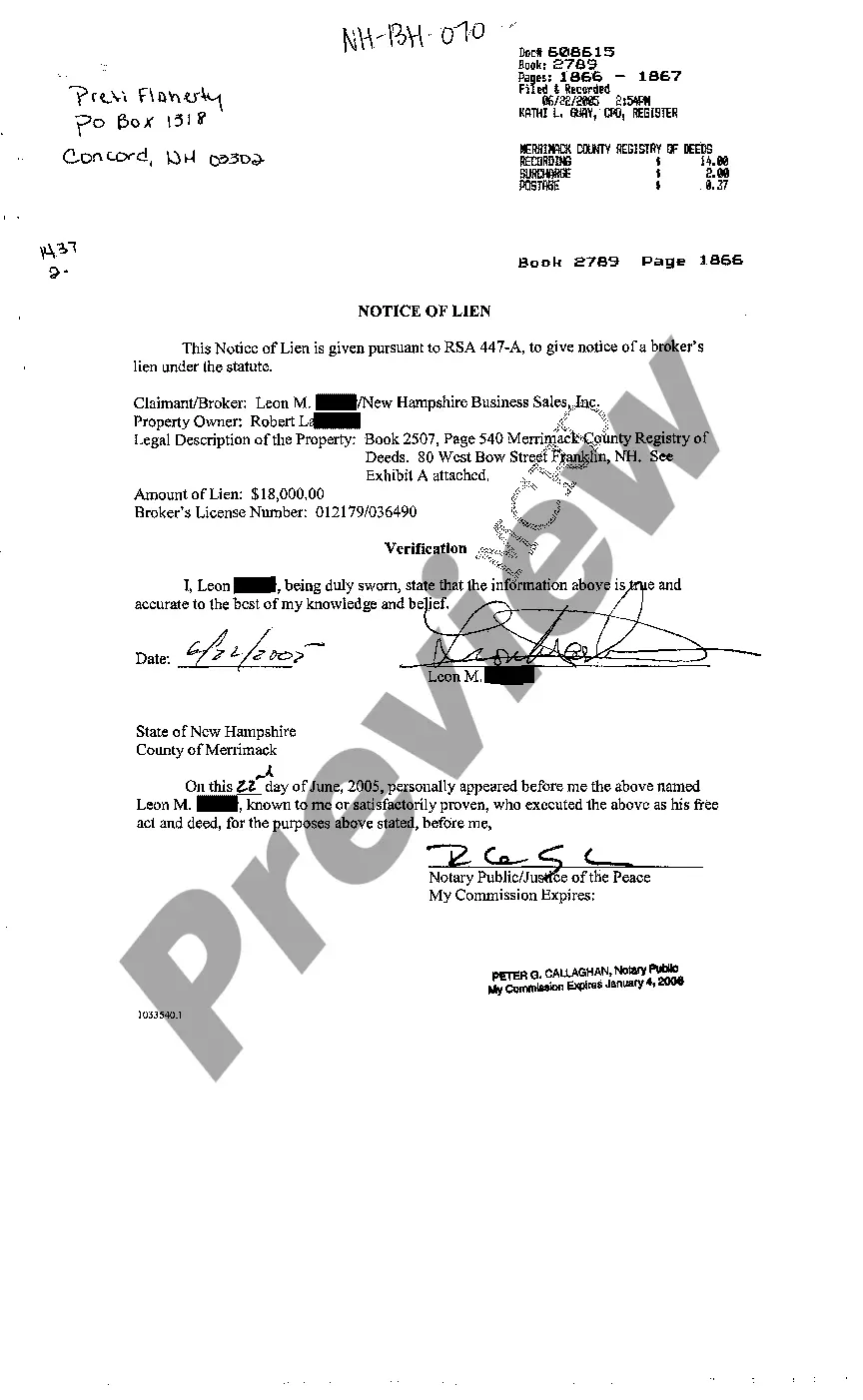

New Hampshire Notice of Lien on Commercial Property

Description

How to fill out New Hampshire Notice Of Lien On Commercial Property?

Avoid costly lawyers and find the New Hampshire Notice of Lien on Commercial Property you want at a reasonable price on the US Legal Forms website. Use our simple groups function to look for and obtain legal and tax files. Read their descriptions and preview them well before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to obtain and fill out each and every template.

US Legal Forms subscribers basically have to log in and download the specific form they need to their My Forms tab. Those, who have not got a subscription yet should stick to the guidelines below:

- Make sure the New Hampshire Notice of Lien on Commercial Property is eligible for use in your state.

- If available, look through the description and use the Preview option prior to downloading the templates.

- If you’re confident the document fits your needs, click on Buy Now.

- If the template is incorrect, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, you may fill out the New Hampshire Notice of Lien on Commercial Property by hand or an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

With the judgment in hand, a judgment creditor can place a judgment lien on your real estate and occasionally on personal property depending on the state in which you live.

The commercial lien is simple, inexpensive, and takes very little time. It requires no court action or judge's approval. And, it has proven to be very direct and effective, if it is handled correctly.

In order to have a mechanics lien in New Hampshire, the lien claimant must file an Ex Parte Petition to Secure Mechanics Lien with the court. This may be done without notice of this action to the owner or other parties (Notice of Attempt to Lien must be given previously if lien claimant is not the general contractor).

If you want to place a lien on a commercial rental property and you are not the landlord, you may need to put a lien on the property by filing with the court of record in the jurisdiction where the property is actually located.

The commercial lien is used by the IRS to take possession of the homes and cars of many citizens in America. However, when it comes to all things outside of the IRS from real estate to basic business practices, the commercial lien is something that just about anyone can file.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

A lien refers to a notice that is attached to assets used as collateral for any potential debts owed. This occurs when a business owner borrows money from a lender. The lender will hold onto the property lien until the debt has been paid in full.