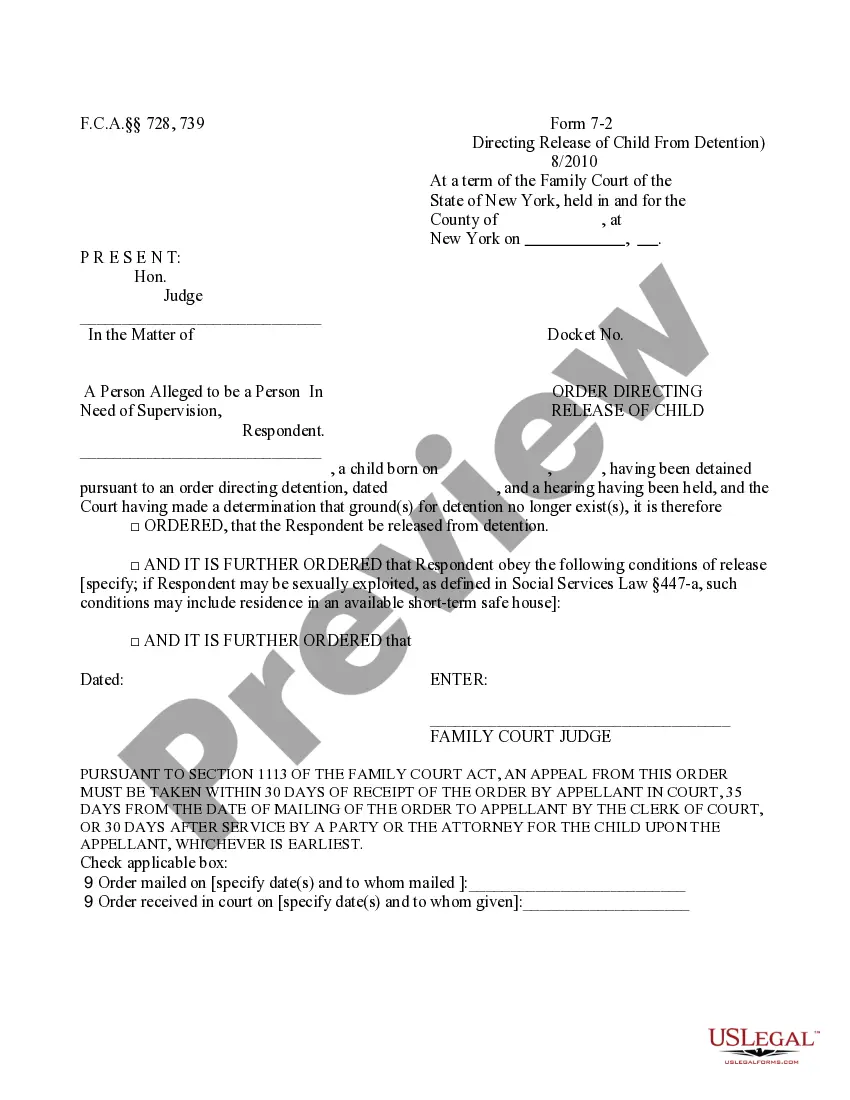

New Hampshire Form C-1 is a form used by corporations in the state of New Hampshire to convert their corporate status from a corporation to a limited liability company (LLC). The form is used to document the conversion and is filed with the New Hampshire Secretary of State. There are two types of New Hampshire Form C-1: a Certificate of Conversion and a Certificate of Continuance. The Certificate of Conversion is used when the corporation is converting to an LLC without any changes to the corporate structure, while the Certificate of Continuance is used when changes to the corporate structure are being made. Both documents, along with the required filing fee and other documents, must be filed with the New Hampshire Secretary of State in order for the conversion to be completed.

New Hampshire Form C-1 NH Corporation to a NH Limited Liability Company

Description

How to fill out New Hampshire Form C-1 NH Corporation To A NH Limited Liability Company?

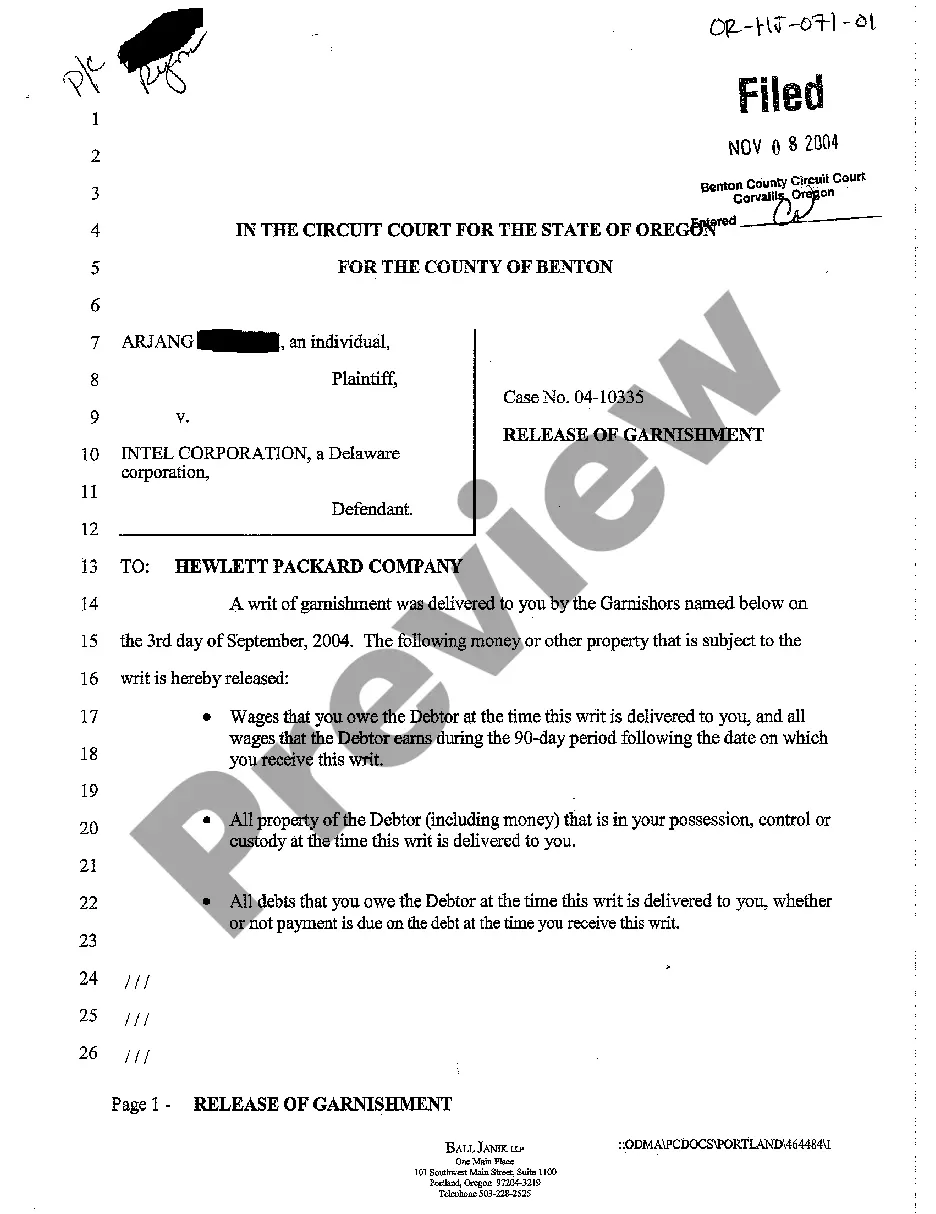

US Legal Forms is the most simple and affordable way to locate appropriate legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with national and local laws - just like your New Hampshire Form C-1 NH Corporation to a NH Limited Liability Company.

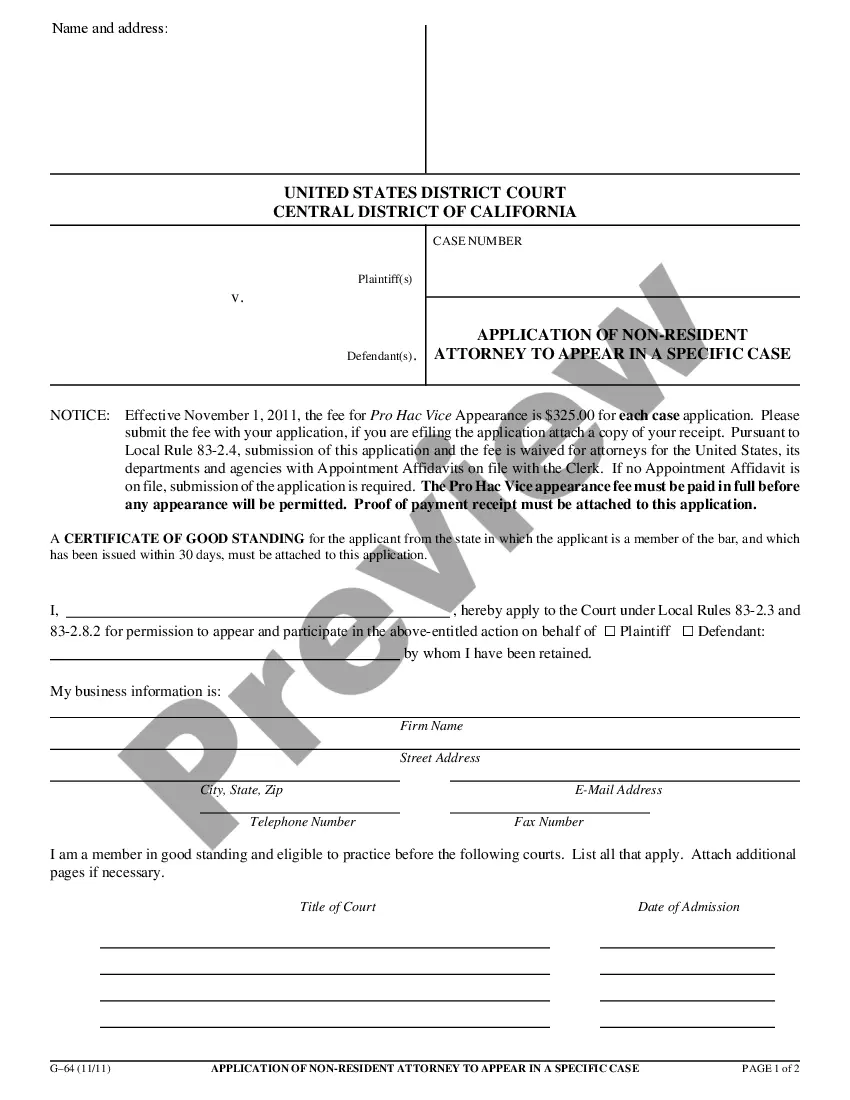

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New Hampshire Form C-1 NH Corporation to a NH Limited Liability Company if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one corresponding to your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your New Hampshire Form C-1 NH Corporation to a NH Limited Liability Company and save it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your reliable assistant in obtaining the corresponding formal documentation. Try it out!

Form popularity

FAQ

Not in Good Standing ? Entity that owes reports and/or fees and/or agent has resigned.

Reinstatement / Revival for Limited Liability Companies: If the LLC was administratively dissolved within 120 days, the entity will request a reinstatement form from the New Hampshire Secretary of State. The entity will file the reinstatement form and all missed annual reports with the Secretary of State.

Only business entities that are active can have a good standing status, so a business that has been voluntarily terminated will also show ?not in good standing? because it is no longer active. The status can be returned to Good Standing by addressing the manner in which the business is out of compliance.

How do you dissolve a New Hampshire Corporation? To dissolve your New Hampshire Corporation, you file Articles of Dissolution by Board of Directors and Shareholders with the New Hampshire Department of State (DOS).

Step 1: Your entity needs to file Articles of Domestication accompanied by Articles of Incorporation (Organization) and Statement of Compilance with New Hampshire Department of State. Step 2: Your entity is then dissolved in the home state (or ?domesticated out?, depending on the state).

How much does it cost to open an LLC in New Hampshire? It costs $100 to file for a New Hampshire LLC. If you file the form online, there is an additional $2 service fee charged with the $100.

Yes. New Hampshire state law (Section 293-A:15.07) requires business entities to maintain a registered agent who resides in the state. If you do not appoint a New Hampshire registered agent, you cannot legally conduct business in the state.

Filing your Certificate of Formation has a fee of $100. You can submit the certificate through the mail or in person, or you can do it online through NH QuickStart, though you'll need to add $2 for online filings. Once your certificate is processed, your New Hampshire LLC is officially formed.