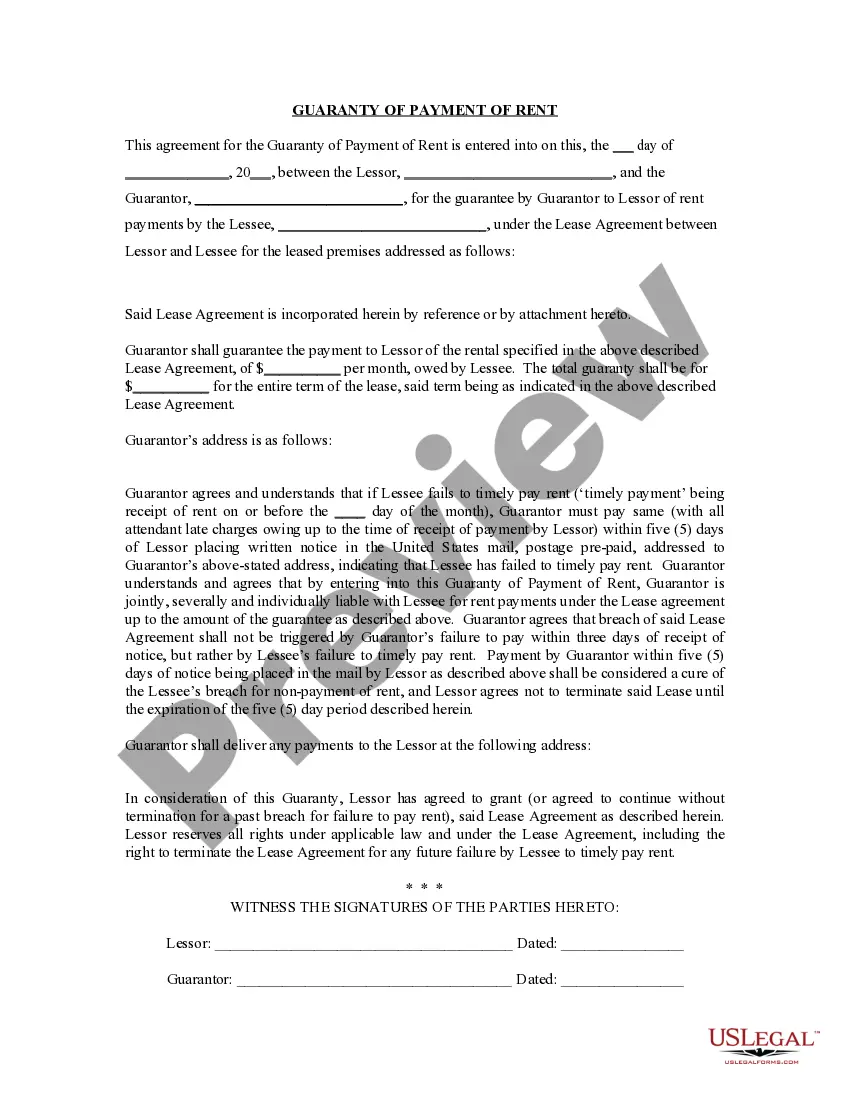

A New Hampshire Contract of Sale and Leaseback of an Apartment Building with the Purchaser Assuming an Outstanding Note Secured by a Mortgage or Deed of Trust is a legal agreement that involves the sale of an apartment building, along with a leaseback arrangement and the assumption of an existing loan secured by a mortgage or deed of trust. This type of contract is common in real estate transactions where the property owner wishes to sell their apartment building but wants to retain occupancy of the property by entering into a leaseback agreement. In addition, the purchaser assumes the existing loan attached to the property, which is secured by a mortgage or deed of trust. Multiple variations of the New Hampshire Contract of Sale and Leaseback of an Apartment Building with the Purchaser Assuming an Outstanding Note Secured by a Mortgage or Deed of Trust may exist, catering to specific circumstances or requirements. Some of these variations may include: 1. Residential Leaseback Agreement: This specific type of contract is used when the apartment building consists mainly of residential units. The leaseback terms, including duration, rental payment, and other conditions, are tailored to accommodate residential tenants. 2. Commercial Leaseback Agreement: This variation is applicable when the apartment building comprises commercial units or a combination of residential and commercial spaces. The leaseback provisions will address the specific needs and expectations of commercial tenants. 3. Partial Note Assumption: In certain cases, the agreement may involve the purchaser assuming only a portion of the outstanding loan secured by a mortgage or deed of trust. This can be negotiated between the parties to distribute financial responsibility in a more favorable manner. 4. Loan Reworking Agreement: This type of contract may be used when the existing loan secured by a mortgage or deed of trust needs to be modified or restructured before the transfer of ownership and leaseback arrangement occur. It allows for adjustments of interest rates, repayment terms, or other loan conditions to better suit the needs of both parties. When entering into a New Hampshire Contract of Sale and Leaseback of an Apartment Building with the Purchaser Assuming an Outstanding Note Secured by a Mortgage or Deed of Trust, it is essential to consult with legal professionals experienced in real estate transactions. They can ensure that the contract complies with New Hampshire state laws, protect the interests of both parties, and accurately reflect the agreed-upon terms and conditions.

New Hampshire Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust

Description

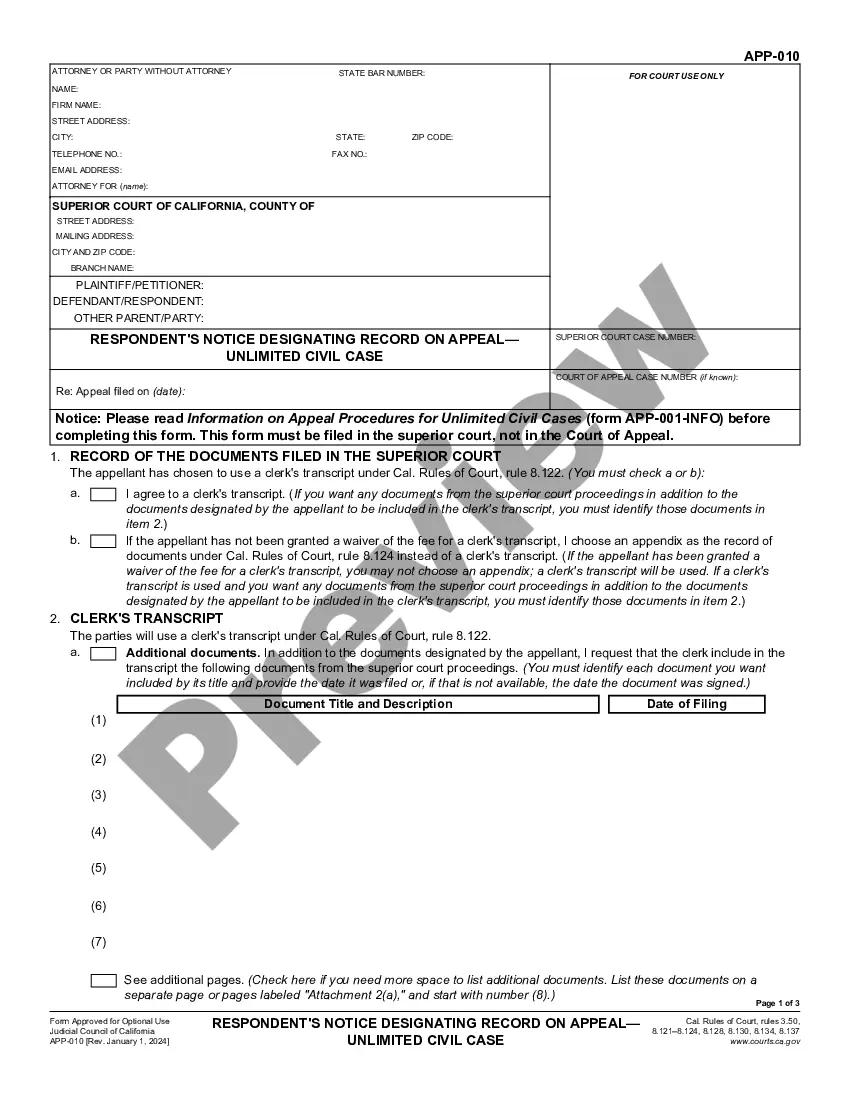

How to fill out New Hampshire Contract Of Sale And Leaseback Of Apartment Building With Purchaser Assuming Outstanding Note Secured By A Mortgage Or Deed Of Trust?

US Legal Forms - one of the largest libraries of authorized forms in the States - delivers a variety of authorized file themes you are able to download or produce. Utilizing the site, you can find 1000s of forms for business and individual purposes, sorted by categories, claims, or key phrases.You can find the newest types of forms such as the New Hampshire Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust within minutes.

If you already have a registration, log in and download New Hampshire Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust from your US Legal Forms collection. The Obtain option will appear on each kind you see. You get access to all previously delivered electronically forms from the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, here are easy recommendations to help you started:

- Be sure to have chosen the right kind for your personal area/area. Go through the Preview option to analyze the form`s information. Browse the kind information to actually have chosen the proper kind.

- When the kind does not suit your specifications, take advantage of the Search field near the top of the monitor to obtain the one who does.

- If you are pleased with the form, verify your option by clicking the Buy now option. Then, choose the pricing strategy you favor and supply your accreditations to sign up for an accounts.

- Procedure the purchase. Use your Visa or Mastercard or PayPal accounts to complete the purchase.

- Pick the format and download the form on your product.

- Make changes. Fill out, revise and produce and indication the delivered electronically New Hampshire Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust.

Each design you put into your account does not have an expiration day and is yours for a long time. So, if you wish to download or produce one more version, just proceed to the My Forms segment and click on on the kind you need.

Gain access to the New Hampshire Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust with US Legal Forms, the most substantial collection of authorized file themes. Use 1000s of expert and condition-particular themes that meet your organization or individual requires and specifications.