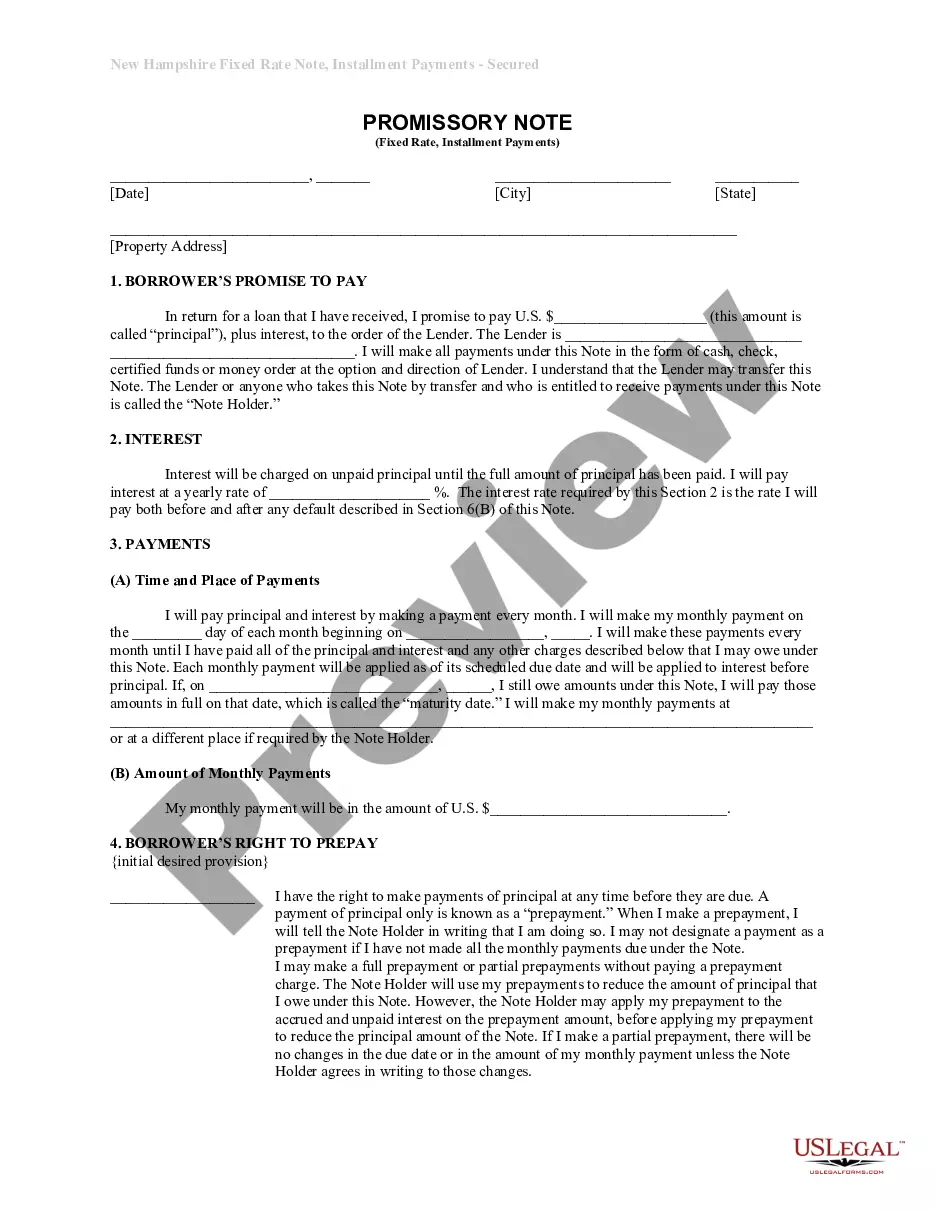

New Hampshire Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out New Hampshire Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

US Legal Forms is really a unique platform where you can find any legal or tax template for submitting, including New Hampshire Installments Fixed Rate Promissory Note Secured by Residential Real Estate. If you’re tired with wasting time searching for perfect examples and paying money on record preparation/lawyer charges, then US Legal Forms is precisely what you’re seeking.

To experience all of the service’s benefits, you don't have to install any software but just choose a subscription plan and sign up an account. If you already have one, just log in and find an appropriate sample, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Installments Fixed Rate Promissory Note Secured by Residential Real Estate, have a look at the instructions listed below:

- make sure that the form you’re considering applies in the state you want it in.

- Preview the form its description.

- Click on Buy Now button to access the register webpage.

- Select a pricing plan and carry on registering by entering some info.

- Select a payment method to complete the registration.

- Download the file by choosing the preferred format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel unsure regarding your New Hampshire Installments Fixed Rate Promissory Note Secured by Residential Real Estate form, contact a legal professional to review it before you send out or file it. Start hassle-free!

Form popularity

FAQ

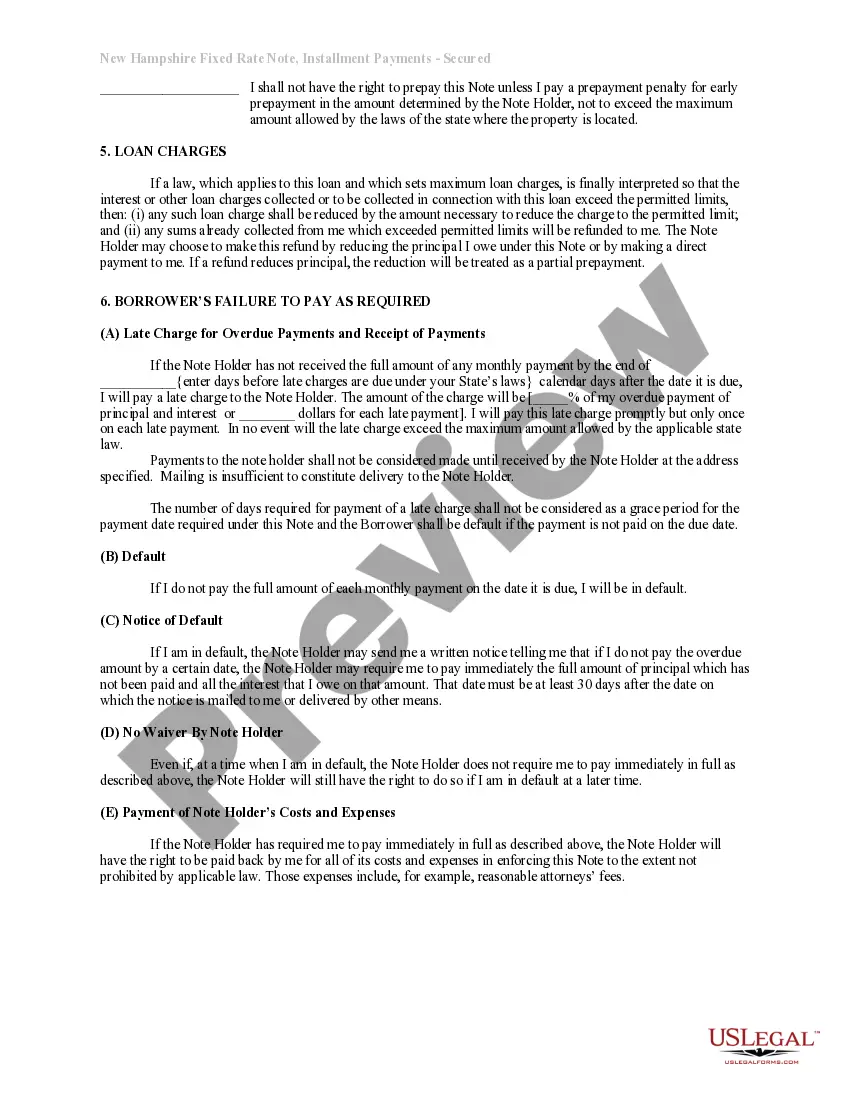

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.