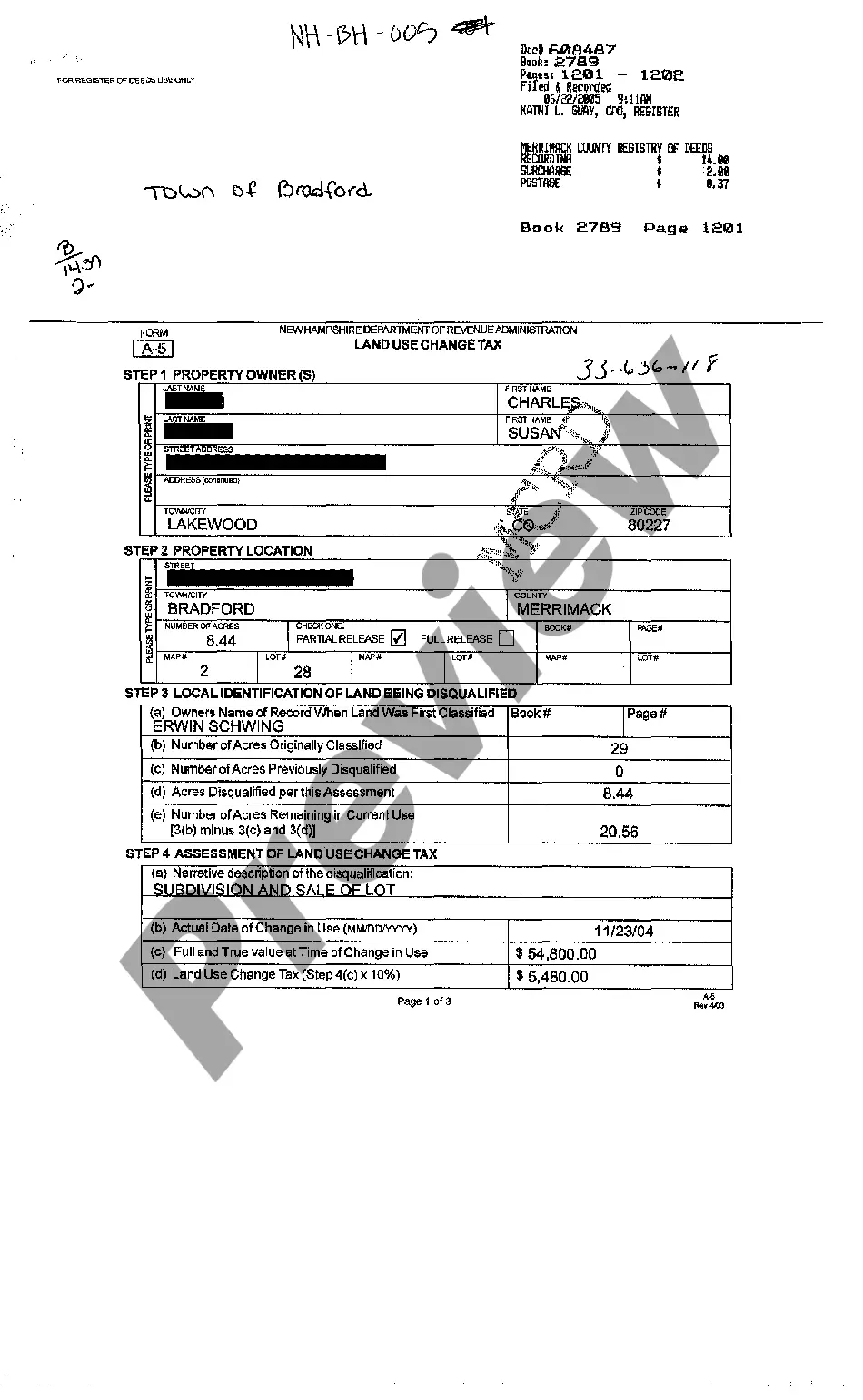

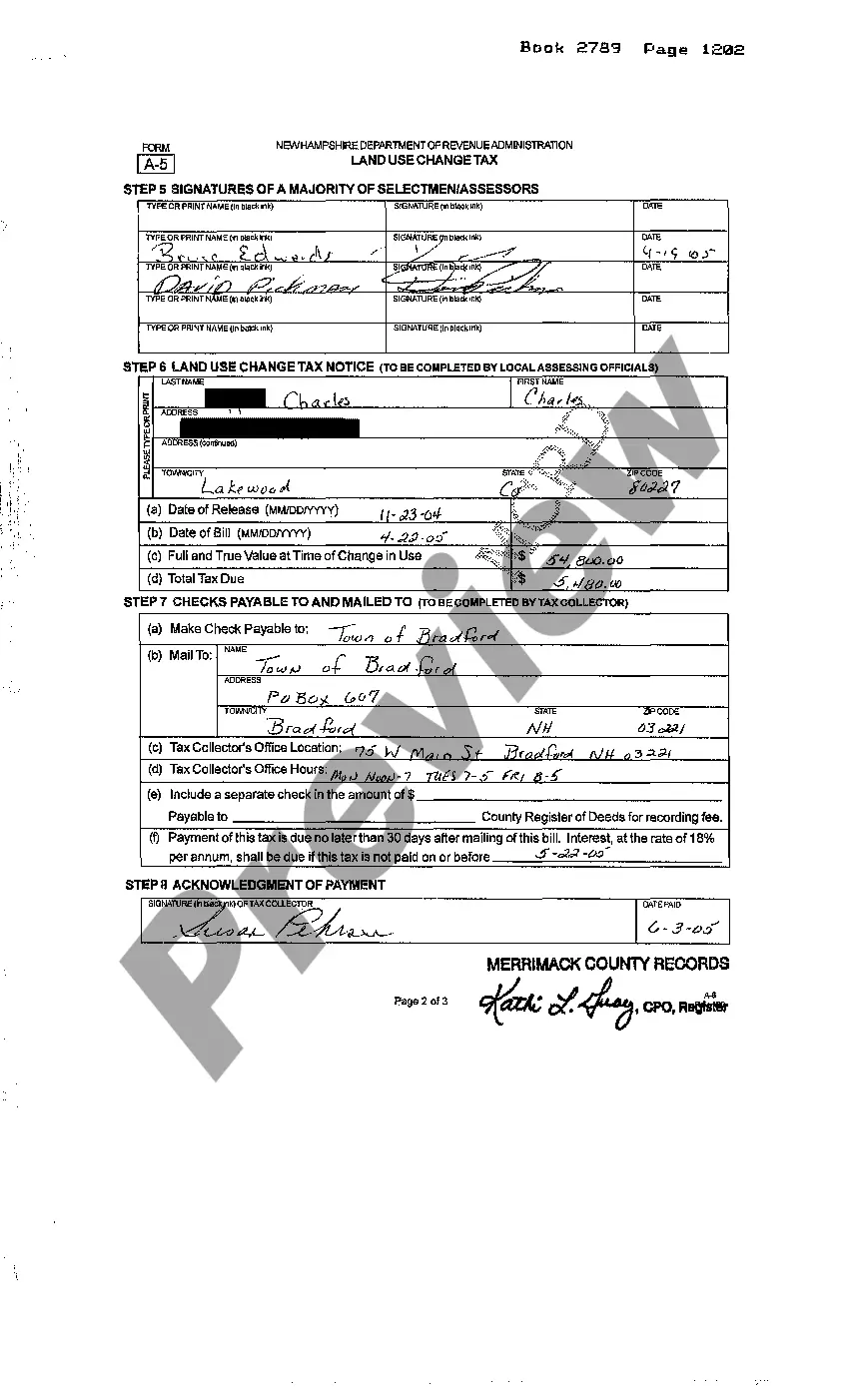

New Hampshire Land use Change Tax

Description

How to fill out New Hampshire Land Use Change Tax?

Avoid expensive attorneys and find the New Hampshire Land use Change Tax you need at a affordable price on the US Legal Forms website. Use our simple categories functionality to find and download legal and tax documents. Go through their descriptions and preview them prior to downloading. Moreover, US Legal Forms provides customers with step-by-step tips on how to obtain and complete each and every template.

US Legal Forms customers simply need to log in and get the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet must follow the tips below:

- Ensure the New Hampshire Land use Change Tax is eligible for use in your state.

- If available, read the description and use the Preview option prior to downloading the sample.

- If you’re confident the template meets your needs, click on Buy Now.

- In case the form is wrong, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

After downloading, you are able to fill out the New Hampshire Land use Change Tax by hand or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

More Definitions of Current UseCurrent Use means any utilisation of the Company Real Property relating to the operation of the Business (including, but not limited to, production, administration and distribution).

PENALTY: The land use change tax due to the town is 10% of the full and true value (non-current use value) of the changed portion as assessed by the town at the time of the change.

Let's start with a definition: Current Use is a state-specific property tax reduction program in which landowners with qualifying forests or farms can get a significant annual tax break if enrolled. The primary benefits to the landowner are the reduced property taxes which can help you hold on to your property.

Can land in current use be posted against trespassing? Yes, although very little actually is. Owners receive additional tax savings if they keep their land open and without fee all year for hunting, fishing, snowshoeing, hiking, skiing and nature observation.

Current use is the means for encouraging the preservation of open space and conserving the land, water, forest, agricultural, and wildlife resources. Property owners with 10 or more acres of land, which are left in their natural state may apply.

NH Current Use Law RSA 79-A What is Current Use? Current use is a taxing strategy aimed at making it easier for landowners to keep their open space undeveloped.In other words, land is taxed as a woodlot, or a farm, not as a potential site for houses. Current use keeps property taxes at a lower, more predictable rate.