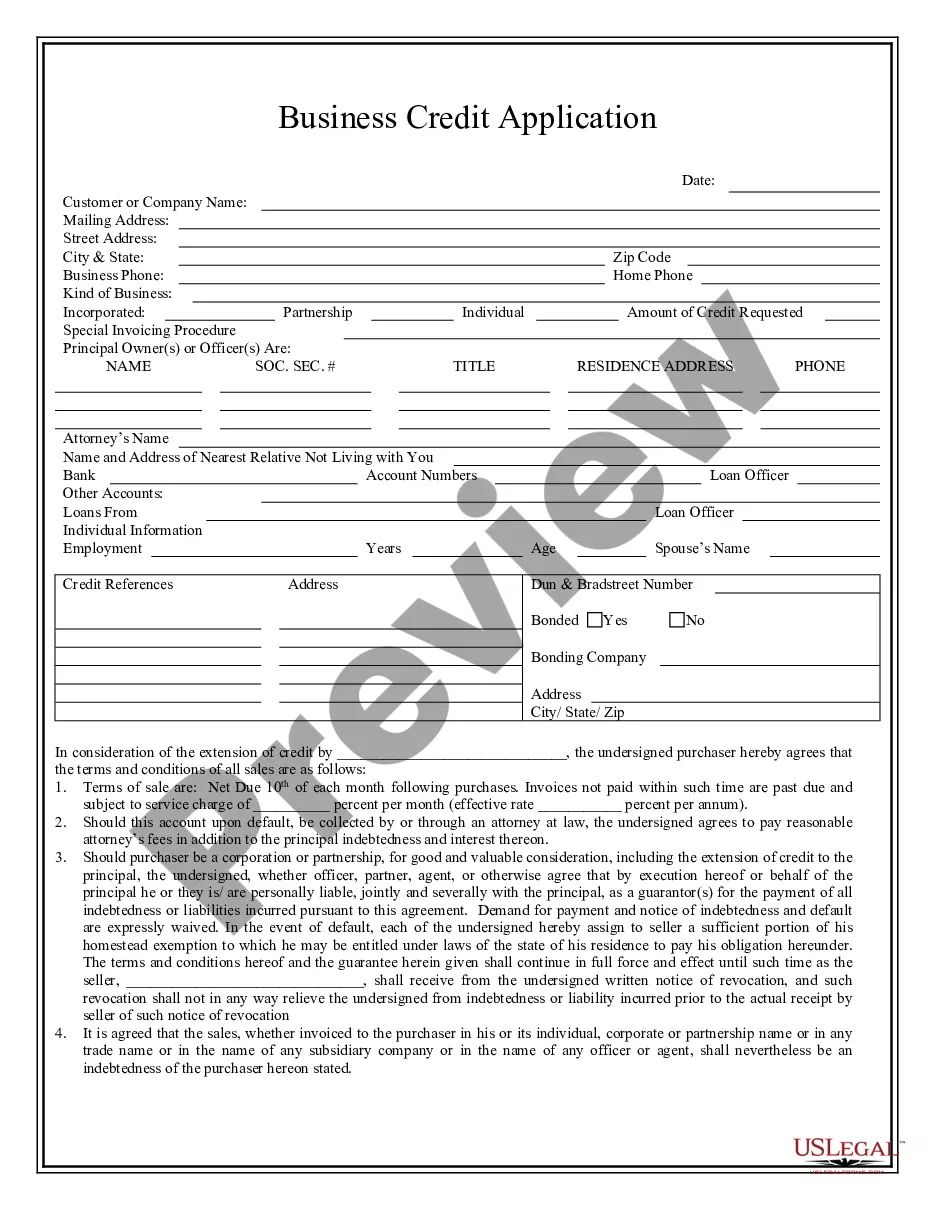

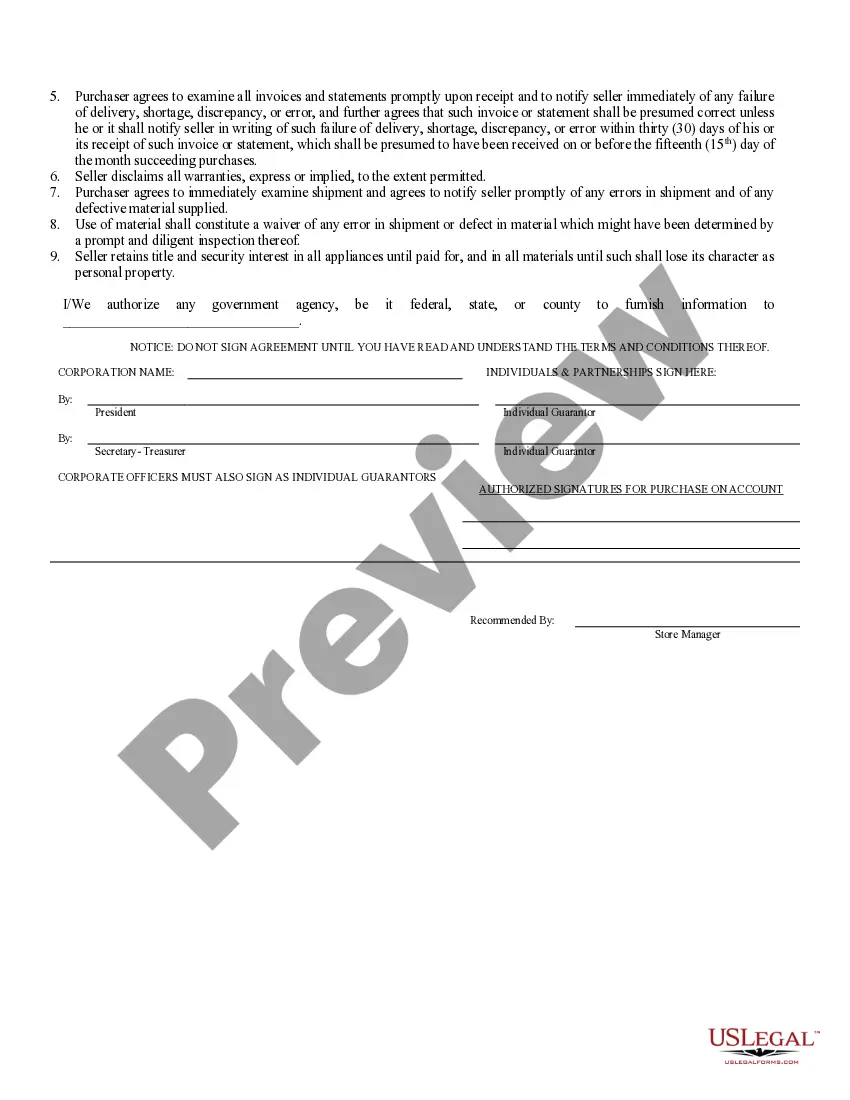

New Hampshire Business Credit Application

Description

How to fill out New Hampshire Business Credit Application?

Avoid pricey attorneys and find the New Hampshire Business Credit Application you want at a reasonable price on the US Legal Forms site. Use our simple groups functionality to find and obtain legal and tax files. Read their descriptions and preview them before downloading. Additionally, US Legal Forms provides customers with step-by-step instructions on how to obtain and complete every single form.

US Legal Forms customers merely must log in and download the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet should stick to the tips below:

- Ensure the New Hampshire Business Credit Application is eligible for use in your state.

- If available, read the description and use the Preview option prior to downloading the sample.

- If you’re sure the document suits you, click on Buy Now.

- If the template is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, it is possible to fill out the New Hampshire Business Credit Application manually or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

If you want a business credit card for a new enterprise, side hustle or startup, you don't have to wait to establish a business credit history before applying. If you have good credit represented by a credit score of 690 or above you can generally qualify based on your personal credit history.

Limited Credit: Capital One Spark Classic for Business. You'll get 1% cash back on all purchases. Fair Credit: Staples Business Credit Card. Bad Credit: Wells Fargo Business Secured Credit Card. Personal Option: Discover it Secured Credit Card.

Check your credit scores. Know your annual income. Research available reward options. Understand the rates you'll be paying on your credit card debt. Know the eligibility requirements for the card you select. Apply for the business credit card.

In addition, many banks will look at both your personal and business income when deciding whether to approve you for a business credit card. So even if you have a new business with little to no income, it is possible to get approved for the top business cards if you have other sources of income and a good credit score.

Ink Business Cash® Credit Card: Best No Annual Fee Business Card.Ink Business UnlimitedA® Credit Card: Best Flat Rate Rewards for Business.The Blue BusinessA® Plus Credit Card from American Express: Best for Business Flexible Rewards.Ink Business PreferredA® Credit Card: Best Travel Rewards Business Card.Best Business Credit Cards Of 2021 Forbes Advisor\nwww.forbes.com > advisor > credit-cards > best > business

Own or operate a business. Check your personal credit score. Determine whether you need cards for employees. Choose between rewards and 0% rates. Compare cards based on your intended usage. Apply for the best credit card for your business.

Know your personal credit score. Operate a small business with the intent of making a profit. Compare business cards to find the best fit for your particular circumstances. Use your business card for business expenses.

On your business credit card application, your card issuer will request some information about your business financials, including your income and estimated monthly spend. (That's partly how they'll determine your eligibility for the card and, if so, the size of your credit line.)