New Hampshire Taxation of Costs is a system of taxation that is used to recover costs incurred by the state in providing public services or other activities. This type of taxation is typically imposed on businesses through a variety of taxes, including the Business Profits Tax, Business Enterprise Tax, Interest and Dividends Tax, and Real Estate Transfer Tax. There are also taxes imposed on individuals, such as the Interest and Dividends Tax, and the Real Estate Transfer Tax. New Hampshire Taxation of Costs is divided into two types: direct and indirect. Direct taxes are taxes imposed on businesses and individuals, such as the Business Profits Tax, Business Enterprise Tax, Interest and Dividends Tax, and Real Estate Transfer Tax. Indirect taxes are those that are imposed on goods and services, such as the Meals and Rooms Tax, the Motor Vehicle Registration Tax, and the Liquor Tax. The New Hampshire Taxation of Costs is designed to provide the state with revenue to pay for public services, such as public education, public safety, and infrastructure. The revenue generated by this taxation system is also used to fund other government activities, such as economic development and environmental protection.

New Hampshire Taxation of Costs

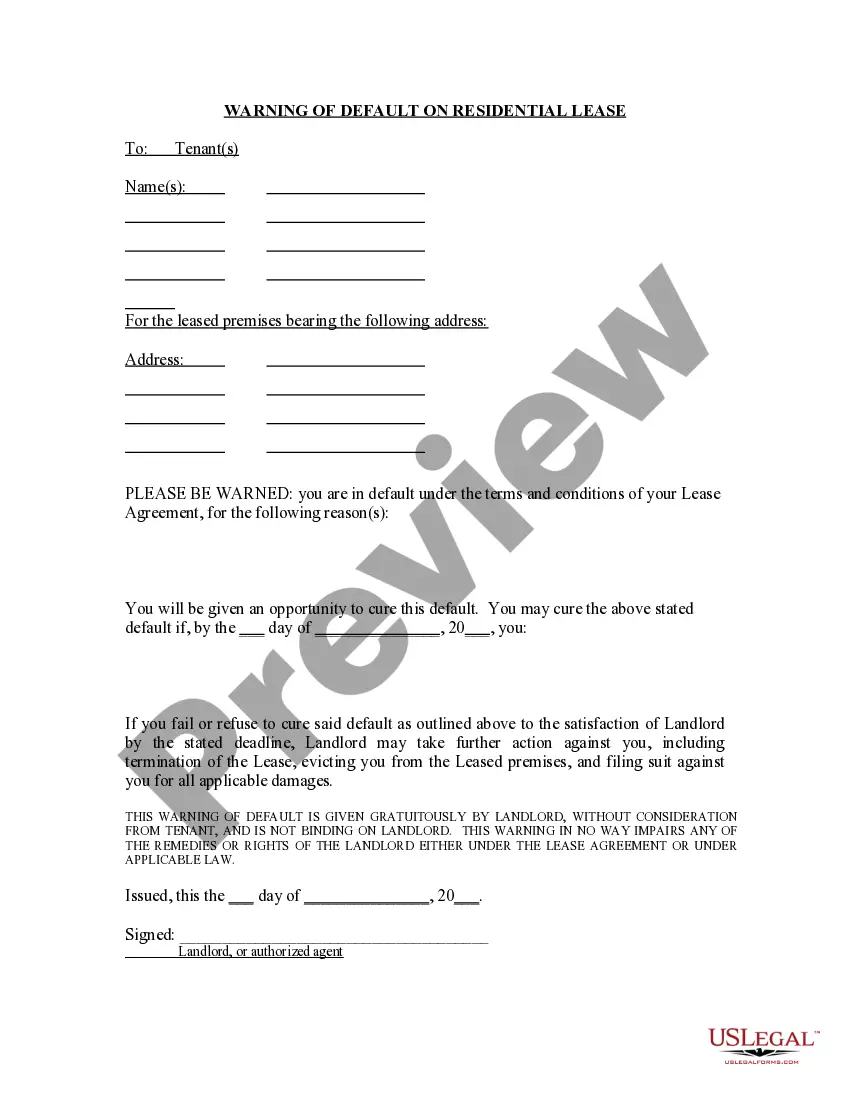

Description

How to fill out New Hampshire Taxation Of Costs?

How much time and resources do you usually spend on composing official paperwork? There’s a better way to get such forms than hiring legal specialists or spending hours browsing the web for a suitable template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, including the New Hampshire Taxation of Costs.

To get and complete a suitable New Hampshire Taxation of Costs template, adhere to these simple steps:

- Look through the form content to ensure it complies with your state laws. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the New Hampshire Taxation of Costs. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely secure for that.

- Download your New Hampshire Taxation of Costs on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!