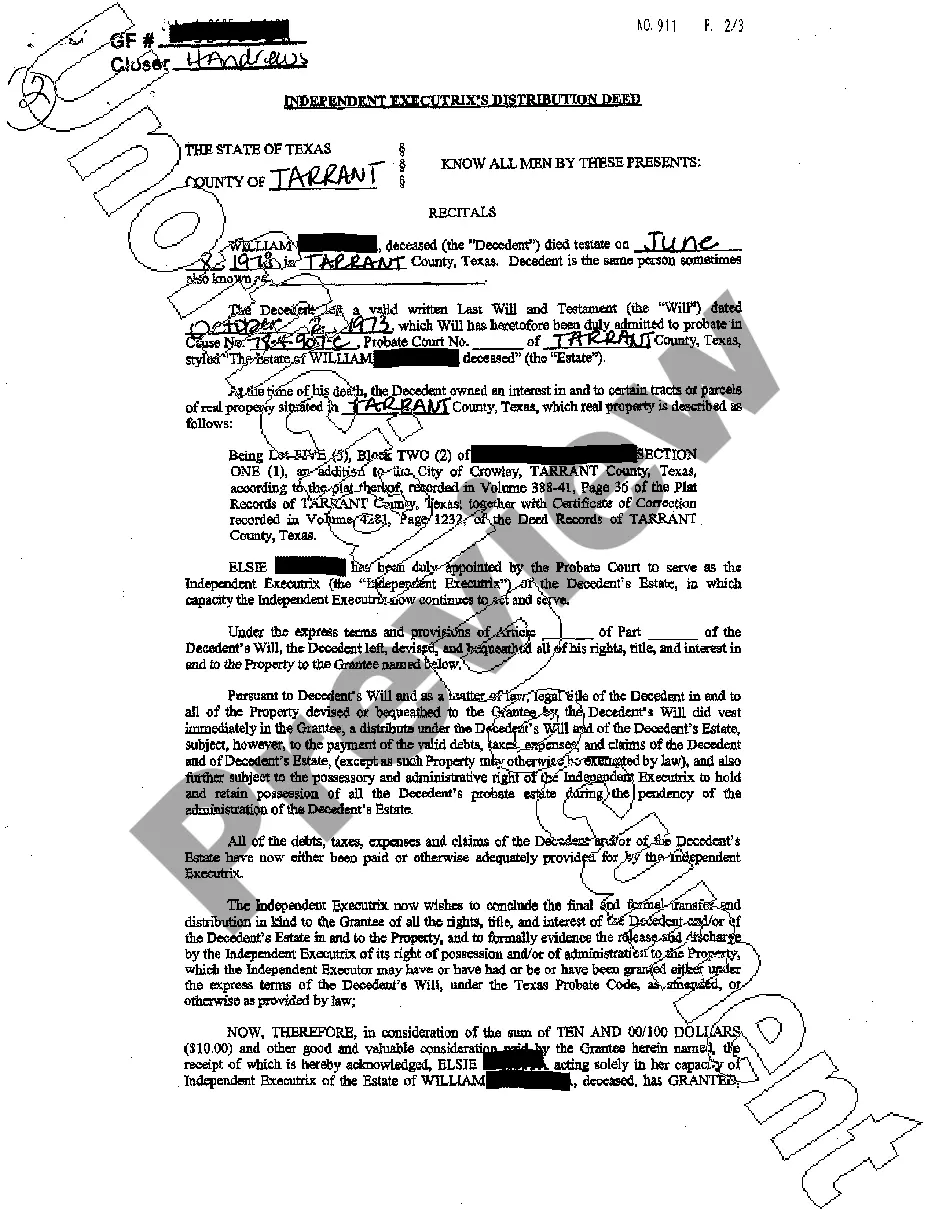

New Hampshire Form FNP-3 Foreign Nonprofit Amendment is a document used to register foreign nonprofit entities in the state of New Hampshire. It is used to update information on a foreign nonprofit corporation's registration and to maintain its corporate status in New Hampshire. This form must be completed and signed by a director or officer of the foreign nonprofit entity and filed with the New Hampshire Secretary of State. There are two types of New Hampshire Form FNP-3 Foreign Nonprofit Amendment: Amendment of Registered Agent and Amendment of Name. The Amendment of Registered Agent changes the name and/or address of the registered agent for service of process. The Amendment of Name changes the name of the foreign nonprofit entity. Both amendments must be accompanied by the appropriate filing fee.

New Hampshire Form FNP-3 Foreign Nonprofit Amendment

Description

How to fill out New Hampshire Form FNP-3 Foreign Nonprofit Amendment?

How much time and resources do you typically spend on composing formal documentation? There’s a better way to get such forms than hiring legal specialists or spending hours browsing the web for a proper template. US Legal Forms is the premier online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the New Hampshire Form FNP-3 Foreign Nonprofit Amendment.

To get and complete a suitable New Hampshire Form FNP-3 Foreign Nonprofit Amendment template, adhere to these simple steps:

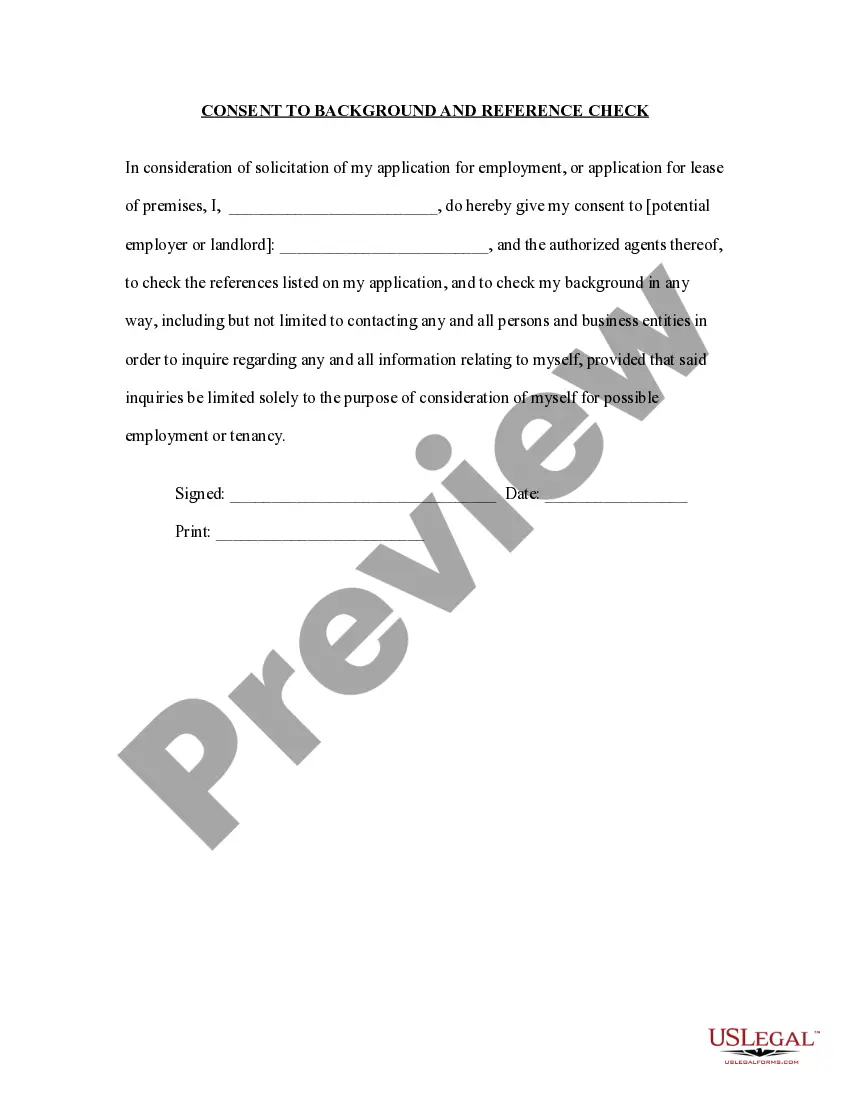

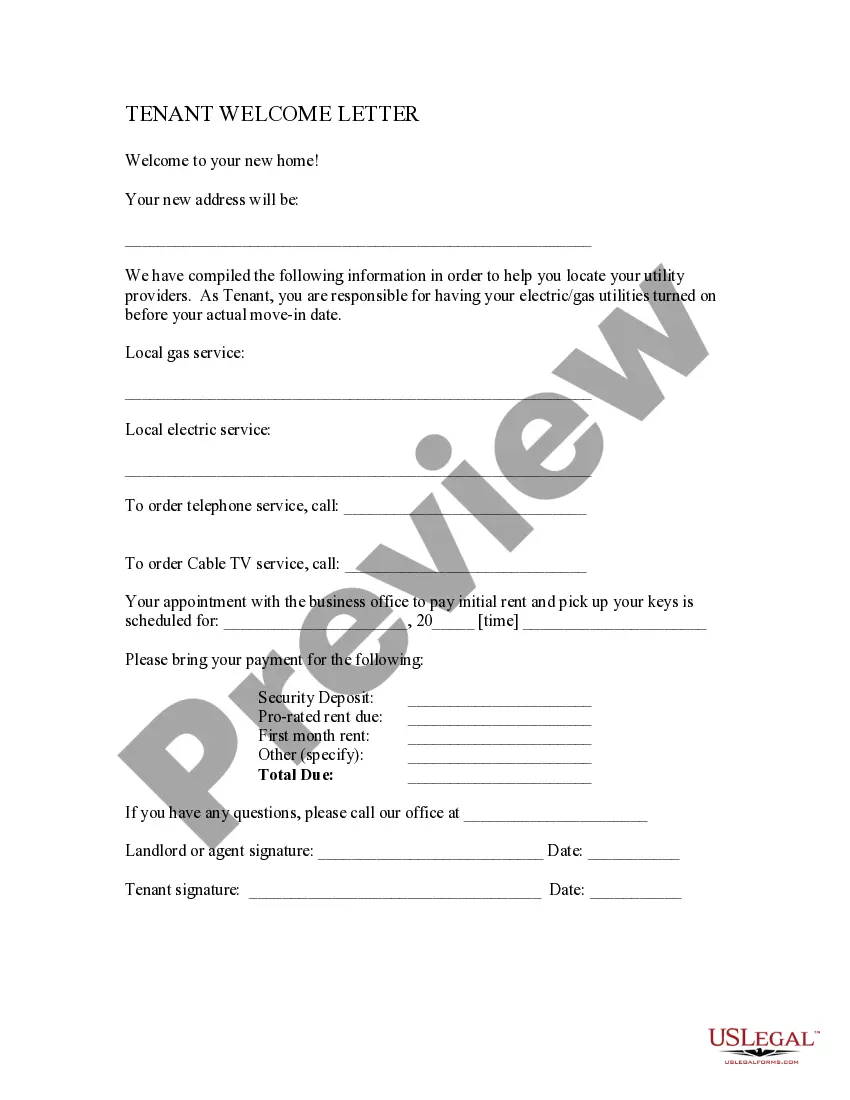

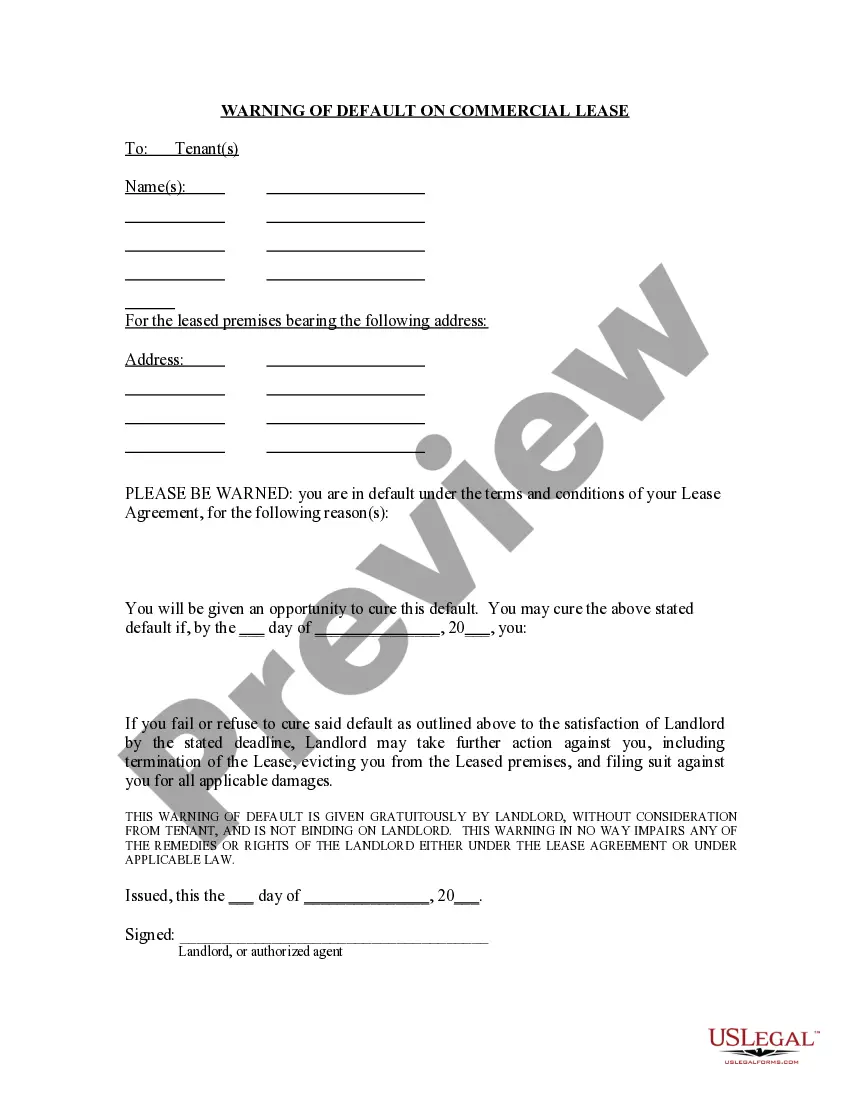

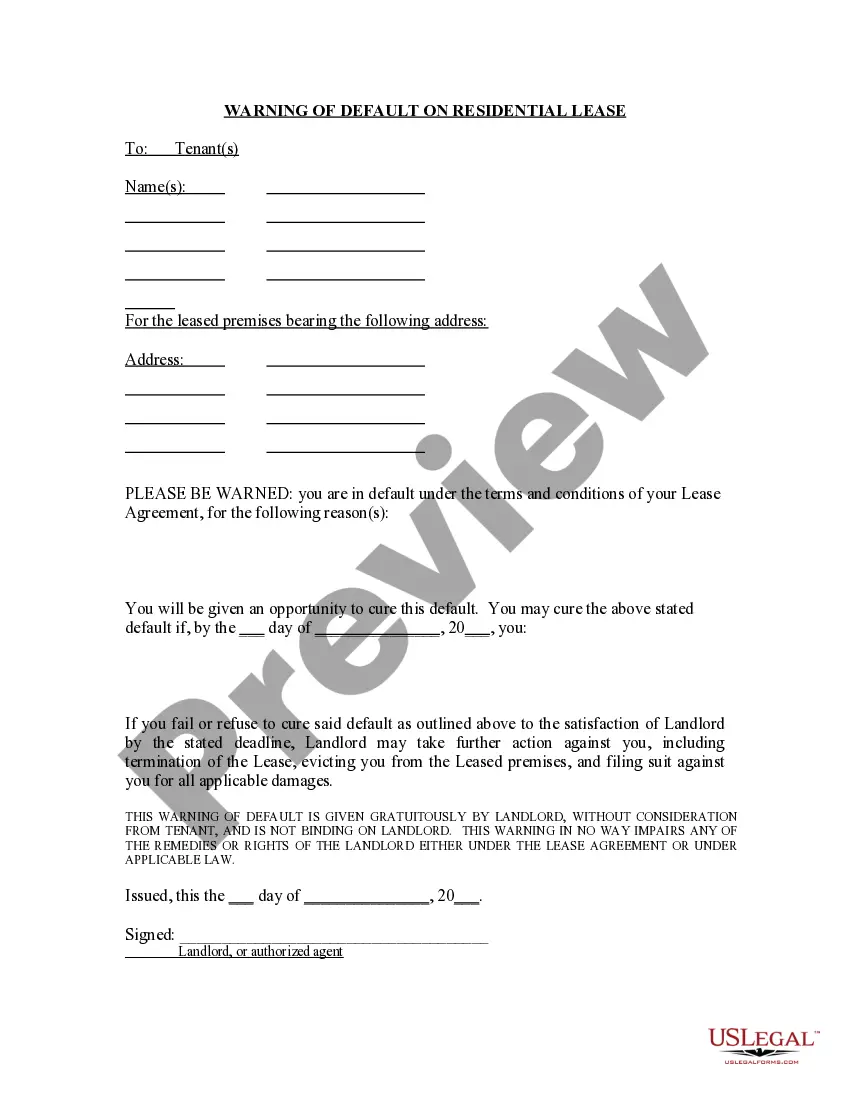

- Examine the form content to ensure it meets your state regulations. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, locate another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the New Hampshire Form FNP-3 Foreign Nonprofit Amendment. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely safe for that.

- Download your New Hampshire Form FNP-3 Foreign Nonprofit Amendment on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

To withdraw/cancel your foreign New Hampshire Corporation, file an Application for Certificate of Withdrawal with the Department of State by mail or in person. Type or print on the form in black ink. Submit the signed, dated original cancellation/withdrawal form, the tax clearance certificate, and the fee.

profit organization is a group organized for purposes other than generating profit and in which no part of the organization's income is distributed to its members, directors, or officers.

To register a foreign corporation in New Hampshire, you must file a New Hampshire Application for Certificate of Authority with the New Hampshire Department of State, Corporation Division. You can submit this document online, by mail, or in person.

To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application. The application must be submitted electronically on Pay.gov and must, including the appropriate user fee.

The steps that go into starting a 501(c)(3) include choosing a name for your nonprofit, writing your purpose statement and bylaws, recruiting and establishing a board of directors, filing your articles of incorporation, applying for federal tax-exempt status as a 501(c)(3) and filing for state recognition of tax

To register your foreign LLC in New Hampshire, you'll have to complete the state's Application for Foreign Limited Liability Company Registration and file it with the New Hampshire's DOS. On this form, you'll include: The name of your LLC. The name under which your LLC will do business in New Hampshire.

How to Start a Nonprofit in New Hampshire Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.

Nonprofit institutions are exempt from paying property taxes, but many New Hampshire cities and towns are now asking nonprofits to pay for municipal services through so-called PILOT agreements.