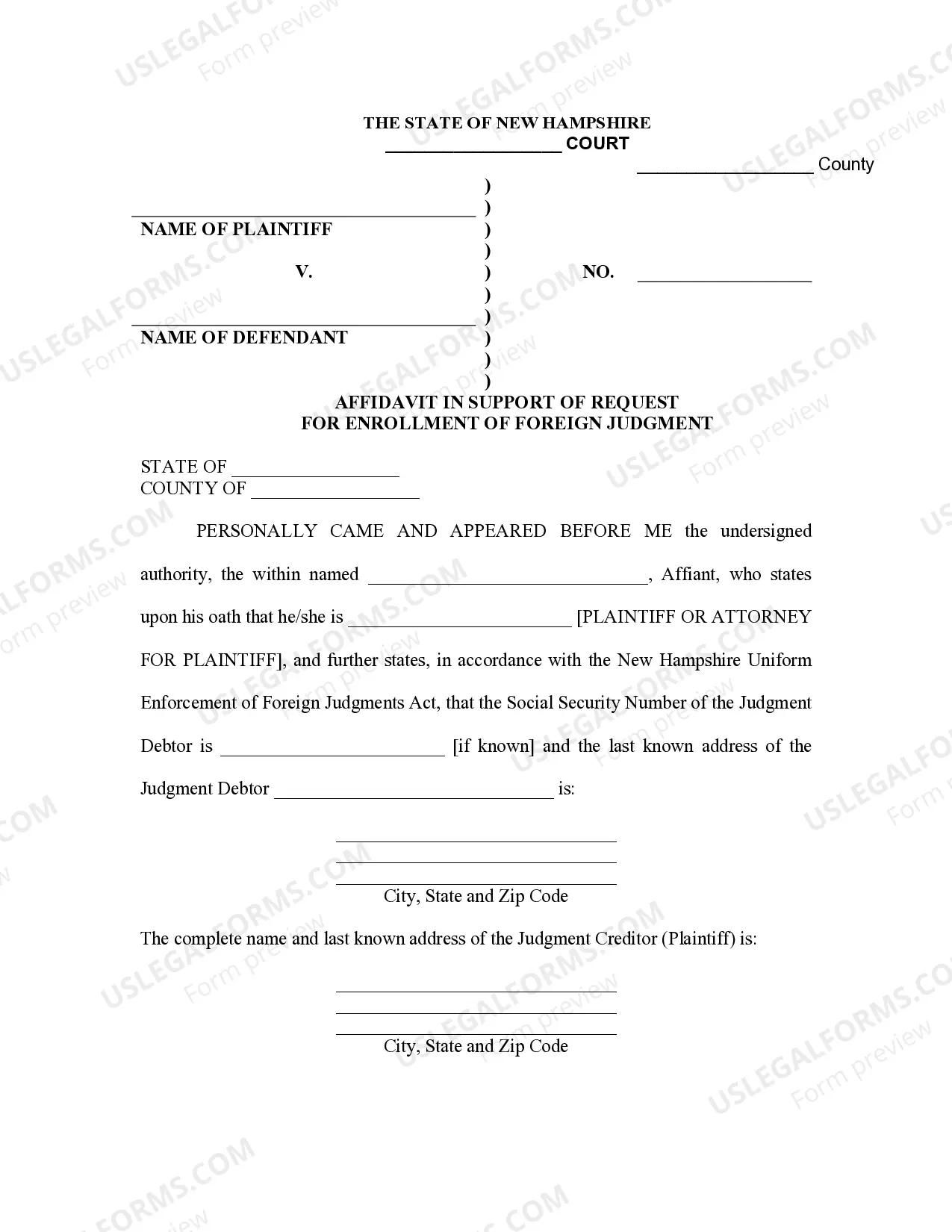

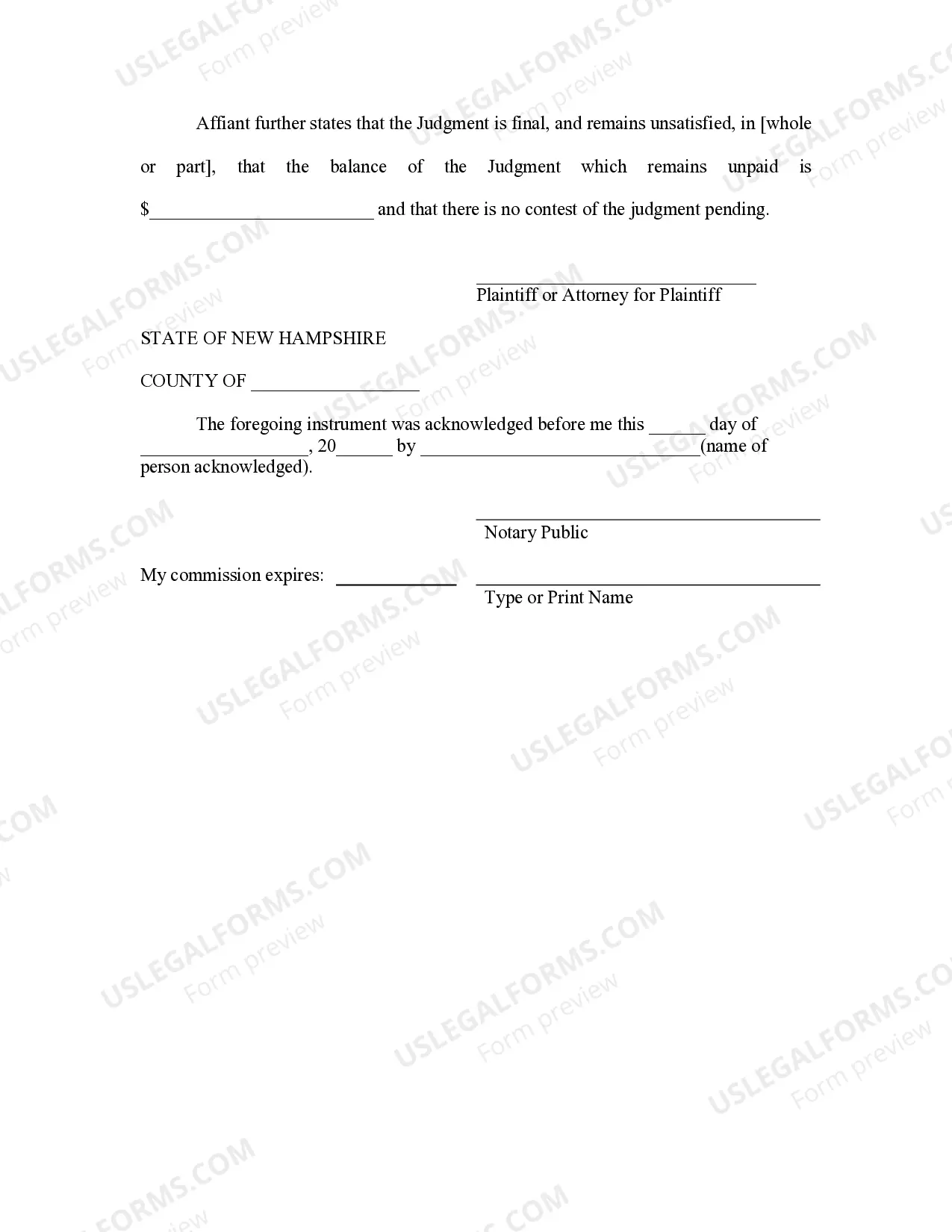

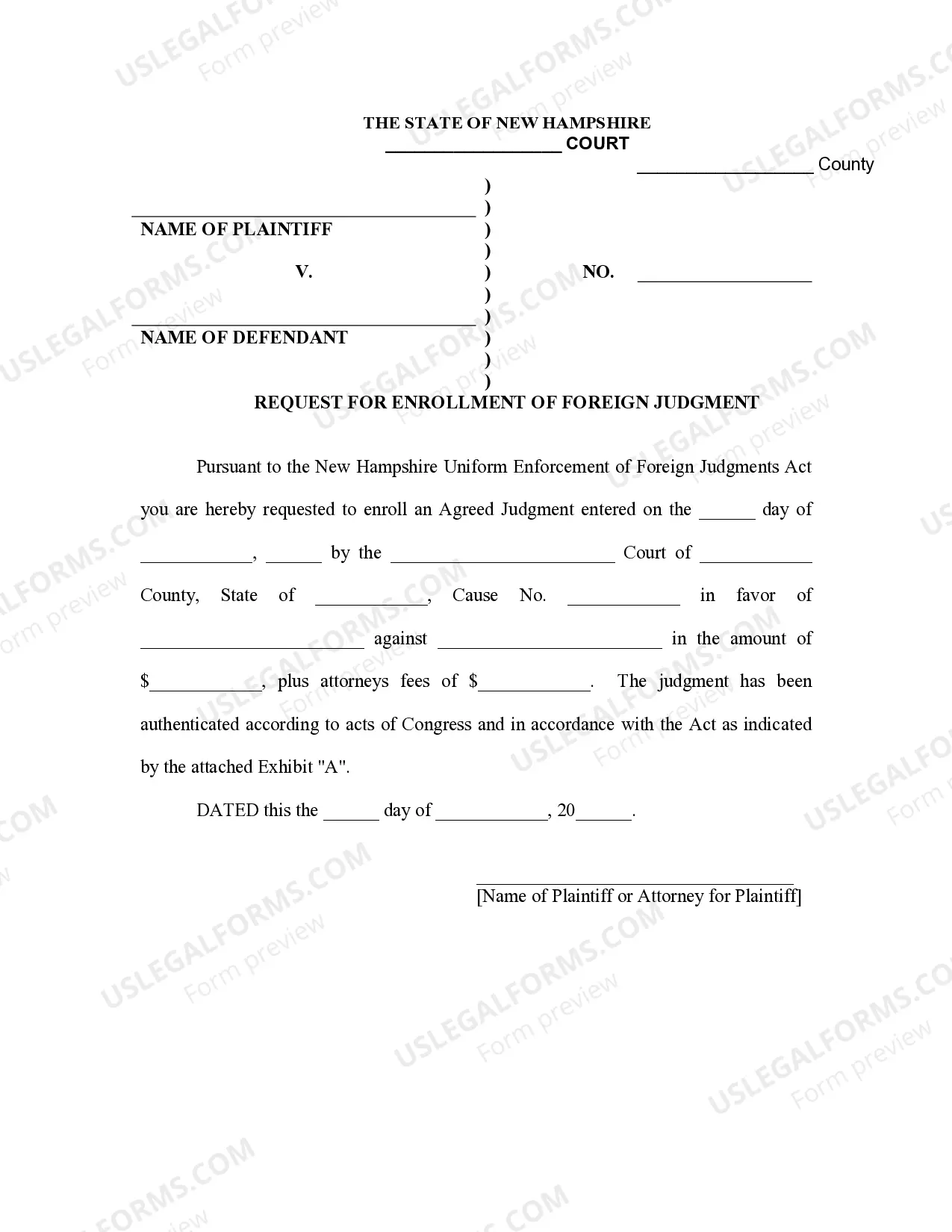

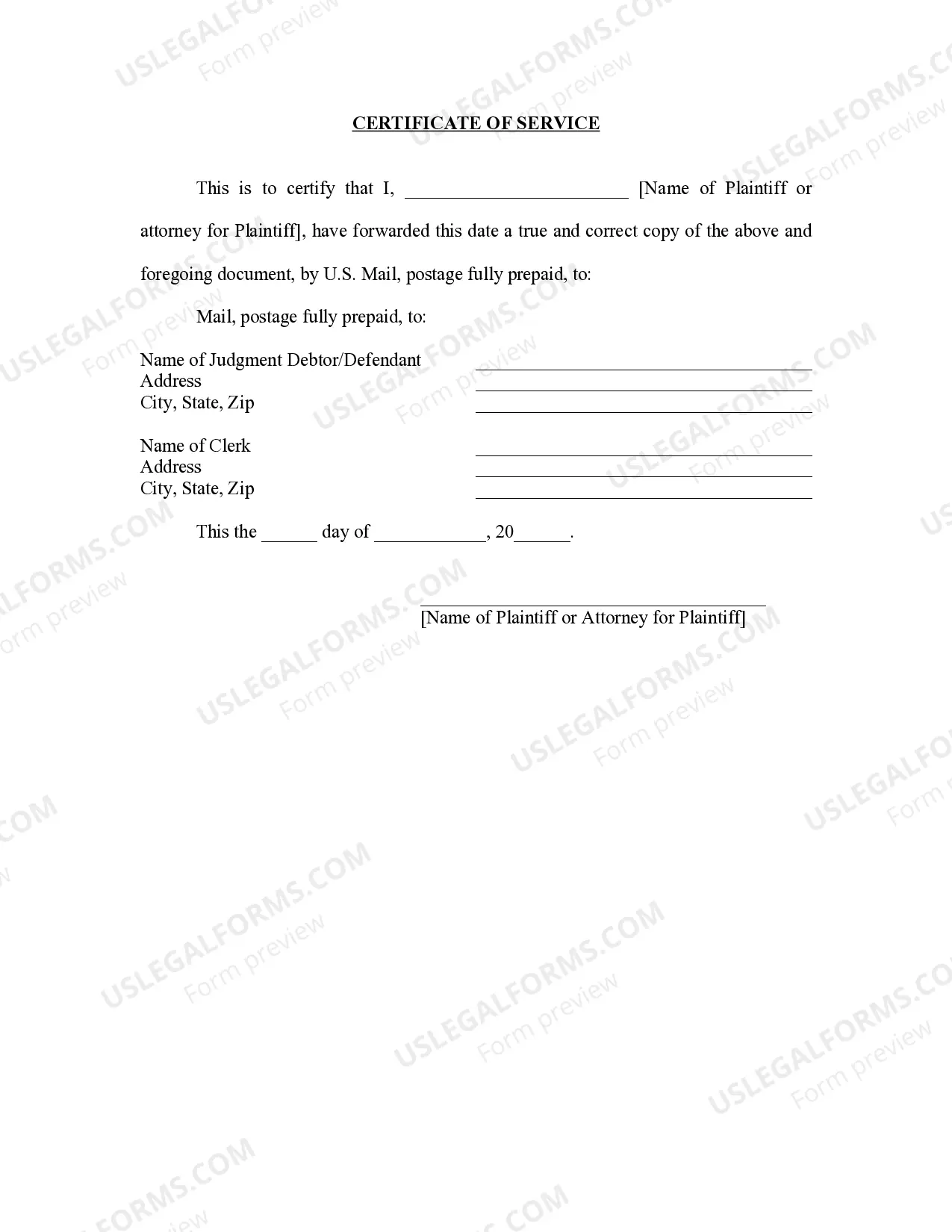

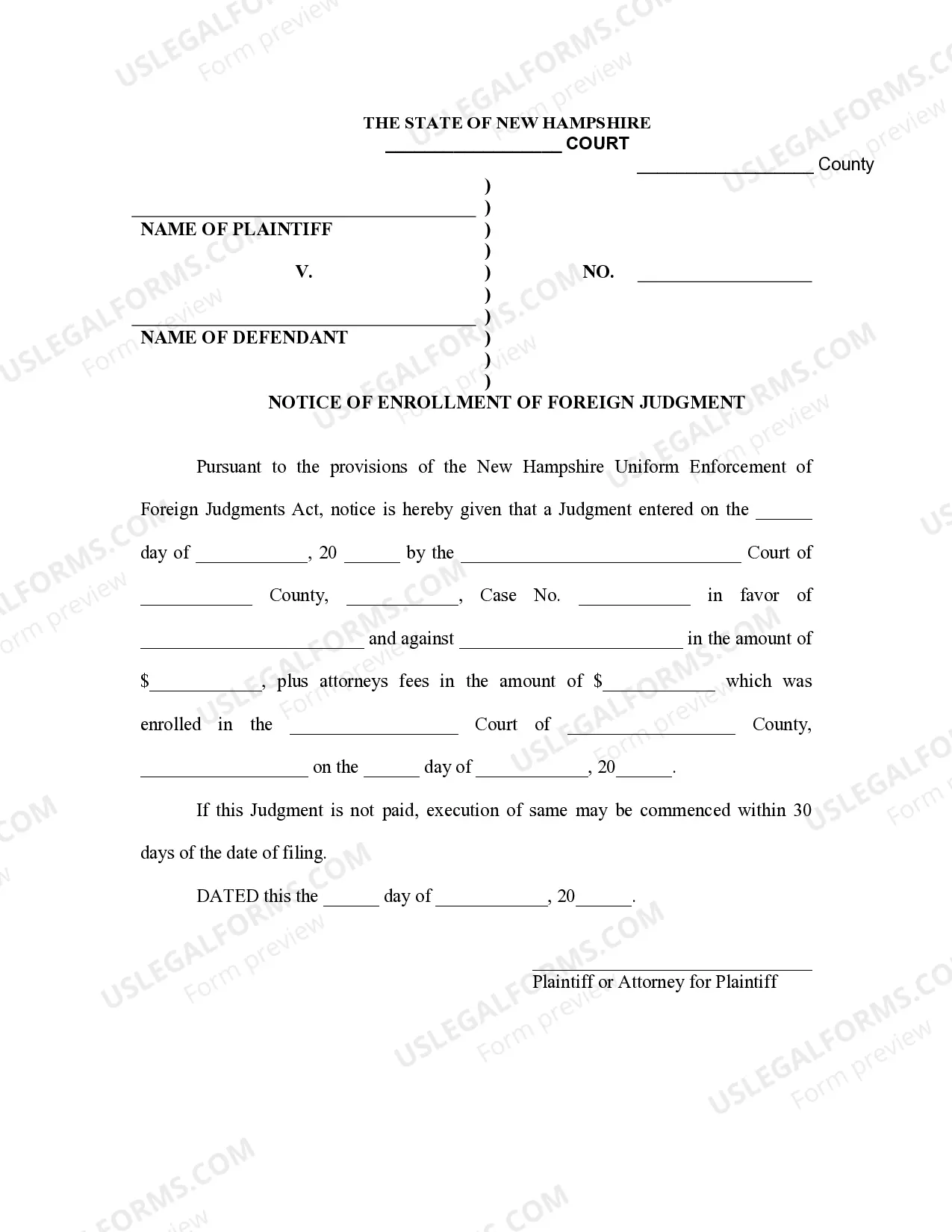

New Hampshire Foreign Judgment Enrollment

Description

How to fill out New Hampshire Foreign Judgment Enrollment?

US Legal Forms is actually a special platform where you can find any legal or tax document for submitting, including New Hampshire Foreign Judgment Enrollment. If you’re tired of wasting time looking for suitable examples and paying money on papers preparation/attorney charges, then US Legal Forms is precisely what you’re looking for.

To enjoy all of the service’s benefits, you don't need to download any application but just choose a subscription plan and create an account. If you already have one, just log in and find a suitable sample, save it, and fill it out. Downloaded files are all saved in the My Forms folder.

If you don't have a subscription but need New Hampshire Foreign Judgment Enrollment, check out the guidelines listed below:

- check out the form you’re considering applies in the state you want it in.

- Preview the sample its description.

- Click Buy Now to reach the register webpage.

- Pick a pricing plan and proceed signing up by providing some information.

- Decide on a payment method to complete the sign up.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you are unsure concerning your New Hampshire Foreign Judgment Enrollment sample, contact a attorney to examine it before you decide to send or file it. Begin hassle-free!

Form popularity

FAQ

New Hampshire 401(k)s and IRAs: With no income tax, your 401(k) and IRA distributions are tax-free, too.

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return.If you have investment income from interest and dividends. (described in detail in the "NH Income Tax" section), you may have to file a New Hampshire tax return for that income.

It is a 5% tax on interest and dividends income. Who pays it? All New Hampshire residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4800 for joint filers).

PA-33 STATEMENT OF QUALIFICATION FOR PROPERTY TAX CREDIT, EXEMPTION OR. TAX DEFERRAL UNDER RSA , V. (to be submitted with Form PA-29 or Form PA-30) USE THIS FORM IF YOUR PROPERTY IS HELD IN A TRUST, HAS EQUITABLE TITLE OR HAS A LIFE ESTATE. TYPE OR PRINT.

The Interest and Dividends Tax Instructions, page 3, Line 2 states: These distributions are subject to tax in New Hampshire as a "dividend".Taxable annuities are those annuities not invested in a tax-deferred investment plan pursuant to RSA 77:4-b.

For individual and joint filers, the amount to be reported on Line 1(a) is from Line 2(b) of IRS Form 1040. For all other filers, the amount to be reported on Line 1(a) is the total of all interest income reported on your federal return.

Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008.

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. The taxpayer can enter the date of residency during the New Hampshire Q&A.