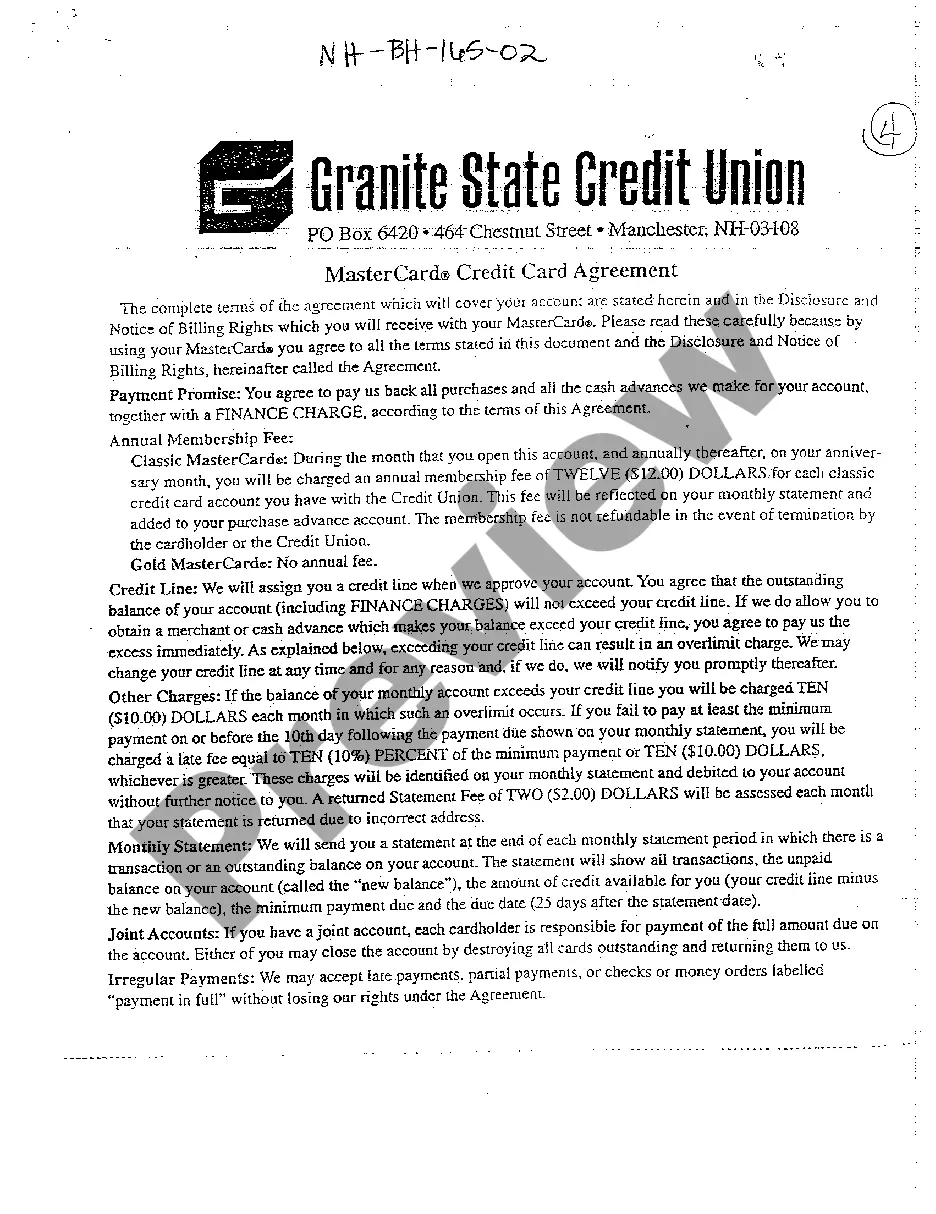

New Hampshire Master Card Credit Card Agreement Letter

Description

How to fill out New Hampshire Master Card Credit Card Agreement Letter?

Avoid pricey attorneys and find the New Hampshire Master Card Credit Card Agreement Letter you need at a reasonable price on the US Legal Forms website. Use our simple groups functionality to look for and download legal and tax files. Read their descriptions and preview them prior to downloading. Moreover, US Legal Forms provides customers with step-by-step instructions on how to download and complete every template.

US Legal Forms clients simply need to log in and get the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must follow the guidelines below:

- Ensure the New Hampshire Master Card Credit Card Agreement Letter is eligible for use in your state.

- If available, read the description and make use of the Preview option well before downloading the templates.

- If you are sure the document fits your needs, click on Buy Now.

- In case the form is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you are able to fill out the New Hampshire Master Card Credit Card Agreement Letter manually or by using an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

To sum it up, there are two main reasons businesses might choose not to accept a particular type of credit card, or none at all fees and partnerships. Swipe fees can take a big bite out of a merchant's profits, especially in businesses with tight profit margins like restaurants and every percentage point counts.

If you are a current account holder and want a copy of your specific agreement, you can request one on the issuer's site or call the toll-free customer service number listed on the back of your credit card. The larger card issuers offer a wide variety of credit cards.

A credit card authorization form is a legal document. The cardholder signs it to grant permission to the business to charge their debit or credit card. You can use it for a single transaction or for recurring charges on the card. The signed form helps safeguard your business from chargebacks or any financial problems.

Visa and Mastercard don't actually issue or distribute credit cards. Instead, they are payment networks they process payments between banks and merchants for credit card purchases.

To withdraw consent, simply tell whoever issued your card (the bank, building society or credit card company) that you don't want the payment to be made.Your card issuer has no right to insist that you ask the company taking the payment first. They have to stop the payments if you ask them to.

A federal law known as the Truth in Lending Act governs the minutiae of when card issuers should credit the payments you make.And Karen, it is not illegal for an issuer to place the sort of hold you mention. According to TILA, the issuer should credit your payment to your account the day it receives your funds.

Can businesses refuse to accept cards? Any business is within its rights to refuse a method of payment. The question is whether this will affect their custom by doing so, especially as the use of non-cash payments is growing fast.

A cardholder agreement is a legal document outlining the terms under which a credit card is offered to a customer. Among other provisions, the cardholder agreement states the annual percentage rate (APR) of the card, as well as how the card's minimum payments are calculated.

Incorrect payment information When attempting to make your purchase, especially online or via mobile app, it's easy to enter a digit of your credit card number, expiration date or security code incorrectly. Or perhaps your billing address is outdated. These could all be simple explanations for a declined transaction.