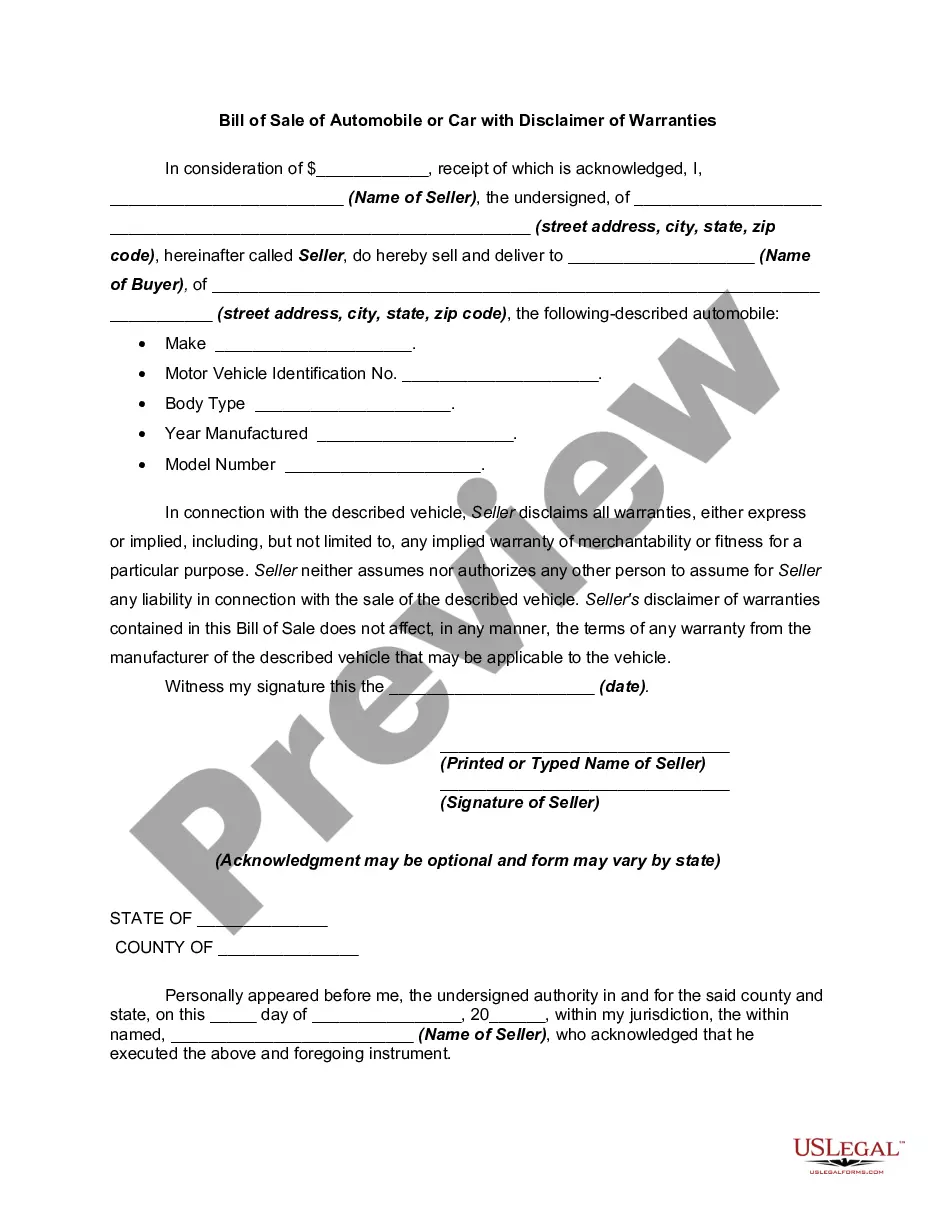

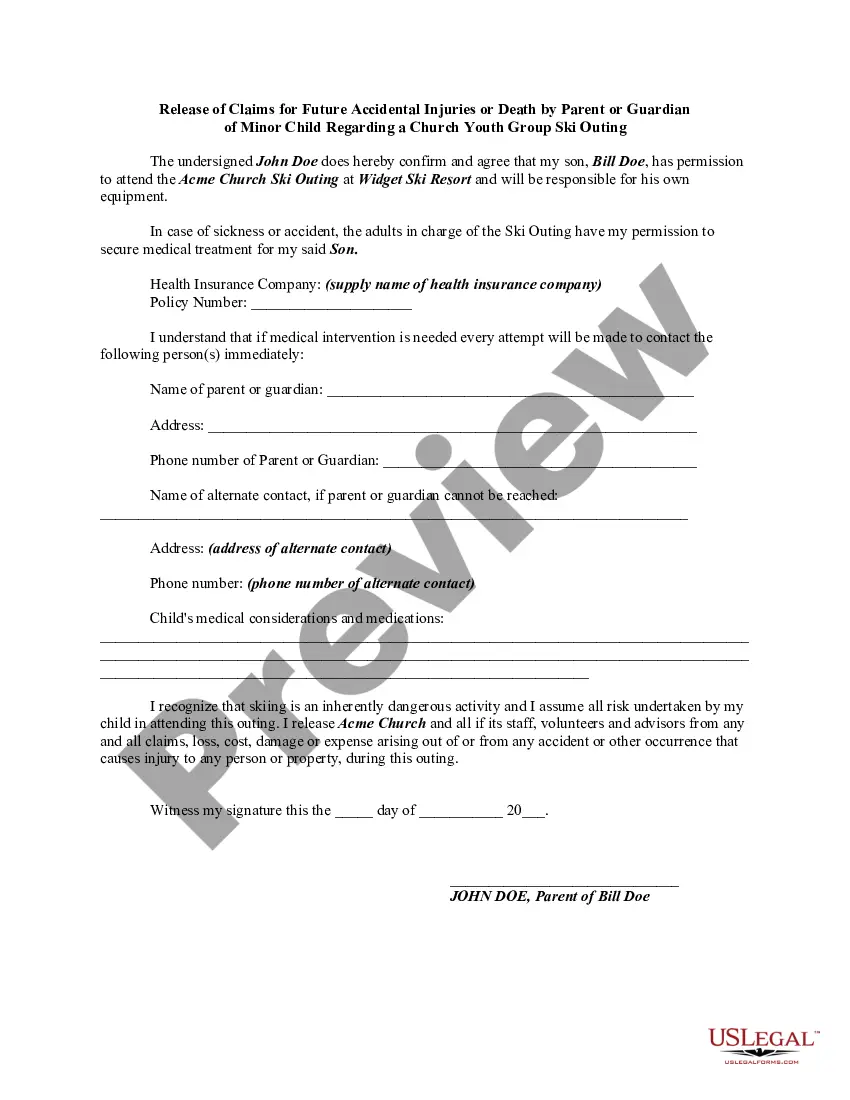

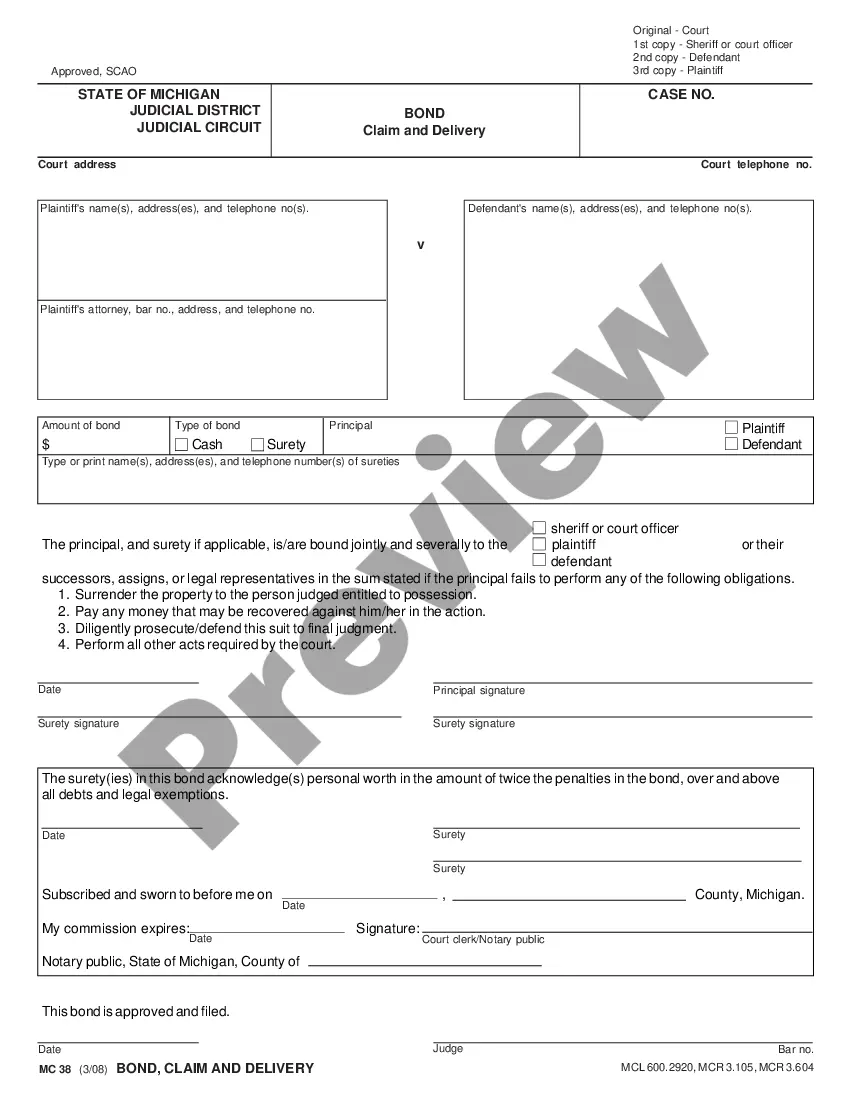

The New Hampshire Bill of Sale — Quitclaim is a legal document that serves as evidence of the transfer of ownership of a particular property or asset from one party to another in the state of New Hampshire. It is a crucial document used in various transactions, including real estate transfers, personal property sales, and motor vehicle transfers. A Quitclaim Bill of Sale in New Hampshire includes relevant details such as the names and contact information of both the buyer (grantee) and the seller (granter). It also specifies a detailed description of the property or asset being transferred. This can include its address, legal description, and any unique identifying marks or characteristics. The New Hampshire Quitclaim Bill of Sale also typically contains a statement that the seller is transferring their rights, title, and interest in the property or asset to the buyer. It guarantees that the seller is the legal owner of the property and has the right to sell it without any encumbrances or claims from third parties. There are no specific types of New Hampshire Bill of Sale — Quitclaim forms, as the content of the document remains fairly standard across various transactions. However, the Bill of Sale can be tailored to specific types of assets or transactions. For example, a real estate Quitclaim Bill of Sale may have additional clauses addressing the condition of the property, any existing liens or encumbrances, and the disclosure of any known defects. It is important to note that a Quitclaim Bill of Sale in New Hampshire is different from a Warranty Bill of Sale. Unlike a Warranty Bill of Sale, a Quitclaim Bill of Sale does not guarantee or provide any assurance that the seller has legal ownership of the property being transferred. It simply transfers whatever rights the seller has to the buyer, leaving any potential title issues or claims for the buyer to address separately. In summary, the New Hampshire Bill of Sale — Quitclaim is a vital legal document used to transfer ownership of properties or assets within the state. Its purpose is to provide a clear record of the transaction and protect the rights of both the buyer and the seller.

New Hampshire Bill of Sale - Quitclaim

Description

How to fill out New Hampshire Bill Of Sale - Quitclaim?

It is feasible to spend time on the internet looking for the legal document template that aligns with the federal and state specifications you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can easily obtain or print the New Hampshire Bill of Sale - Quitclaim from the service.

If available, use the Preview button to view the document template simultaneously.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the New Hampshire Bill of Sale - Quitclaim.

- Every legal document template you receive is your permanent property.

- To retrieve another copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- Firstly, ensure you have chosen the correct document template for your area/city of choice.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

To file a quit claim deed in New Hampshire, you first need to complete the deed form accurately. Ensure that the property description and both parties' names are included. After you sign the document in front of a notary, you can submit it to the local registry of deeds. Using a New Hampshire Bill of Sale - Quitclaim form from UsLegalForms can simplify this process, making it straightforward and efficient.

While a quitclaim deed is a simple and quick way to transfer property ownership, it does come with drawbacks. One significant disadvantage is that it offers no guarantees about the property's title, potentially exposing the grantee to risks if claims arise. Additionally, if there are any liens or liabilities on the property, the new owner may inherit those problems. Understanding these risks is crucial when considering a New Hampshire Bill of Sale - Quitclaim.

To file a quitclaim deed in New Hampshire, start by obtaining the appropriate form, which you can find on platforms like USLegalForms. Fill out the form with all required details, ensuring you include both grantor and grantee information. After signing, you must bring the document to your local county registry of deeds for recording. Once recorded, your New Hampshire Bill of Sale - Quitclaim is legally recognized.

Yes, you can prepare a quit claim deed yourself in New Hampshire, as there are no specific legal requirements for hiring an attorney. However, it's essential to ensure that all necessary information is accurately filled out to avoid complications later. Tools and resources are available, such as US Legal Forms, to assist you in creating a New Hampshire Bill of Sale - Quitclaim efficiently and correctly.

Notarizing a bill of sale is a good practice that adds credibility to your transaction, especially for significant items or properties. If you want reassurance regarding the legitimacy of the transaction, then notarization can be beneficial. If you're using the New Hampshire Bill of Sale - Quitclaim, consider bringing it to a notary to enhance security and peace of mind for both parties.

A New Hampshire bill of sale does not legally require notarization to be valid. However, like with titles, notarization can provide additional security and help ensure that all parties are protected. It may also simplify future transactions related to the item or property. Therefore, while notarization isn't mandatory, it might be a smart choice for your New Hampshire Bill of Sale - Quitclaim.

In New Hampshire, notarization of a title is generally not required, but it can enhance the credibility of the transfer. Title companies or other institutions might request notarization for their records or to facilitate the transaction. If you're processing a New Hampshire Bill of Sale - Quitclaim, consider the benefits of notarization, especially if dealing with larger sums or complex transactions.

Yes, a bill of sale can be valid without a notary in New Hampshire. However, having a notary verify the signatures adds an extra layer of legitimacy and can help prevent disputes later. While it's not strictly required, consider notarizing your New Hampshire Bill of Sale - Quitclaim for better security and trust in the transaction.

One major disadvantage of a quit claim deed is that it does not guarantee that the property title is clear. This means that if there are any hidden claims or liens on the property, the new owner might have to deal with them. Additionally, a quit claim deed will not provide protections against future claims, making it less secure than other types of deeds. Thus, if you are considering a New Hampshire Bill of Sale - Quitclaim, be sure to understand the potential risks.

To file a quitclaim deed in New Hampshire, you must submit the completed form to the local registry of deeds. Ensure that the form is signed and notarized, as this is often a requirement. By choosing platforms like USLegalForms, you can streamline the preparation and filing process of your New Hampshire Bill of Sale - Quitclaim, ensuring everything is done correctly.

Interesting Questions

More info

Calculated Income Tax Rate Using This Formula: Income Tax Rate = [Amount of Tax For Tax Year/100] + [Tax Rate for Previous 12 Quarters/0.5%] +[Change in Tax Rate] Calculated Income Tax Rates — Your Individual & Corporate Tax Rate Using This Formula: Income Tax Rate — Your Individual & Corporate Tax Rate = [Amount of Tax for Tax Year/100] — [Personal Income Tax Rate/100] Note: I am using the tax year for your individual tax return for all personal income tax calculations and tax rates, so if you have a single tax return please use the tax year for your business tax returns, however for all individual tax returns and business tax returns, I am using the tax year for the tax year to calculate your income tax.