US Legal Forms - one of the greatest libraries of legitimate kinds in the USA - gives a wide range of legitimate file templates you may acquire or produce. Using the website, you will get 1000s of kinds for organization and specific reasons, sorted by categories, claims, or keywords.You will discover the latest versions of kinds such as the New Hampshire Participating or Participation Loan Agreement in Connection with Secured Loan Agreement within minutes.

If you already have a subscription, log in and acquire New Hampshire Participating or Participation Loan Agreement in Connection with Secured Loan Agreement from the US Legal Forms catalogue. The Down load switch will show up on each and every develop you see. You get access to all previously saved kinds in the My Forms tab of your own profile.

If you want to use US Legal Forms initially, allow me to share easy recommendations to help you started out:

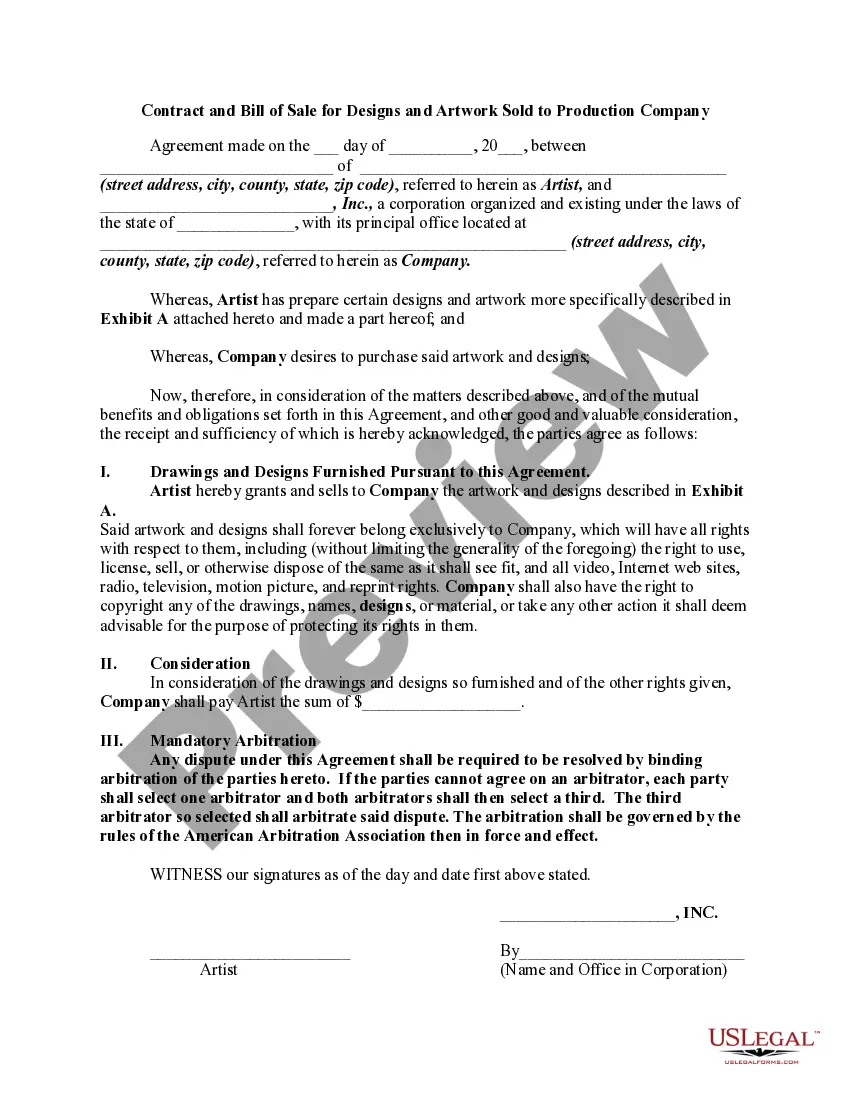

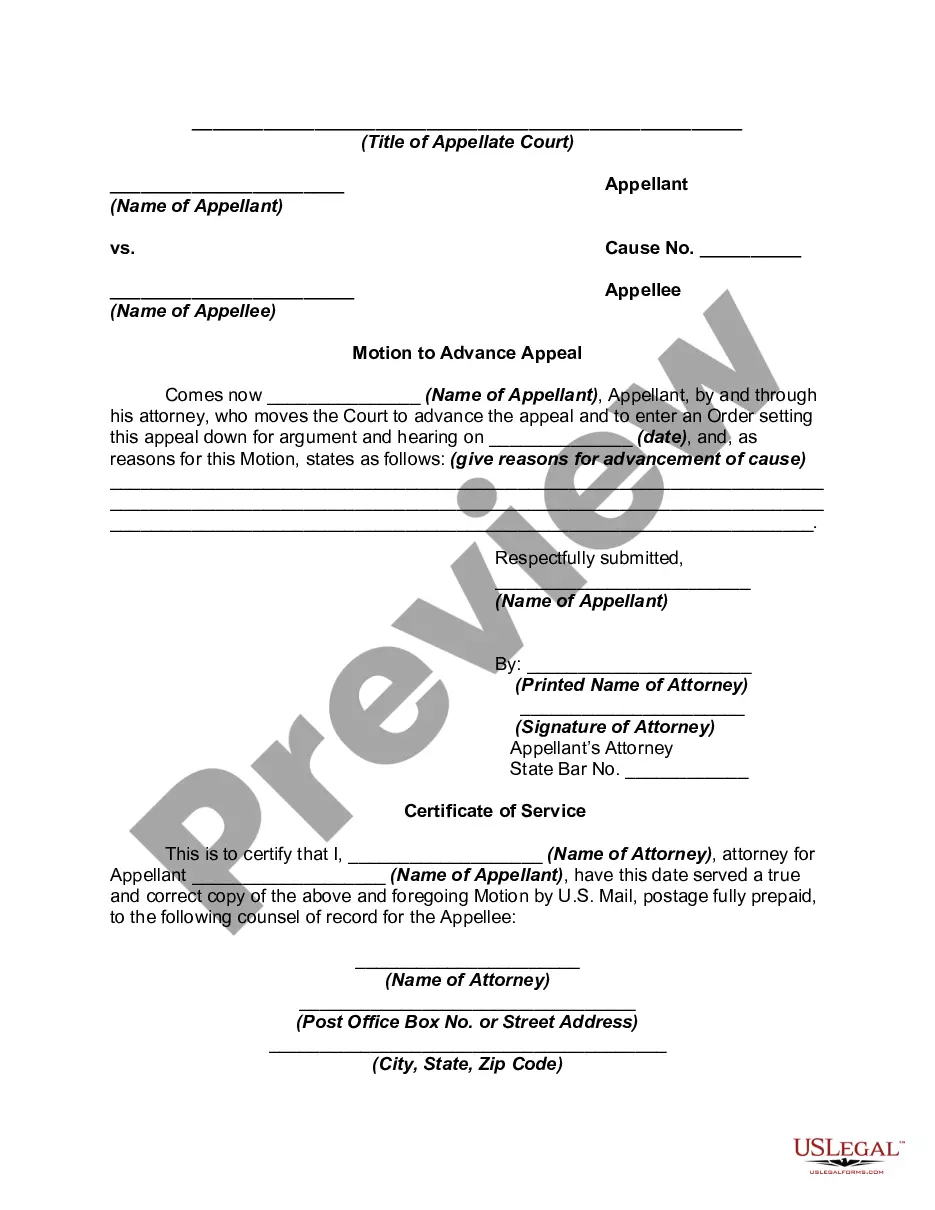

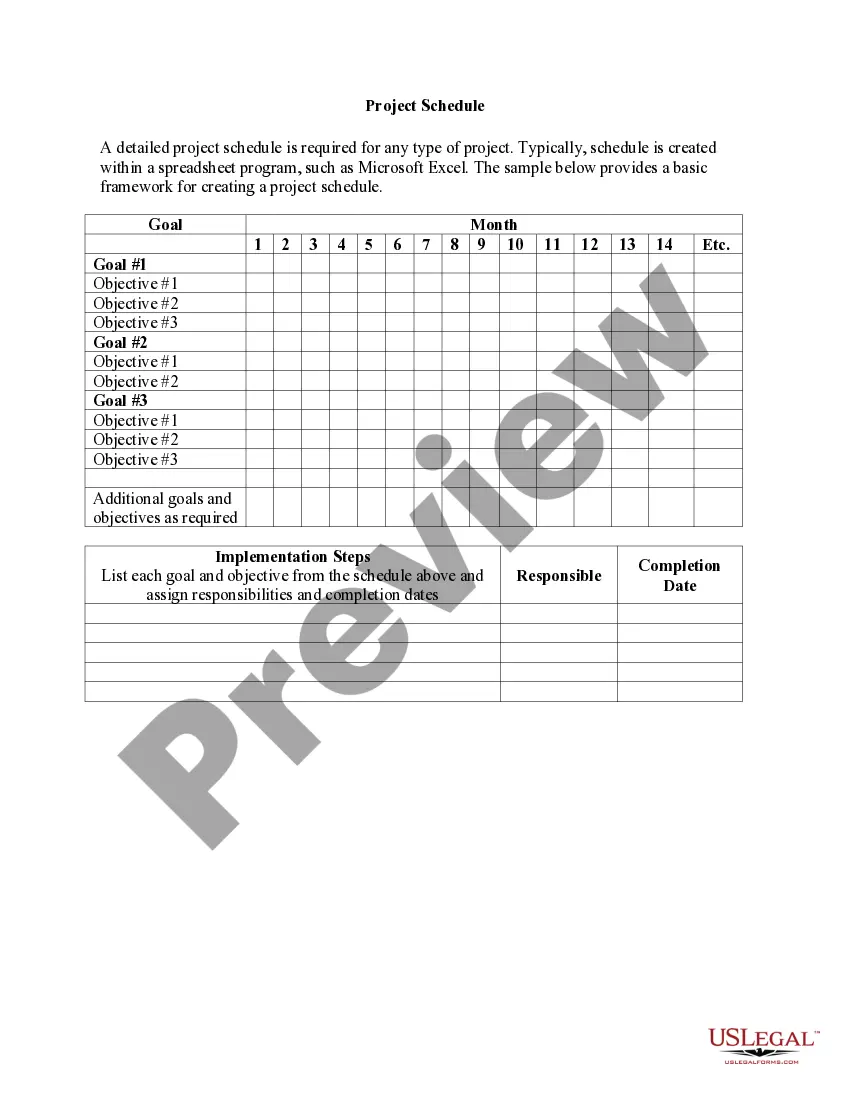

- Be sure to have picked out the best develop for the metropolis/area. Select the Review switch to analyze the form`s content. See the develop outline to ensure that you have selected the appropriate develop.

- In case the develop does not suit your requirements, utilize the Research area towards the top of the display to obtain the one who does.

- Should you be pleased with the form, verify your selection by clicking the Acquire now switch. Then, opt for the pricing plan you want and give your references to sign up for the profile.

- Procedure the transaction. Make use of your bank card or PayPal profile to complete the transaction.

- Find the format and acquire the form on the gadget.

- Make alterations. Load, edit and produce and signal the saved New Hampshire Participating or Participation Loan Agreement in Connection with Secured Loan Agreement.

Each format you included with your account lacks an expiry particular date which is your own property forever. So, in order to acquire or produce another duplicate, just proceed to the My Forms area and click on on the develop you require.

Gain access to the New Hampshire Participating or Participation Loan Agreement in Connection with Secured Loan Agreement with US Legal Forms, the most considerable catalogue of legitimate file templates. Use 1000s of professional and status-particular templates that meet up with your organization or specific requires and requirements.