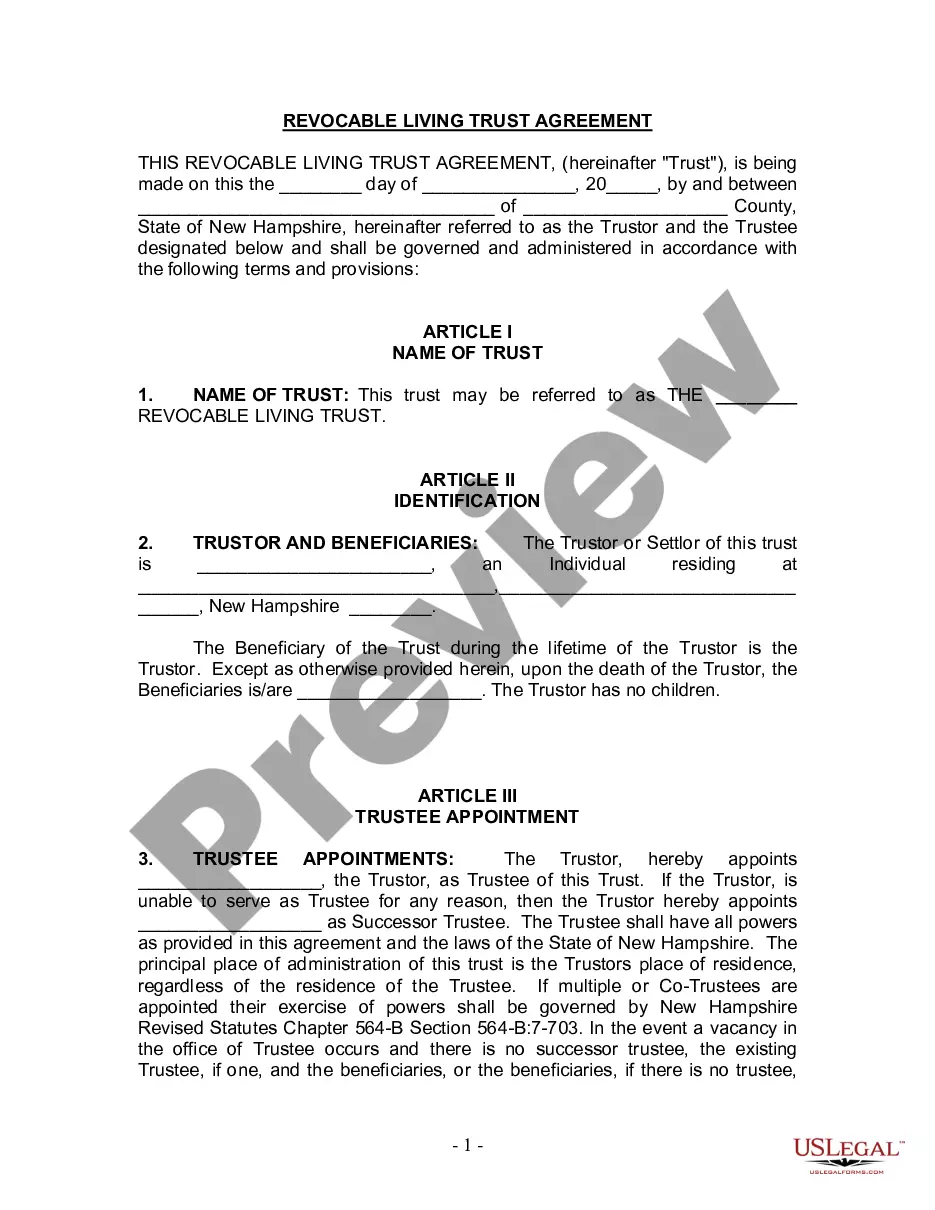

New Hampshire Living Trust for Individual Who is Single, Dvorced or Wdow (or Wdower) with No Children

Description Trust Individual With

How to fill out Who Dvorced No?

US Legal Forms is a unique platform to find any legal or tax document for submitting, including New Hampshire Living Trust for Individual Who is Single, Dvorced or Wdow (or Wdower) with No Children. If you’re fed up with wasting time searching for appropriate samples and spending money on file preparation/legal professional service fees, then US Legal Forms is exactly what you’re searching for.

To enjoy all the service’s benefits, you don't need to download any application but simply pick a subscription plan and register an account. If you already have one, just log in and look for the right sample, download it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Living Trust for Individual Who is Single, Dvorced or Wdow (or Wdower) with No Children, have a look at the guidelines below:

- check out the form you’re taking a look at is valid in the state you need it in.

- Preview the sample its description.

- Click on Buy Now button to reach the sign up webpage.

- Choose a pricing plan and proceed signing up by providing some information.

- Choose a payment method to complete the sign up.

- Save the document by choosing your preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel uncertain about your New Hampshire Living Trust for Individual Who is Single, Dvorced or Wdow (or Wdower) with No Children sample, speak to a lawyer to check it before you send out or file it. Start without hassles!

Nh Trust Wdower Form popularity

Trust Wdow Form Other Form Names

Trust Wdow Agreement FAQ

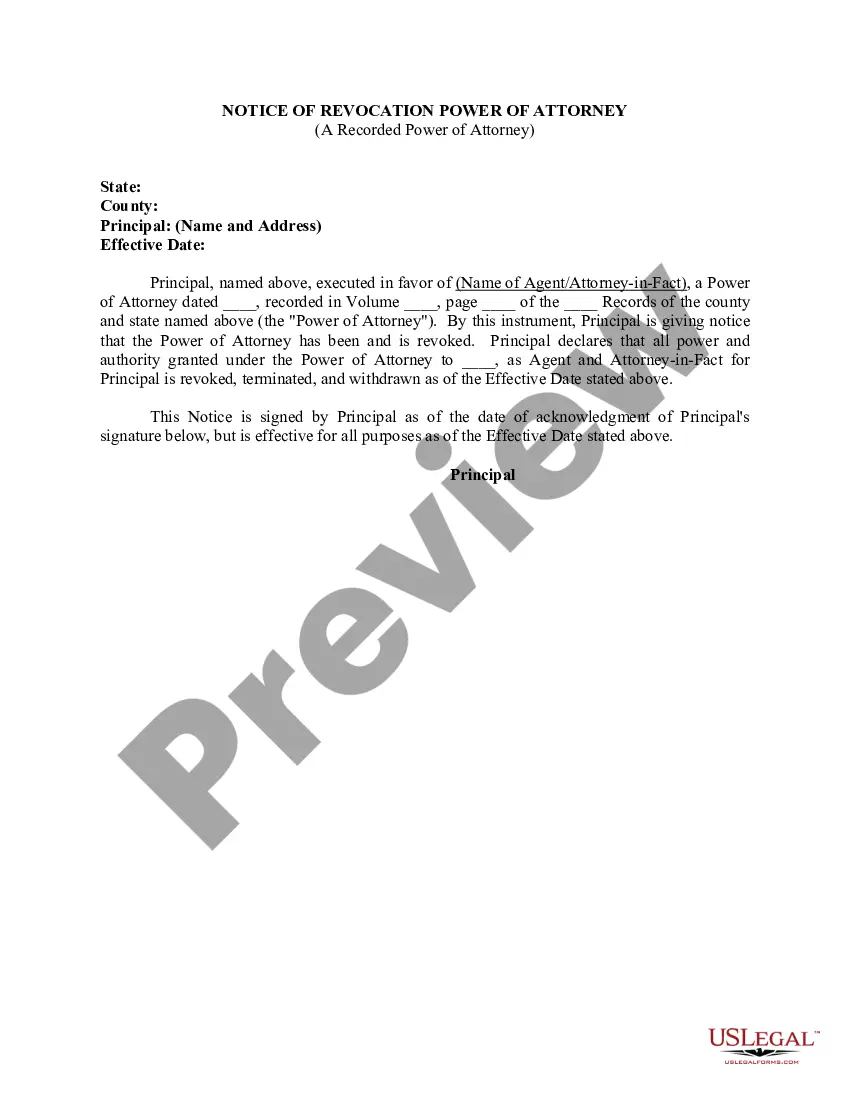

Anyone who is single and has assets titled in their sole name should consider a Revocable Living Trust. The two main reasons are to keep you and your assets out of a court-supervised guardianship and to allow your beneficiaries to avoid the costs and hassles of probate.

To name a special needs trust as a beneficiary, use the name of the trustee and the full legal name of the trust as beneficiary: For example: Chris Lee as the trustee of The Pat Lee Special Needs Trust

An owner of a trust account is the person who has the powers to modify or revoke the terms of the trust, referred to as the trustor/grantor/settlor within the trust.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

The trustee holds legal ownership of the borrower's home in trust until the loan is paid off.The lender has claim to the home if the borrower stops paying the loan before it's fully paid off because the trustee is only acting as an independent third party. A deed of trust often includes a power-of-sale clause.

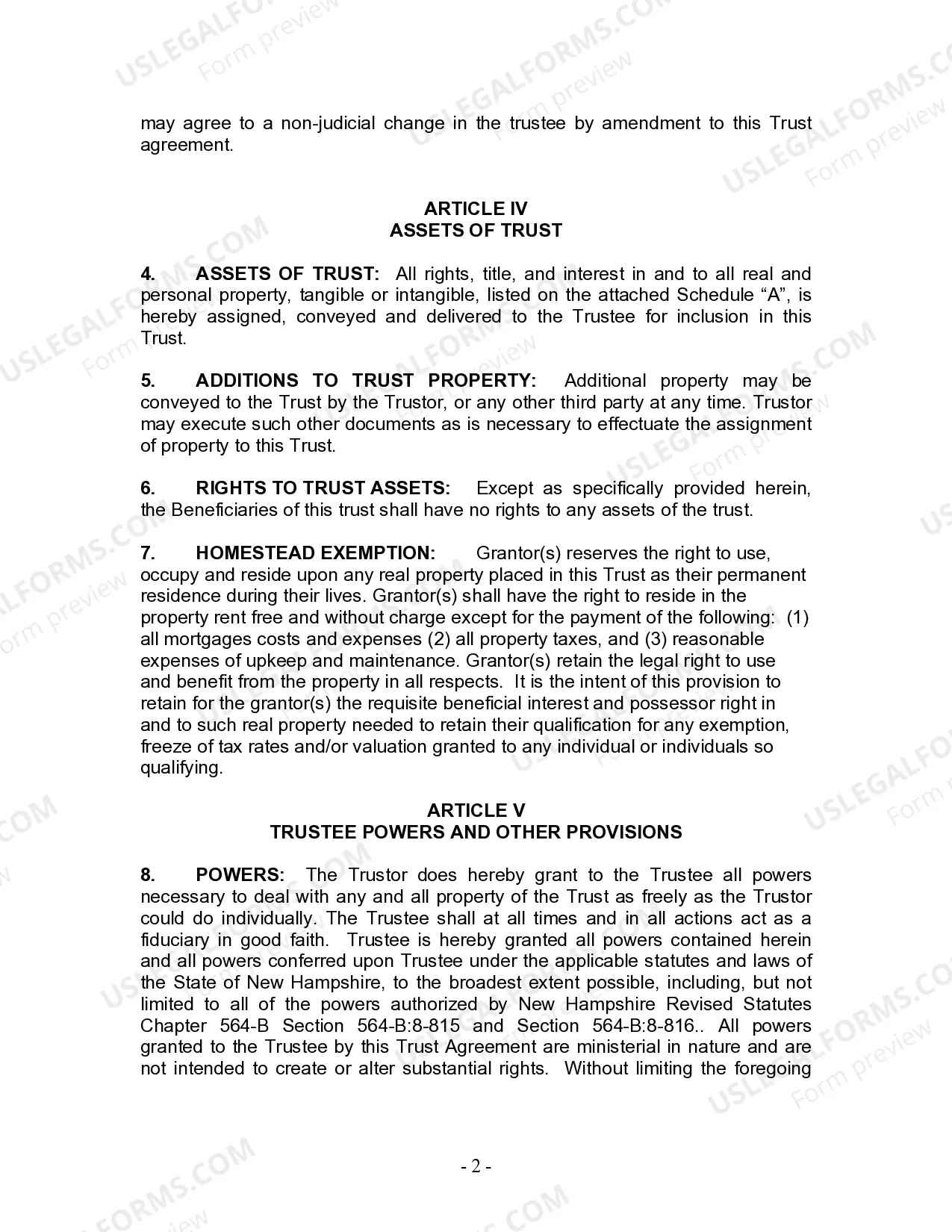

A will covers any property that is only in your name when you die. It does not cover property held in joint tenancy or in a trust. A trust, on the other hand, covers only property that has been transferred to the trust. In order for property to be included in a trust, it must be put in the name of the trust.

A trust is an arrangement in which one person, called the trustee, controls property for the benefit of another person, called the beneficiary. The person who creates the trust is called the settlor, grantor, or trustor.

A trust is an arrangement in which one person, called the trustee, controls property for the benefit of another person, called the beneficiary. The person who creates the trust is called the settlor, grantor, or trustor.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.