New Hampshire Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

Are you within a position that you need files for both enterprise or individual reasons almost every day time? There are a lot of lawful papers themes available on the Internet, but finding types you can trust isn`t effortless. US Legal Forms provides a large number of type themes, like the New Hampshire Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan, that are published to fulfill federal and state specifications.

Should you be currently acquainted with US Legal Forms website and also have a merchant account, basically log in. Afterward, you can obtain the New Hampshire Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan format.

Should you not have an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the type you will need and make sure it is for that appropriate city/area.

- Utilize the Preview option to examine the shape.

- Look at the information to ensure that you have chosen the proper type.

- When the type isn`t what you are seeking, take advantage of the Lookup field to find the type that meets your needs and specifications.

- If you find the appropriate type, just click Purchase now.

- Select the prices strategy you desire, complete the desired information and facts to produce your account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a hassle-free document structure and obtain your duplicate.

Get all the papers themes you possess bought in the My Forms food selection. You can aquire a extra duplicate of New Hampshire Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan any time, if required. Just go through the needed type to obtain or produce the papers format.

Use US Legal Forms, by far the most extensive assortment of lawful varieties, to save some time and avoid blunders. The support provides appropriately manufactured lawful papers themes which can be used for a selection of reasons. Produce a merchant account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

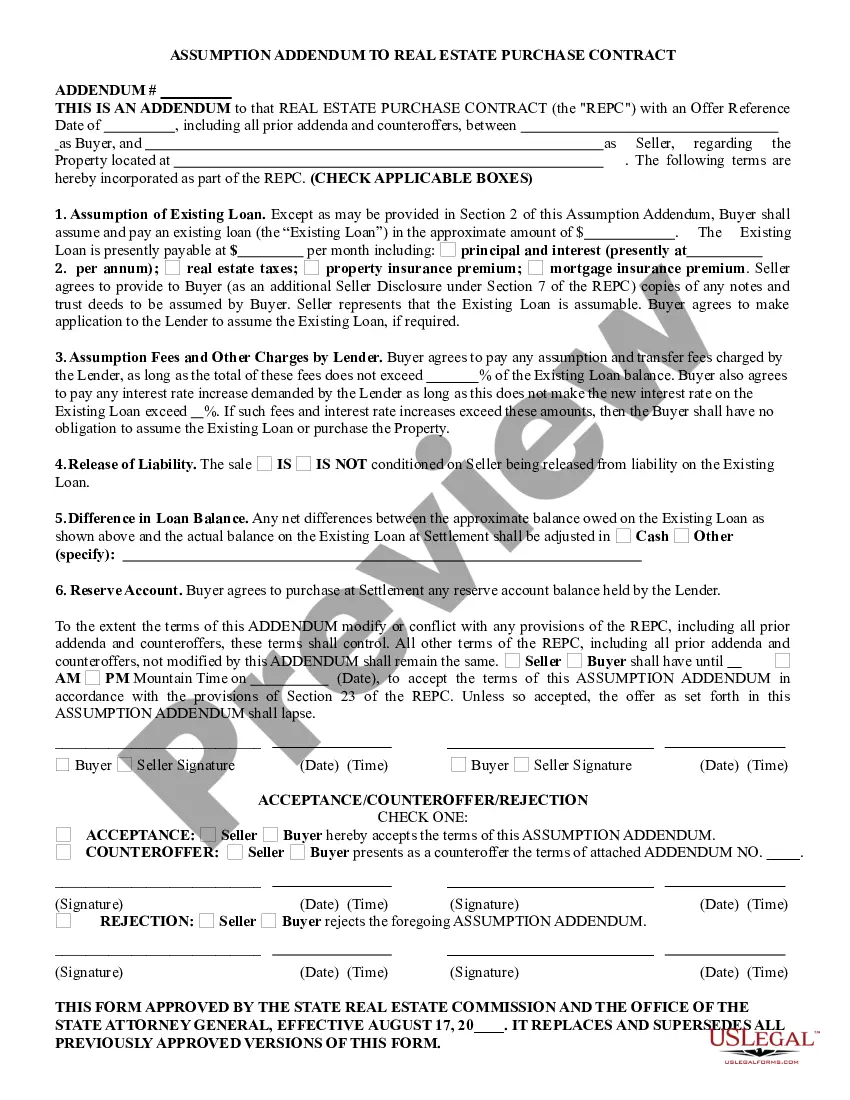

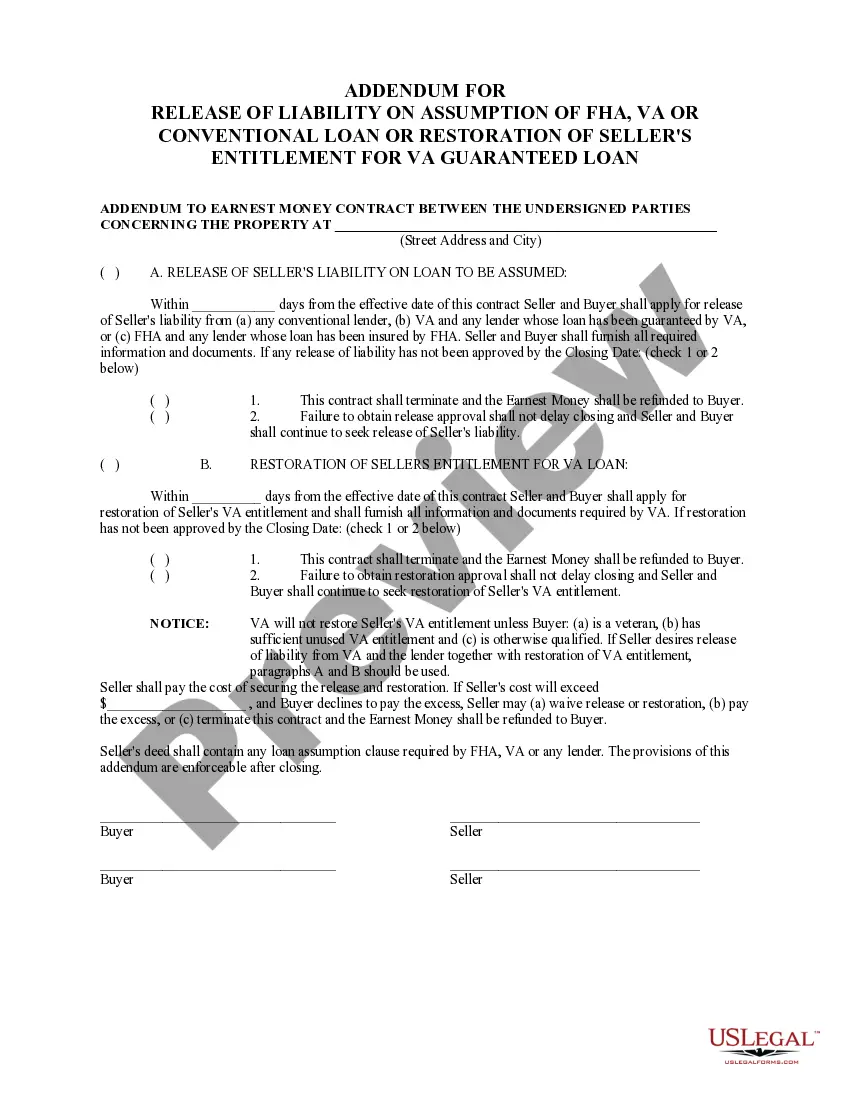

In summary, an addendum is a document that is added to a real estate contract to modify or supplement the terms of the contract. It must be signed by both parties to be legally binding and should be clear and specific about the changes being made.

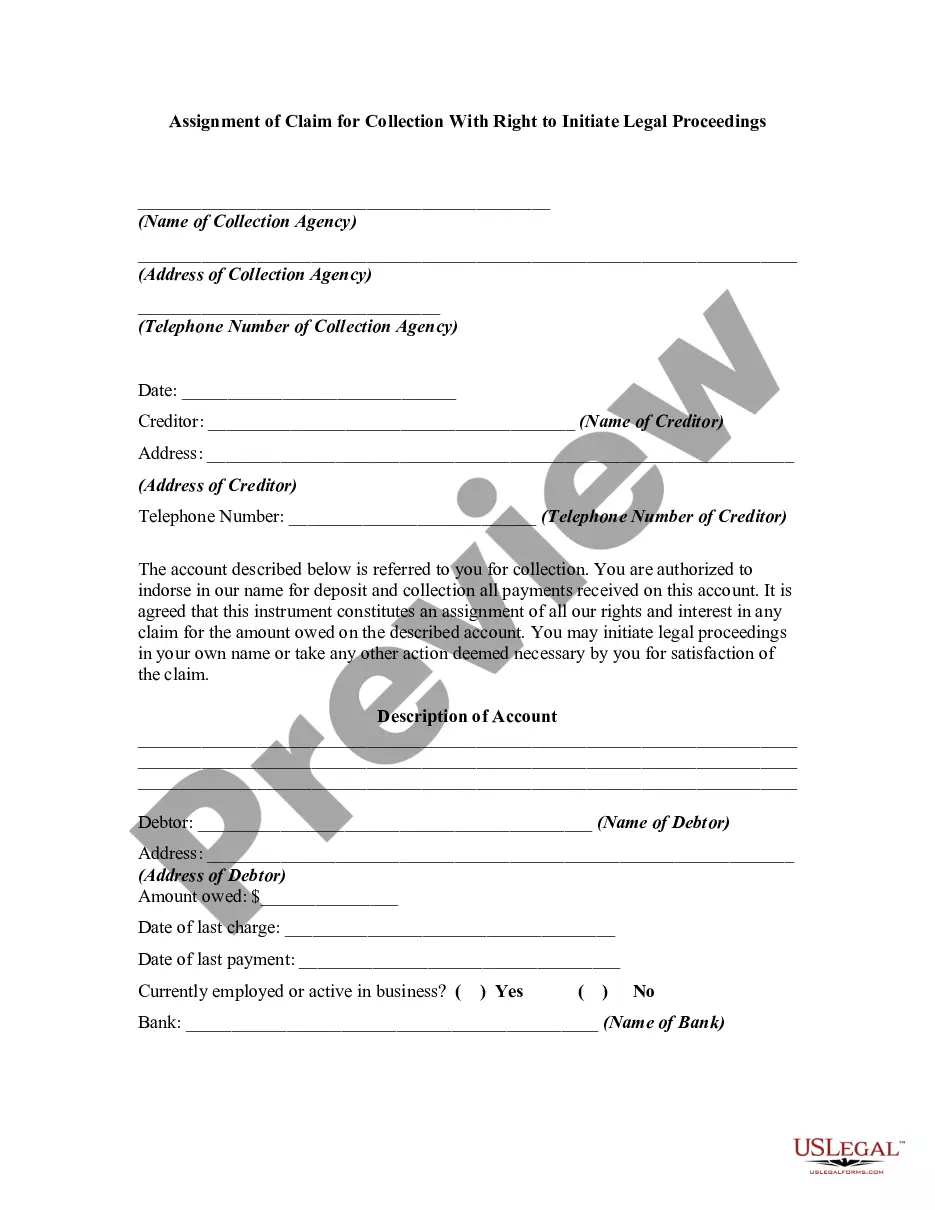

Addendum for Release of Liability on Assumed Loan and/or Restoration of Seller's VA Entitlement. Description: This Addendum is used in conjunction with the Loan Assumption Addendum if the Seller wants to be released from future liability of the loan.

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

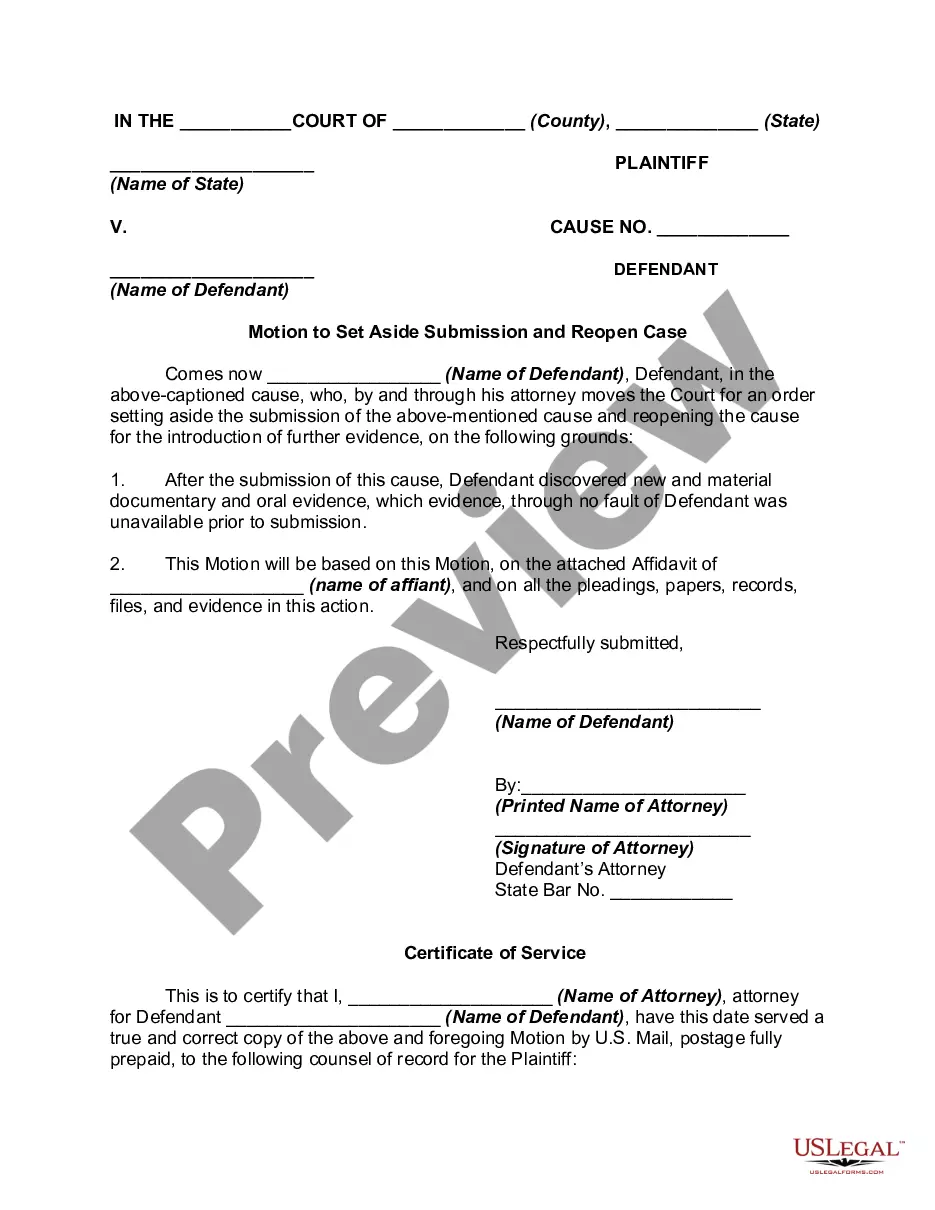

Be sure the sales contract includes the ?VA escape clause? or ?VA option clause.? This provides an option to void the contract if the property doesn't appraise for the contract price.

OMB 2900-0144 The VA Form 26-1802a serves as a loan application for both VA and HUD. Lenders and Veterans use the form to apply for guaranty of home loans.

The VA Escape Clause, also known as the "VA Amendment to Contract" or the "VA Amendatory Clause," is an appraisal contingency that protects homebuyers' earnest money if the VA appraisal determines the home is worth less than what they agreed to pay.