The New Hampshire Simple Partnership Agreement is a legally binding document that outlines the terms and conditions of a partnership formed in the state of New Hampshire. It is aimed at individuals or businesses looking to create a partnership without a complex structure or additional legal formalities. Following are the different types of New Hampshire Simple Partnership Agreement: 1. General Partnership Agreement: This is the most common type of partnership agreement where all partners share equal rights and responsibilities, including management, profits, and liabilities. The New Hampshire Simple Partnership Agreement can be used to establish a general partnership. 2. Limited Partnership Agreement: This type of partnership consists of both general partners and limited partners. General partners have unlimited liability and active involvement in the partnership's operations, while limited partners have limited liability and are not involved in day-to-day management. 3. Limited Liability Partnership Agreement: This agreement is suitable for professionals such as lawyers, accountants, and architects. It provides limited liability protection to partners, shielding them from personal liability for the actions of other partners or employees. The New Hampshire Simple Partnership Agreement typically includes essential details such as the name and purpose of the partnership, duration (if limited), capital contributions of partners, profit and loss distribution, management responsibilities, dispute resolution, partner withdrawal or dissolution procedures, and any additional terms agreed upon by the partners. Partners should carefully consider key clauses like non-compete agreements, decision-making procedures, dispute resolution mechanisms, and buyout provisions to ensure a clear and effective partnership. It is highly recommended consulting with a legal professional for drafting and reviewing a New Hampshire Simple Partnership Agreement to ensure compliance with state laws and to protect the interests of all partners involved.

New Hampshire Simple Partnership Agreement

Description

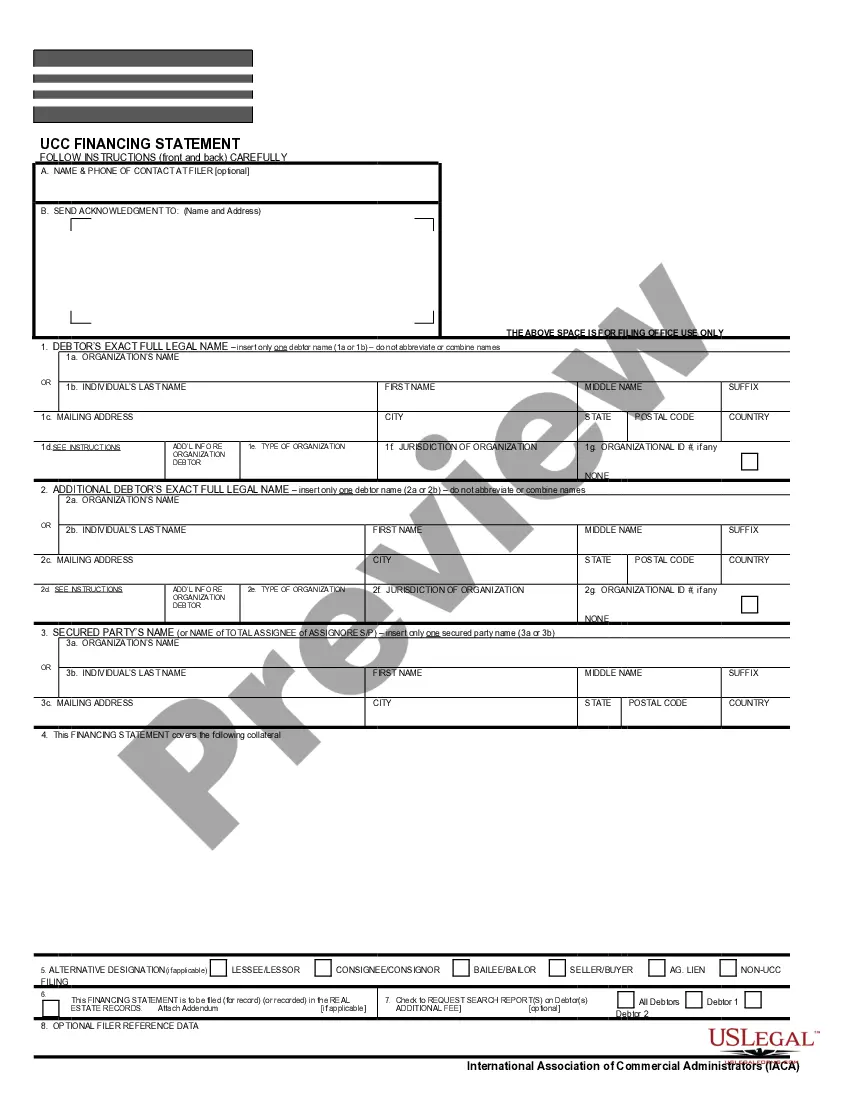

How to fill out New Hampshire Simple Partnership Agreement?

Finding the appropriate legal document template can be a challenge.

There are numerous templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the New Hampshire Simple Partnership Agreement, suitable for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the correct document. Once you are confident the form is appropriate, click on the Buy now button to obtain the document. Select your preferred payment plan and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your system. Complete, edit, print, and sign the acquired New Hampshire Simple Partnership Agreement. US Legal Forms is the largest repository of legal documents where you can find a wide range of document templates. Leverage the service to obtain professionally crafted papers that adhere to state requirements.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the New Hampshire Simple Partnership Agreement.

- Use your account to search for the legal forms you have purchased previously.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/region. You may review the document using the Preview option and read the form description to confirm it is the right one for you.

Form popularity

FAQ

In New Hampshire, partnerships are generally not taxed at the entity level. Instead, the income passes through to the partners, who report it on their individual tax returns. This structure can be beneficial, as it allows for the avoidance of double taxation. However, it's essential to consult a tax professional for personalized advice regarding your specific New Hampshire Simple Partnership Agreement.

Starting a new partnership involves evaluating your business needs and identifying suitable partners. Once you have selected your partners, create a New Hampshire Simple Partnership Agreement to outline everyone’s roles and responsibilities. This agreement is critical for avoiding misunderstandings and fostering trust. Finally, implement your business plan and monitor progress together to achieve your shared vision.

Building a successful partnership involves four key steps: first, identify potential partners who complement your business objectives. Next, establish clear communication to align goals and expectations. Third, develop a New Hampshire Simple Partnership Agreement to formalize your collaboration. Finally, nurture the relationship through regular check-ins and adjustments as needed to ensure mutual growth and success.

The process of forming a partnership begins with selecting partners who align with your business goals. After assembling your team, draft a New Hampshire Simple Partnership Agreement that includes key aspects like responsibilities, profit-sharing, and dispute resolution. Register your business as required by local regulations, and then cultivate a productive working relationship to achieve mutual success. Sticking to this process will set your partnership on a solid foundation.

To form a partnership, you first need to choose your partners wisely, ensuring they share your vision and values. Next, create a New Hampshire Simple Partnership Agreement that details the terms of your partnership, including profit-sharing and decision-making processes. After drafting the agreement, obtain any necessary permits or licenses to legally operate your business. Finally, consider opening a partnership bank account to manage finances effectively.

A partnership is formed when two or more individuals come together to conduct business with a shared purpose. You can establish a New Hampshire Simple Partnership Agreement to outline the roles, responsibilities, and contributions of each partner. This agreement serves as a foundational document that clarifies the partnership's objectives and expectations. Once this document is created and signed, you formally have a partnership.

Generally, all partners in a partnership have the authority to bind the partnership. However, specific authority can be defined within the partnership agreement. Crafting a robust New Hampshire Simple Partnership Agreement clarifies decision-making authority and helps prevent conflicts about who can make binding commitments.

Any partner can write a partnership agreement, but it’s advisable for someone with legal knowledge to be involved. This ensures that all legal requirements are met and that the agreement is enforceable. A comprehensive New Hampshire Simple Partnership Agreement drafted with the help of legal professionals or resources can enhance its validity.

Ideally, the partnership agreement should be drafted by someone knowledgeable about business law, which might include an attorney or a knowledgeable partner. However, many businesses opt to use templates and services available online. Using a New Hampshire Simple Partnership Agreement template from uslegalforms can simplify the creation process and ensure all essential elements are covered.

Creating a simple partnership agreement involves outlining the terms, responsibilities, and profit-sharing arrangements among partners. You should gather input from all partners to ensure everyone's perspectives are included. Utilizing resources from platforms like uslegalforms can streamline the process of drafting your New Hampshire Simple Partnership Agreement.

Interesting Questions

More info

You can then download any of these free templates to use as your business's partnership agreement.