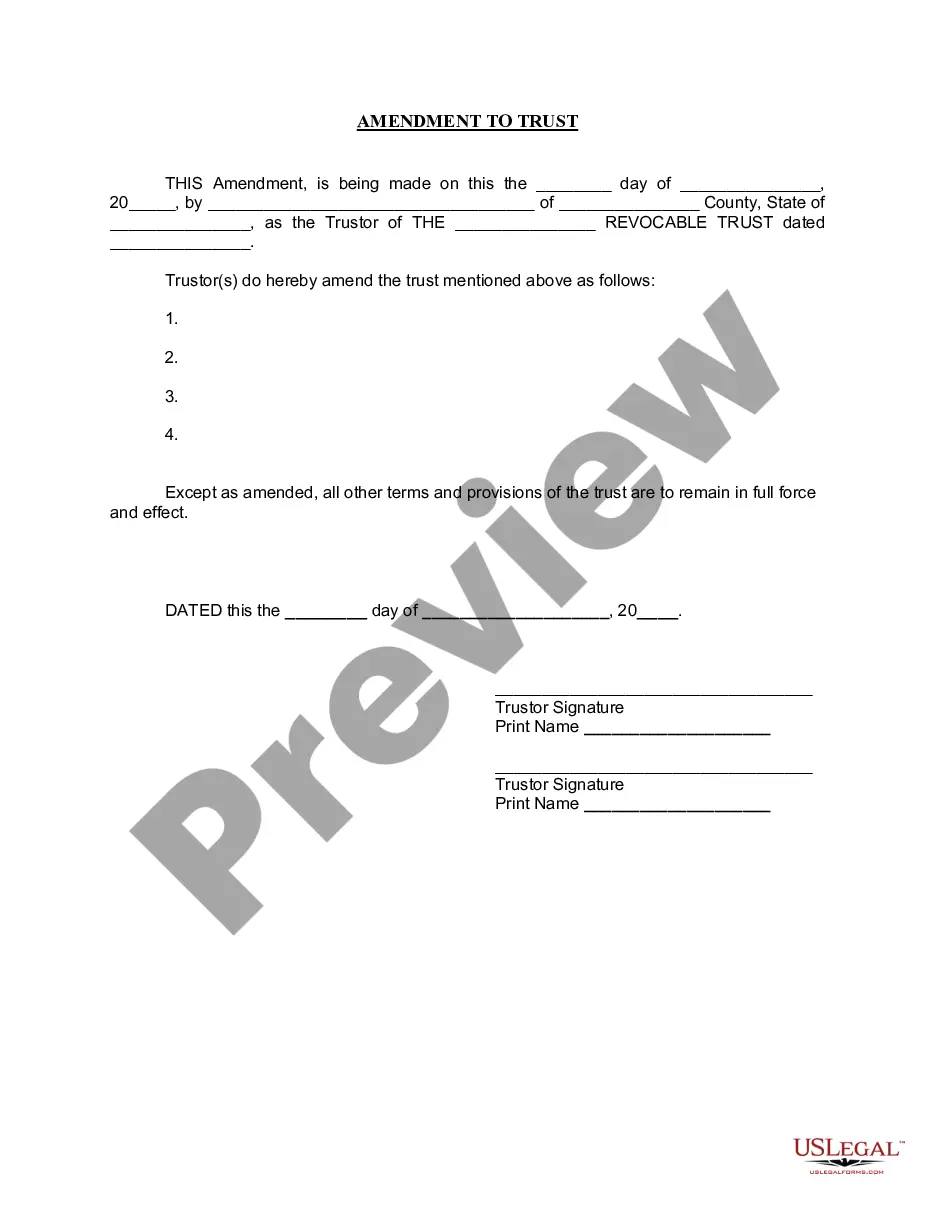

New Hampshire Amendment to Living Trust

Description New Hampshire Living Trust Agreement

How to fill out New Hampshire Amendment To Living Trust?

US Legal Forms is a special platform where you can find any legal or tax form for completing, such as New Hampshire Amendment to Living Trust. If you’re fed up with wasting time searching for ideal samples and spending money on file preparation/lawyer service fees, then US Legal Forms is precisely what you’re looking for.

To enjoy all of the service’s advantages, you don't need to install any software but simply choose a subscription plan and sign up an account. If you already have one, just log in and find an appropriate template, download it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Amendment to Living Trust, take a look at the recommendations listed below:

- Double-check that the form you’re looking at is valid in the state you need it in.

- Preview the sample its description.

- Click on Buy Now button to get to the sign up page.

- Select a pricing plan and continue registering by entering some info.

- Choose a payment method to complete the registration.

- Save the file by selecting the preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you feel uncertain regarding your New Hampshire Amendment to Living Trust template, speak to a attorney to analyze it before you send out or file it. Get started without hassles!

Amendment Living Trust Download Form popularity

Amendment Living Trust Form Other Form Names

FAQ

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.