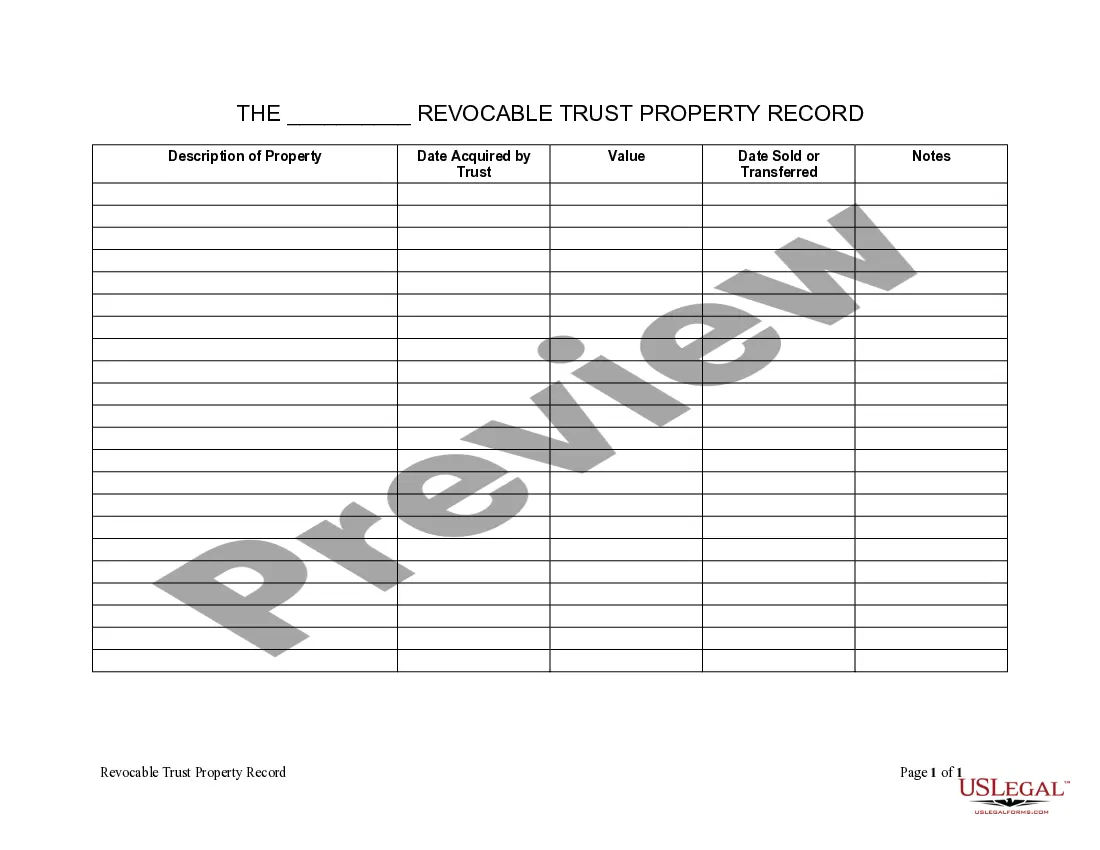

New Hampshire Living Trust Property Record

Description

How to fill out New Hampshire Living Trust Property Record?

US Legal Forms is a unique system to find any legal or tax form for filling out, such as New Hampshire Living Trust Property Record. If you’re tired of wasting time searching for appropriate samples and paying money on file preparation/legal professional service fees, then US Legal Forms is exactly what you’re trying to find.

To reap all the service’s benefits, you don't need to download any application but just pick a subscription plan and create an account. If you have one, just log in and get the right sample, download it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Living Trust Property Record, check out the guidelines listed below:

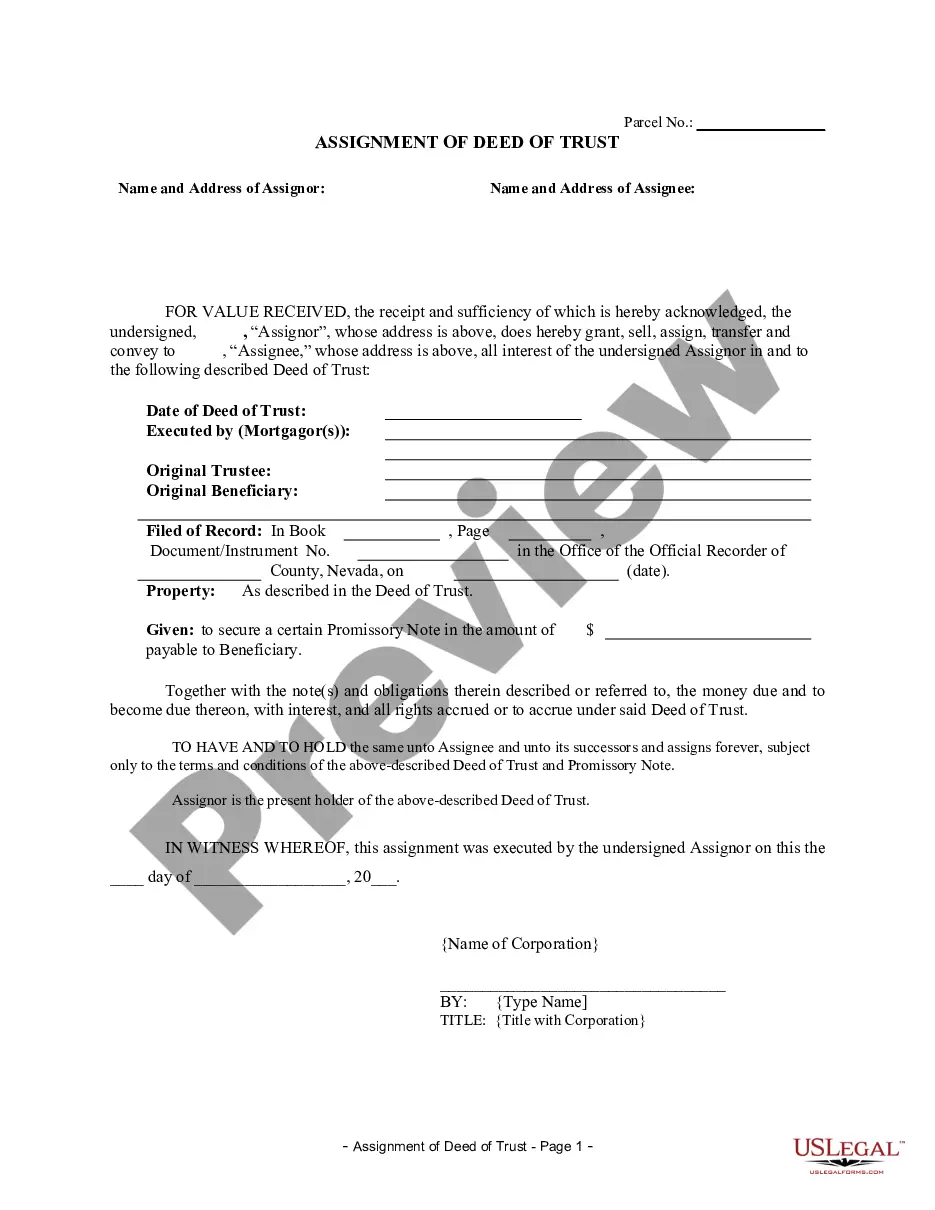

- check out the form you’re checking out is valid in the state you want it in.

- Preview the sample its description.

- Simply click Buy Now to access the register page.

- Choose a pricing plan and proceed registering by providing some info.

- Select a payment method to complete the sign up.

- Download the document by selecting the preferred file format (.docx or .pdf)

Now, submit the file online or print out it. If you feel unsure concerning your New Hampshire Living Trust Property Record sample, speak to a legal professional to review it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Anyone can look up a particular parcel of real estate in the local land records office (often called the county recorder or registry of deeds, depending on where you live) and find out who owns it. (Often, other information is also available, such as the amount of property taxes paid each year.)

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

What happens if you have lost your Trust?If a Trust is lost, and the decedent has assets titled in the name of the Trust, the court will require that the heirs/Successor Trustees spend a significant amount of time and money searching for the Trust and documenting the search process.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

Today clients who have living trusts normally keep the original copy. Having the attorney keep the original copy of the trust is not as important as keeping the original will used to be. At death, a copy of the trust generally suffices for all parties in place of the original.