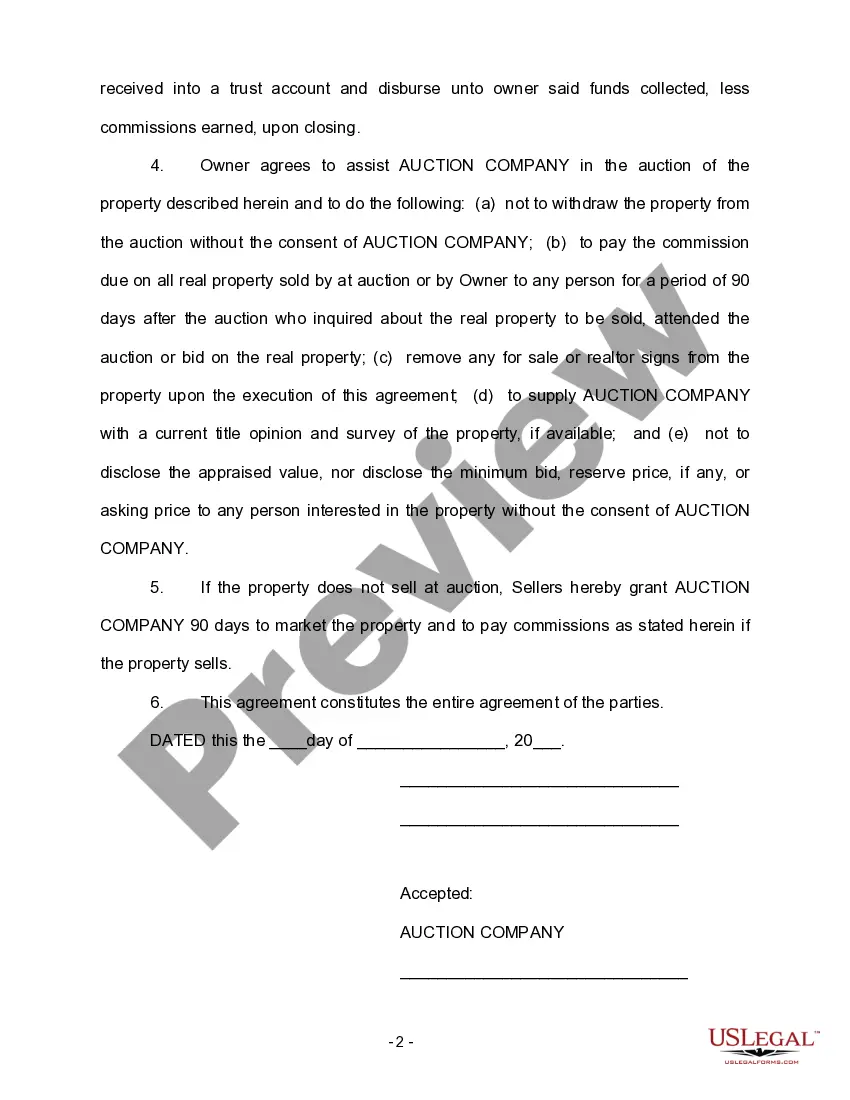

New Hampshire Auction of Real Property Agreement is a legally-binding contract specifically designed for auctions involving real estate properties within the state of New Hampshire. This agreement outlines the terms and conditions that both the seller (typically the property owner) and the buyer (the successful bidder) must adhere to throughout the auction process. The New Hampshire Auction of Real Property Agreement emphasizes the details of the auction, including the property description, bidding procedures, terms of sale, and the responsibilities of each party involved. It serves as a comprehensive guide that ensures transparency, fairness, and protection for all parties participating in the auction. Key elements covered in the New Hampshire Auction of Real Property Agreement may include: 1. Property Description: This section provides a thorough description of the property being auctioned, including the address, boundaries, lot size, and any other relevant details that accurately identify the real estate. 2. Auction Date and Location: Specifies the exact date, time, and location where the auction will take place. This facilitates proper organization, advertisement, and public awareness of the event. 3. Reserve Price (if applicable): The agreement may disclose whether there is a minimum price or reserve that the seller has set, below which the property will not be sold. This protects the seller's interests by ensuring a minimum acceptable price, but may not always be applicable. 4. Auction Terms and Conduct: Outlines the rules and regulations governing the conduct of the auction, including the bidding process, bid increments, the starting bid, and any specific auction rules that participants must follow during the event. 5. Earnest Money Deposit: Specified as a percentage of the total sale price, the earnest money deposit is an amount paid by the buyer to demonstrate their serious intention to purchase the property. This amount is typically held in escrow until the closing of the transaction. 6. Closing Procedures and Timeline: Establishes the timeframe for completing the sale, including critical dates for inspection periods, financing arrangements, contingencies, and other closing-related matters. 7. Seller's Disclosure: Provides a detailed list of any known defects, encumbrances, or conditions affecting the property. This ensures that potential buyers are informed about the property's condition and its potential limitations. 8. Additional Conditions and Contingencies: Allows for the inclusion of any specific conditions or contingencies that must be met for the sale to proceed successfully. This may include the buyer's ability to obtain financing or an inspection report that meets their satisfaction. Types of New Hampshire Auction of Real Property Agreement may vary depending on the nature of the auction and the specific terms agreed upon by the parties involved. Some types of agreements specific to New Hampshire auctions may include Foreclosure Auction Agreements, Tax Lien Auction Agreements, Estate Auction Agreements, and Commercial Real Estate Auction Agreements. These agreements may vary in their content, considering the unique circumstances associated with each type of auction.

New Hampshire Auction of Real Property Agreement

Description

How to fill out New Hampshire Auction Of Real Property Agreement?

Choosing the right authorized papers template could be a struggle. Of course, there are plenty of templates available on the Internet, but how would you find the authorized develop you want? Take advantage of the US Legal Forms website. The assistance offers a large number of templates, including the New Hampshire Auction of Real Property Agreement, that you can use for enterprise and private needs. Each of the forms are checked by pros and satisfy federal and state demands.

When you are presently signed up, log in in your profile and then click the Download option to get the New Hampshire Auction of Real Property Agreement. Use your profile to appear with the authorized forms you might have acquired previously. Visit the My Forms tab of your profile and obtain another duplicate of the papers you want.

When you are a brand new user of US Legal Forms, allow me to share basic guidelines that you should adhere to:

- Initial, be sure you have selected the appropriate develop to your city/county. You may check out the form making use of the Review option and browse the form explanation to ensure it is the right one for you.

- In case the develop fails to satisfy your preferences, make use of the Seach area to obtain the proper develop.

- Once you are sure that the form is acceptable, click on the Purchase now option to get the develop.

- Select the rates strategy you desire and type in the essential information and facts. Design your profile and purchase the order making use of your PayPal profile or bank card.

- Select the document format and down load the authorized papers template in your system.

- Comprehensive, edit and produce and signal the received New Hampshire Auction of Real Property Agreement.

US Legal Forms may be the largest local library of authorized forms in which you will find numerous papers templates. Take advantage of the service to down load expertly-created paperwork that adhere to express demands.