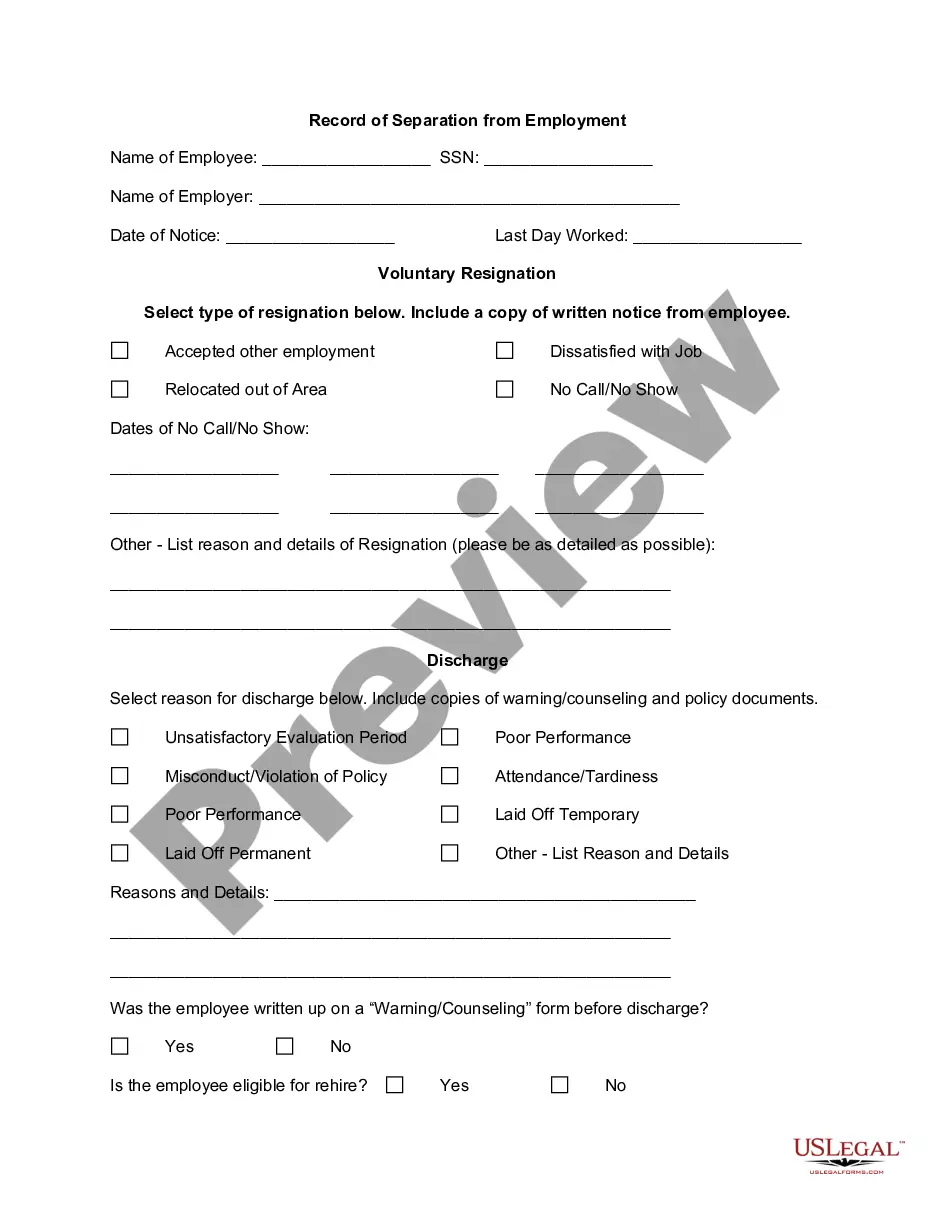

New Hampshire Employment Contract of Consultant with Nonprofit Corporation is a legal document that outlines the agreed-upon terms and conditions between a consultant and a nonprofit corporation in the state of New Hampshire. This contract serves as a binding agreement between both parties and ensures that their rights, responsibilities, and obligations are clearly defined. Key elements of the New Hampshire Employment Contract of Consultant with Nonprofit Corporation may include: 1. Parties involved: The contract identifies the consultant, who is an independent contractor, and the nonprofit corporation with which they are entering into a business relationship. 2. Scope of work: The contract outlines the specific services or expertise that the consultant will provide to the nonprofit corporation. This could include strategic planning, fundraising, project management, marketing, or any other specialized area. 3. Duration and termination: The contract specifies the duration of the agreement, whether it is for a specific project or an ongoing engagement. Additionally, it outlines the circumstances under which either party may terminate the contract, such as non-performance, breach of terms, or mutual agreement. 4. Compensation and payment terms: The contract details the consultant's compensation, including the rate, method of payment, and any additional expenses or reimbursements. It may also include provisions for invoicing, payment terms, and milestones. 5. Confidentiality and non-disclosure: This section ensures that any proprietary or confidential information shared between the consultant and the nonprofit corporation remains protected. It may include clauses related to the use, disclosure, and return of confidential information. 6. Intellectual property rights: If the consultant creates any intellectual property during the course of their work for the nonprofit, this section clarifies the ownership and licensing rights of such intellectual property. 7. Indemnification and liability: The contract may specify the responsibilities and liabilities of each party, ensuring that they hold each other harmless from any claims, damages, or losses that may arise during the engagement. 8. Governing law and jurisdiction: This section identifies that the contract is subject to the laws of the state of New Hampshire and determines the jurisdiction and venue for any potential disputes. Different types of New Hampshire Employment Contract of Consultant with Nonprofit Corporation may include: 1. Project-based contract: This type of contract is suitable for a specific project or task that requires the consultant's expertise for a defined period. 2. Retainer contract: This establishes an ongoing arrangement between the consultant and the nonprofit corporation, typically for a set number of hours or days per month. It allows the consultant to provide continuous support and services as needed. 3. Fixed-term contract: This type of contract outlines a specific contractual period, which is agreed upon between the consultant and the nonprofit corporation. It clearly defines the start and end dates of the engagement. 4. Exclusive contract: An exclusive contract may be entered into when the nonprofit corporation requires the consultant's full dedication and availability. This ensures that the consultant will not provide similar services to any other organization during the term of the contract. Overall, the New Hampshire Employment Contract of Consultant with Nonprofit Corporation plays a critical role in establishing a clear understanding between both parties, protecting their rights, and minimizing the risk of disputes that may arise during the course of their collaboration.

New Hampshire Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out New Hampshire Employment Contract Of Consultant With Nonprofit Corporation?

Choosing the right authorized papers format can be quite a battle. Obviously, there are plenty of web templates available on the net, but how would you get the authorized form you need? Make use of the US Legal Forms web site. The support offers a large number of web templates, such as the New Hampshire Employment Contract of Consultant with Nonprofit Corporation, that you can use for organization and personal requirements. Every one of the forms are examined by professionals and meet federal and state needs.

Should you be already listed, log in for your accounts and click the Down load option to find the New Hampshire Employment Contract of Consultant with Nonprofit Corporation. Make use of accounts to look from the authorized forms you have bought formerly. Check out the My Forms tab of your own accounts and get another copy of the papers you need.

Should you be a brand new end user of US Legal Forms, allow me to share basic guidelines for you to comply with:

- First, make sure you have chosen the correct form for your area/region. You are able to look through the shape while using Preview option and browse the shape description to make sure this is basically the right one for you.

- When the form is not going to meet your needs, take advantage of the Seach discipline to discover the right form.

- When you are certain the shape would work, click the Acquire now option to find the form.

- Select the pricing strategy you desire and type in the required information. Make your accounts and buy the order utilizing your PayPal accounts or Visa or Mastercard.

- Select the submit formatting and acquire the authorized papers format for your system.

- Comprehensive, revise and print and sign the received New Hampshire Employment Contract of Consultant with Nonprofit Corporation.

US Legal Forms is the greatest collection of authorized forms for which you will find different papers web templates. Make use of the company to acquire appropriately-created files that comply with condition needs.