A New Hampshire Donation or Gift to Charity of Personal Property refers to the act of giving or donating personal belongings or assets to a charitable organization located in the state of New Hampshire. This gesture aims to support the charitable cause of the organization and help individuals or communities in need. When making a donation or gift of personal property in New Hampshire, it is important to follow certain procedures and guidelines to ensure that the donation is properly documented and recognized. The process typically involves the donor transferring ownership of the personal property to the charitable organization, which can then use, sell, or dispose of the property as deemed fit. There are different types of New Hampshire Donation or Gift to Charity of Personal Property that individuals can make, such as: 1. Monetary Donations: This involves giving a sum of money to a charitable organization to support their cause. Monetary donations are usually made through checks, online transfers, or credit card payments. 2. Real Estate Donation: Individuals may choose to donate real estate properties, including residential homes, commercial buildings, or vacant land, to charitable organizations. This type of donation can provide the donor with potential tax benefits. 3. Vehicle Donation: Donating vehicles, such as cars, trucks, motorcycles, or boats, is also a common way to contribute to charitable organizations. The donated vehicles can be sold by the organization to raise funds or used directly for their operations. 4. Art and Collectible Donations: Individuals who possess valuable art pieces, antiques, collectibles, or other valuable items can donate them to charitable organizations. These donations can be auctioned off or used to enhance the organization's mission. 5. Clothing and Household Item Donations: Many charitable organizations accept donations of clothing, furniture, electronics, and other household items in good condition. These items are either distributed directly to those in need or sold to generate funds for the organization. When making a donation or gift of personal property in New Hampshire, it is advisable to consult with tax professionals or legal advisors to understand the applicable tax benefits and legal implications of the donation. Proper documentation, including receipts and appraisals, may be necessary to claim tax deductions for the donated property.

New Hampshire Donation or Gift to Charity of Personal Property

Description

How to fill out New Hampshire Donation Or Gift To Charity Of Personal Property?

Discovering the right lawful file design can be quite a struggle. Obviously, there are plenty of layouts available on the net, but how do you discover the lawful type you will need? Take advantage of the US Legal Forms website. The support gives thousands of layouts, including the New Hampshire Donation or Gift to Charity of Personal Property, that can be used for company and private requirements. Each of the forms are inspected by experts and fulfill federal and state demands.

When you are currently signed up, log in to the bank account and click the Acquire switch to get the New Hampshire Donation or Gift to Charity of Personal Property. Use your bank account to search with the lawful forms you might have bought formerly. Visit the My Forms tab of your respective bank account and have another version of the file you will need.

When you are a brand new customer of US Legal Forms, listed here are easy recommendations that you can comply with:

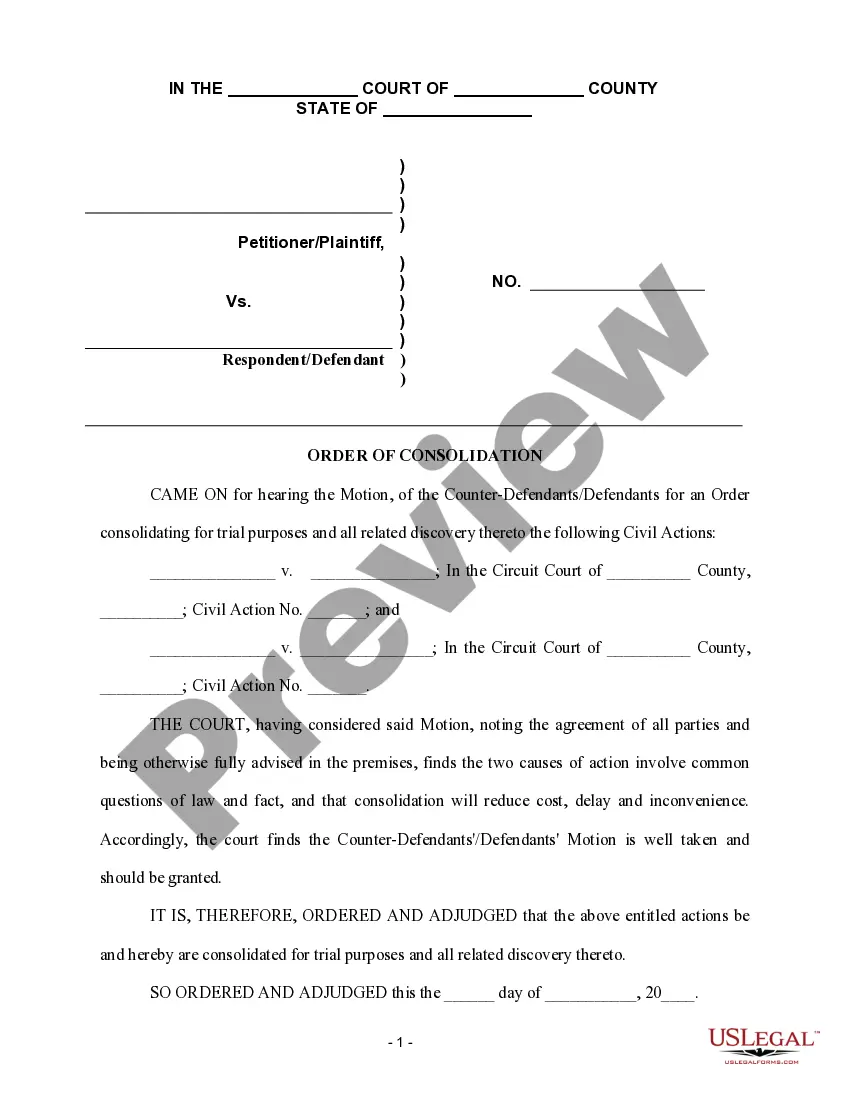

- Initial, ensure you have selected the appropriate type for your city/area. You can check out the form while using Preview switch and browse the form description to guarantee it is the right one for you.

- In case the type fails to fulfill your needs, make use of the Seach industry to obtain the correct type.

- When you are positive that the form is suitable, select the Get now switch to get the type.

- Pick the pricing program you need and enter the needed information and facts. Design your bank account and pay for your order making use of your PayPal bank account or Visa or Mastercard.

- Pick the submit file format and obtain the lawful file design to the product.

- Full, modify and printing and indication the attained New Hampshire Donation or Gift to Charity of Personal Property.

US Legal Forms is the greatest local library of lawful forms where you can find various file layouts. Take advantage of the service to obtain expertly-produced documents that comply with status demands.