New Hampshire Limited Liability Company LLC Formation Package

Description

How to fill out New Hampshire Limited Liability Company LLC Formation Package?

Avoid expensive lawyers and find the New Hampshire Limited Liability Company LLC Formation Package you need at a affordable price on the US Legal Forms website. Use our simple categories function to look for and download legal and tax forms. Read their descriptions and preview them before downloading. Additionally, US Legal Forms provides users with step-by-step instructions on how to obtain and fill out every single template.

US Legal Forms customers just must log in and download the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should stick to the guidelines below:

- Ensure the New Hampshire Limited Liability Company LLC Formation Package is eligible for use in your state.

- If available, look through the description and make use of the Preview option just before downloading the templates.

- If you’re sure the template is right for you, click on Buy Now.

- If the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, you can fill out the New Hampshire Limited Liability Company LLC Formation Package manually or an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

There are no restrictions to the number of LLC Members (owners) an LLC can have.Exception to the rule: If an LLC is taxed as an S-Corp with the IRS it can't have more than 100 shareholders (Members).

In addition to "president" and "CEO," common titles used by LLC chief executives are "principal," "founder," "consultant" and "owner." Along with being correct and true, these titles accurately represent your position in the company.

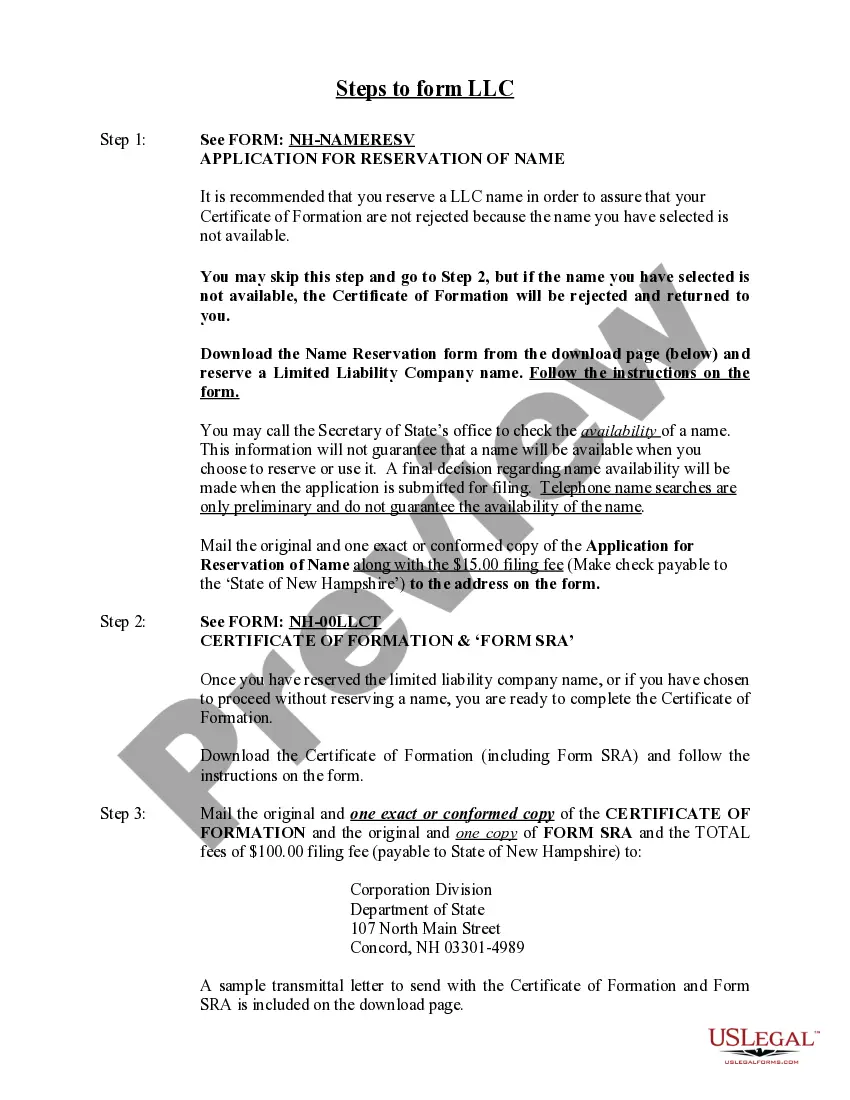

Starting an LLC in New Hampshire is Easy. To start a New Hampshire Limited Liability Company, you will need to file your Certificate of Formation with the State of New Hampshire, which costs $100.

The President is essentially the highest ranking manager in the LLC. The Operating Agreement typically gives the President general management powers of the business of the LLC, as well as full power to open bank accounts. Other titles of LLC officers and managers are Secretary and Treasurer for example.

Owner. Managing member. CEO. President. Principal. Managing Director. Creative Director. Technical Director.

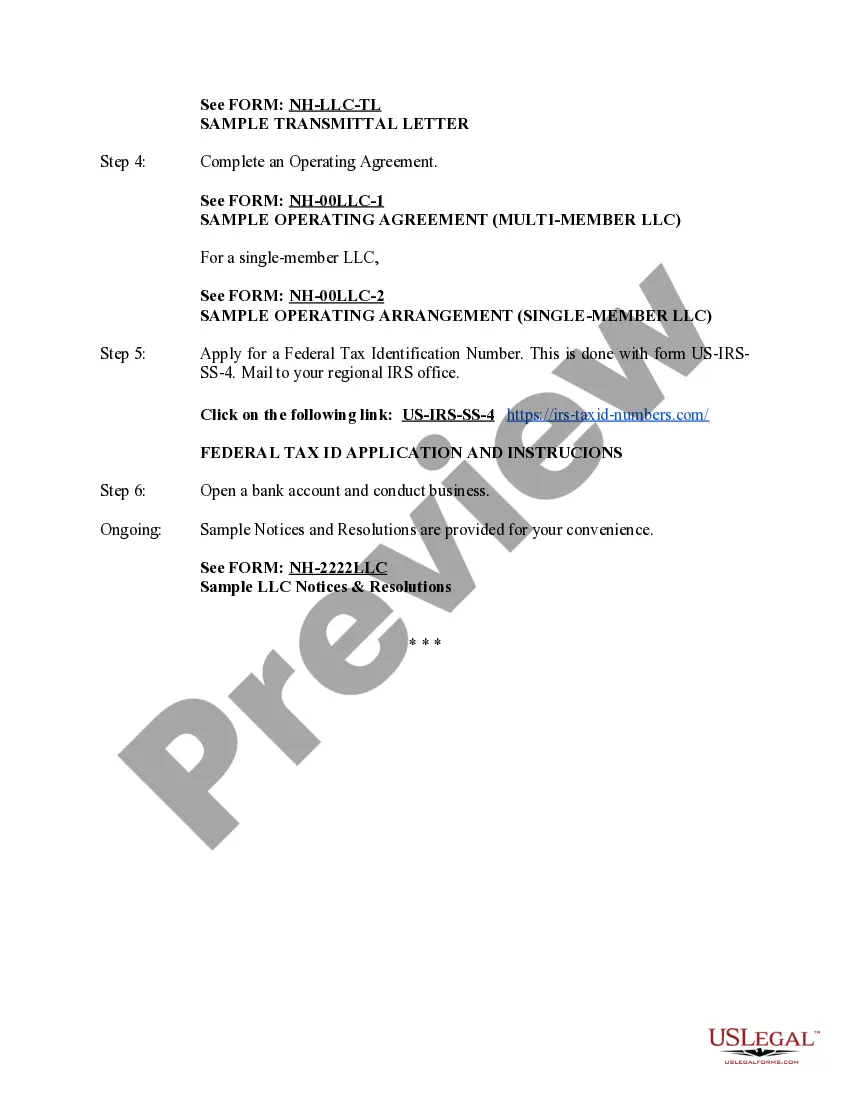

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.