This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

New Hampshire Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

You can easily obtain or create the New Hampshire Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage from our service.

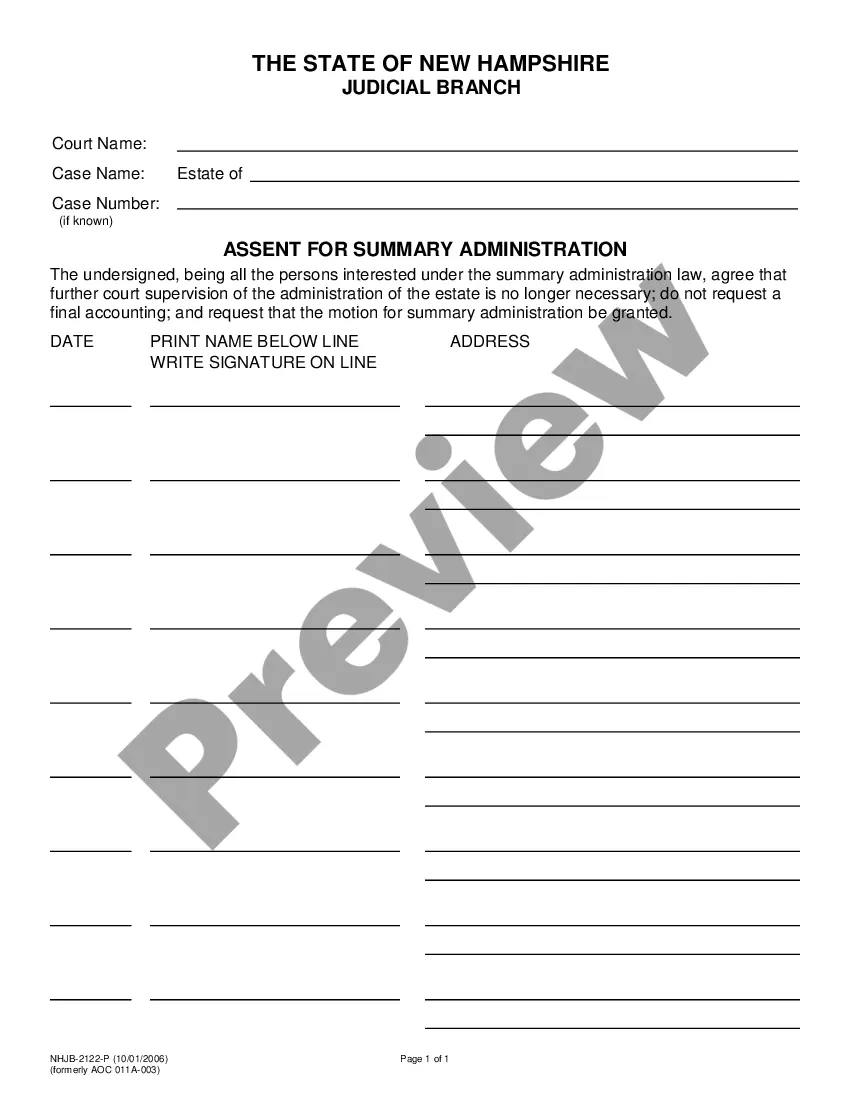

If available, use the Preview option to view the document template as well.

- If you have a US Legal Forms account, you can Log In and then click the Acquire button.

- Afterwards, you can complete, edit, print, or sign the New Hampshire Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage.

- Every legal document template you purchase is yours for an extended period.

- To obtain another copy of the purchased form, visit the My documents section and click the relevant option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form details to confirm that you have chosen the appropriate template.

Form popularity

FAQ

No, the New Hampshire Insurance Company operates as a separate entity and is not part of AIG. While both have a strong presence in the insurance market, they maintain distinct operations. If you need to understand how this relates to a New Hampshire Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, consider reaching out to uslegalforms for assistance. They can help clarify any questions you may have about your insurance coverage.

To complain about insurance in New Hampshire, you should first contact your insurance company directly to resolve the issue. If that does not yield results, you can file a complaint with the New Hampshire Department of Insurance. Filing a New Hampshire Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage may also be appropriate if you believe your policy is being improperly handled. Utilizing platforms like uslegalforms can simplify the process, guiding you through the necessary steps.

The insurance commissioner of New Hampshire oversees the insurance industry within the state, ensuring regulations are followed. As of October 2023, the commissioner is Christopher Nicolopoulos. If you have concerns regarding your policy or need assistance with a New Hampshire Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, the commissioner's office can provide guidance and resources.

In New Hampshire, the statute of limitations for filing a claim under the Consumer Protection Act is three years. This period begins when you become aware of the unfair or deceptive act. If you are considering a New Hampshire Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, be mindful of this timeline. Taking timely action can help you secure your rights.

Declaratory judgment actions are an exception to this rule and permit a party to seek a court judgment that defines the parties' rights before an injury occurs. A declaratory judgment differs from other judgments because it does not provide for any enforcement or order a party to take any action or pay damages.

A plaintiff seeking declaratory relief must show that there is an actual controversy even though declaratory relief will not order enforceable action against the defendant. An actual controversy means there is a connection between the challenged conduct and injury, and redressability that the court could order.

The declaratory judgment would clarify the parties' rights and obligations under the insurance policy. It could guide future actions related to the claim.

Rule 11. (a) A request for court order must be made by motion which must (1) be in writing unless made during a hearing or trial, (2) state with particularity the grounds for seeking the order, and (3) state the relief sought.

So what is a "declaratory judgment" lawsuit? This answer is this: It's a lawsuit that a plaintiff files in which the plaintiff asks the court to "declare" through issuance of a "declaratory judgment" what the respective rights of the parties are.

Rule 19 contemplates the transfer of whole cases, or of particular proceedings in cases, even in the absence of a related pending case or proceeding in the county to which transfer is sought.