A New Hampshire Security Agreement for Promissory Note is a legal document that establishes a security interest in an asset or property to secure the repayment of a promissory note. It is commonly used in business transactions where a lender provides a loan or advances money to a borrower, and the borrower pledges collateral to secure the repayment. The security agreement serves as a written contract between the lender and the borrower, outlining the specific terms and conditions of the promissory note and the collateral being pledged. It ensures that the lender has a legal claim over the collateral in case the borrower defaults on the loan. In the state of New Hampshire, there are various types of security agreements for promissory notes that may be used, depending on the specific circumstances or nature of the transaction. These may include: 1. Real Estate Security Agreement: This type of security agreement involves the pledge of real property as collateral for a promissory note. It may be used in real estate financing, mortgage loans, or construction loans. 2. Personal Property Security Agreement: This agreement involves the pledge of personal property, such as equipment, vehicles, inventory, or accounts receivable, as collateral for a promissory note. It is commonly used in commercial lending and business financing. 3. Intellectual Property Security Agreement: In cases where intellectual property, such as patents, copyrights, or trademarks, is being used as collateral, an intellectual property security agreement may be utilized. This ensures that the lender has a claim on the intellectual property in case of default. The specific terms and conditions of the security agreement may vary depending on the parties involved, the type of collateral, and the negotiated terms. Key elements typically included in a New Hampshire Security Agreement for Promissory Note are: 1. Identification of the parties: The agreement should clearly identify the lender (secured party) and the borrower (debtor). 2. Description of the collateral: The agreement should have a detailed description of the collateral being pledged, including its nature, location, and any identifying information. 3. Obligations of the borrower: The agreement should outline the borrower's obligations, including the repayment terms, interest rates, maturity date, and any other terms of the promissory note. 4. Security interest: The agreement should establish the security interest in the collateral and the conditions under which the lender can enforce its rights in case of default. 5. Default and remedies: The agreement should outline the events that constitute default and the remedies available to the lender, such as repossession and sale of the collateral. 6. Governing law: The agreement should specify that it is governed by the laws of the state of New Hampshire and any specific provisions of the Uniform Commercial Code (UCC) that apply to security agreements. It is important to note that the specific content and requirements of a New Hampshire Security Agreement for Promissory Note may vary depending on the unique circumstances of the transaction and should be tailored to meet the needs of the parties involved. It is always advisable to consult with legal professionals who specialize in commercial law or finance to ensure compliance with relevant laws and regulations.

New Hampshire Security Agreement for Promissory Note

Description

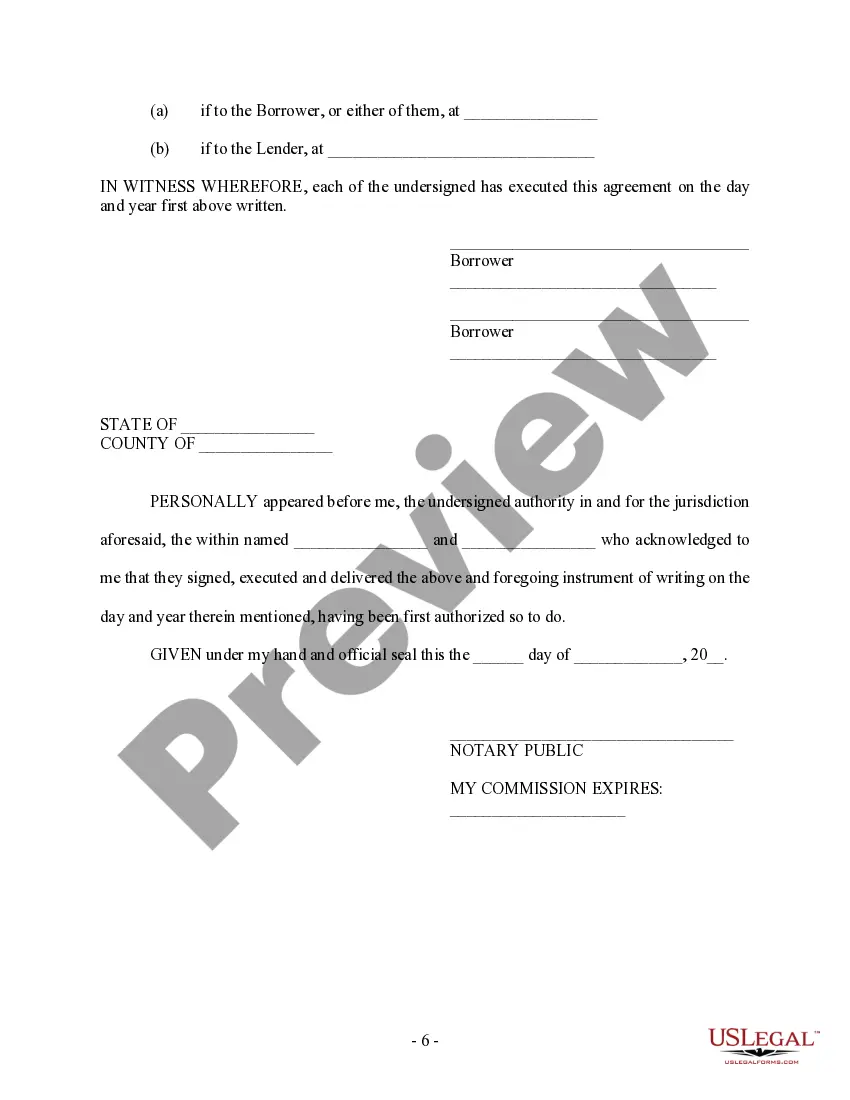

How to fill out New Hampshire Security Agreement For Promissory Note?

US Legal Forms - one of many biggest libraries of legal varieties in the United States - delivers a wide array of legal record themes you can acquire or print out. While using site, you will get a large number of varieties for organization and individual reasons, sorted by types, states, or keywords and phrases.You can find the most up-to-date variations of varieties much like the New Hampshire Security Agreement for Promissory Note in seconds.

If you currently have a monthly subscription, log in and acquire New Hampshire Security Agreement for Promissory Note through the US Legal Forms local library. The Download button will appear on each type you see. You gain access to all previously downloaded varieties from the My Forms tab of the account.

In order to use US Legal Forms for the first time, allow me to share simple guidelines to obtain started out:

- Ensure you have chosen the right type for the city/state. Click the Review button to analyze the form`s articles. Read the type information to ensure that you have selected the appropriate type.

- When the type does not fit your needs, take advantage of the Research discipline near the top of the screen to obtain the one that does.

- Should you be content with the form, affirm your choice by visiting the Acquire now button. Then, pick the pricing plan you want and give your qualifications to register on an account.

- Procedure the transaction. Make use of credit card or PayPal account to accomplish the transaction.

- Pick the file format and acquire the form on your device.

- Make adjustments. Fill up, modify and print out and indicator the downloaded New Hampshire Security Agreement for Promissory Note.

Each design you added to your account does not have an expiration day which is yours eternally. So, if you wish to acquire or print out yet another backup, just check out the My Forms section and click on on the type you need.

Gain access to the New Hampshire Security Agreement for Promissory Note with US Legal Forms, by far the most considerable local library of legal record themes. Use a large number of expert and state-distinct themes that satisfy your business or individual requires and needs.