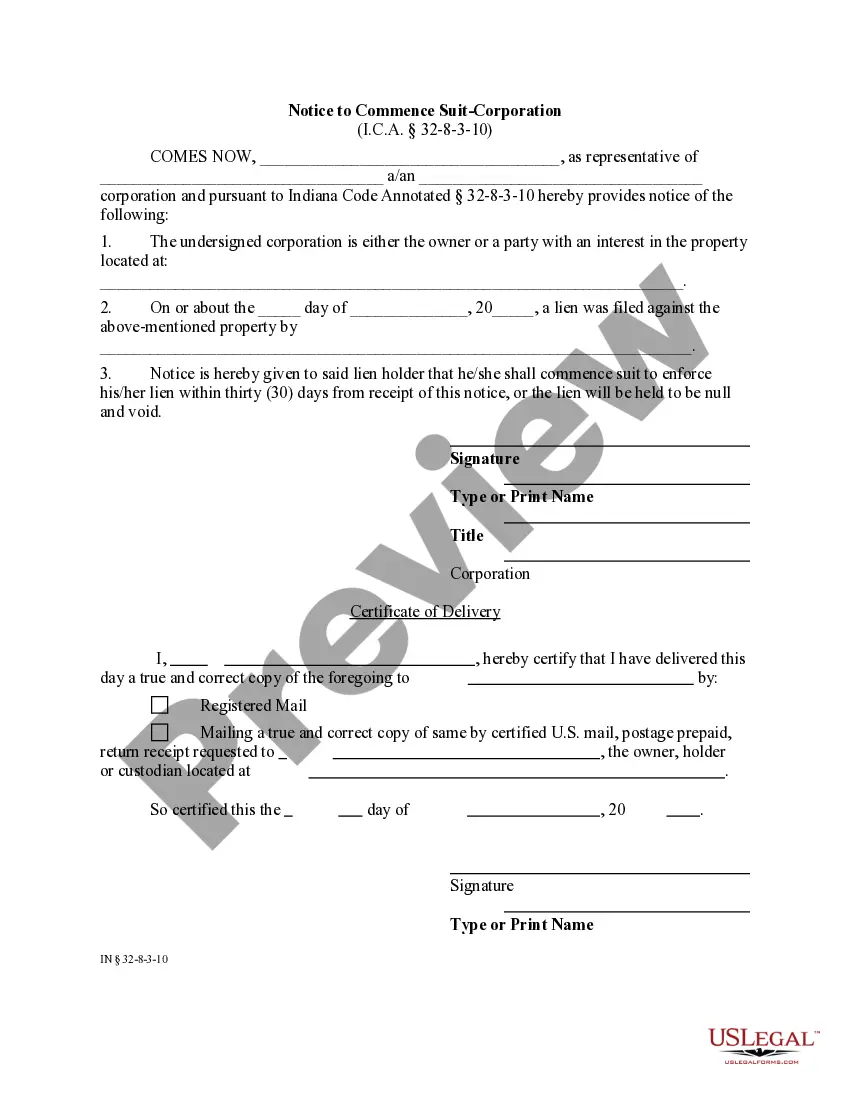

This form is a sample letter in Word format covering the subject matter of the title of the form.

New Hampshire Sample Letter to Bank concerning Accounts of Decedent

Description

How to fill out Sample Letter To Bank Concerning Accounts Of Decedent?

Choosing the best authorized record format could be a have difficulties. Obviously, there are a lot of themes available on the net, but how do you discover the authorized kind you want? Make use of the US Legal Forms web site. The support offers a huge number of themes, including the New Hampshire Sample Letter to Bank concerning Accounts of Decedent, which you can use for company and private needs. Every one of the forms are checked by experts and satisfy state and federal needs.

In case you are previously listed, log in to your bank account and click on the Acquire button to obtain the New Hampshire Sample Letter to Bank concerning Accounts of Decedent. Make use of your bank account to look from the authorized forms you possess bought earlier. Visit the My Forms tab of your own bank account and acquire one more duplicate from the record you want.

In case you are a fresh customer of US Legal Forms, here are easy directions that you should adhere to:

- Very first, make certain you have selected the appropriate kind for your metropolis/region. You may examine the form making use of the Preview button and read the form information to make sure this is the right one for you.

- In case the kind fails to satisfy your needs, use the Seach industry to find the appropriate kind.

- When you are certain that the form is suitable, click on the Purchase now button to obtain the kind.

- Opt for the costs plan you want and enter the necessary information and facts. Create your bank account and purchase the transaction with your PayPal bank account or charge card.

- Opt for the document file format and download the authorized record format to your gadget.

- Total, edit and print and indication the obtained New Hampshire Sample Letter to Bank concerning Accounts of Decedent.

US Legal Forms is definitely the greatest library of authorized forms in which you can discover different record themes. Make use of the service to download skillfully-manufactured papers that adhere to express needs.

Form popularity

FAQ

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

After a person dies, the state supervises the administration of his or her estate in a process called probate. New Hampshire does not require every estate to go through probate. Review the state's probate rules to inform your estate plans and ensure your executor can carry out your wishes as intended.

For decedent's estates, probate court can usually be avoided by creating a revocable trust as a new legal entity and transferring all your assets to the trust. The trust would name who would conduct the trust's affairs as trustee, and who would be the beneficiaries.

Even if there are no assets, but there is a will, you must file the will, any codicils (amendments), and a death certificate with the Probate Court within thirty (30) days of the date of death.

The probate process After receiving permission, called ?Letters Testamentary? in New Hampshire, the executor has 90 days to file an inventory of estate assets with the court. He or she will pay any outstanding creditors and taxes of your estate before distributing property to your heirs ing to your wishes.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

You may be able to avoid probate in New Hampshire by: Making a Revocable Living Trust. Titling property: Joint Tenancy.

If you are unmarried and die without a valid will and last testament in New Hampshire, then your estate passes on to your children in equal shares. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.