New Hampshire Tax Free Exchange Agreement Section 1031, commonly known as a 1031 exchange, refers to a provision in the Internal Revenue Code that allows for the tax deferral of capital gains on the sale of certain properties. It is a beneficial tax strategy utilized by taxpayers in New Hampshire to defer their capital gains tax obligations when exchanging one investment property for another. Under this provision, property owners in New Hampshire can sell their investment or business property and reinvest the proceeds into a like-kind property without immediately incurring any capital gains tax. The tax liability is deferred until the new property is sold, allowing investors to preserve their cash flow and potentially build their real estate portfolio more efficiently. New Hampshire offers different types of tax-free exchange agreements under Section 1031, such as: 1. Simultaneous Exchange: This is the simplest type of 1031 exchange where the sale and purchase of properties occur on the same day. The taxpayer sells their relinquished property and simultaneously acquires the replacement property. 2. Delayed Exchange: Also known as a "Starker Exchange" or "Forward Exchange," this is the most common type of 1031 exchange. It allows the taxpayer to sell their relinquished property and identify their replacement property(s) within 45 days. The purchase of the replacement property must be completed within 180 days after the sale of the relinquished property. 3. Reverse Exchange: This type of exchange allows the taxpayer to acquire a replacement property before selling the relinquished property. It is a more complex process where a qualified intermediary holds the title to either the replacement or relinquished property until the other property is sold. 4. Construction or Improvement Exchange: Sometimes, taxpayers wish to use 1031 exchanges for construction or improvement purposes. In such cases, the taxpayer sells their relinquished property and utilizes the exchange proceeds to fund the construction or improvement of the replacement property. It is important for taxpayers in New Hampshire considering a 1031 exchange to seek professional guidance from a qualified intermediary and tax advisors experienced in this area. Compliance with specific requirements and regulations is crucial to ensure eligibility for tax deferral and to navigate the complexities of the exchange process successfully. In summary, the New Hampshire Tax Free Exchange Agreement Section 1031 provides a valuable opportunity for taxpayers to defer capital gains tax when exchanging investment properties. By utilizing the various types of exchanges available, property owners can optimize their investments, diversify their portfolios, and maximize their returns.

New Hampshire Tax Free Exchange Agreement Section 1031

Description

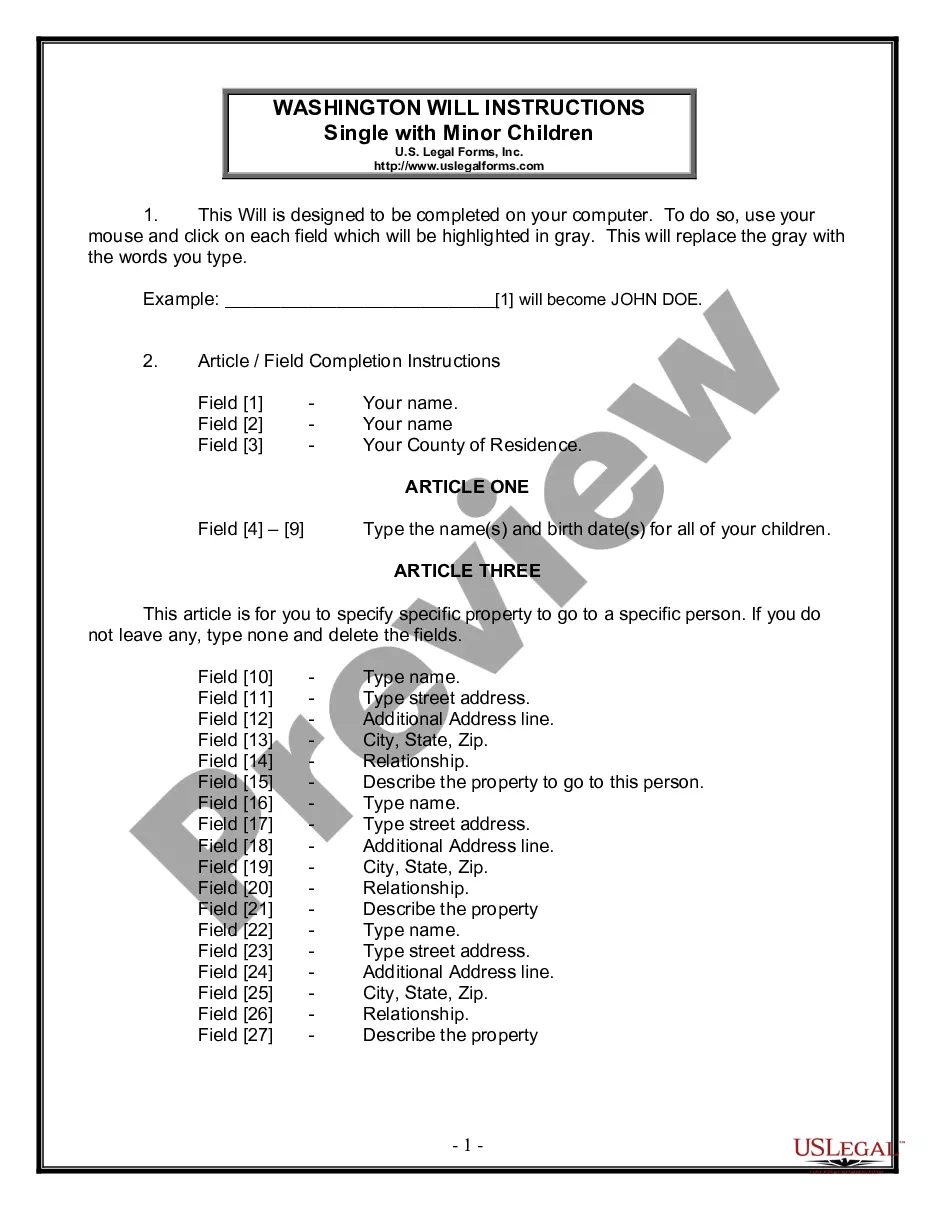

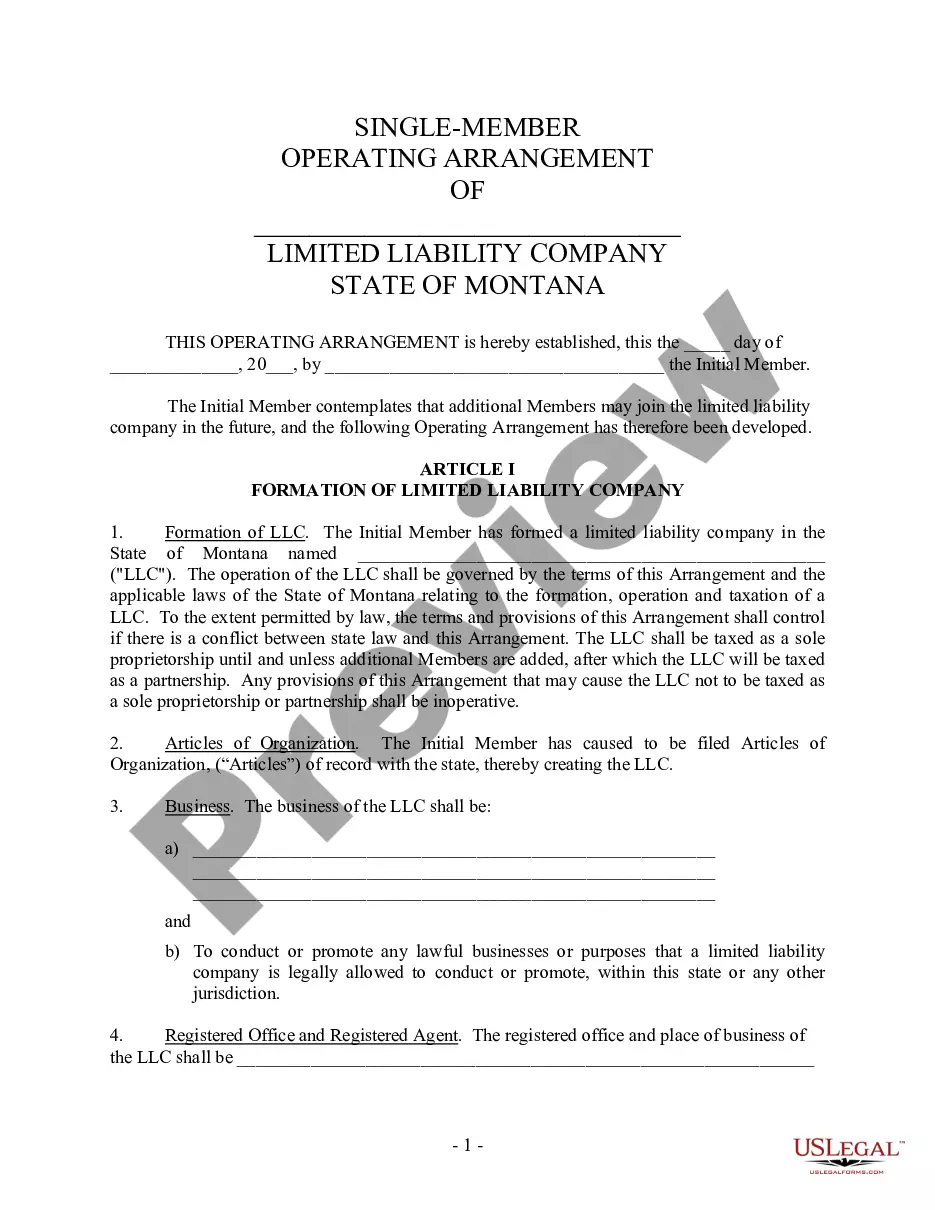

How to fill out New Hampshire Tax Free Exchange Agreement Section 1031?

Selecting the most suitable authorized document template can be challenging.

Undoubtedly, there are numerous layouts accessible online, but how can you find the specific authorized form you need.

Utilize the US Legal Forms website. The platform offers a multitude of templates, including the New Hampshire Tax Free Exchange Agreement Section 1031, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, utilize the Search feature to find the appropriate form. Once you are confident that the form is suitable, choose the Buy now option to purchase the form. Select the pricing plan you need and provide the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Complete, modify, print, and sign the acquired New Hampshire Tax Free Exchange Agreement Section 1031. US Legal Forms is the largest repository of authorized forms where you can find various document templates. Take advantage of the service to download professionally-prepared documents that meet state regulations.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and click the Download button to retrieve the New Hampshire Tax Free Exchange Agreement Section 1031.

- Use your account to browse the authorized forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure that you have selected the correct form for your region. You can preview the form using the Review button and examine the form details to confirm it is suitable for you.

Form popularity

FAQ

No, a 1031 exchange does not have to involve properties of the exact same value. However, the replacement property should be of equal or greater value to maximize the tax deferral benefits. Different strategies exist to manage potential disparities in value, making it crucial to consult a knowledgeable professional during this process.

To determine transfer tax in New Hampshire, you should calculate the seller's consideration amount, which includes all monetary compensation for the property. The tax is generally set at a rate of $1.50 per $1,000 of the consideration. Keeping accurate records and seeking assistance from professionals can streamline this process. Platforms like UsLegalForms provide tools and templates to assist with the calculations.

The gain on the sale of the property goes untaxed as long as it is reinvested. Biden said he would get rid of 1031 exchanges on the 2020 campaign trail and instead expand funding for the care economy. But that elimination has yet to happen.

If the sale of your Relinquished Property closed on or between October 18, 2021 and December 31, 2021, the standard 180-day exchange period will be shortened. However, you can file for a tax extension by April 15, 2022 to obtain a full 180-day exchange period.

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

Under the Tax Cuts and Jobs Act, Section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. An exchange of real property held primarily for sale still does not qualify as a like-kind exchange.

Under Internal Revenue Code Section 1031, real estate located in one U.S. state is like kind to real estate located in any other state, and you can trade from one state to another. In most cases you are able to defer both federal and state tax, assuming the state has an income tax.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

Interesting Questions

More info

Aviation Aircraft having manufacturer serial number currently registered with Federal Aviation Administration equipped with Honeywell Model engines bearing manufacturer serial numbers collectively treated property referred herein Acquired property for consideration of 750,000 cash, real estate, and improvements which Exchanger has obtained from Assault Aviation for cash and investment in the trade business Investment of Exchanger in the trade business includes 100,000 per year cash for two years purchase and 25,000 a year for two years interest to be paid to Assault Aviation on delivery of Aircraft wherein interest is paid at 12% rate on the cash acquired interest for twelve months and then 6%, thereafter and is thereafter paid quarterly on the remaining cash that does not vest or mature as to Exchanger.