A New Hampshire Balloon Unsecured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of New Hampshire. This type of promissory note is commonly used when the borrower needs a large sum of money upfront and agrees to repay the loan in regular installments over time, with a final "balloon" payment due at the end of the term. The New Hampshire Balloon Unsecured Promissory Note specifies important details such as the principal amount borrowed, the interest rate charged, the repayment schedule, and any penalties or fees for late payments or defaults. Unlike a secured promissory note, this type of note does not require any collateral, making it especially suitable for borrowers who may not possess significant assets. There can be different types of New Hampshire Balloon Unsecured Promissory Notes, depending on the specific terms agreed upon by the parties involved. For instance, some promissory notes may have fixed interest rates, while others might have variable rates that adjust over time. Additionally, the length of the loan term and the amount of the balloon payment can vary between different promissory notes. It is important for both parties to carefully review and understand the terms of a New Hampshire Balloon Unsecured Promissory Note before signing. The borrower should ensure they are capable of making the regular installment payments and be prepared for the larger balloon payment at the end. The lender must assess the borrower's creditworthiness to mitigate the risk of default and consider the legal remedies available in case of non-payment. By using a New Hampshire Balloon Unsecured Promissory Note, both the borrower and the lender can establish a clear understanding of their financial obligations and rights. This legal document provides protection and clarity throughout the loan repayment process, fostering a transparent and mutually beneficial agreement between both parties.

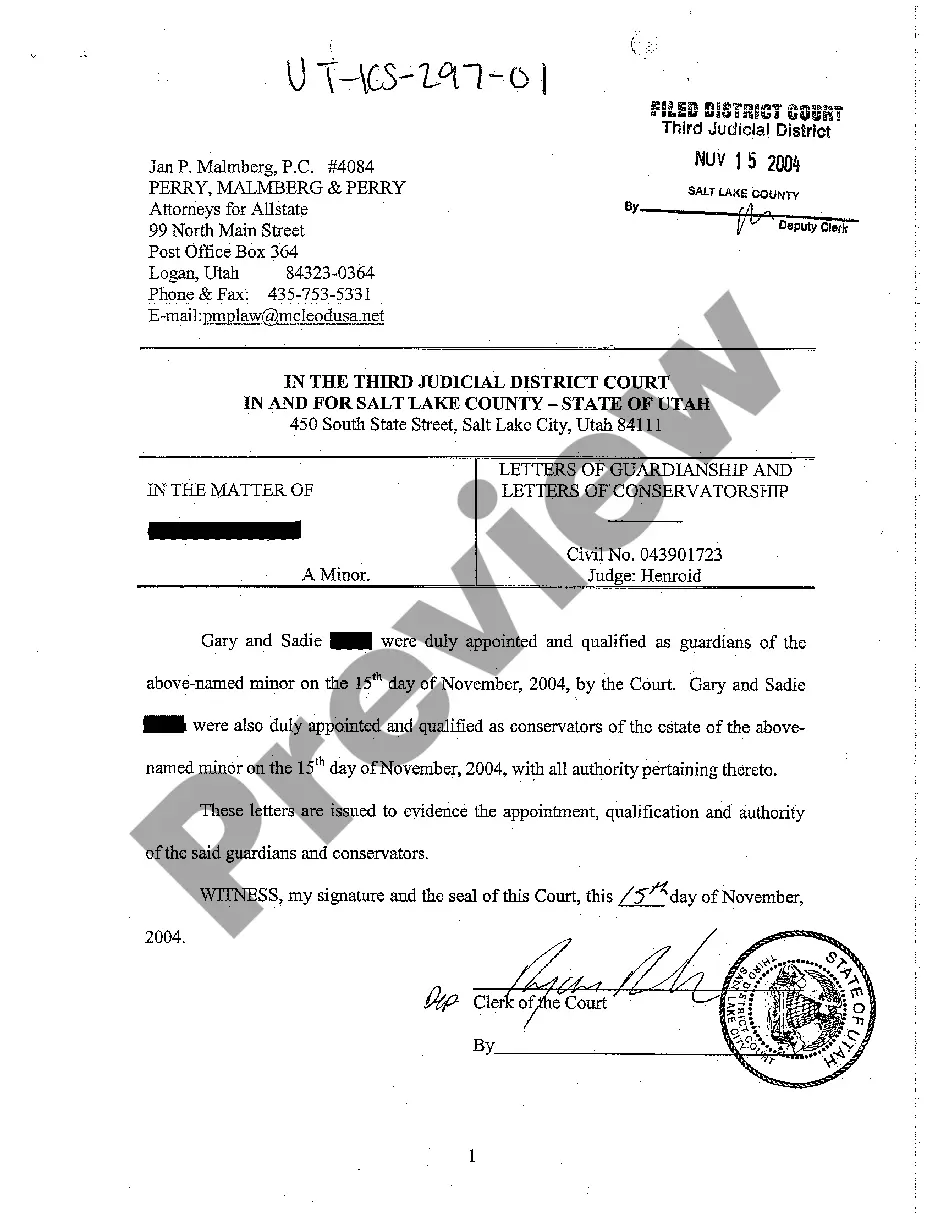

Balloon Payment Example

Description

How to fill out New Hampshire Balloon Unsecured Promissory Note?

You might devote hours online searching for the valid document template that meets the local and federal requirements you need.

US Legal Forms offers thousands of valid forms that can be evaluated by experts.

You can easily obtain or print the New Hampshire Balloon Unsecured Promissory Note from our service.

First, ensure you have selected the correct document template for your state/region of your choice. Check the form description to be certain you have picked the right form. If available, utilize the Review button to browse the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, modify, print, or sign the New Hampshire Balloon Unsecured Promissory Note.

- Every valid document template you acquire is yours permanently.

- To get another copy of the purchased form, visit the My documents section and click the relevant button.

- If you are accessing the US Legal Forms website for the first time, follow these simple directions below.

Form popularity

FAQ

Promissory notes can be either secured or unsecured, depending on whether a collateral is required. Unsecured notes do not involve collateral, meaning they carry a higher risk for lenders. If you are exploring options like a New Hampshire Balloon Unsecured Promissory Note, be aware that these types of loans may have higher interest rates due to the increased risk for lenders.

A promissory note with a balloon payment is an agreement where the borrower pays smaller amounts initially, but one large payment is due at the end of the term. This can be beneficial for those who anticipate having the funds available at that time or who plan to refinance. Understanding the details of a New Hampshire Balloon Unsecured Promissory Note can help you make informed financial decisions.

Yes, many promissory notes, including the New Hampshire Balloon Unsecured Promissory Note, can be classified as exempt securities. They often fall under regulatory exemptions, allowing them to be issued without the extensive disclosures typically required for securities. However, it’s important to verify the specific circumstances surrounding each promissory note to ensure compliance.

You can obtain a promissory note by creating one yourself or through legal resources and templates available online. The US Legal Forms platform is an excellent option for generating a New Hampshire Balloon Unsecured Promissory Note tailored to your specific requirements. Ensure you understand the terms and conditions before finalizing the document.

If you lose a promissory note, you should notify the lender immediately. They may require you to provide proof of identity and possibly sign an affidavit stating the note is lost. To avoid future issues, consider using the US Legal Forms platform to create a New Hampshire Balloon Unsecured Promissory Note that includes copies stored electronically.

Generally, an unsecured promissory note is not classified as a security because it does not involve an investment contract or shares in a business. However, it still represents a legal commitment that requires repayment. If you're considering a New Hampshire Balloon Unsecured Promissory Note, understanding its legal implications is crucial for both borrowers and lenders.

To obtain your promissory note, you should refer to the lender or financial institution that issued it. They will provide you with a copy of the note upon request. Utilizing US Legal Forms can help streamline the process of creating or accessing a New Hampshire Balloon Unsecured Promissory Note that meets your specifications.

Interesting Questions

More info

Homeowner's Association FHA & VA FHA Refinance (FHA and VA programs) FHA-VA (FHA, VA and Federal Housing Authority programs) FHA Homebuyer's Loan FF ELP Federal Family Loan FF ELP Direct Loan (Fellowship Program) Homebuyer's Loan FF ELP Direct Loan (Fellowship Program) Mortgage Refinances Home Equity Lines of Credit First Lien Loans (First-Lien Loans) Private Student Loans (Graduate PLUS Loans) Student Loans FHA Loan Consolidations Loan Protection Program (PSP) Federal Housing Administration FHA Home Loan FFFA Loan FHA-VA Loan FF ELP Student Loans FHA PLUS Loan (FFFA PLUS Loan Program) FHA PLUS Loan (FFFA PLUS Loan Program) Consolidation Loan FHA Plus Student Loan Lending/Consolidation Loan FIFA Home Loans FFFA PLUS Loans Lending/Consolidation Loan FHA-VA Loan Lending/Consolidation Loan Business Loans Lending Program FF ELP Commercial LOANS (Loans for Business) FF ELP and VA Loans Home Equity Lines of Credit PLUS Loans FF ELP and VA Loans Subsidized and Unsubsidized Loans Direct PLUS