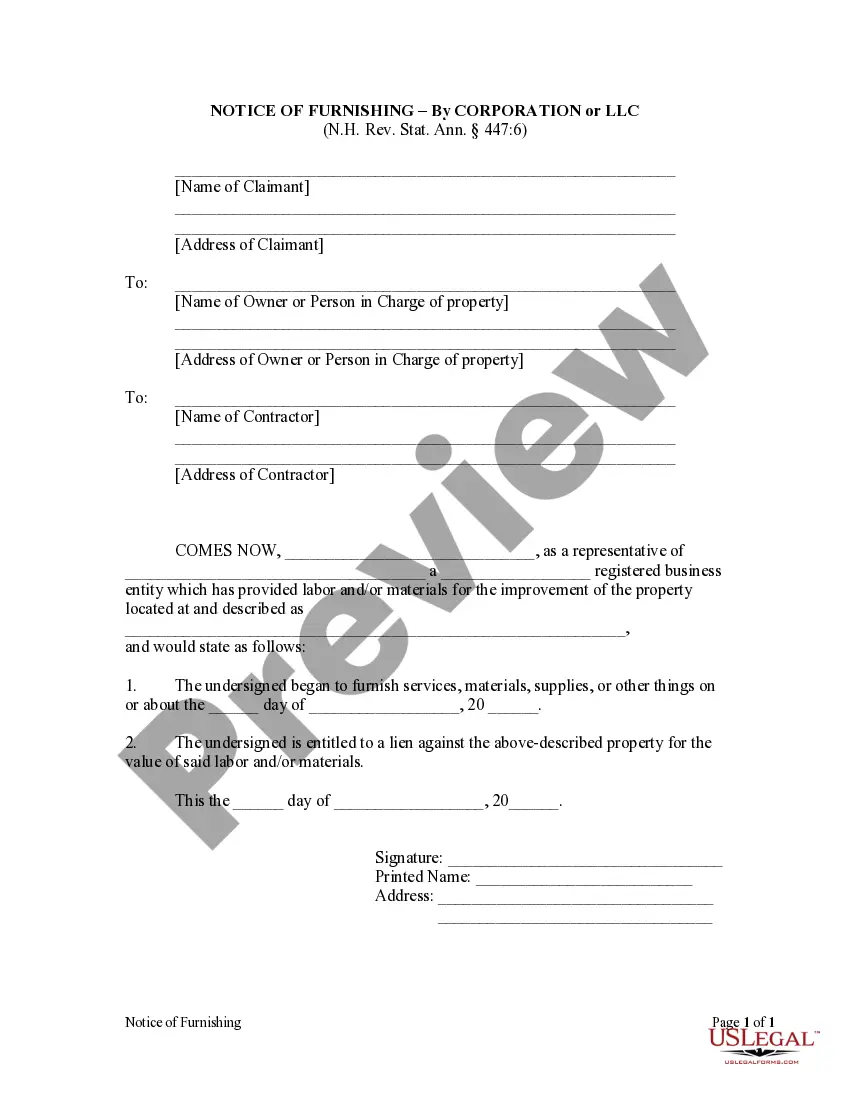

This is a Notice of Furnishing to be used by a corporation that has provided labor and/or materials for the improvement of the property to provide notice of the date that the corporation began to furnish services, materials, supplies, or other things, and that the corporation is entitled to a lien against the property for the value of said labor and/or materials.

New Hampshire Notice of Furnishing - Corporation

Description

How to fill out New Hampshire Notice Of Furnishing - Corporation?

Avoid expensive attorneys and find the New Hampshire Notice of Furnishing - Corporation or LLC you want at a reasonable price on the US Legal Forms website. Use our simple categories function to find and download legal and tax files. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms provides customers with step-by-step instructions on how to download and complete every single form.

US Legal Forms clients merely have to log in and obtain the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the guidelines below:

- Ensure the New Hampshire Notice of Furnishing - Corporation or LLC is eligible for use in your state.

- If available, look through the description and use the Preview option before downloading the templates.

- If you are confident the document fits your needs, click on Buy Now.

- If the form is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to your gadget or print it out.

Right after downloading, it is possible to fill out the New Hampshire Notice of Furnishing - Corporation or LLC manually or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Registration of New Business: All businesses operating in the State of New Hampshire are required to register with the Secretary of State's Office. Depending on your business structure, you may have additional filing requirements. Forms can also be downloaded off the Secretary of State's web site.

Accountants. Electricians. Plumbers. Contractors. Mechanics. Collection agents. Physicians. Appraisers.

If you plan to do business in the state of New Hampshire, but your company was not formed in New Hampshire, you will often need to obtain Foreign Qualification. Typically, doing business is defined by activities such as maintaining a physical office or having employees in the state.

LicenseLogix can help you acquire and maintain business licenses for all U.S. states and for most industries. Notes: To obtain (and maintain) this license, the State of New Hampshire requires an application, a $900 fee, extensive supporting documentation, and annual renewals.

To file your trade name, you must fill out the Application for Registration of a Trade Name and submit it to the New Hampshire Secretary of State. The filing fee is $50. Your business may need to obtain business licenses or professional licenses depending on its business activities.

The State of New Hampshire does not have a general, state-level business license. Instead, business licenses are mandated at the local level. https://www.nh.gov/government/ click on the county where your LLC is located and then call them about license and/or permit requirements for your business.

A Business ID Number, in this context, is assigned by the Corporation Division of the NH Department of State (this office) when the business is filed with us. The Federal ID Number or Employer ID Number is a separate number which is assigned by the US Internal Revenue Service.

The State of New Hampshire does not have a general, state-level business license. Instead, business licenses are mandated at the local level. https://www.nh.gov/government/ click on the county where your LLC is located and then call them about license and/or permit requirements for your business.

Starting an LLC in New Hampshire is Easy. To start a New Hampshire Limited Liability Company, you will need to file your Certificate of Formation with the State of New Hampshire, which costs $100.