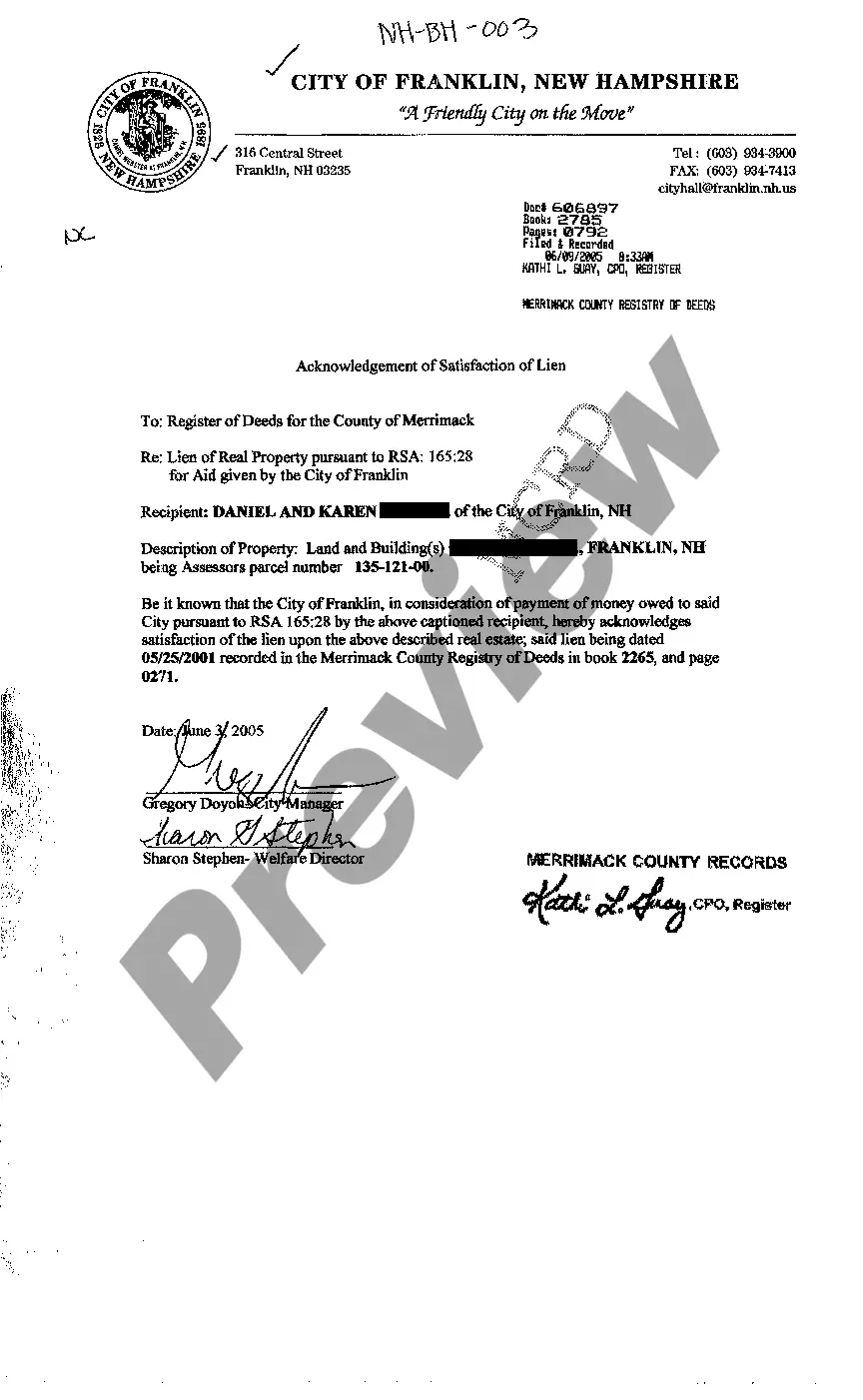

New Hampshire Acknowledgment of Satisfaction of Lien

Description

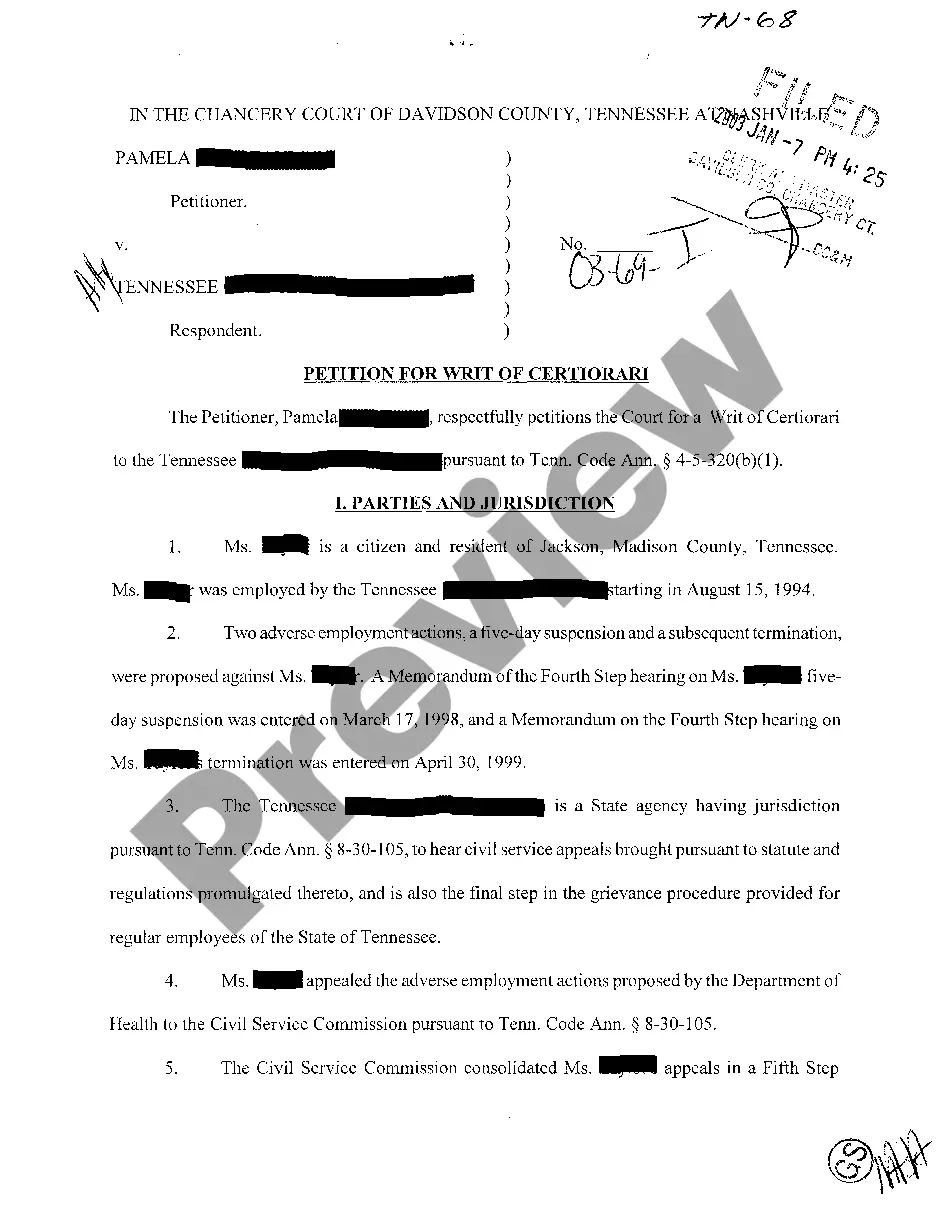

How to fill out New Hampshire Acknowledgment Of Satisfaction Of Lien?

Avoid costly lawyers and find the New Hampshire Acknowledgment of Satisfaction of Lien you want at a reasonable price on the US Legal Forms website. Use our simple categories functionality to find and obtain legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides users with step-by-step instructions on how to download and fill out each and every form.

US Legal Forms clients just have to log in and get the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet must stick to the guidelines listed below:

- Make sure the New Hampshire Acknowledgment of Satisfaction of Lien is eligible for use where you live.

- If available, look through the description and make use of the Preview option before downloading the templates.

- If you’re sure the document meets your needs, click on Buy Now.

- If the form is wrong, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you can fill out the New Hampshire Acknowledgment of Satisfaction of Lien manually or an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

If you can't find out which company took over, call the Federal Deposit Insurance Corporation's (FDIC) lien release number at (888) 206-4662 (toll free) or visit the Closed Banks and Asset Sales section on the FDIC's "Contact Us" page.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.When you call the lender, ask for the release of lien department.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

When a bank loan is paid off, a Release of Lien or Certificate of Satisfaction is provided by the bank and is recorded in the Land Records office to provide notice that the prior lien has now been paid in full and released from the property.

Key Takeaways. A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.