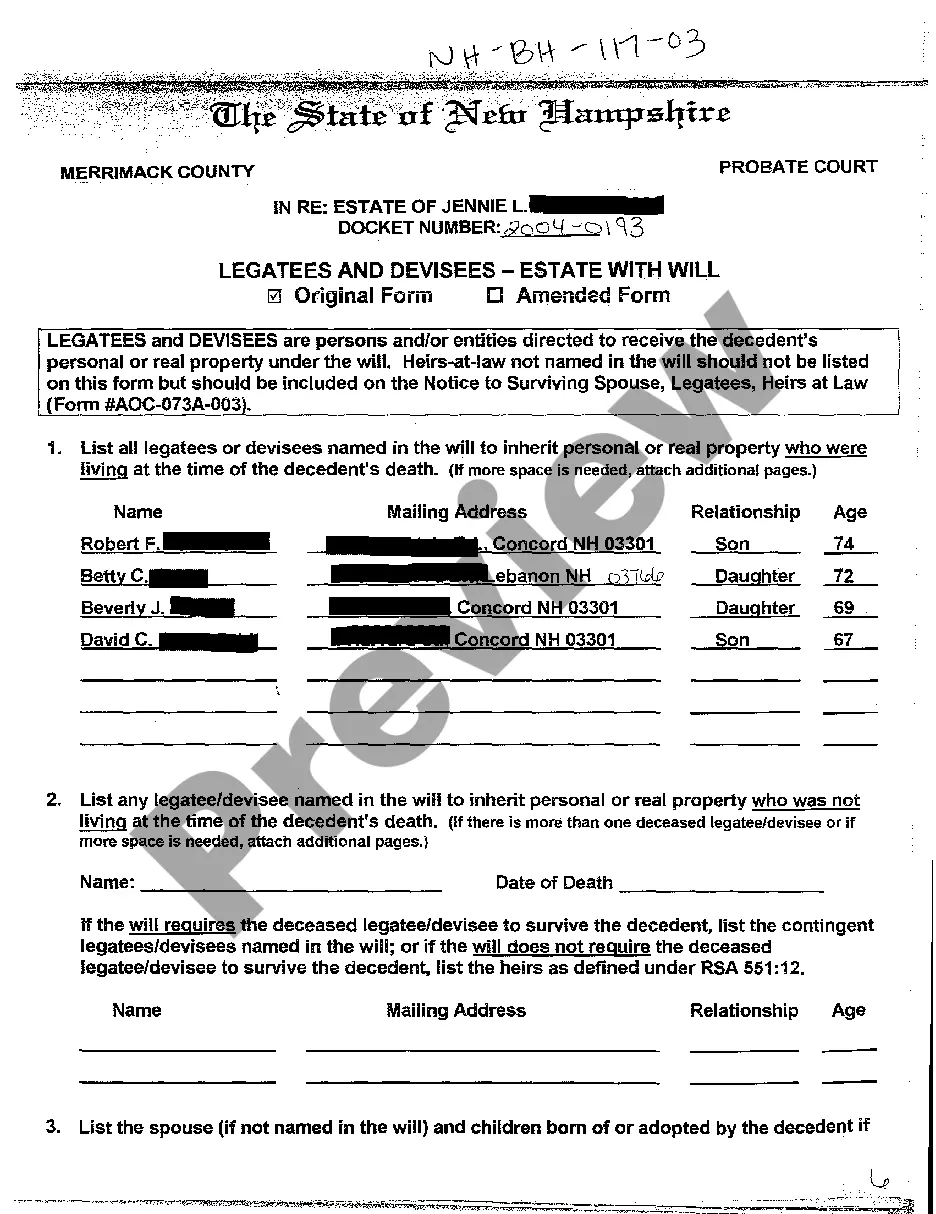

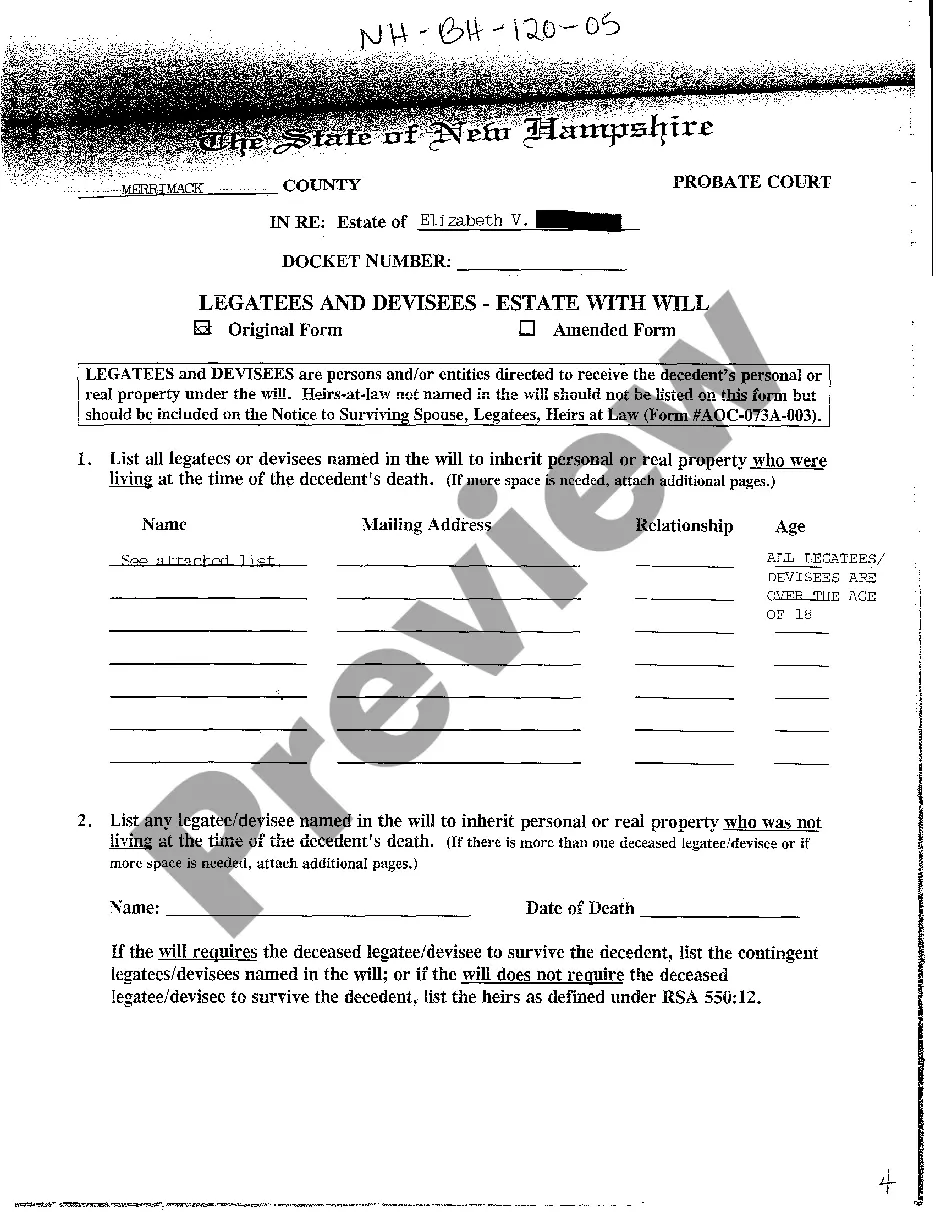

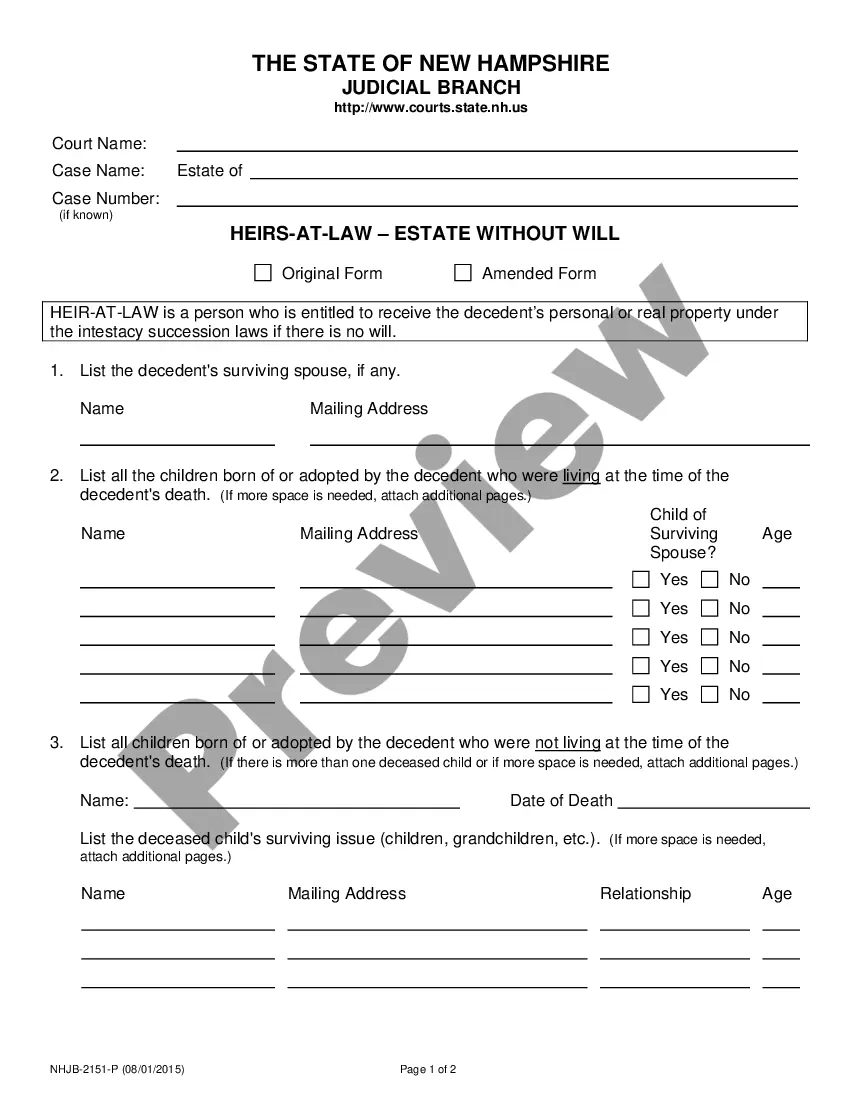

This is an official form from the New Hampshire Judicial Branch that is used to identify the deceased's legatees and devisees. A legatee or devisee is a person, charitable organization or living trust named in the will to inherit personal or real property. (This form should not be used if the deceased died prior to January 1, 2003.) It complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New Hampshire statutes and law.

New Hampshire Legatees and Devisees - Estate with Will

Description

How to fill out New Hampshire Legatees And Devisees - Estate With Will?

US Legal Forms is really a unique system where you can find any legal or tax document for submitting, including New Hampshire Legatees and Devisees - Estate with Will. If you’re sick and tired of wasting time looking for suitable examples and spending money on file preparation/attorney fees, then US Legal Forms is precisely what you’re seeking.

To enjoy all of the service’s advantages, you don't have to download any software but just pick a subscription plan and sign up your account. If you already have one, just log in and find a suitable template, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need New Hampshire Legatees and Devisees - Estate with Will, check out the recommendations below:

- check out the form you’re checking out is valid in the state you want it in.

- Preview the sample and look at its description.

- Simply click Buy Now to reach the register webpage.

- Choose a pricing plan and proceed registering by providing some info.

- Pick a payment method to complete the registration.

- Download the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel unsure about your New Hampshire Legatees and Devisees - Estate with Will template, contact a lawyer to review it before you send or file it. Begin hassle-free!

Form popularity

FAQ

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

Although a state's laws might not technically require the filing of a will, the probate process cannot beginand thus any heirs or beneficiaries cannot inherit any of the deceased individual's assetsuntil someone submits the document to the probate court.

There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it.

If an estate has a will, you must file a petition with the probate court to have the will admitted to probate. A will generally names an executor to administer the estate.Whether the decedent left a will also determines whether the decedent's wishes or the state laws determine who receives the assets.

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

If your beneficiary dies before you or at the same time as you, the proceeds will have to go through probate so they can be distributed with your other assets. If your beneficiary is incapacitated, the probate court will probably take control of the funds through a guardianship/conservatorship.

Estate administration is the process that occurs after a person dies. During this process, the decedent's probate assets are collected, creditors are paid, and then the remaining assets are distributed to the decedent's beneficiaries in accordance with the decedent's will.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

Unfortunately, every estate is different, and that means timelines can vary. A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.