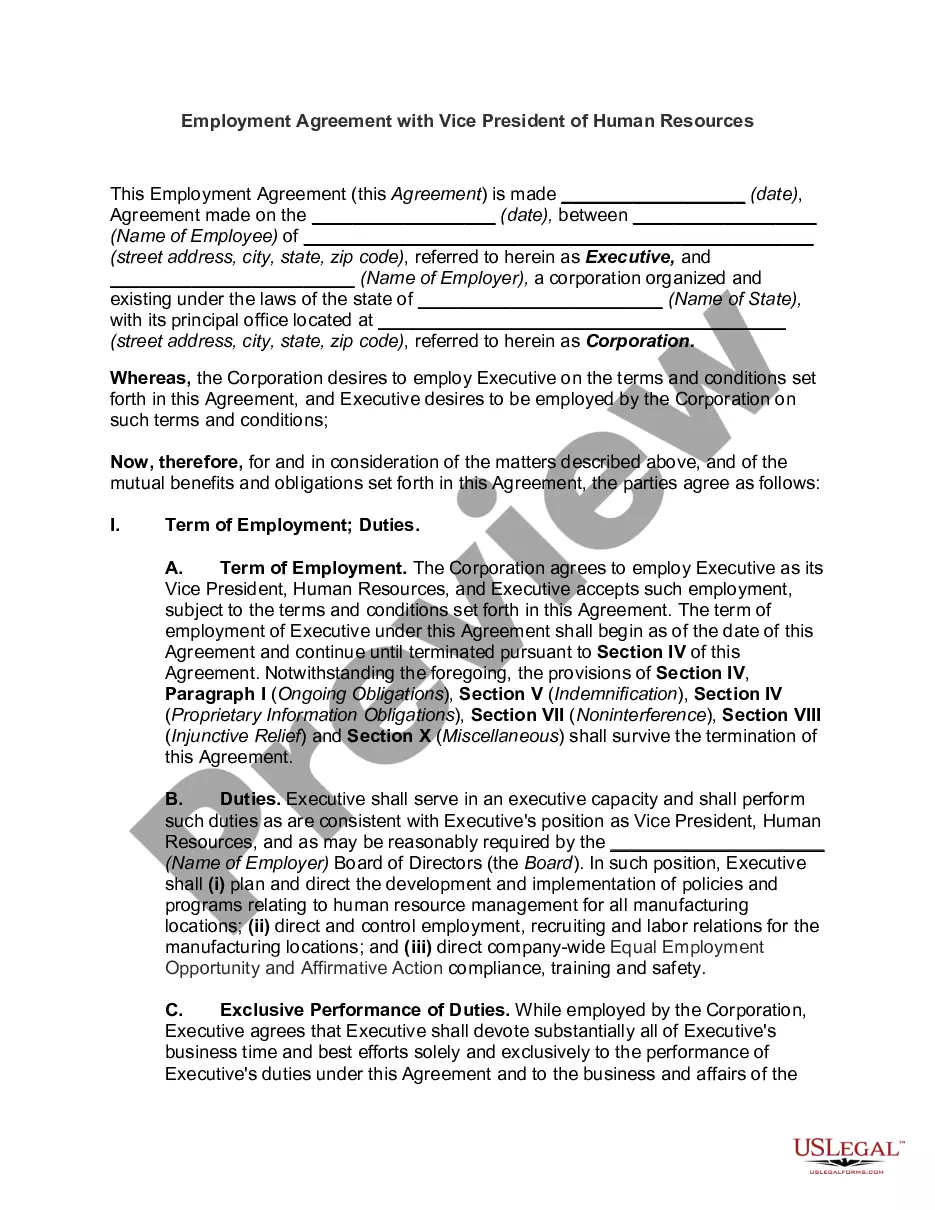

This form is a sample letter in Word format covering the subject matter of the title of the form.

Title: A Comprehensive Guide to New Hampshire Sample Letters for Payoff of Loan Held by Mortgage Companies Introduction: New Hampshire homeowners seeking to pay off their loans held by mortgage companies may require a sample letter to streamline the process. This article offers a detailed description of what a New Hampshire sample letter for payoff of a loan held by a mortgage company entails, along with some different types of such letters. 1. Importance of a Payoff Letter: A payoff letter serves as a formal request to the mortgage company, providing essential information and instructions to complete the loan repayment process. It ensures clarity and helps avoid any future disputes or confusion. 2. Common Content in a New Hampshire Sample Letter: a. Borrower's Information: Include the borrower's full name, contact details, and mortgage account number. b. Mortgage Company Details: Mention the mortgage company's name, mailing address, and contact information. c. Loan Information: Specify the loan amount, loan number, and the date the loan was originated. d. Request for Payoff Amount: Clearly state the intention to pay off the loan and request an exact payoff amount as of a specific date. e. Payment Instructions: Provide instructions for the mortgage company to process the payoff, including modes of payment (e.g., certified check, wire transfer) and any specific requirements. f. Account Verification: Request a written confirmation that the loan has been paid in full, mentioning the account details and a statement of release of mortgage lien. 3. New Hampshire Sample Letter Types: a. Standard Payoff Request Letter: This is a general letter format suitable for most loan payoffs, intended to convey the borrower's intent to pay off the loan promptly. b. Printable Payoff Request Letter: Some borrowers prefer a printable format for convenience, allowing them to print, sign, and mail the letter to the mortgage company. c. Email Request Letter: With the prevalence of digital communication, an email request letter can serve as a quick and efficient way to request a payoff amount and instructions. d. Notarized Payoff Letter: Occasionally, mortgage companies may require a notarized letter to provide an additional layer of authenticity and prevent fraudulent payoffs. This type of letter should be signed in the presence of a notary public. Conclusion: When it comes to paying off a loan held by a mortgage company in New Hampshire, a well-crafted sample letter ensures clear communication and helps streamline the process. Whether via a standard letter, printable format, email, or notarized letter, it is crucial to provide necessary borrower and loan information, request a payoff amount, and specify payment instructions. Remember to request written confirmation of the loan's full payment and the release of the mortgage lien. Keywords: New Hampshire, sample letter, payoff of loan, mortgage company, borrower's information, mortgage company details, loan information, payment instructions, account verification, standard payoff request letter, printable payoff request letter, email request letter, notarized payoff letter.Title: A Comprehensive Guide to New Hampshire Sample Letters for Payoff of Loan Held by Mortgage Companies Introduction: New Hampshire homeowners seeking to pay off their loans held by mortgage companies may require a sample letter to streamline the process. This article offers a detailed description of what a New Hampshire sample letter for payoff of a loan held by a mortgage company entails, along with some different types of such letters. 1. Importance of a Payoff Letter: A payoff letter serves as a formal request to the mortgage company, providing essential information and instructions to complete the loan repayment process. It ensures clarity and helps avoid any future disputes or confusion. 2. Common Content in a New Hampshire Sample Letter: a. Borrower's Information: Include the borrower's full name, contact details, and mortgage account number. b. Mortgage Company Details: Mention the mortgage company's name, mailing address, and contact information. c. Loan Information: Specify the loan amount, loan number, and the date the loan was originated. d. Request for Payoff Amount: Clearly state the intention to pay off the loan and request an exact payoff amount as of a specific date. e. Payment Instructions: Provide instructions for the mortgage company to process the payoff, including modes of payment (e.g., certified check, wire transfer) and any specific requirements. f. Account Verification: Request a written confirmation that the loan has been paid in full, mentioning the account details and a statement of release of mortgage lien. 3. New Hampshire Sample Letter Types: a. Standard Payoff Request Letter: This is a general letter format suitable for most loan payoffs, intended to convey the borrower's intent to pay off the loan promptly. b. Printable Payoff Request Letter: Some borrowers prefer a printable format for convenience, allowing them to print, sign, and mail the letter to the mortgage company. c. Email Request Letter: With the prevalence of digital communication, an email request letter can serve as a quick and efficient way to request a payoff amount and instructions. d. Notarized Payoff Letter: Occasionally, mortgage companies may require a notarized letter to provide an additional layer of authenticity and prevent fraudulent payoffs. This type of letter should be signed in the presence of a notary public. Conclusion: When it comes to paying off a loan held by a mortgage company in New Hampshire, a well-crafted sample letter ensures clear communication and helps streamline the process. Whether via a standard letter, printable format, email, or notarized letter, it is crucial to provide necessary borrower and loan information, request a payoff amount, and specify payment instructions. Remember to request written confirmation of the loan's full payment and the release of the mortgage lien. Keywords: New Hampshire, sample letter, payoff of loan, mortgage company, borrower's information, mortgage company details, loan information, payment instructions, account verification, standard payoff request letter, printable payoff request letter, email request letter, notarized payoff letter.