New Hampshire Promissory Note - Balloon Note

Description

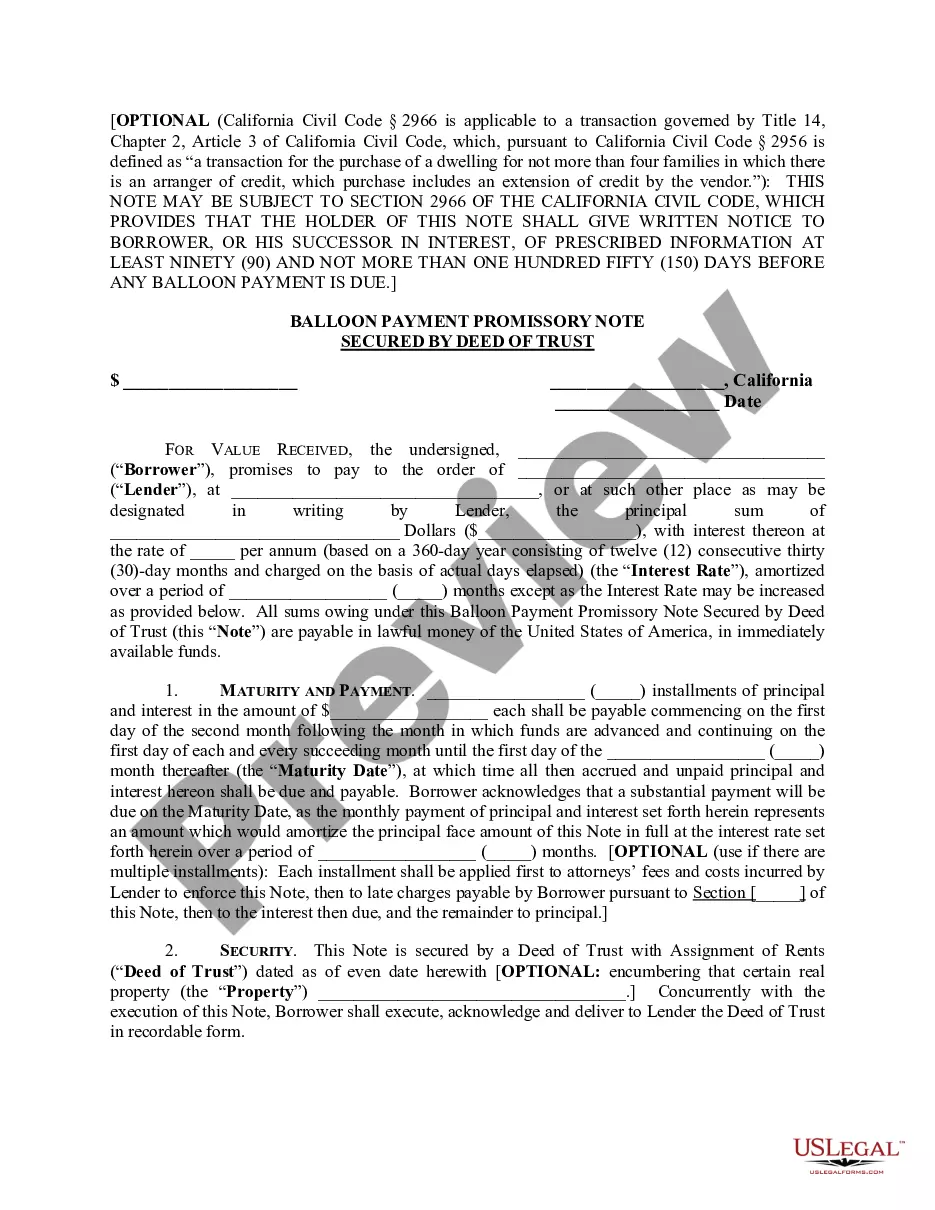

How to fill out Promissory Note - Balloon Note?

Selecting the appropriate legal document template may pose a challenge.

Of course, there is a multitude of templates accessible online, but how can you acquire the legal document you need.

Utilize the US Legal Forms site.

First, ensure you have chosen the correct form for your city/county. You can browse the document using the Review button and examine the document outline to confirm it is suitable for your needs.

- This service provides thousands of templates, such as the New Hampshire Promissory Note - Balloon Note, suitable for both business and personal requirements.

- All of the documents are reviewed by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click on the Download button to obtain the New Hampshire Promissory Note - Balloon Note.

- Use your account to review the legal documents you have previously ordered.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

Form popularity

FAQ

Filling out a promissory demand note involves similar steps to a standard promissory note. You should include the names and addresses of both the borrower and lender, as well as the principal amount and any interest rate. It's important to note that a demand note allows the lender to request full payment at any time, so make sure to outline this clearly in the document. For assistance in drafting such notes, platforms like US Legal Forms can provide templates to ensure your documents are accurate.

To obtain a New Hampshire Promissory Note - Balloon Note, you can visit reputable online platforms, such as US Legal Forms. These platforms provide customizable templates that are easy to understand and fill out, ensuring you include all necessary details. After selecting a template, you can tailor it to your specific needs and print it for signing. This process simplifies your experience while ensuring your promissory note meets legal requirements.

Yes, you can negotiate a balloon payment in your New Hampshire Promissory Note - Balloon Note. It's important to discuss this upfront with the lender, as flexibility can often be built into the agreement. Both parties should agree on the terms to avoid confusion or complications down the line.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

Balloon payments allow borrowers to reduce that fixed payment amount in exchange for making a larger payment at the end of the loan's term. In general, these loans are good for borrowers who have excellent credit and a substantial income.

A balloon loan is a type of loan that includes lower monthly payments in exchange for a larger one-time payment at the end of your loan term. If you plan to finance your car purchase, you may be offered the option of a balloon loan.

A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.