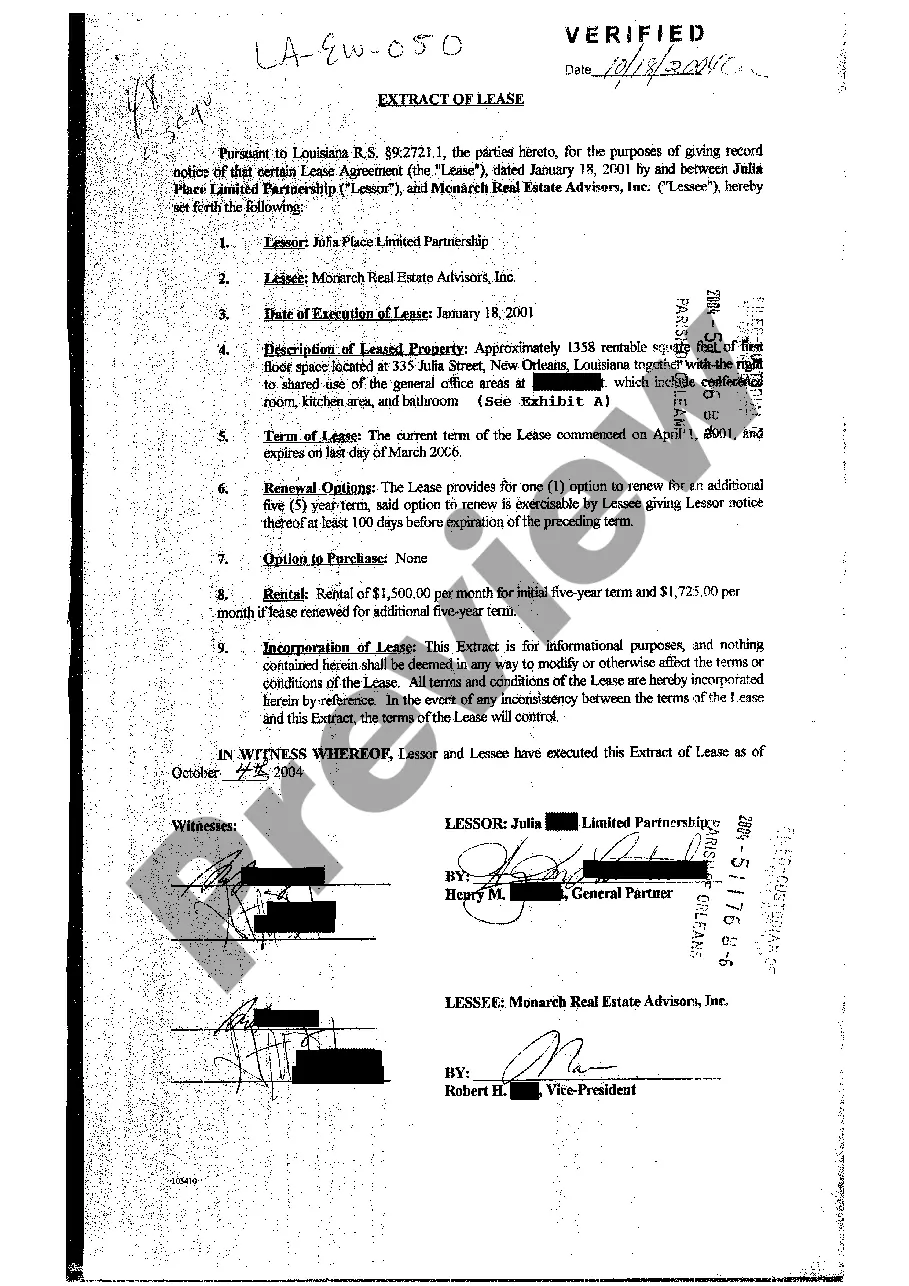

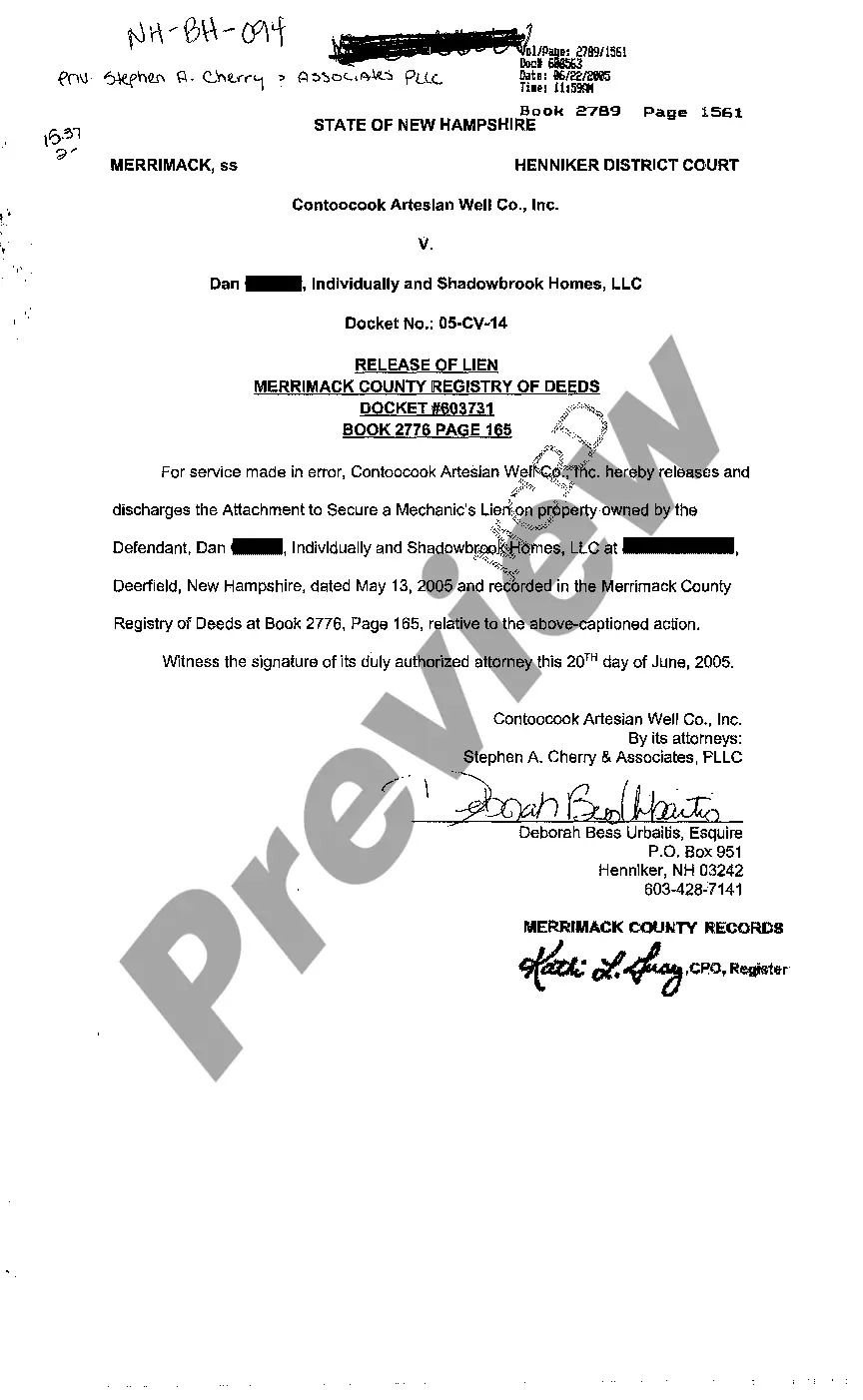

New Hampshire Release of Lien of County Registry of Deeds

Description Nh Lien Release For For Registry Of Deeds

How to fill out New Hampshire Release Of Lien Of County Registry Of Deeds?

Avoid costly lawyers and find the New Hampshire Release of Lien of County Registry of Deeds you want at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax forms. Go through their descriptions and preview them just before downloading. In addition, US Legal Forms provides users with step-by-step instructions on how to download and fill out every template.

US Legal Forms clients simply need to log in and download the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should stick to the tips listed below:

- Make sure the New Hampshire Release of Lien of County Registry of Deeds is eligible for use where you live.

- If available, look through the description and make use of the Preview option before downloading the templates.

- If you’re confident the template suits you, click Buy Now.

- In case the template is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you may fill out the New Hampshire Release of Lien of County Registry of Deeds by hand or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

An owner legally transfers his property to another person on an instrument known as a deed.However, failure to record a deed may cause problems for the new owner. For example, the lack of an official deed will make it nearly impossible to sell the property again or refinance a mortgage.

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.When you call the lender, ask for the release of lien department.

A "lien" is a notice that attaches to your property, telling the world that a creditor claims you owe it some money. A lien is typically a public record.A lien on your house, mobile home, car, or other property makes your title unclear. To clear up the title, you must pay off the lien.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

Do-It-Yourself Should you run out of patience, you can often release the lien yourself. If your local or state laws permit, you can bring written third party evidence of your pay off of the mortgage to the appropriate government office and request that it release the lien.

Deeds can be obtained at the Strafford County Registry of Deeds. Their website is www.nhdeeds.com. They can also be contacted at Strafford County Registry of Deeds, 259 County Farm Road, Suite 202, Dover, NH 03820, (603) 742-1741. Most deeds are also available in the Assessing Office.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

A deed of trust or mortgage is a contract that places a lien on your property. Both provide a way for your lender to take back your home through foreclosure. Deeds of trust and mortgages both serve the same basic purpose.