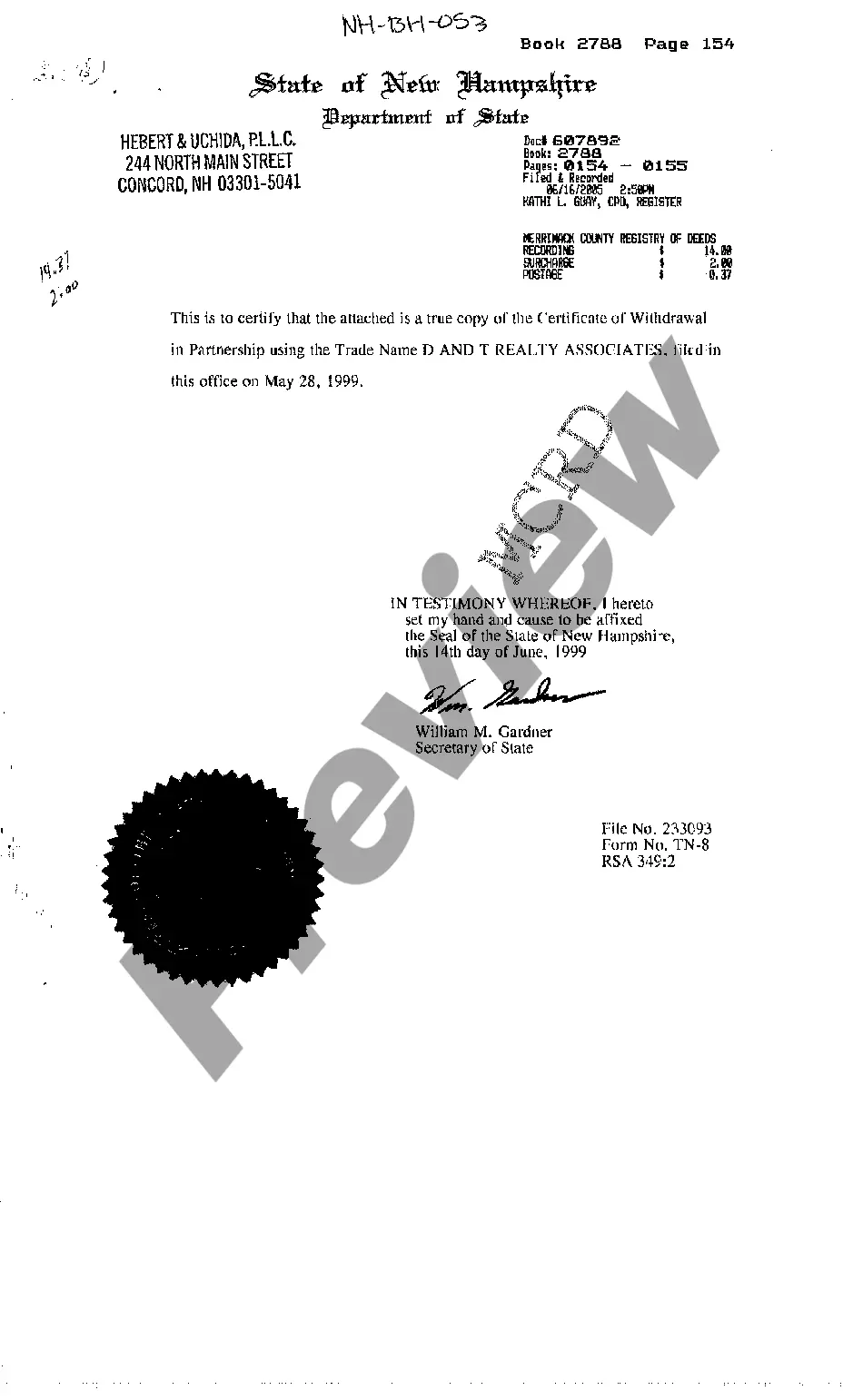

This form is used to notify the state of a withdrawal of a former business owner who who was using the trade name of a business which was previously registered with the state.

New Hampshire Certificate of Withdrawal in Members Using Trade Name

Description

How to fill out New Hampshire Certificate Of Withdrawal In Members Using Trade Name?

US Legal Forms is a special system to find any legal or tax template for submitting, including New Hampshire Certificate of Withdrawal in Members Using Trade Name. If you’re tired with wasting time searching for perfect examples and spending money on record preparation/legal professional service fees, then US Legal Forms is exactly what you’re trying to find.

To enjoy all of the service’s advantages, you don't have to download any application but simply pick a subscription plan and sign up an account. If you already have one, just log in and find the right sample, download it, and fill it out. Downloaded files are all saved in the My Forms folder.

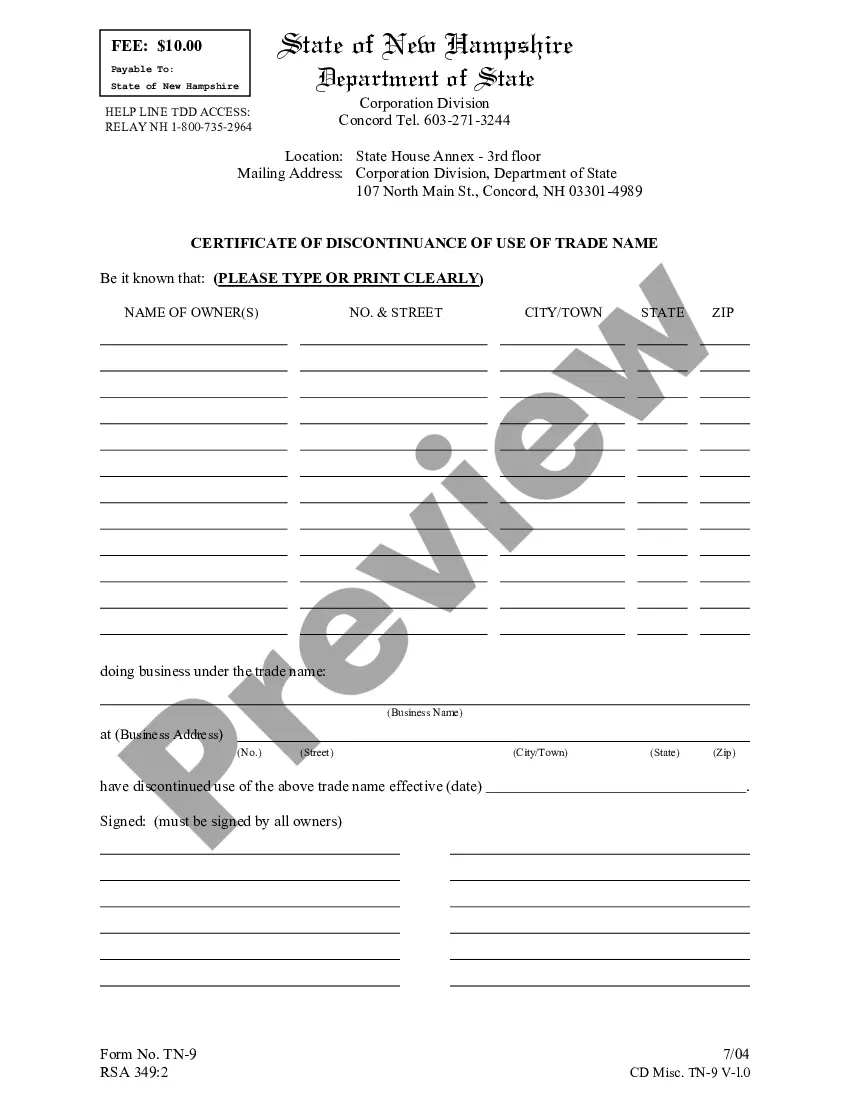

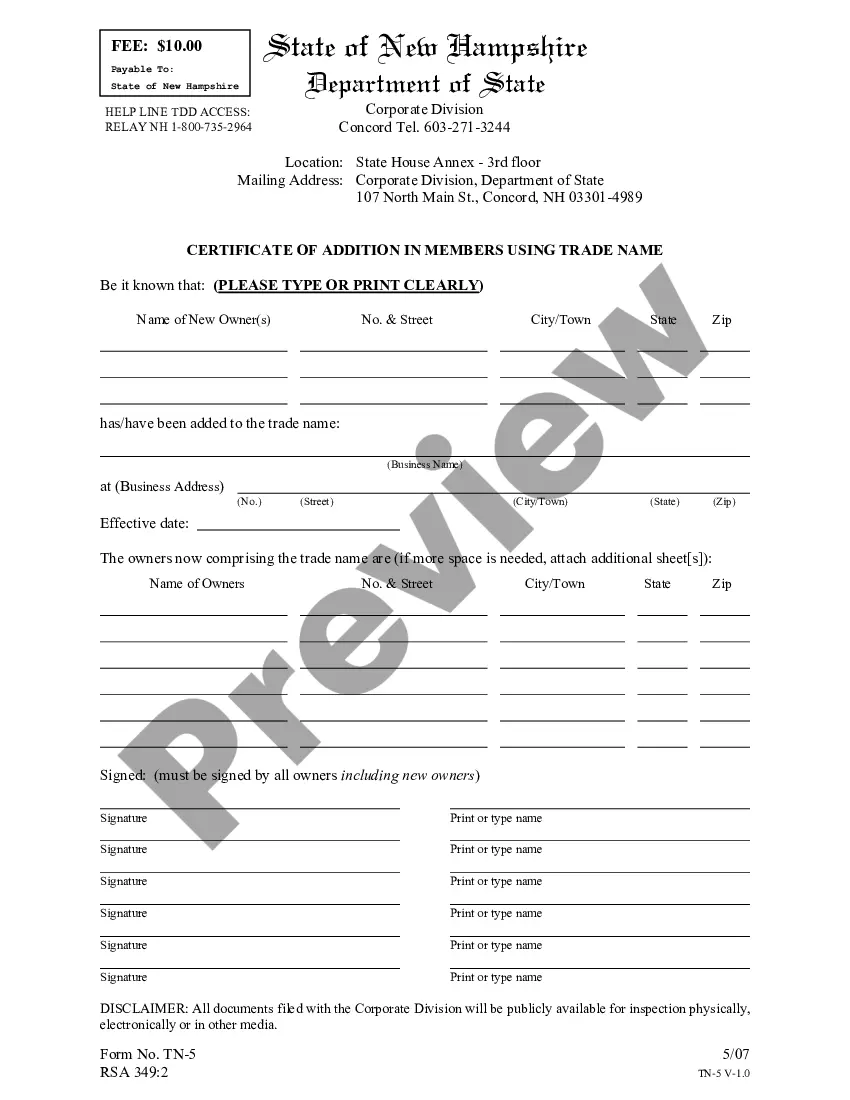

If you don't have a subscription but need to have New Hampshire Certificate of Withdrawal in Members Using Trade Name, check out the recommendations below:

- check out the form you’re considering is valid in the state you want it in.

- Preview the example and look at its description.

- Click on Buy Now button to reach the sign up webpage.

- Pick a pricing plan and continue signing up by providing some info.

- Pick a payment method to complete the registration.

- Save the file by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are uncertain about your New Hampshire Certificate of Withdrawal in Members Using Trade Name sample, contact a legal professional to review it before you decide to send or file it. Start hassle-free!

Form popularity

FAQ

The biggest difference between a DBA and an LLC is liability protection.On the other hand, an LLC provides limited liability protection. The business owners' personal property remains completely separate from the business. In addition, a DBA does not provide any tax benefits.

The State of New Hampshire does not have a general, state-level business license. Instead, business licenses are mandated at the local level. https://www.nh.gov/government/ click on the county where your LLC is located and then call them about license and/or permit requirements for your business.

The State of New Hampshire does not have a general, state-level business license. Instead, business licenses are mandated at the local level. https://www.nh.gov/government/ click on the county where your LLC is located and then call them about license and/or permit requirements for your business.

No Special Tax Benefits: Unlike a corporation, filing a DBA that is not part of an LLC or another 'corporate umbrella' will not give you any special tax benefits. Your business' revenues will be passed on to your individual tax return and taxed accordingly.

DBA means doing business as and is required for businesses operating under a name other than their legal name. Filing for a DBA allows you to do business under a name other than yours, or the name under which your business is legally registered.

Walk-In. State House Annex. Mail. Corporation Division. Fees. $50 Filing Fee. DBA Questions. Call the New Hampshire Secretary of State's Corporation Division: (603-271-3246) Renew Your DBA with the State. Change Your DBA. Withdraw Your DBA.

Doing business as (DBA) refers to businesses that operate under a fictitious name, while limited liability company (LLC) refers to legal entities that are entirely separate from business owners.

Registering your DBA name doesn't provide legal protection by itself, but most states require you to register your DBA if you use one. Some business structures require you to use a DBA.

LicenseLogix can help you acquire and maintain business licenses for all U.S. states and for most industries. Notes: To obtain (and maintain) this license, the State of New Hampshire requires an application, a $900 fee, extensive supporting documentation, and annual renewals.