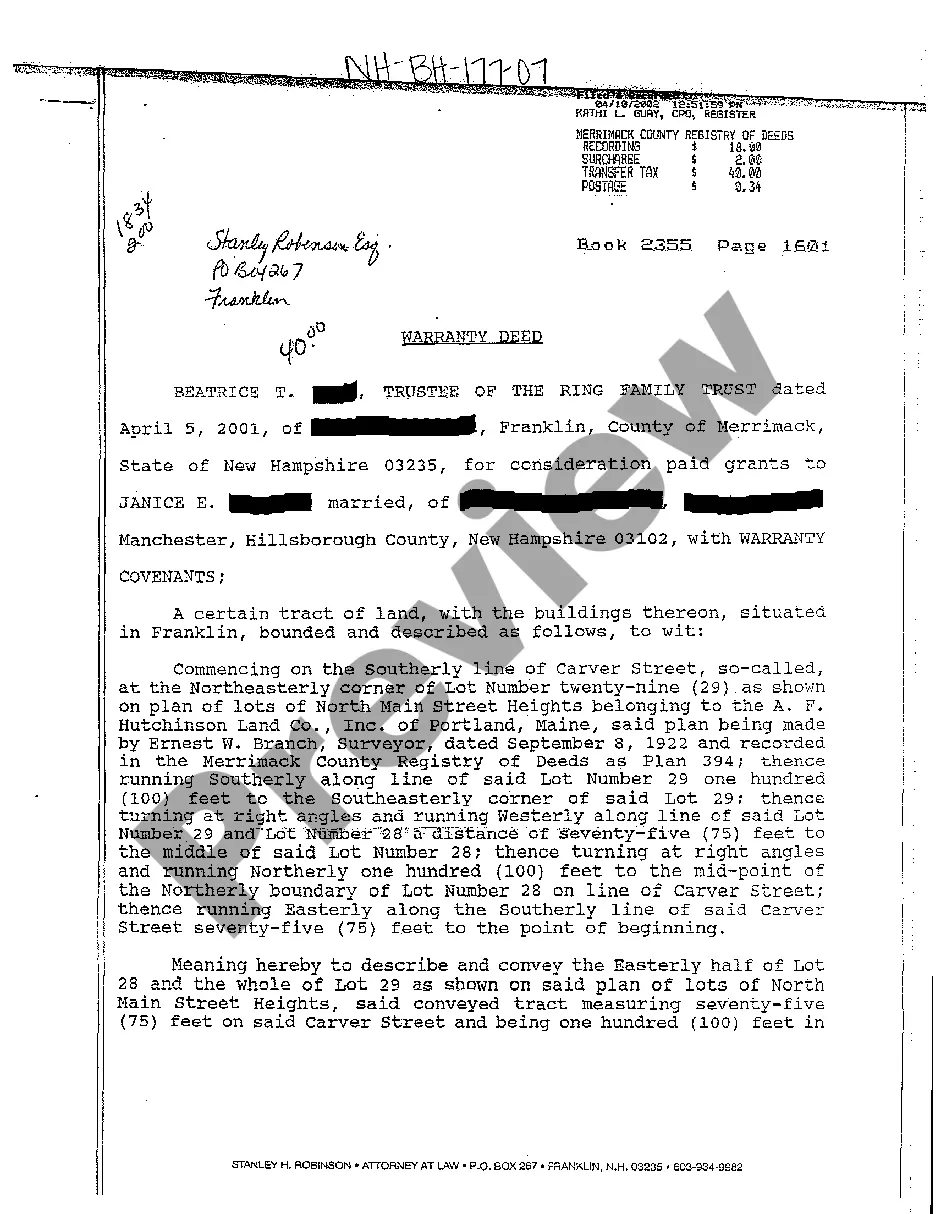

New Hampshire Warranty Deed Pertaining to Conservatorship

Description

How to fill out New Hampshire Warranty Deed Pertaining To Conservatorship?

US Legal Forms is really a unique system to find any legal or tax form for filling out, including New Hampshire Warranty Deed Pertaining to Conservatorship. If you’re sick and tired of wasting time looking for appropriate examples and spending money on record preparation/lawyer service fees, then US Legal Forms is precisely what you’re seeking.

To enjoy all the service’s benefits, you don't have to install any application but just pick a subscription plan and register an account. If you have one, just log in and look for the right sample, save it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need New Hampshire Warranty Deed Pertaining to Conservatorship, take a look at the instructions below:

- make sure that the form you’re considering applies in the state you want it in.

- Preview the form and look at its description.

- Simply click Buy Now to access the sign up page.

- Choose a pricing plan and proceed signing up by entering some information.

- Choose a payment method to finish the registration.

- Save the file by selecting your preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel unsure regarding your New Hampshire Warranty Deed Pertaining to Conservatorship form, speak to a legal professional to analyze it before you send or file it. Begin without hassles!

Form popularity

FAQ

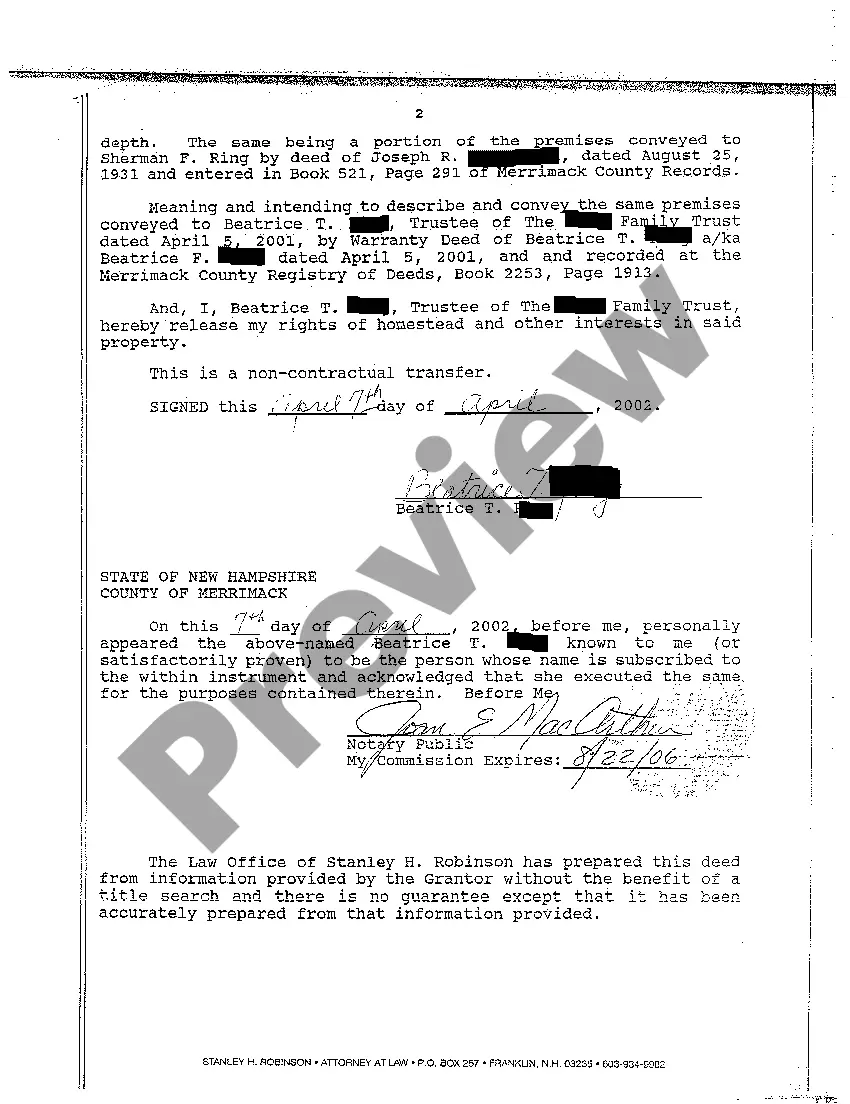

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

No, in most states, the Grantee is not required to sign the Quitclaim Deed. However, some counties do require that the Quitclaim Deed be signed by the Grantee in addition to the Grantor.

In a Warranty Deed, the grantee is the person who the interest in a property is being transferred to. For example, if you are buying a property from someone else, you are the grantee, and the person selling it is the grantor.

The General Warranty Deed A general warranty deed provides the highest level of protection for the buyer because it includes significant covenants or warranties conveyed by the grantor to the grantee.

Grantor's signature: The grantor must sign the deed for it to be valid. Usually, if more than one person owns a property, all the owners must sign. In some states a husband or wife who own property by themselves may have to have the spouse also sign the deed even though the spouse does not have title to the property.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

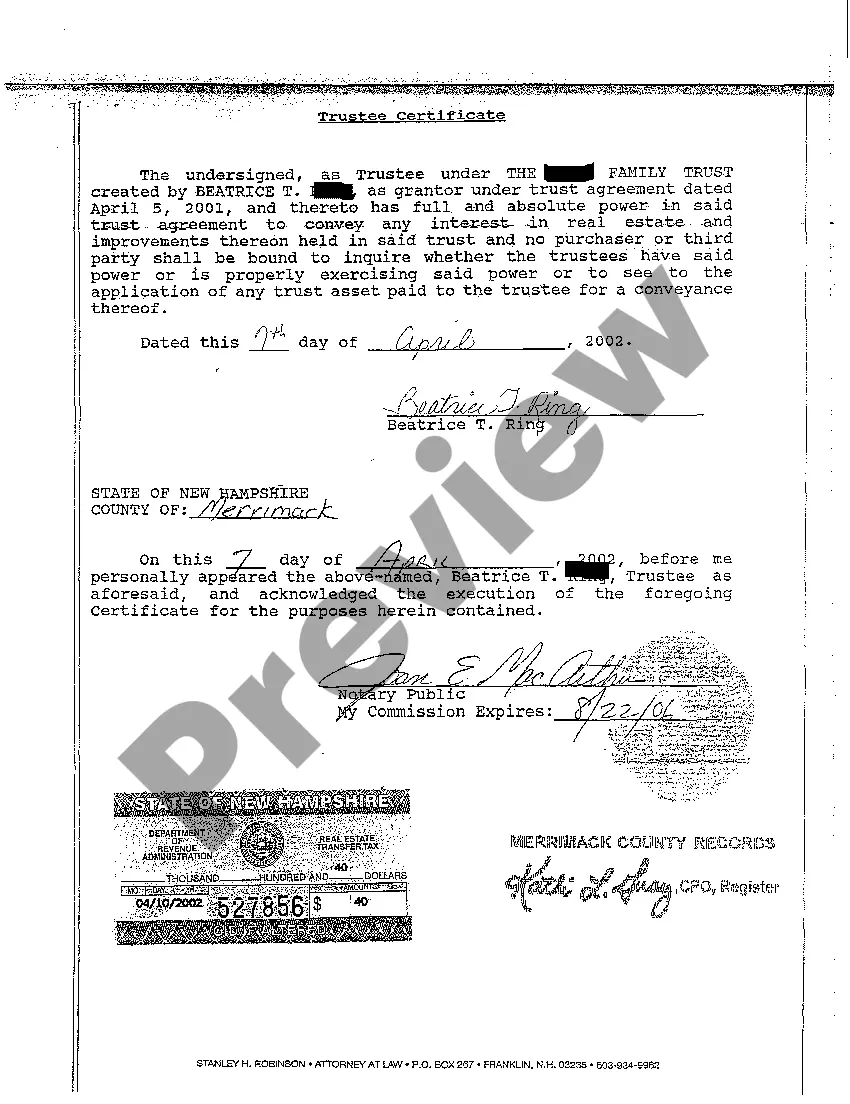

A fiduciary deed does not contain the same warranties as a warranty or grant deed. Often it only warranties that the fiduciary acts in an appointed capacity and that signing the deed falls within the authority given him.

No, California does not require that the Grantee sign a warranty deed. However, some states and counties require that the deed be signed by the Grantee in addition to the Grantor.

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons. Fiduciary deeds are commonly employed when settling estates and the original owner of the property is deceased.