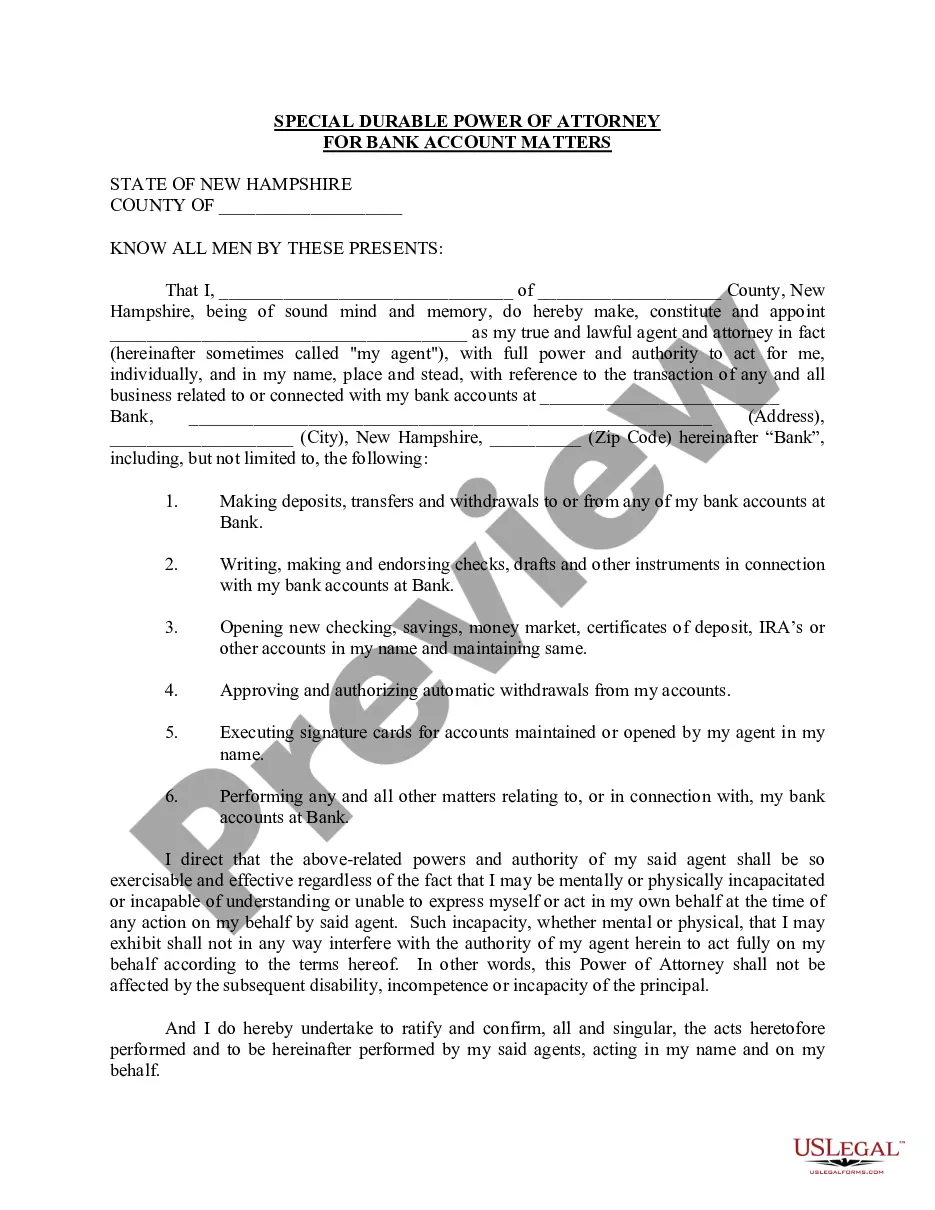

New Hampshire Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out New Hampshire Special Durable Power Of Attorney For Bank Account Matters?

US Legal Forms is actually a special system to find any legal or tax form for submitting, including New Hampshire Special Durable Power of Attorney for Bank Account Matters. If you’re tired with wasting time searching for appropriate examples and paying money on file preparation/attorney fees, then US Legal Forms is precisely what you’re searching for.

To reap all the service’s benefits, you don't have to install any software but simply choose a subscription plan and register an account. If you already have one, just log in and get a suitable template, save it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need New Hampshire Special Durable Power of Attorney for Bank Account Matters, check out the instructions listed below:

- Double-check that the form you’re checking out is valid in the state you want it in.

- Preview the form and look at its description.

- Click on Buy Now button to get to the sign up page.

- Pick a pricing plan and proceed registering by providing some information.

- Choose a payment method to complete the registration.

- Save the file by selecting the preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel uncertain about your New Hampshire Special Durable Power of Attorney for Bank Account Matters template, contact a attorney to examine it before you decide to send or file it. Get started without hassles!

Form popularity

FAQ

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

Bank Pays Price for Refusing to Honor Request Made Under a Power of Attorney.But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

For the most part, the person you appoint as your agent is not responsible for your debts when you die. However, there are a few exceptions: They were a co-signer on a loan with you.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.