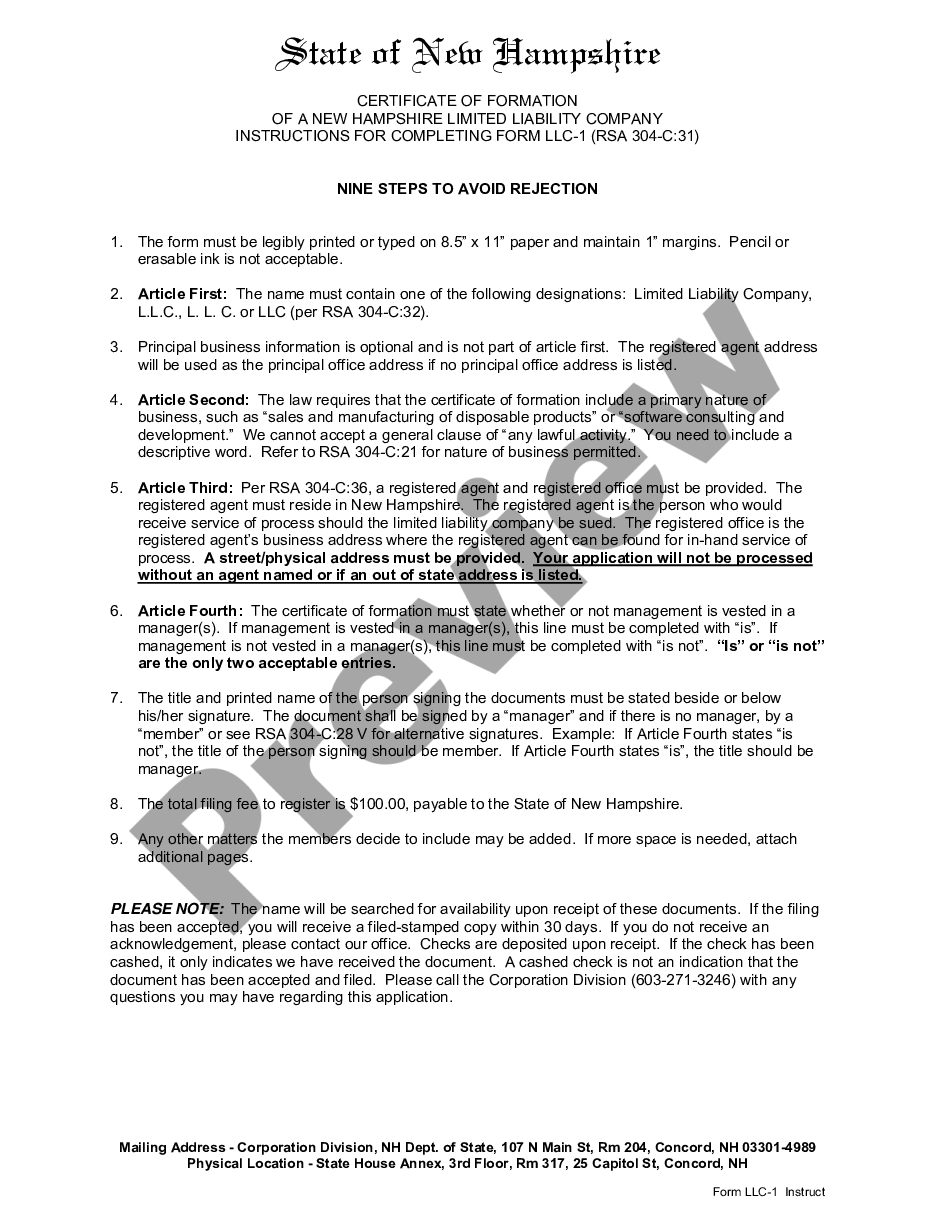

LLC operating agreements do not need to be filed with the state. Do not confuse the LLC operating agreement with the articles of organization. Articles of organization are public documents that are filed with the state to actually form the LLC.

The IRS treats one-member LLCs as sole proprietorships for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. As the sole owner of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your 1040 tax return.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

It can secure your liability protection. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.In order to keep this liability protection, you need to keep your business affairs and personal affairs separate.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

There is no requirement that the operating agreement is notarized. Even without being notarized, the document is still considered legally enforceable among the parties. However, some businesses will still have the signatures notarized to make things feel more official.

If you're not sure who is serving as the LLC's registered business agent, the information is available through the Secretary of State's office in the state where your business is registered. The same office may also have a copy of your LLC operating agreement, although filing such agreements is generally not required.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.