New Hampshire Memorandum of Trust

Description

How to fill out New Hampshire Memorandum Of Trust?

Avoid pricey attorneys and find the New Hampshire Memorandum of Trust you want at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax forms. Go through their descriptions and preview them well before downloading. In addition, US Legal Forms enables customers with step-by-step instructions on how to obtain and complete each template.

US Legal Forms subscribers merely must log in and get the particular document they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the guidelines listed below:

- Make sure the New Hampshire Memorandum of Trust is eligible for use where you live.

- If available, read the description and use the Preview option before downloading the templates.

- If you are sure the document meets your needs, click on Buy Now.

- In case the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you can fill out the New Hampshire Memorandum of Trust by hand or by using an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.Understanding the 3 primary types of trusts - The Des Moines Register\nwww.desmoinesregister.com > money > business > columnists > 2015/08/31

A trust, in legal terms, is any arrangement in which one party holds property for another party's benefit. The property owner never gives up control of the assets cash, stocks, bonds, real estate but the trustee becomes the owner for legal purposes.The person or entity that holds the property is the trustee.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

Once property has been transferred to a trust, the trust itself becomes the rightful owner of the assets. In an irrevocable trust, the assets can no longer be controlled or claimed by the previous owner.

Putting your home or other real estate into a trust is a popular way to protect, shield and transfer your property to your heirs. You can create a revocable living trust to hold your home and other real estate.

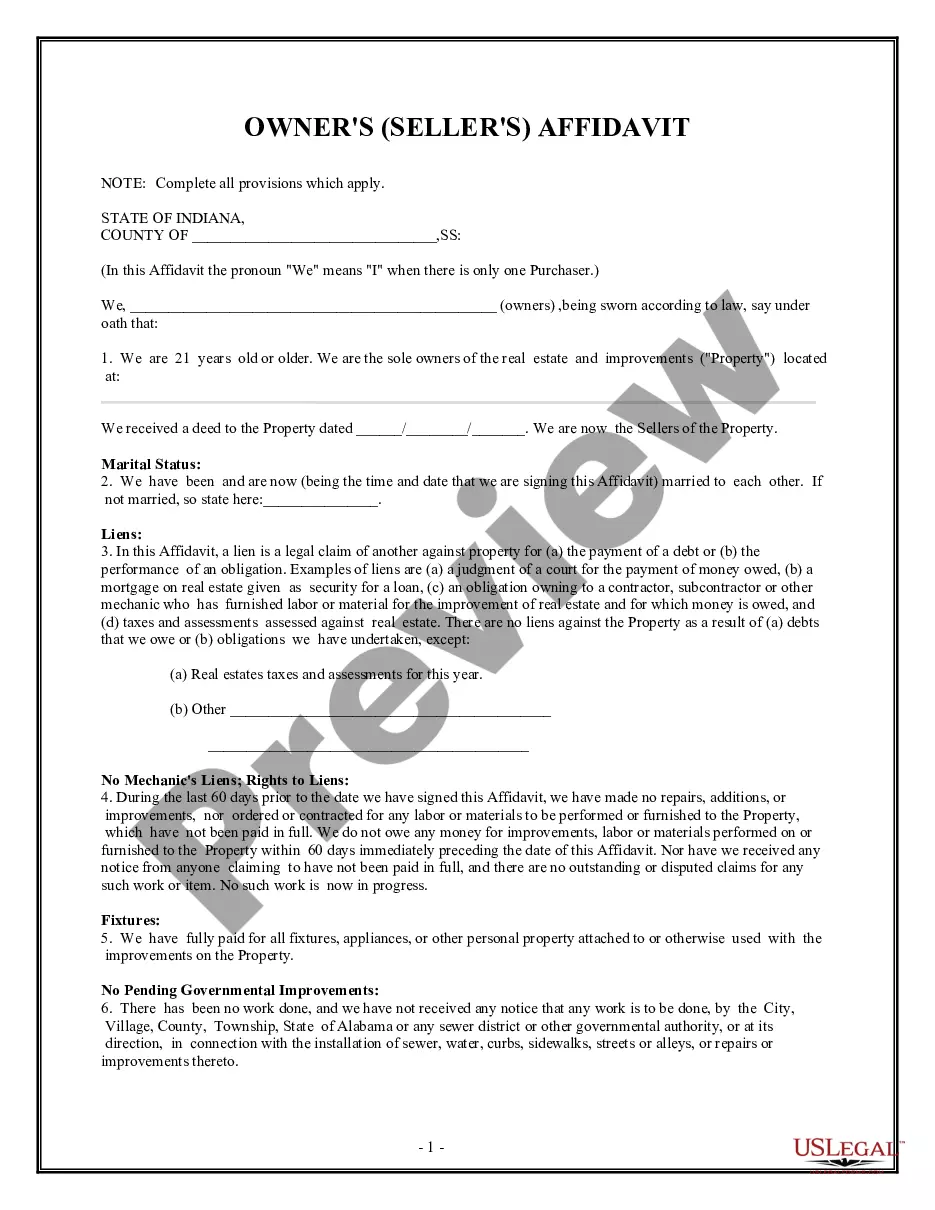

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust.A Certification of Trust is used in place of the actual trust to open up an account on behalf of a trust at a financial institution.

Trust property refers to the assets placed into a trust, which are controlled by the trustee on behalf of the trustor's beneficiaries.Estate planning allows for trust property to pass directly to the designated beneficiaries upon the trustor's death without probate.

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.