New Hampshire Agreement for Sale of Commercial Real Estate

Description

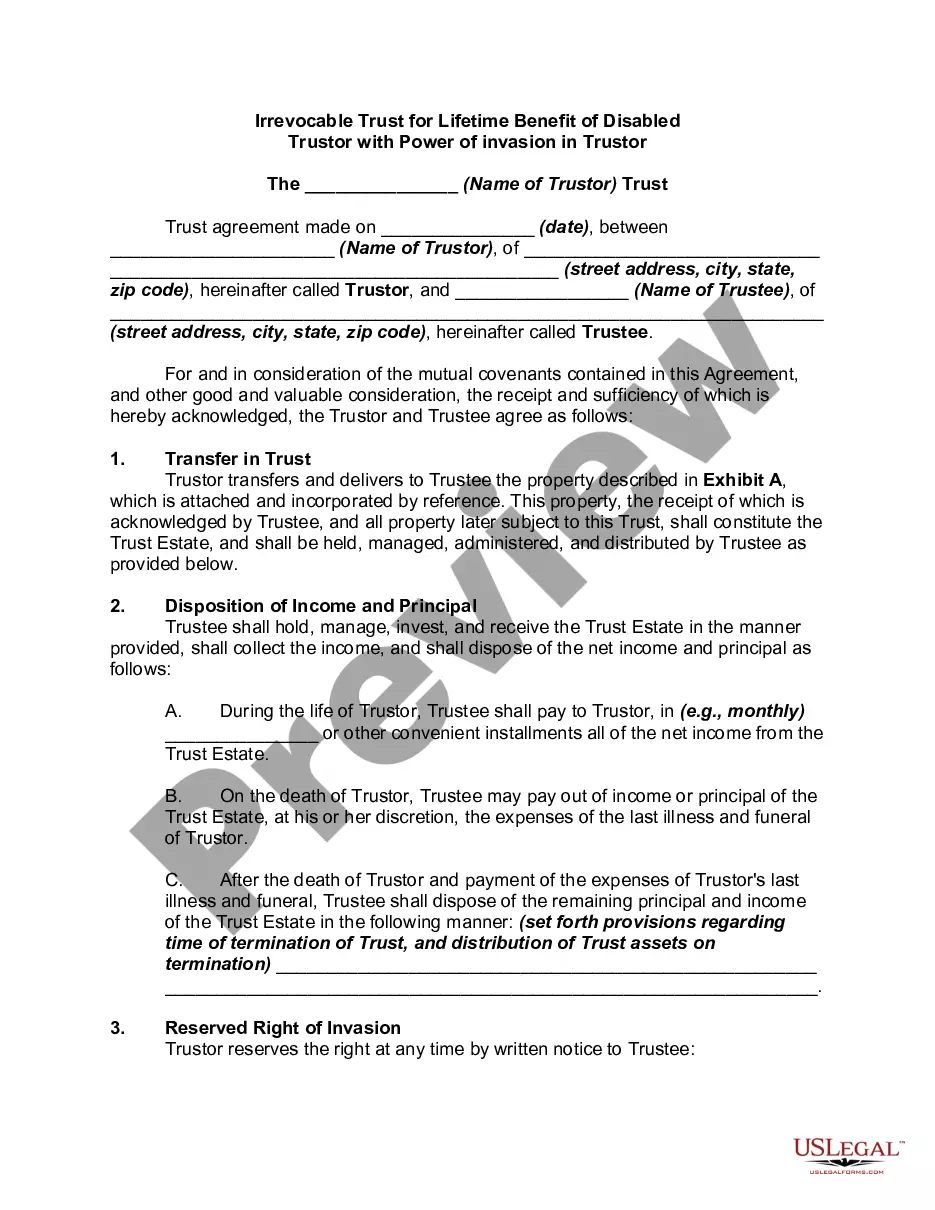

How to fill out Agreement For Sale Of Commercial Real Estate?

US Legal Forms - one of the largest collections of legal templates in the country - provides a range of legal document templates that you can obtain or print.

By using the website, you will find thousands of forms for both professional and personal purposes, categorized by types, states, or keywords. You can acquire the latest versions of forms such as the New Hampshire Agreement for Sale of Commercial Real Estate in just a few moments.

If you already have an account, Log In and obtain the New Hampshire Agreement for Sale of Commercial Real Estate from the US Legal Forms database. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Download the format and obtain the form on your device. Edit. Fill out, modify, and print and sign the downloaded New Hampshire Agreement for Sale of Commercial Real Estate. Every template you add to your account does not expire and belongs to you indefinitely. Therefore, if you wish to obtain or print another copy, just go to the My documents section and click on the form you need. Access the New Hampshire Agreement for Sale of Commercial Real Estate with US Legal Forms, which has one of the most extensive collections of legal document templates. Utilize a plethora of professional and state-specific templates that meet your business or personal requirements.

- If you intend to use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the appropriate form for your location/region.

- Click the Preview button to check the content of the form.

- Review the form summary to confirm you have chosen the correct one.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you wish and provide your details to create an account.

Form popularity

FAQ

An example of a commercial agreement is a lease agreement for an office space, which outlines the rights and responsibilities of both the landlord and tenant. This document details important factors such as rental amount, lease duration, and property maintenance responsibilities. Another common example is a New Hampshire Agreement for Sale of Commercial Real Estate, which covers the sale terms for buyers and sellers involved in commercial property transactions.

Yes, in most situations, you need a commercial real estate license to sell commercial property in New Hampshire. This license ensures that you comply with state regulations and provides consumers with protection during transactions. If you are considering selling property, it is essential to either obtain the necessary licensing or collaborate with a licensed real estate professional. They can help you navigate the details of a New Hampshire Agreement for Sale of Commercial Real Estate.

Yes, you can write your own contract agreement for the New Hampshire Agreement for Sale of Commercial Real Estate. However, it is essential to ensure that your contract meets legal standards and addresses all necessary terms. Using a reliable platform like UsLegalForms can simplify this process by providing templates and guidance tailored to New Hampshire laws. This approach helps you create a comprehensive agreement while minimizing potential legal issues.

One major issue in commercial real estate is the complexity of negotiations. Factors like zoning laws, financing, and market conditions can create challenges. Additionally, ensuring compliance with the New Hampshire Agreement for Sale of Commercial Real Estate adds another layer of consideration. Navigating these elements carefully can prevent costly mistakes.

Writing a simple written agreement starts with specifying the parties involved and the agreement's purpose. Clearly outline the expectations and responsibilities of each party. Incorporating the New Hampshire Agreement for Sale of Commercial Real Estate can provide a suitable structure that ensures the document is both simple and effective.

To complete a commercial real estate deal, start with market research to identify potential properties and their values. Then, negotiate terms with the seller and use a legal document like the New Hampshire Agreement for Sale of Commercial Real Estate to finalize the terms and conditions. This ensures all aspects of the transaction are clear and legally valid.

To write a real estate sales agreement, begin by clearly identifying the parties involved, the property in question, and the sale amount. Incorporate clauses regarding inspections and financing to ensure a smooth transaction. Incorporating the New Hampshire Agreement for Sale of Commercial Real Estate can simplify this process by providing a reliable framework.

To sell your commercial real estate property, start by conducting a thorough market analysis to determine its value. Next, create a detailed listing that highlights the property's features, location, and potential uses. Consider using the New Hampshire Agreement for Sale of Commercial Real Estate to formalize offers and negotiate terms with potential buyers.