New Hampshire Warranty Deed for Separate or Joint Property to Joint Tenancy

Description New Hampshire Warranty Deed Form

How to fill out Nh Warranty Separate?

Among numerous paid and free examples which you get on the web, you can't be certain about their reliability. For example, who made them or if they’re skilled enough to deal with the thing you need them to. Always keep relaxed and utilize US Legal Forms! Locate New Hampshire Warranty Deed for Separate or Joint Property to Joint Tenancy templates made by professional attorneys and get away from the costly and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access all of your previously saved samples in the My Forms menu.

If you are utilizing our service the very first time, follow the instructions below to get your New Hampshire Warranty Deed for Separate or Joint Property to Joint Tenancy with ease:

- Make certain that the file you discover applies in the state where you live.

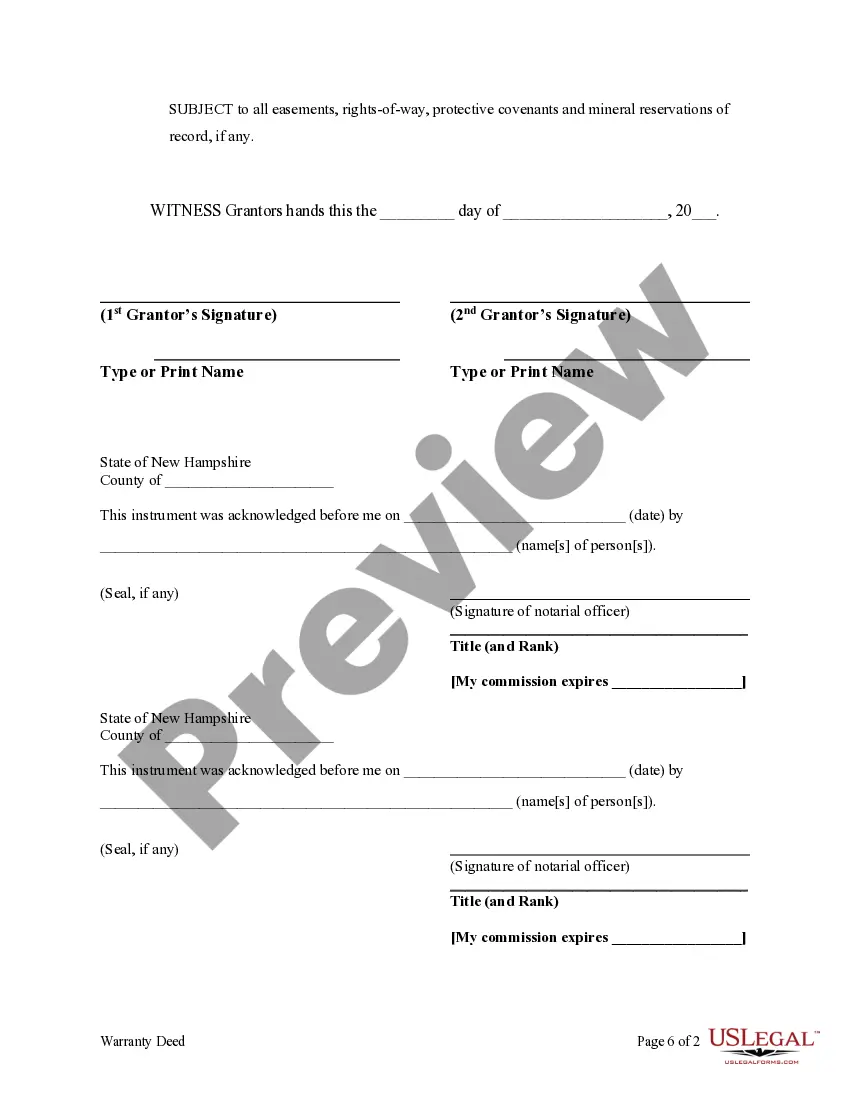

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you have signed up and purchased your subscription, you can utilize your New Hampshire Warranty Deed for Separate or Joint Property to Joint Tenancy as often as you need or for as long as it stays valid in your state. Change it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Deed Joint Property Form popularity

New Hampshire Tenancy Other Form Names

Nh Warranty Property FAQ

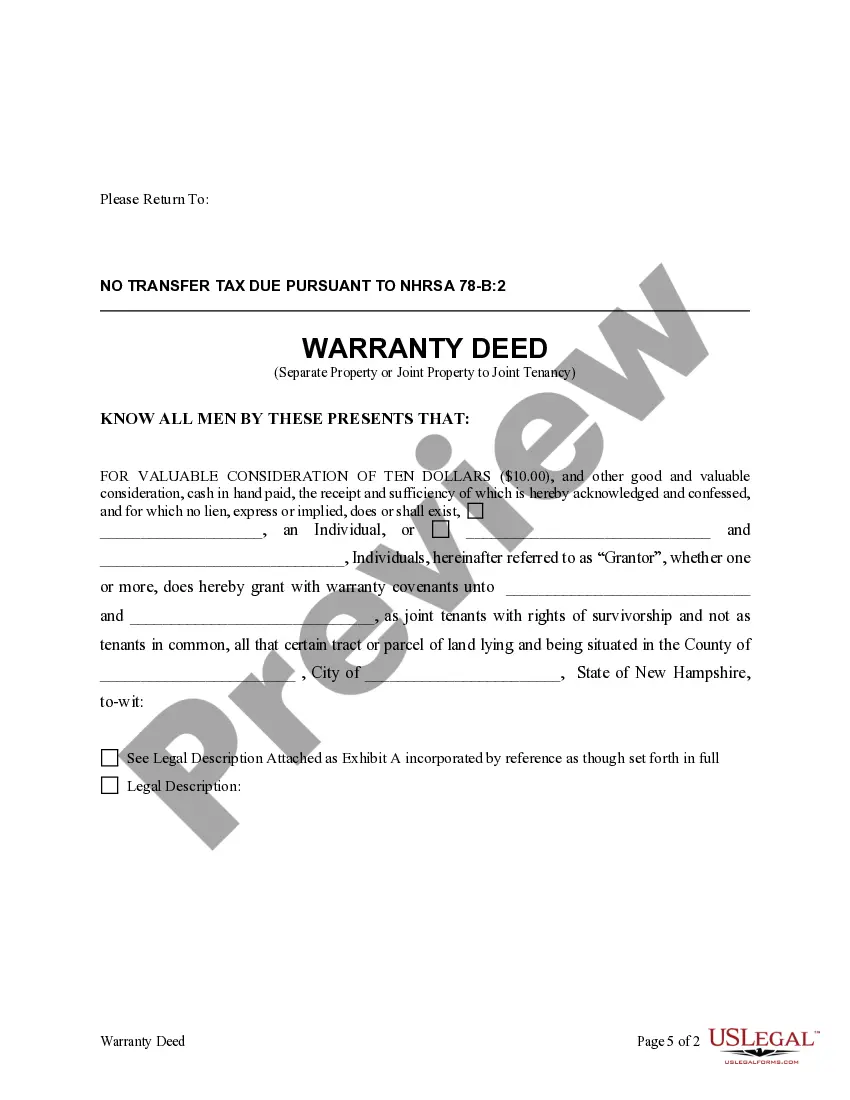

Key Takeaways. A property deed is a legal document that transfers the ownership of real estate from a seller to a buyer.General warranty deeds give the grantee the most protection, special warranty deeds give the grantee more limited protection, and a quitclaim deed gives the grantee the least protection under the law

In title law, when we talk about tenants, we're talking about people who own property.When joint tenants have right of survivorship, it means that the property shares of one co-tenant are transferred directly to the surviving co-tenant (or co-tenants) upon their death.

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

Survivorship rights take precedence over any contrary terms in a person's will because property subject to rights of survivorship is not legally part of their estate at death and so cannot be distributed through a will.

With a Survivorship Deed in place, when one of the parties in a joint tenancy dies, the other party (or parties) takes over the deceased party's interest in the property instead of it passing to the deceased's heirs or beneficiaries.

A joint tenant can indeed sever the right of survivorship WITHOUT the consent of the other joint tenants.In order to sever the right of survivorship, a tenant must only record a new deed showing that his or her interest in the title is now held in a Tenancy-in-Common or as Community Property.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating