New Hampshire Employment Application for Taxi Driver

Description

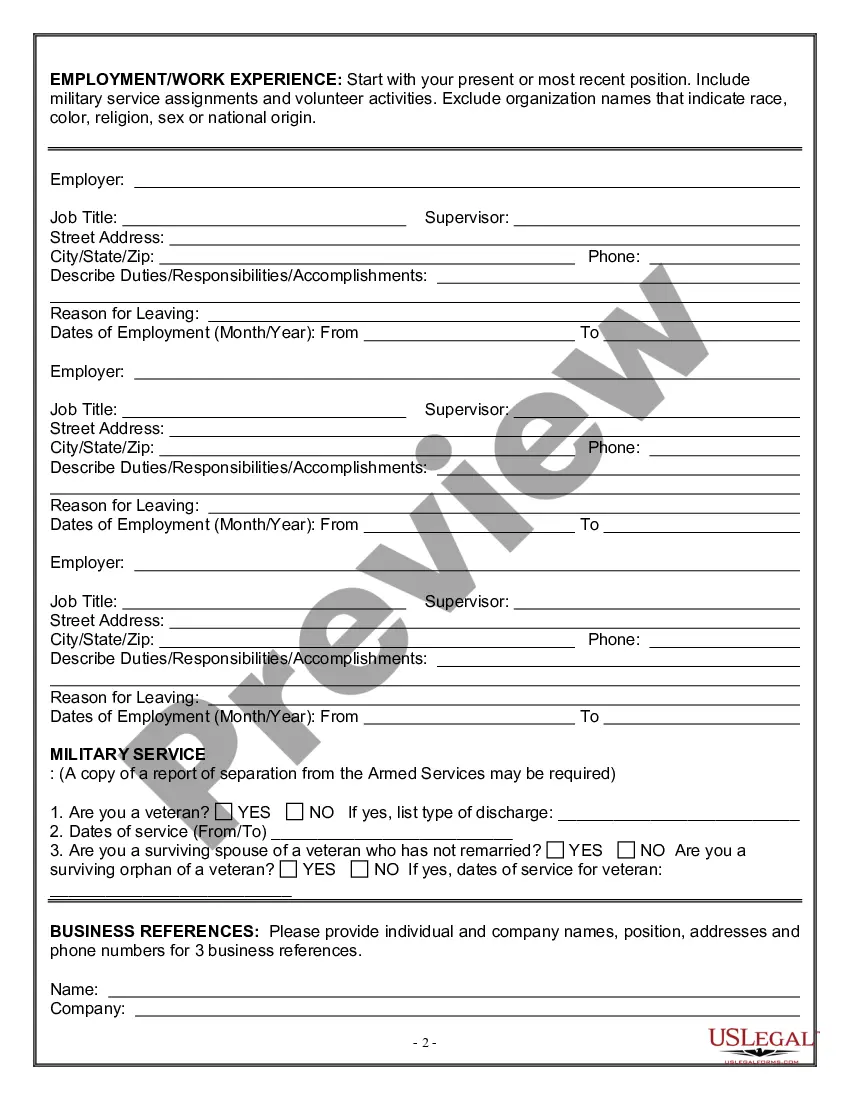

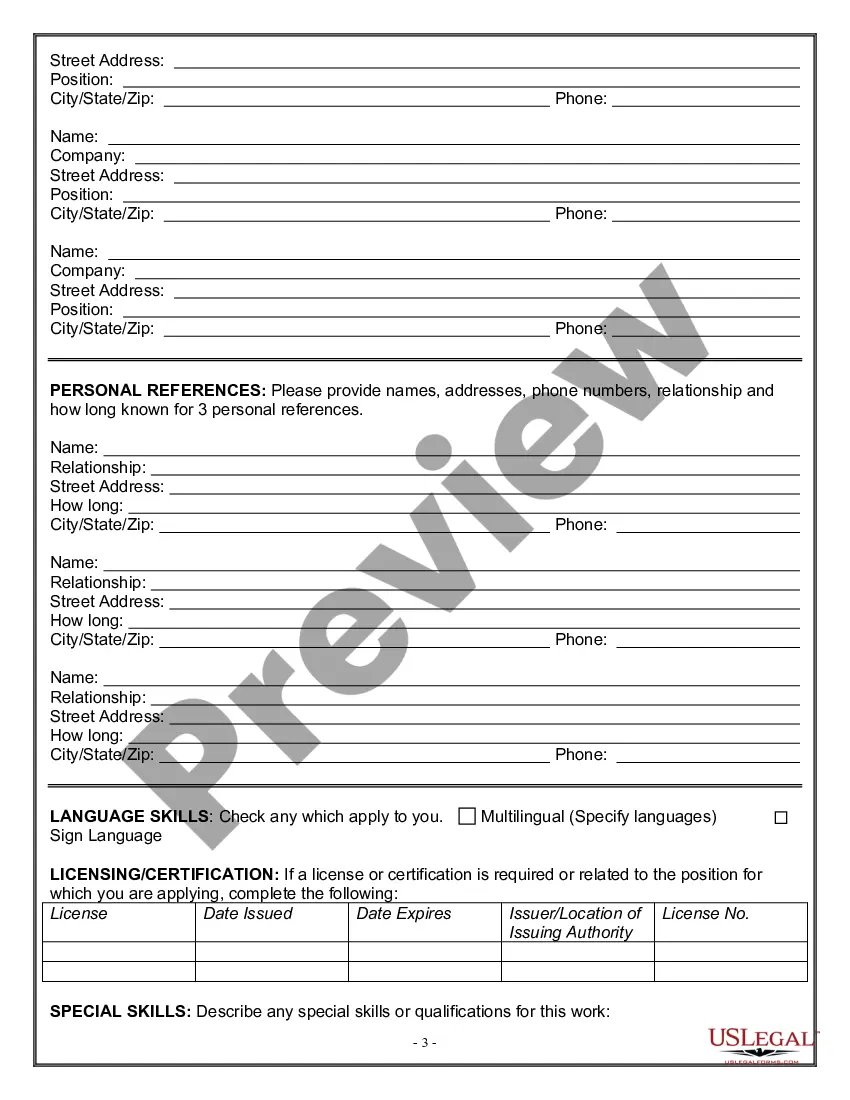

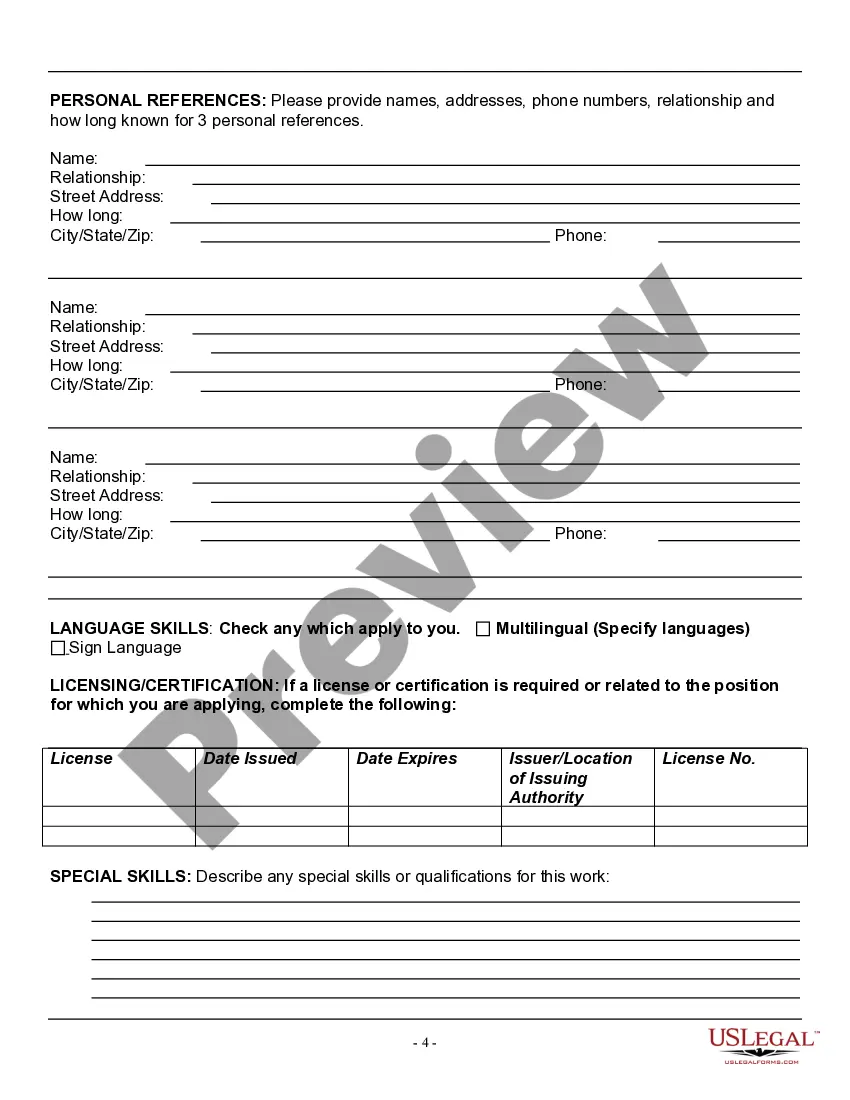

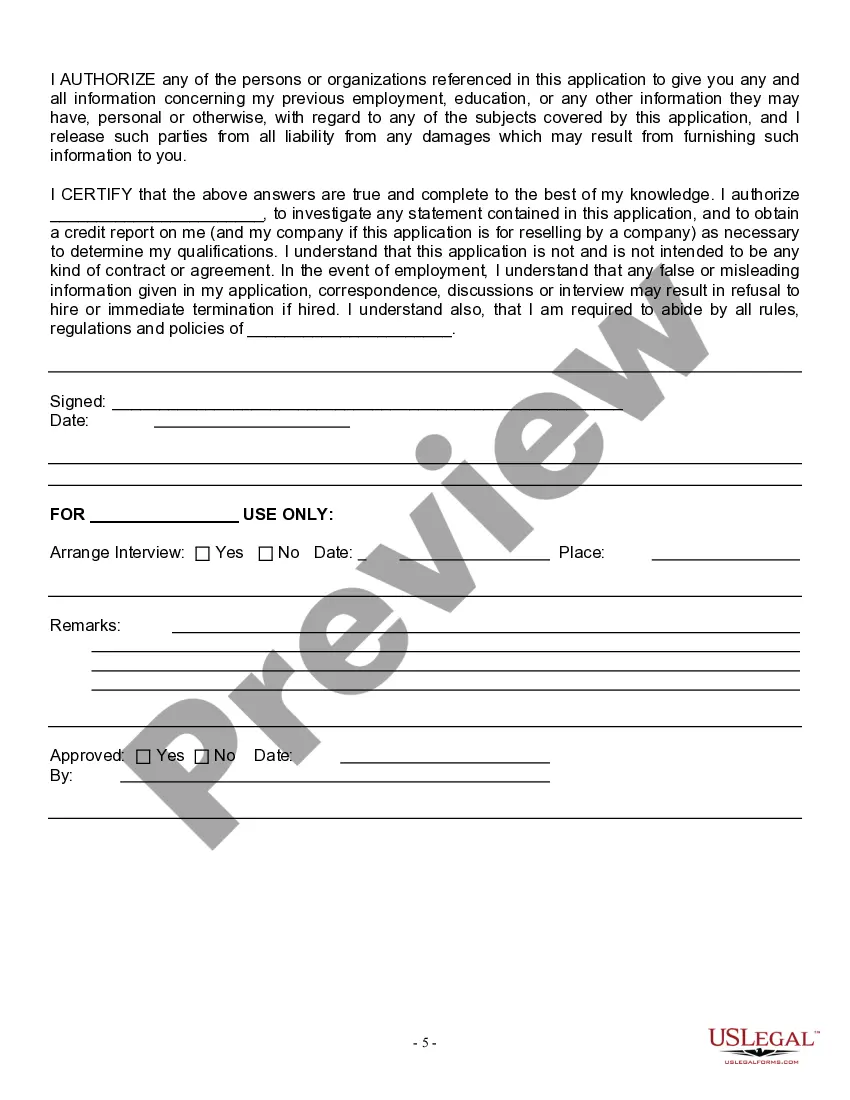

How to fill out Employment Application For Taxi Driver?

If you desire to be thorough, acquire, or print official document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Make use of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by groups and states, or by keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 6. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 7. Choose the format of the legal document and download it to your device. Step 8. Complete, edit, and print or sign the New Hampshire Employment Application for Taxi Driver. Every legal document template you acquire is yours forever. You have access to every form you downloaded with your account. Visit the My documents section and select a form to print or download again. Be proactive and obtain, and print the New Hampshire Employment Application for Taxi Driver with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- Employ US Legal Forms to obtain the New Hampshire Employment Application for Taxi Driver with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Get button to acquire the New Hampshire Employment Application for Taxi Driver.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

When can taxi drivers claim mileage? Like any other expense claim, taxi drivers can only claim back the mileage they've undertaken as part of their job. Therefore, you'll need to track the mileage you drive while on shift. However, this comes with two key conditions: that you're on shift and within your licensed area.

Taxi drivers are mostly self-employed and so have the flexibility to choose their own working hours. Those that choose to work unsociable hours will benefit from the higher fare rates that occur in evenings and bank holidays. Taxi fares will vary considerably depending on the location that you are working in.

Answer for Taxi Drivers as Workers No, all London taxi drivers are self-employed. Transport for London (TfL) is the regulatory body for taxi and private hire services in the Capital.

Based on the elements of professionalism, can a taxi driver be considered a professional? A. No, because driving is not a college/ university degree.

You can deduct common driving expenses, including fees and tolls that Uber and Lyft take out of your pay. Your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or separate cell phones for driving.

Alternative titles for this job include Cab driver, private hire driver, minicab driver. Taxi drivers pick up passengers and charge a fee to take them to their destination by the quickest route.

Below is a comprehensive list of the most common expenses a Taxi Driver can claim.Petrol or diesel costs.Repairs, servicing and running the taxi.The costs of your annual road tax and your MOT test.The cost of washing or cleaning your own taxi.Interest on any bank or personal loans taken out to purchase your taxi.More items...

You are considered a self-employed taxi driver if you work for yourself and set your own hours. Even if you use someone else's vehicle for your job and use the services of a dispatcher, in the eyes of HRMC you are considered an independent contractor.

You could also claim for:Maintenance and repairs to your taxi.Annual road tax and MOT tests.Costs of washing or cleaning your taxi.Taxi licence or other registration fees.Office expenses including rent, gas and electricity (this can even apply to home offices).Vehicle insurance.AA/RAC membership.More items...

Self-Employment Tax Deduction. Social Security and Medicare Taxes.Home Office Deduction.Internet and Phone Bills Deduction.Health Insurance Premiums Deduction.Meals Deduction.Travel Deduction.Vehicle Use Deduction.Interest Deduction.More items...