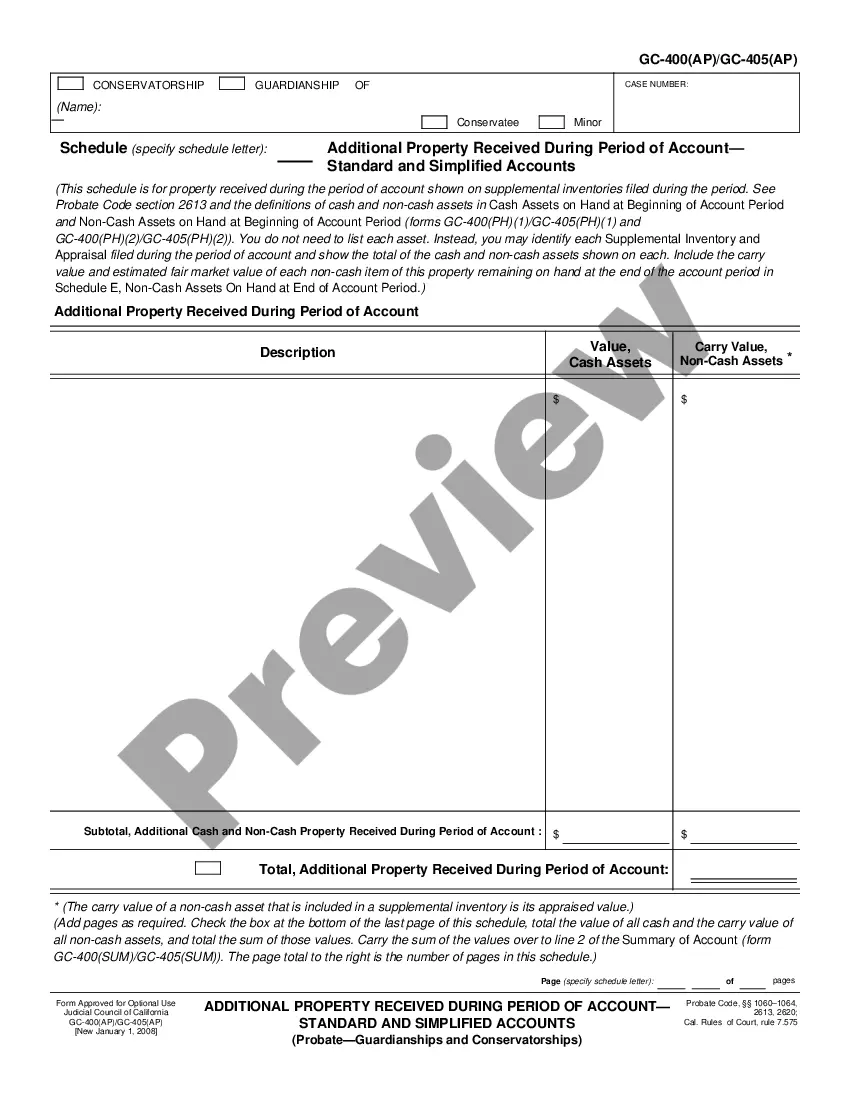

This form, along with the required attachments, is a report of all the transactions that have taken place during the accounting period specified on the form. Basically, it is used to show the court the details of how the assets of an estate have been managed. It will summarize the money the estate had or received , and the money spent out of the estate.

New Hampshire Executor's / Administrator's Accounting

Description

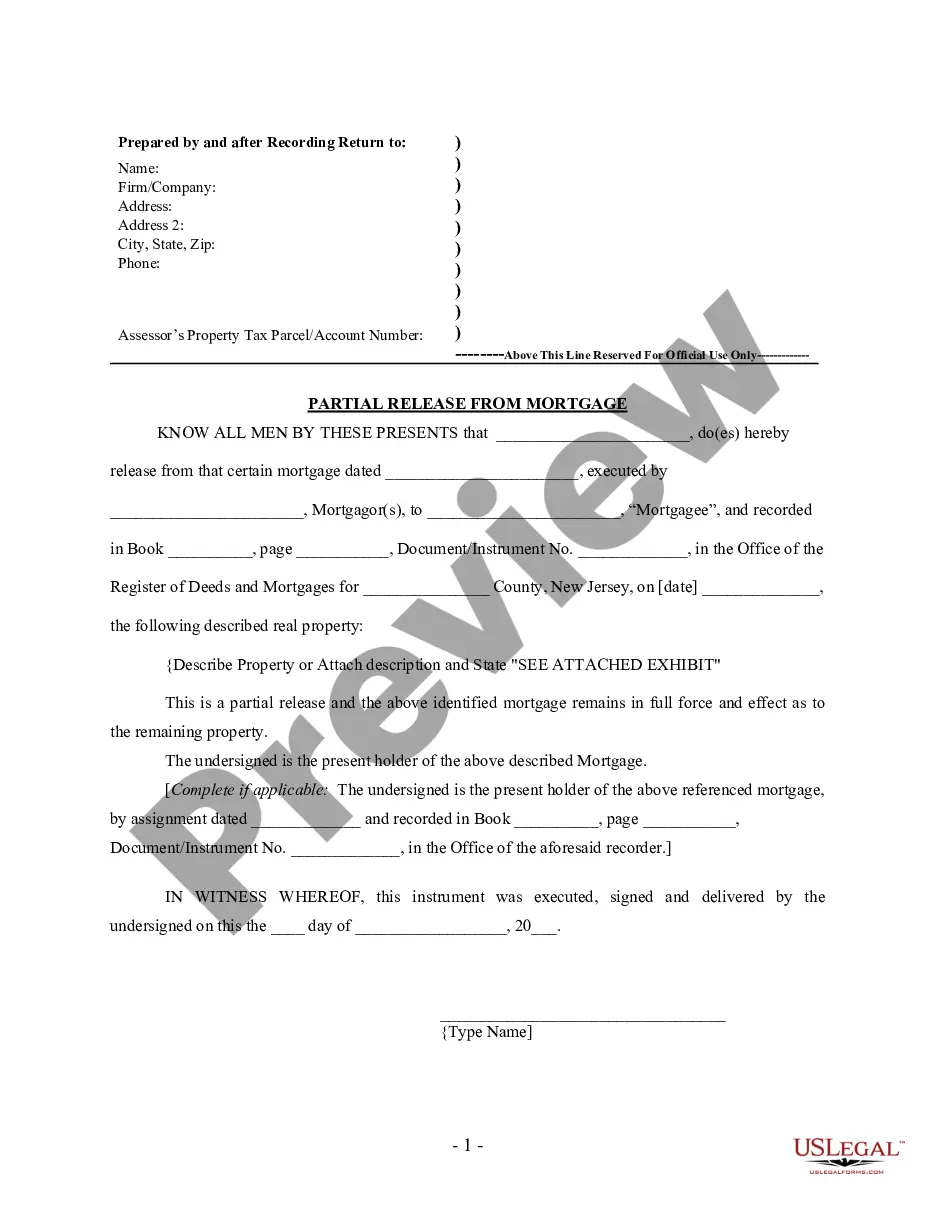

How to fill out New Hampshire Executor's / Administrator's Accounting?

Avoid costly attorneys and find the New Hampshire Executor's / Administrator's Accounting you want at a affordable price on the US Legal Forms site. Use our simple groups functionality to search for and download legal and tax forms. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to download and complete every single template.

US Legal Forms customers basically must log in and obtain the particular document they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the tips below:

- Ensure the New Hampshire Executor's / Administrator's Accounting is eligible for use in your state.

- If available, read the description and make use of the Preview option just before downloading the templates.

- If you’re sure the template is right for you, click on Buy Now.

- In case the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, it is possible to fill out the New Hampshire Executor's / Administrator's Accounting manually or by using an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Probate is the process through which a deceased person's property, known as the estate, is passed to his or her heirs and legatees (people named in the will). The entire process, supervised by the probate court, can take up to a year to fifteen months.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

Each beneficiary is entitled to a trustee's accounting, at least annually, at termination of the trust, and on upon a change of trustee. (California Probate Code 16062). Unfortunately, not all beneficiaries are entitled to automatic accounting, nevertheless, the court may force the trustee to provide an accounting.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Yes an estate can have 2 administrators but it is not likely. If a names co-executors the Court may allow this, but if two people want to serve as co-administrators most Courts say "No" to the future conflicts between adminsitrators.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

Small estates involving only personal property with a value of $10,000 or less are eligible for a simplified form of administration called Voluntary or Small Estate Administration, if the decedent died prior to January 1, 2006.