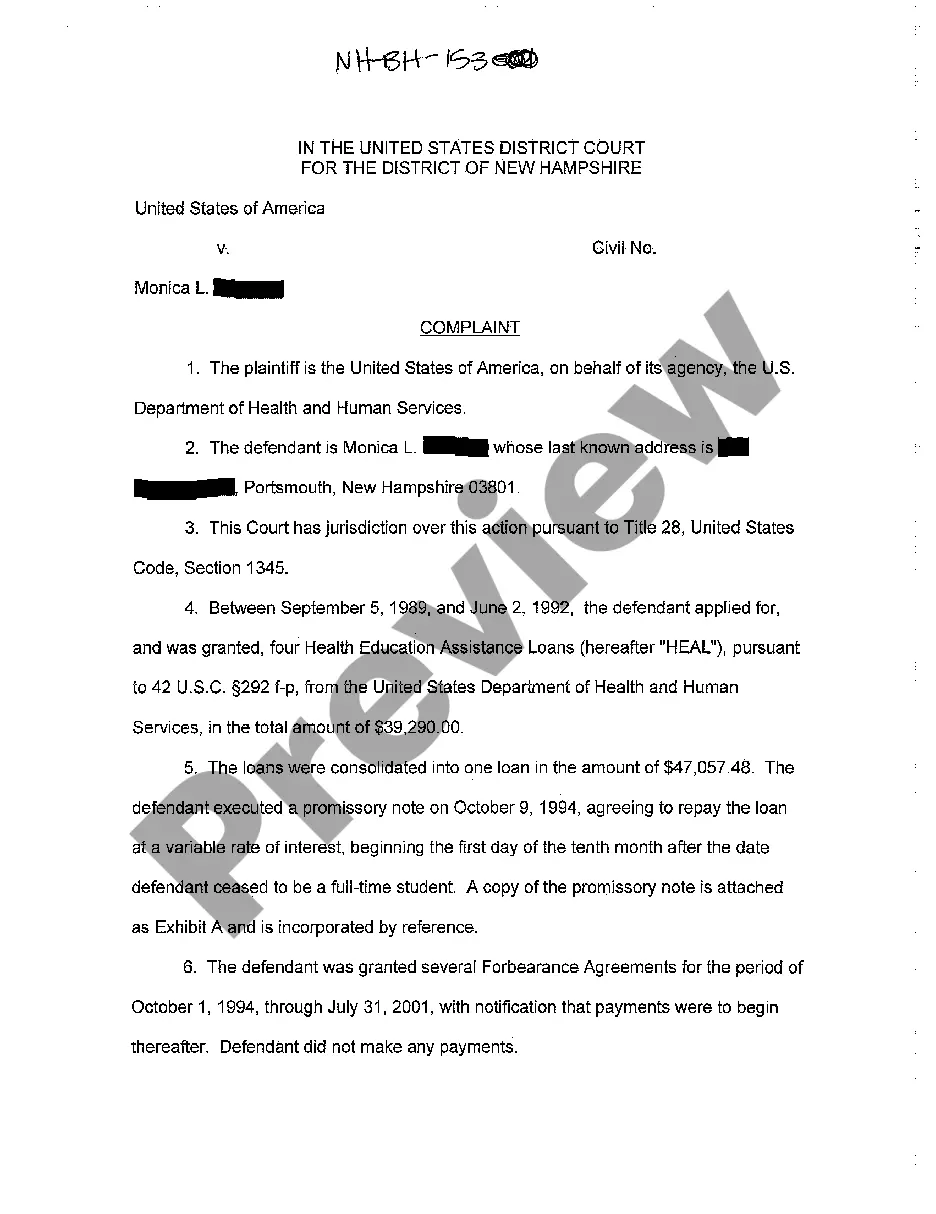

New Hampshire Complaint for Student Loan Repayment by United States After Defendant Declared Chapter 13 Bankruptcy

Description

How to fill out New Hampshire Complaint For Student Loan Repayment By United States After Defendant Declared Chapter 13 Bankruptcy?

Avoid costly attorneys and find the New Hampshire Complaint for Student Loan Repayment by United States After Defendant Declared Chapter 13 Bankruptcy you want at a reasonable price on the US Legal Forms website. Use our simple groups functionality to look for and download legal and tax documents. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms provides customers with step-by-step instructions on how to download and complete every form.

US Legal Forms customers simply have to log in and obtain the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet should stick to the tips listed below:

- Make sure the New Hampshire Complaint for Student Loan Repayment by United States After Defendant Declared Chapter 13 Bankruptcy is eligible for use in your state.

- If available, read the description and make use of the Preview option well before downloading the sample.

- If you are confident the template suits you, click Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, it is possible to fill out the New Hampshire Complaint for Student Loan Repayment by United States After Defendant Declared Chapter 13 Bankruptcy manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Tax returns. Medical records and bills if you have a disability or medical condition. Bank statements. Credit card statements. Necessary expenses such as food, clothing, household maintenance, etc. Documentation showing you made previous attempts to pay off your loans.

What is a partial financial hardship? Having a partial financial hardship means that your student loan bills are too high for your income, relatively speaking. In practical terms, it means you would pay less each month in an income-driven repayment plan than the standard repayment plan.

If you can successfully prove undue hardship, your student loan will be completely canceled. Filing for bankruptcy also automatically protects you from collection actions on all of your debts, at least until the bankruptcy case is resolved or until the creditor gets permission from the court to start collecting again.

In most cases, you can't get new credit or take out a loan during your Chapter 13 case. But there are some exceptions. Getting new credit or a loan during your Chapter 13 bankruptcy case is difficult. However, in certain circumstances, it might be possible.

Student Loans Are Treated As Nonpriority Unsecured Debts in Chapter 13 Bankruptcy. In Chapter 13 bankruptcy, student loans are treated as nonpriority unsecured debts just like credit cards and medical bills.However, once your Chapter 13 bankruptcy is over, you must continue to pay your student loans.

To qualify for student loan discharge through bankruptcy, you'll have to prove you'd face undue hardship in repaying them. The definition of undue hardship can vary by person, so a bankruptcy court might evaluate your case using the Brunner Test.

Most debtors won't be able to discharge (wipe out) student loan debt in Chapter 7 or Chapter 13 bankruptcy. However, if you can prove that repaying your student loans would cause an undue hardship to you, you can get rid of your student loans in bankruptcy.

Once your ready and you've completed your payments, your assigned Chapter 13 trustee will complete an entire review of your Chapter 13 case.After the report from the trustee has been filed, the U.S. Bankruptcy Court will mail you a form titled Certification of Eligibility for Chapter 13 Discharge.

Undue hardship is defined as the inability (now or in the future) to repay the student loan debt and still maintain a minimal standard of living. An example of this might be a person who becomes sick or injured to the point at which he or she is no longer able to perform any wage-earning job, now or in the future.