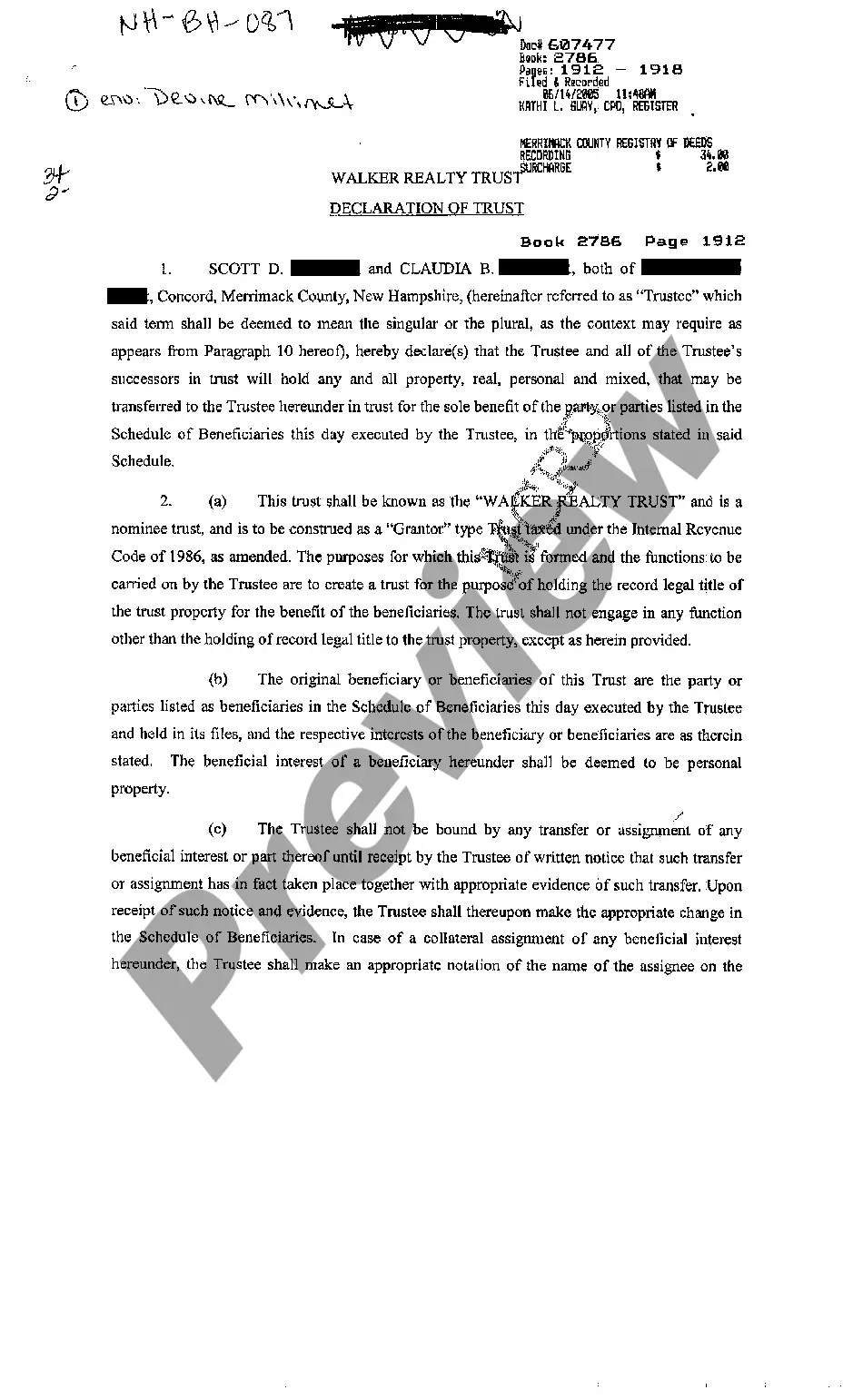

New Hampshire Declaration of Realty Trust

Description

How to fill out New Hampshire Declaration Of Realty Trust?

Avoid expensive attorneys and find the New Hampshire Declaration of Realty Trust you need at a reasonable price on the US Legal Forms site. Use our simple categories functionality to search for and obtain legal and tax files. Read their descriptions and preview them prior to downloading. Moreover, US Legal Forms enables customers with step-by-step tips on how to download and complete every single form.

US Legal Forms clients just have to log in and download the particular form they need to their My Forms tab. Those, who have not got a subscription yet must stick to the tips below:

- Make sure the New Hampshire Declaration of Realty Trust is eligible for use in your state.

- If available, look through the description and use the Preview option prior to downloading the templates.

- If you’re sure the template meets your needs, click Buy Now.

- If the template is wrong, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you are able to fill out the New Hampshire Declaration of Realty Trust by hand or by using an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Once property has been transferred to a trust, the trust itself becomes the rightful owner of the assets. In an irrevocable trust, the assets can no longer be controlled or claimed by the previous owner.

As a legally binding document, the declaration of trust cannot be ignored when coming to a conclusion as to how much you should receive either on being bought out or after a sale of the property. It does not allow either of you to change your minds about how you will divide the money from the property.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

If you are the sole Trustee of the Trust, the document used to create it is called a declaration of trust. If the there is an additional Trustee, the document used to create the trust is called a trust agreement.

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.The declaration of trust is sometimes referred to as a nominee declaration.

What's included in a Declaration of Trust will depend on your individual circumstances. It can include: How much each person contributes to the deposit, and how much will be repaid to them. What percentage of the property each person will own, and how the money will be split if the property is sold.